Age assurance is a concept designed to ensure that only verified users of a minimum age can access age-restricted products. Due to this development, companies must use an online age verification solution to achieve age assurance. This guide assimilates the challenges in attaining age authentication for businesses and what to look for in an age verification system.

What is Age Assurance?

Age verification is a method used to achieve age assurance. It plays a vital role in creating a safe environment for online users and a business’s compliance with legal obligations and regulations, including COPPA in the US, the EU’s GDPR, and the Digital Economy Act of 2017.

Age assurance is the term that describes the adequate verification of a user’s age when they sign up for tangible or digital services. For this reason, its importance extends far beyond legal and regulatory compliance and addresses the ethical concerns of minors’ use of the internet and online services.

Age Verification and Children’s Data Regulators

Misalignment with local and international children’s data privacy laws can result in significant fines and penalization. For more information, read ComplyCube’s LinkedIn post referencing the significance of age verification technologies.

Using an Age Verification Solution for the COPPA Regulation

The Children’s Online Privacy Protection Rule (COPPA) became effective in 2000 and was amended in 2013. It is designed to protect children and give parents control over what information is collected about them, particularly those under the age of 13.

A critical aspect of complying with COPPA regulations involves determining the age of online users to clarify what can be done with their data. An excellent example of a successful age assurance strategy would be when an online platform successfully verifies a user’s age and either allows or prohibits access based on the result.

Achieving Age Assurance to Comply with GDPR

The General Data Protection Regulation (GDPR) unifies data protection across EU member states, ensuring that all businesses trading in the EU bloc properly collect and use minors’ data. Therefore, age verification systems must adhere to the strictest levels of data privacy and storage.

Popular social platform TikTok was fined “€345 million after finding their handling of children’s data not to be compliant with GDPR.” The social media app was also found to have failed to prohibit users under the minimum age threshold of 13 from gaining access to the platform.

GDPR policies require age verification methods to attain a reasonable belief that the user is who they say they are and that they are of a certain age. The GDPR mandate is that users must be 16 to consent for data to be collected and used.

The UK Online Safety Bill (2023)

This act was designed to provide a new framework to aid policies that regulate the use of the Internet. This bill grants new powers to the Office for Communications (OFCOM), and digital platforms will be required to remove harmful content proactively and ensure higher safety standards, especially for content accessible by minors.

This measure is vital for reducing online risks and protecting vulnerable users in a digital age that increasingly blurs public and private boundaries. This is particularly important for minors who are far more susceptible to the dangers posed by an online social life

The UK Digital Economy Act (2017)

The UK’s Digital Economy Act 2017 aimed to increase digital security surrounding accessibility to 18+ content, particularly explicit content. This ambitious proposal would have been the world’s first attempt to introduce an age verification solution for viewing this type of content.

This policy, however, faced significant complexities at a national implementation level. The Act now attempts to balance a sense of freedom of expression, privacy, and security with the necessity to protect minors.

If such a development were to occur for national age restrictions, the requirement for an online age verification system would be absolute. While this is not likely in the immediate future, there is every possibility that it will become a reality in the near future.

Age Verification Challenges

Verifying digital profiles is becoming increasingly complex. Much of the globe’s economy and social life is happening online, leading to a significant rise in the number of digital profiles. More pertinently, every individual worldwide now uses multiple different digital accounts frequently.

Social Media: A global report from 2023 found that the average individual has over 8 social media accounts.

Gambling: The average gambler in the UK had 3.2 accounts per person in 2020, up from 2.7 in 2018.

These figures show a growing trend of individuals opening multiple accounts to interact with the same industry, be it age-restricted services or not. Furthermore, the same individuals must be verified multiple times on different platforms, giving rise to a greater risk of synthetic fraud.

On a global perspective, the average individual boasts 8.4 social media accounts.

These figures prove challenging for the entire Identity Verification (IDV) process, from age verification to document and identity authentication. Traditional age verification methods (manually checking IDs) can be easy to circumvent. Artificial Intelligence (AI) and advanced editing tools have created convincing deepfakes and altered KYC documents, making it increasingly challenging to verify a user’s age manually with certainty.

These fraudulent risks compromise the integrity of a platform’s security and demand the need for age assurance methods. Not integrating with a modern age verification solution exposes businesses to fraudulent attacks, enabling underage product or service misuse and being liable to legal issues or misconduct fines.

Data Privacy Challenges

Age verification inherently requires the collection of sensitive customer data. In a digital environment, users might not be willing to submit this information due to fears of online safety in their data processing. There is a natural risk of unauthorized access and misuse of client data.

For this reason, age verification methods must be employed with data privacy in mind, leading to the adoption of age verification solutions to meet these complex requirements. Such solutions make compliance with international data standards, such as GDPR, far more straightforward and become a significantly cost-effective investment.

Verification Accuracy and Throughput

The increasing volume of digital profiles requires a far more sophisticated methodology for achieving age assurance. This is due to the sheer volume of profiles that must be vetted and confirmed, which has a corresponding effect on the accuracy of the checks.

Traditional and manual age verification methods cannot cope with the increasing trend in digital profiles, particularly when this data suggests an exponentially increasing number of digital profiles and interactions.

Manual verification requires a trained human to be present to carry out a specific authentication process for a new user. This incurs a number of challenges that are no longer viable in modern-day business practices:

Inaccuracy of checks and human error.

Limited working hours of humans.

Limitations in transaction/verification throughput.

Labor and training costs.

These pain points are becoming increasingly costly for businesses and solvable with age verification systems. Online age verification services are proving to be a considerable driver in efficiency, easily complying with regulators and significantly streamlining operational costs.

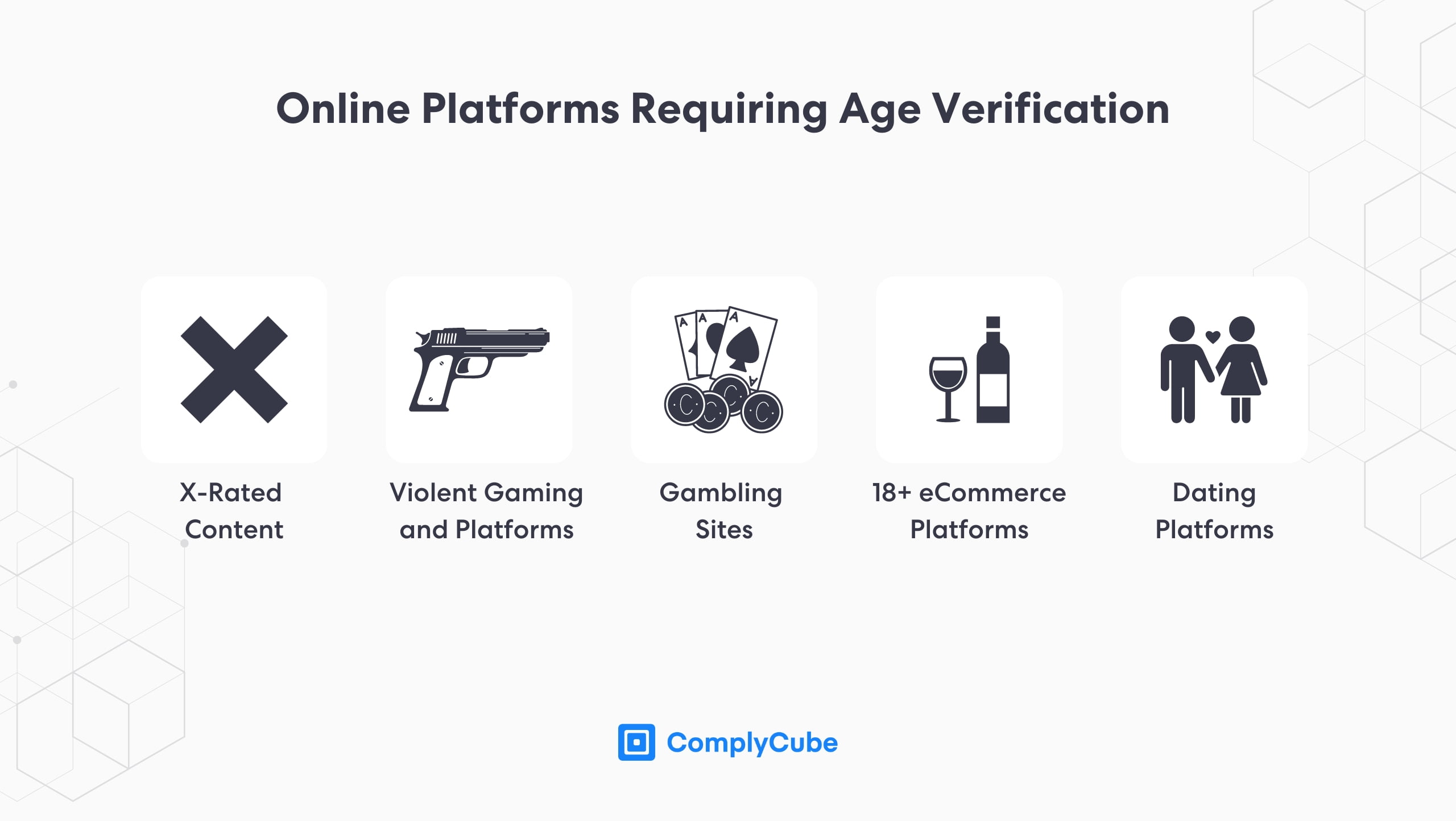

Online Age Verification Solutions

Regarding Know Your Customer (KYC) and IDV solutions, age assurance is an umbrella term for various age verification methods. Regulatory requirements can vary depending on the level of harmful content a platform might facilitate.

The dynamic landscape of online content means that age verification systems must be versatile. They must recognize that different age groups will access different products and content. This means that the legal requirements for age verification services will demand different verification methods.

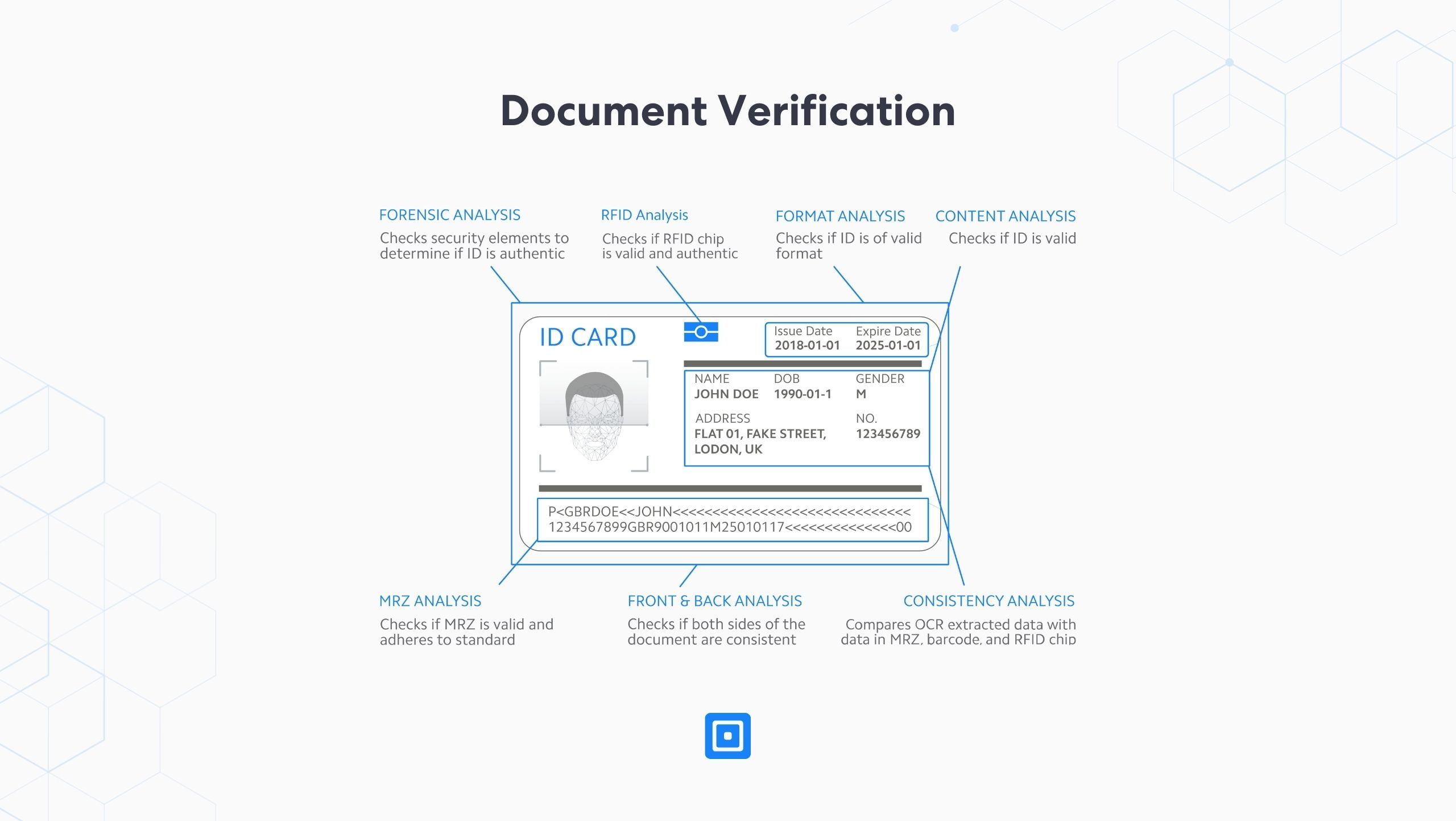

Document Verification

Document verification enables businesses to comply with legal age restrictions and regulations. Modern automated IDV and KYC solutions use cutting-edge technologies and AI to instantly analyze and authenticate KYC documents, such as a driver’s license.

Automated analysis like this can detect forgeries, falsifications, and any other fraudulent attempt far quicker and more precisely than a human by immediately analyzing multiple data points in one flow. This strengthens the age assurance framework by preventing underage access to age-restricted products.

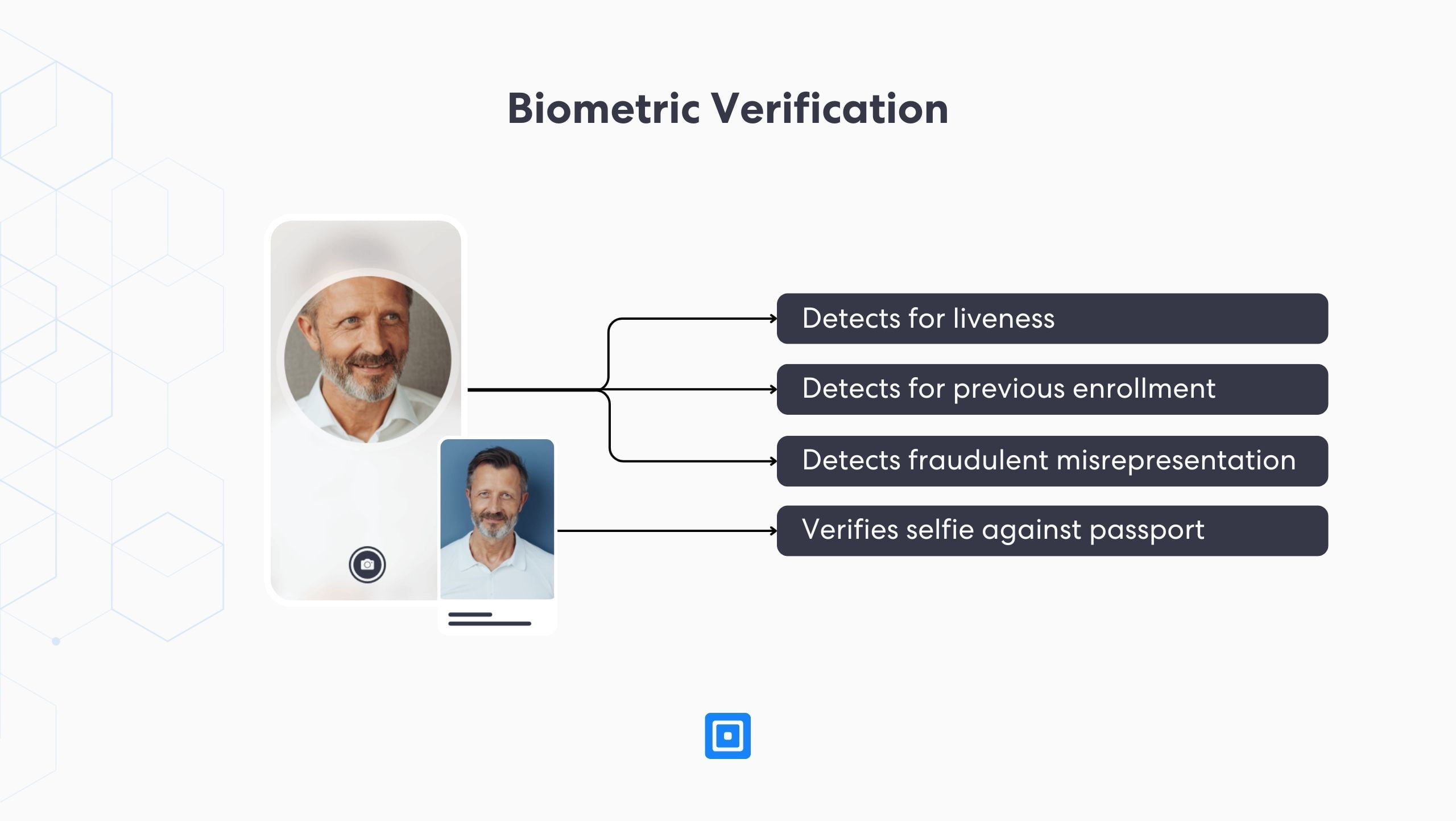

Biometric Verification

Biometric verification also leverages sophisticated AI algorithms and a liveness detection feature to determine if the selfie a user has supplied is genuine and not forged. It also matches for similarities between the stock photo in the user’s document, analyzing facial features as well as a host of other structures.

The combination provides companies with a powerful mechanism for verifying a user’s identity and, thus, their age. Document and biometric verification can both be completed in under 30 seconds, making it a scalable and precise method for achieving age assurance.

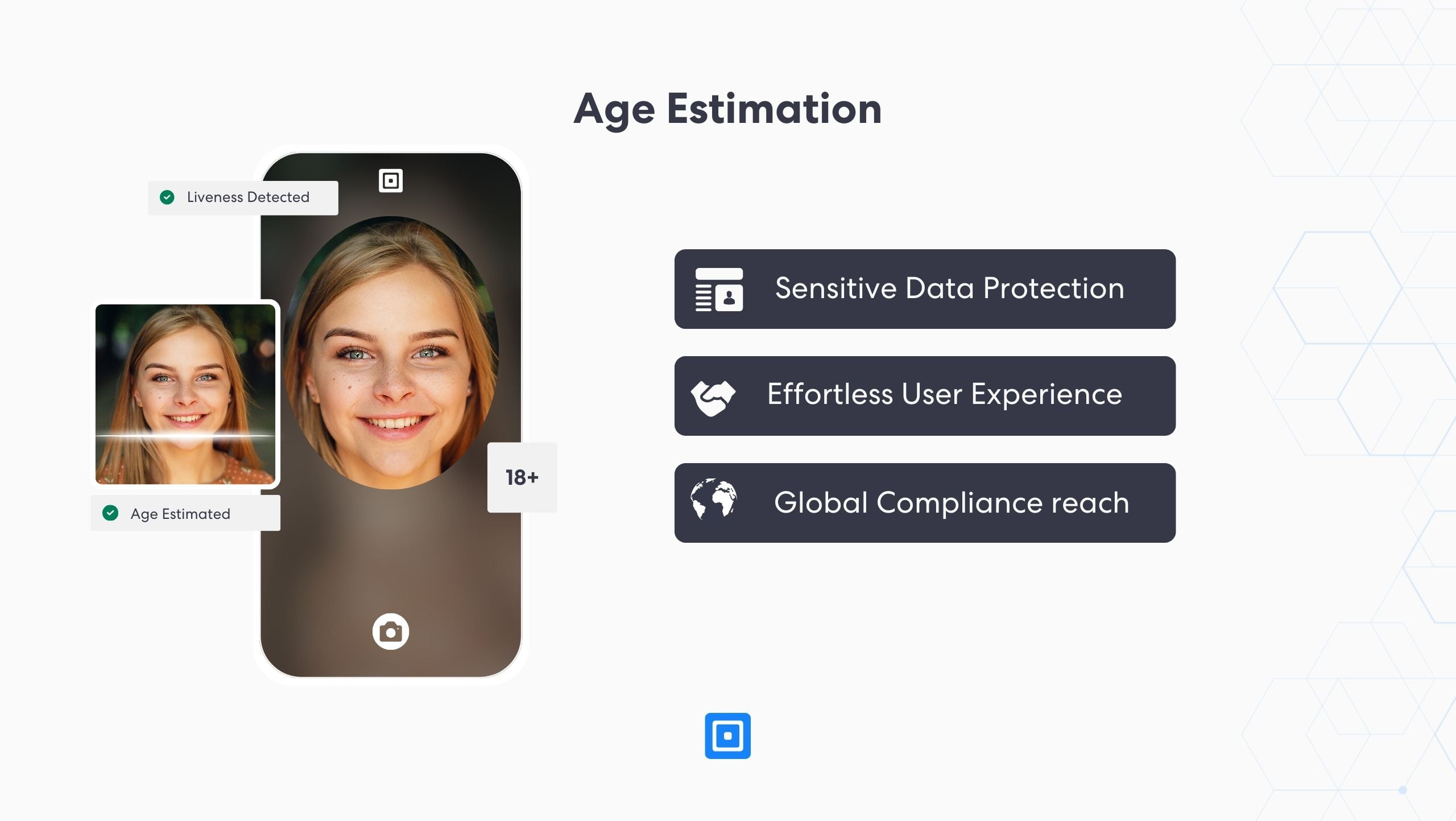

Age Estimation

Leveraging the same technology as biometric verification, age estimation provides businesses with a sleek and extremely versatile age verification solution. Users of a wide age range can be accurately authenticated in an average of 5 seconds.

Even with the aid of an AI-powered solution, estimating user age does not provide the same level of age assurance as authenticating users with document and biometric verification. However, it allows businesses with fewer regulatory requirements to implement a robust yet frictionless age-gating process. For more information on digital age verification, read What is an Online Age Verification System?

Time to Partner with an Age Verification Solution?

Robust age assurance solutions are increasingly important to online safety. They ensure that only users of the appropriate age can access age-restricted content. The accessibility of the Internet and online material has significantly dampened the efficacy of parental consent.

The complexities associated with online age verification, from ensuring compliance with international regulations to addressing data privacy concerns and achieving verification accuracy, underscore the necessity for advanced and reliable age verification systems.

Integrating a sophisticated age verification solution not only protects minors from accessing inappropriate content but also safeguards brand reputation by mitigating legal risks and enhancing corporate operational efficiency. This is a growing trend that cannot be overstated as global societies and economies increasingly convene online.

About ComplyCube’s Age Verification Solutions

ComplyCube is Age Check Certification Scheme (ACCS) certified for for Age Check Systems and Data Protection and Privacy Certification. Such an accolade would not be possible without an industry-leading product.

The AML, KYC, and IDV leader empowers firms of all sizes to accurately verify their users’ age with customizable automation routes and powerful liveness detection technology. If your business is looking for a partner for IDV solutions, contact ComplyCube today to find a solution.