Electronic Identification (eID) schemes have become a critical component of Europe’s digital transformation, establishing a robust and interoperable ecosystem for individuals and businesses to verify identities online. At the heart of these schemes is Europe’s digital identity framework, eIDAS. eIDAS Regulation (EU) No 910/2014, implemented in 2016, set the standards for trust services and identity verification across Europe. The eIDAS regulation mandates the mutual recognition of eID schemes among member states, ensuring interoperability for cross-border digital services. This framework is now further strengthened through the implementation of the European Digital Identity Wallet (EUDI Wallet) under eIDAS 2.0. The EUDI Wallet will facilitate secure and interoperable eID verification across the EU, contributing to the creation of a secure, digital Europe.

The notion of a European Digital Identity Wallet (EUDI Wallet) was first proposed in 2021 by the European Commission, with the aim of creating a single digital ecosystem that could span across Europe. In doing so, the Commission proposed to reshape the original eIDAS legislation (No 910/2014) in order to introduce this new concept of an accessible and interoperable European Digital Identity. In addition to enhancing seamless cross-border use, the introduction of a secure digital wallet would offer users increased privacy and control, granting them the power to decide what data to share and with whom.

The European Identity Wallet will enable all Europeans to access services online without having to use private identification methods or unnecessarily sharing personal data. – European Commission, June 2021.

The EU formally introduced eIDAS 2.0 in 2023, with its implementation scheduled to take place over the course of 2024 and beyond. eIDAS 2.0 presented revamped regulations crafted for a modern, digital Europe. These new mandates established the “European Digital Identity Framework,” which will introduce the EU Digital Identity Wallet (EUDI). EUDI marks the beginning of a future of trusted digital identities, in which all European citizens, residents, or businesses can use their eID across member states without the need for additional registration. This will be a welcomed change, with 63% of EU citizens having reported that they want a “secure single digital ID for all online services.”

Shaping The Future of Identification in the EU: What a Digital Identity Future Looks Like

Practical use cases will include opening a bank account, filing tax returns, renting a car using a digital license, dealing with public services that request birth certificates or medical certificates, applying for university, reporting a change of address, and much more. A digital future offers increased practicality, as outlined by the 2030 Digital Decade policy which currently sets out Europe’s digital transformation goal.

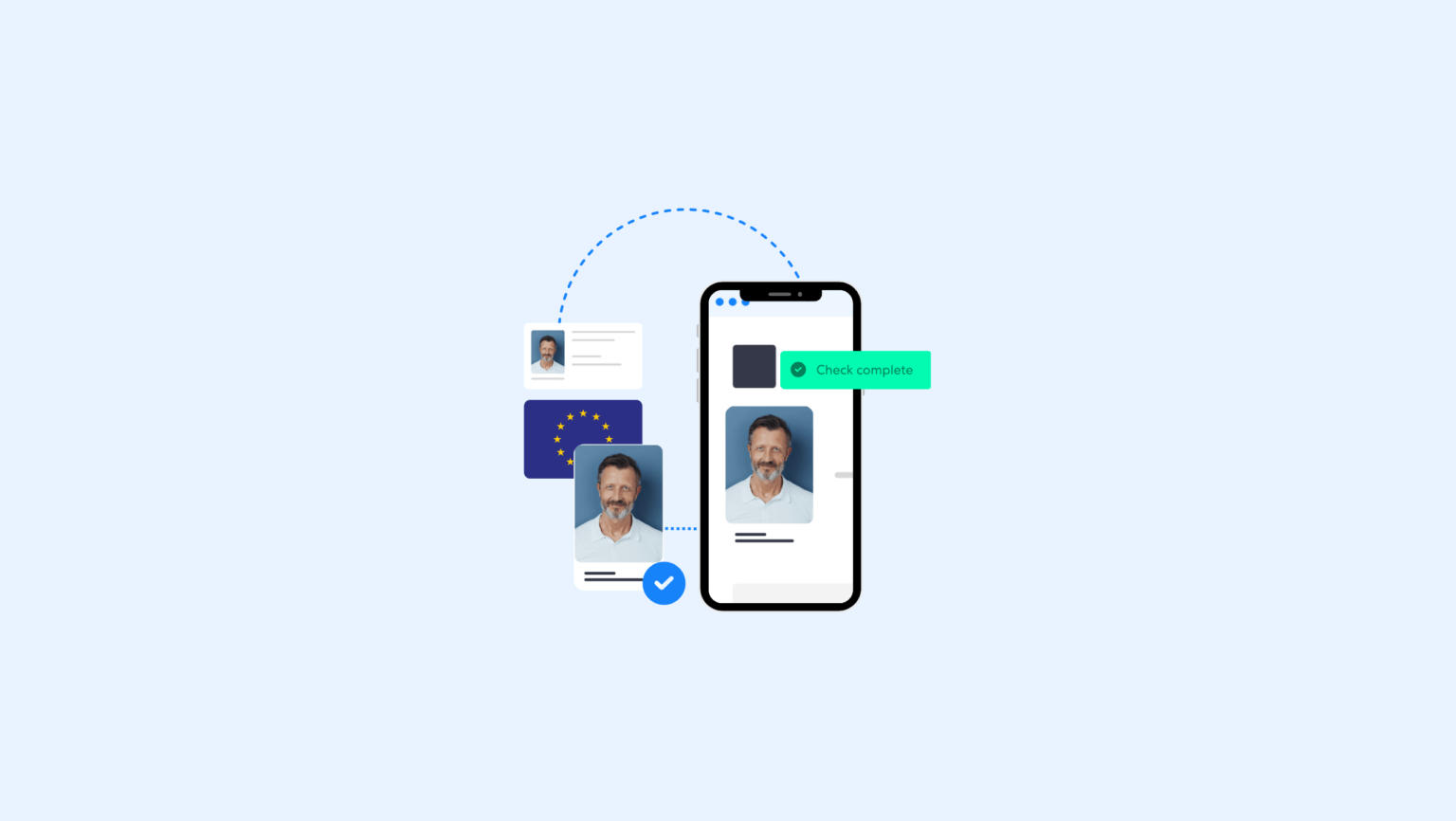

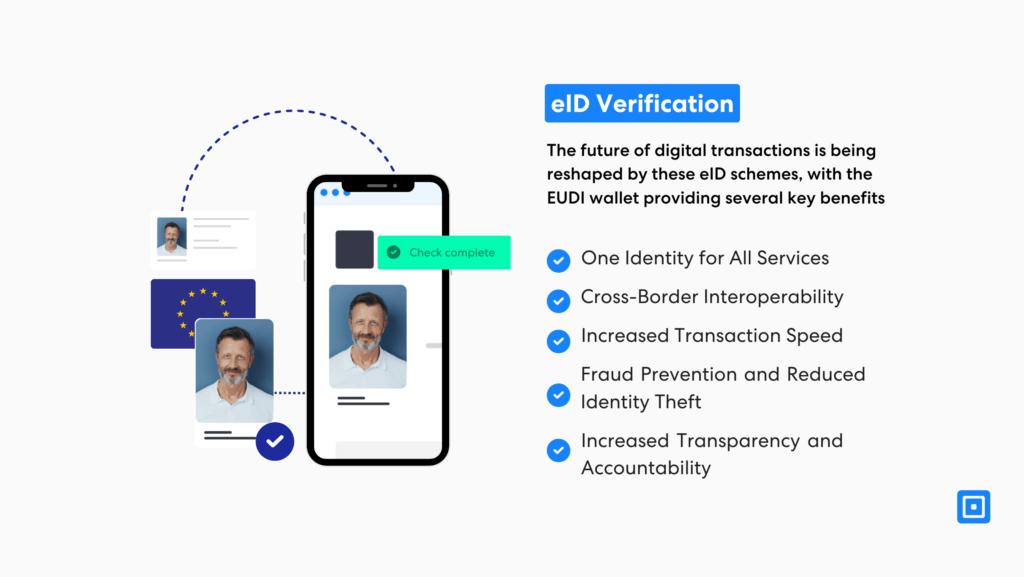

These targets outline that by 2030, all key public services in the European Union should be available online, increasing accessibility to things like health records across all member states. The future of digital transactions is being reshaped by these eID schemes, with the EUDI wallet providing several key benefits:

- Increased Transparency and Accountability: Each transaction tied to an eID is logged securely, creating an audit trail that prevents fraudulent activity.Digital Identity Service Providers (IDSPs) can be certified under the DIATF framework, with a medium level of confidence required by HMRC.

- One Identity for All Services: Users will no longer need multiple credentials for different platforms. A single digital wallet will be far more practical, supporting increased interoperability across various public and private services.

- Cross-Border Interoperability: EU citizens will be able to use their eID across EU member states without the need for registration. This will allow for a more seamless user experience, as a Spaniard can open a bank account in Germany using the same eID credentials.

- Increased Transaction Speed: Manual document submissions or in-person verification can now be eliminated, with instant verification for services such as government applications or e-commerce transactions.

- Fraud Prevention and Reduced Identity Theft: Fraudulent transactions can be effectively prevented by using identity verification within payment processes. The fact that eIDs are government-certified minimizes the risks of fake IDs and tampering, both online and offline.

Broader Impact: The Possibility For Economic Growth

Beyond streamlining identity verification practices, the eID scheme also lays the foundation for a fast digital economy in which transactions can be carried out quickly and securely, even across borders. This allows businesses to expand their operations across Europe member states as well as cater to a larger customer base.

The introduction of the European Digital Identity Wallet is bringing the European Union to the brink of a digital revolution, transforming the way European citizens and businesses handle their personal data and carry out transactions across borders.

In addition, building public trust in online systems can lead to more people carrying out purchases online, leading to economic growth. eIDs also reduce bureaucratic barriers, allowing for sectors such as FinTech, e-commerce, and healthcare to innovate and evolve at a higher speed.

eID Schemes Across Europe

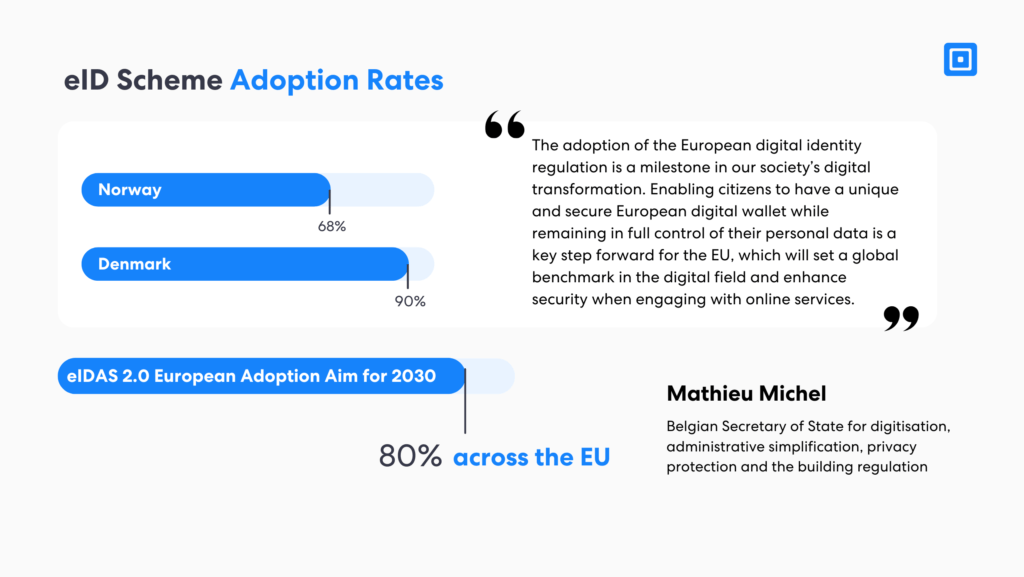

eID schemes have been put in place across Europe in countries like Sweden, Denmark, Norway, Belgium, and the Netherlands. While these nations have fully operational systems, other European countries are still continuing to establish their schemes.

Denmark

Denmark’s national eID, MitID, has transformed how citizens interact with digital services. Adopted by over 90% of the population, it facilitates more than 75 million monthly transactions, highlighting its pivotal role in everyday life. Estimated at €117 million, the eID market underscores its economic and societal significance.

Introduced in 2022, MitID replaced NemID as the country’s third-generation eID, offering enhanced security and functionality. Its applications range from secure authentication to Qualified Electronic Signatures, enabling seamless access to public and private digital services.

Today, more than 90 percent of the population uses their national eID in situations where it is essential to document one’s identity electronically. It allows for residents to access their public services 24 hours a day.

The Danish Agency for Digital Government, which operates under the Danish Ministry of Finance, states that “eID is the key to digital Denmark,” cementing MitID’s position as a cornerstone of the nation’s digital-first approach. The Agency highlights that over 90% of the population uses MitID.

Norway

BankID is a cornerstone of Norway’s digital infrastructure, used by 4.5 million citizens—approximately 68% of the population—for secure verification, authentication, and Qualified Electronic Signatures (QES). It establishes a trustworthy digital foundation across key services such as banking, government, healthcare, e-commerce, and real estate.

From logging into online banking and filing taxes to signing digital contracts and renewing driver’s licenses, BankID ensures seamless and secure access. In healthcare, it enables authentication for patient portals and e-prescriptions, while in e-commerce, it facilitates secure payments.

The transition to the BankID app represents a leap forward in user experience. With features like facial recognition, fingerprint scanning, and PIN authentication, the app reduces login times from 30 to just 10 seconds. Additionally, the new BankID Biometric option introduces a streamlined, lower-assurance solution tailored to specific use cases, enhancing accessibility and convenience.

Belgium

The eID scheme in Belgium, ItsME, was co-created by banks and telecom providers. It enables seamless identity verification. Seven million users rely on this scheme, and 1 million identity actions are carried out each day.

ItsME has drastically up levelled onboarding processes across Belgium, helping businesses identify clients quickly, minimise acquisition costs, prevent fraud, and achieve regulatory compliance.

Netherlands

iDIN, a joint initiative of Dutch banks, is transforming digital identity in the Netherlands by combining security, usability, and privacy. Built on the banks’ expertise in online banking and the widely trusted iDEAL payment service, iDIN offers a seamless way for users to verify their identity, log in to services, and sign documents electronically.

iDIN increases usability without compromising security and privacy. Moreover, iDIN secures and protects personal data.

Since its launch, more than 200 organizations across industries have integrated iDIN into their customer journeys, with over 8 million transactions logged for identification and authentication.

The Role of the EUDI Wallet in Cross-Border eID Verification

As of November 2024, several EU Member States have notified their electronic identification (eID) schemes under the eIDAS Regulation, indicating their readiness for cross-border recognition. In March of 2024, the European Identity Council outlined revised legislation and expectations for digital identities in Europe. Critical changes included:

- Member states will provide citizens and businesses with digital wallets that can be linked to their national digital identities with proof of other personal attributes. This way, citizens can prove their identity easily by providing documents from their digital wallets through their mobile phones.

- By 2026, all member states must make a digital identity wallet available to its citizens and accept European Digital Identity Wallets (EDIWs) from other member states according to their revised legislation.

By 2030, The European Identity Council also aims for an 80% adoption rate of eID schemes across the EU. Next year will be critical for governments, European regulators, and digital ID providers as they fine-tune the EUDI Wallet, and adoption increases across Europe.

eID Verification with ComplyCube

ComplyCube empowers businesses to harness schemes across Europe through a single integration, streamlining identity verification while ensuring compliance. By processing unique data points like ID numbers, names, and addresses from national eID schemes, ComplyCube integrates these with services such as Proof of Address (POA), AML Screening, and Ongoing AML Monitoring, delivering secure and efficient onboarding solutions.

With eID adoption surging—like Denmark’s MitID at 75 million monthly transactions and Norway’s BankID supporting millions—ComplyCube’s scalable platform is built to handle high volumes across markets. Businesses can reduce onboarding times, enhance customer satisfaction, and meet stringent regulatory standards effortlessly.

As Europe moves toward the EUDI Wallet, ComplyCube is ideally positioned, offering both an advanced Document Verification solution as well as eID scheme integrations to cater for markets where they are transitioning from documents to fully digital.

For more information on ComplyCube’s services, reach out to their expert compliance team.