International regulatory frameworks protect global organizations and individuals from fraud as financial crime increases with the development of AI-powered tools. Organizations like the FATF serve as international watchdogs, ensuring that nations remain compliant with critical standards and values that serve global economies and individuals. In the United Kingdom, several regulatory bodies ensure compliance within different sectors, working together to enable faster detection and disruption of illicit financial activities. UK AML regulation places a strong focus on risk-based approaches, requiring businesses to assess the unique risks they face and implement tailored measures to prevent fraud.

The Financial Conduct Authority (FCA) focuses primarily on businesses within the finance sector, while His Majesty’s Revenue & Customs (HMRC) watches real estate firms or accountancies, ensuring all UK industries are aligned with both national and international expectations. The FCA, HMRC, and National Crime Agency (NCA) work together very closely to ensure a cohesive, unified approach to crimes, including money laundering, identity fraud, and terrorist financing.

Core UK AML Regulation

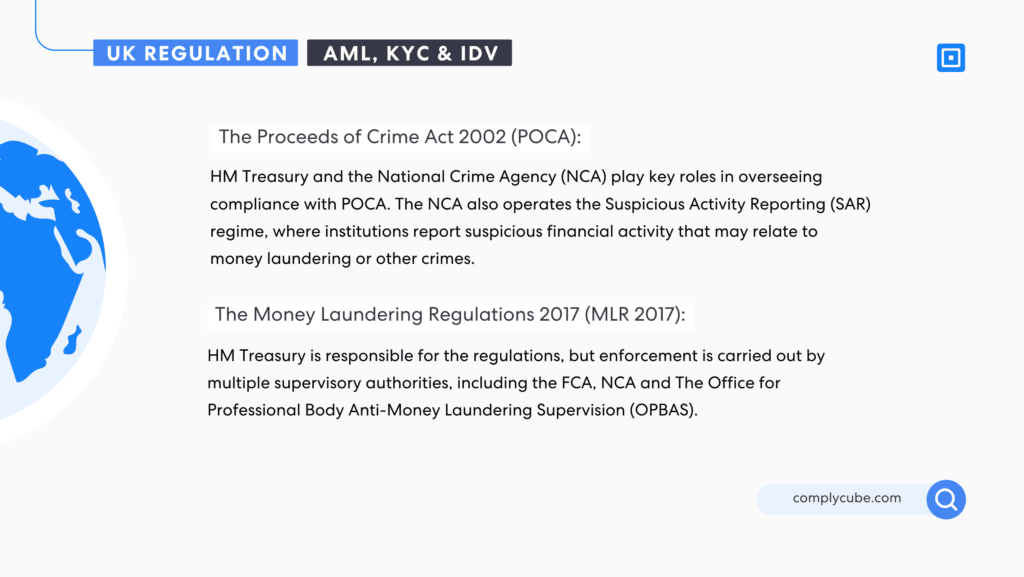

In the UK, The Proceeds of Crime Act 2002 (POCA) and The Money Laundering Regulations 2017 (MLR 2017) are enforced and overseen by various regulatory bodies. These regulations form the core of the UK’s Anti-Money Laundering (AML) framework.

- The Proceeds of Crime Act 2002 (POCA):

- HM Treasury and the National Crime Agency (NCA) play key roles in overseeing compliance with POCA. The NCA also operates the Suspicious Activity Reporting (SAR) regime, where institutions report suspicious financial activity that may relate to money laundering or other crimes.

- The Money Laundering Regulations 2017 (MLR 2017):

- HM Treasury is responsible for the regulations, but enforcement is carried out by multiple supervisory authorities, including the FCA, HMRC and The Office for Professional Body Anti-Money Laundering Supervision (OPBAS).

- Under MLR 2017, businesses must conduct customer due diligence (CDD) which includes comprehensive identity verification practices. Maintaining ongoing monitoring of business relationships and keeping records of CDD and transactions is also required. Suspicious activities must be reported, and risk-based approaches to AML are implemented.

The Sanctions and Anti-Money Laundering Act granted the UK government the authority to create regulations and impose financial sanctions in 2018 after Brexit. Before SAMLA, these sanctions were largely governed by EU law. SAMLA outlines several regulations that businesses must comply with, particularly concerning financial sanctions. The framework outlines that businesses must ensure they do not engage in transactions with Designated Persons (DPs) or entities owned or controlled by DPs who are on sanctions lists. Companies also have a duty to report suspected sanctions breaches and freeze assets when necessary.

UK Regulators

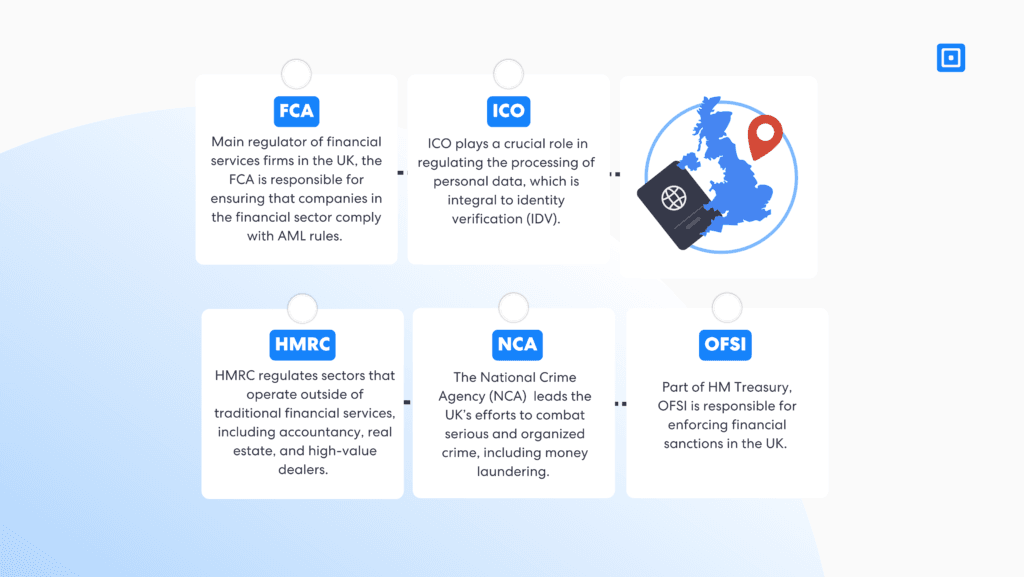

The enforcement of AML, IDV, and KYC regulation in the UK is not carried out solely by one organization but rather is pushed forth by several leading bodies, some of which include:

- Financial Conduct Authority (FCA): As the main regulator of financial services firms in the UK, the FCA is responsible for ensuring that companies in the financial sector comply with AML rules. It sets out the requirements for AML controls, conducts supervisory reviews, and can impose penalties for non-compliance. Financial entities such as banks, insurance providers, and investment firms fall under the FCA’s jurisdiction for enforcement.

- HM Revenue & Customs (HMRC): HMRC regulates sectors that operate outside of traditional financial services, including accountancy, real estate, and high-value dealers. It ensures these businesses adhere to AML and IDV regulations by conducting inspections, offering guidance, and taking enforcement actions where necessary. Additionally, HMRC collaborates with other law enforcement bodies to investigate and prosecute cases of money laundering.

- National Crime Agency (NCA): The NCA leads the UK’s efforts to combat serious and organized crime, including money laundering. It plays a critical role in identifying, investigating, and dismantling illicit financial operations. The NCA analyzes suspicious activity reports from businesses, law enforcement, and international partners, conducts in-depth investigations into money laundering schemes, and seizes illegal assets, working closely with both domestic and global entities in the fight against financial crime.

- The Office of Financial Sanctions Implementation (OFSI): Part of HM Treasury, OFSI is responsible for enforcing financial sanctions in the UK. Financial sanctions are an important tool in combatting money laundering and terrorist financing.

- The Information Commissioner’s Office (ICO): While not directly involved in AML or KYC, the ICO plays a crucial role in regulating the processing of personal data, which is integral to identity verification (IDV) procedures. It ensures that organizations comply with data protection regulations, such as GDPR when collecting and storing information for KYC purposes.

Who is Subject to AML Regulation in the UK?

The FCA reports that there are over 100,000 businesses in the UK that are subject to AML regulations. This includes, but isn’t limited to:

- Financial institutions such as banks, building societies, and credit institutions

- Crypto exchanges and businesses

- High-value dealers (jewelers, art dealers, auctioneers, car dealers)

- Accountancies and law firms

- Money service businesses such as currency exchanges or money transfer services

- Real estate agents

- Crowdfunding platforms and fintechs

- Tax advisors

Resources For AML Regulatory Compliance

FCA Handbook: The FCA provides a handbook that outlines expectations regarding customer verification and necessary checks, as well as further expectations such as ongoing monitoring. The handbook states, “Firms must identify their customers and, where applicable, their beneficial owners and verify their identities. They must also understand the purpose and intended nature of the customer’s relationship with the firm and collect information about the customer and, where relevant, the beneficial owner. This should be sufficient to obtain a complete picture of the risk associated with the business relationship and provide a meaningful basis for subsequent monitoring.”

Firms must identify their customers and, where applicable, their beneficial owners and verify their identities.

JMLSG Guides: This guide lays out expectations regarding how businesses should prevent and approach money laundering and terrorist financing. It outlines expectations for firms to prevent financial crime while offering flexibility on how they apply these rules based on their specific products, services, transactions, and customer base.

HMRC’s notices can also be helpful for monitoring AML, KYC, and IDV updates and expectations.

Navigating Compliance in the UK

Ensuring that your business is able to stay compliant with national and international watchdog regulatory mandates is critical for scalable growth, global reputation, and avoidance of hefty fines. As fraud continually becomes more sophisticated, regulations will continue to tighten to ensure businesses take accountability for financial crime occurring on their doorstep.

Recent updates in the space include the world’s first scam reimbursement rule, which went live on the 7th of October in the UK. The FCA now requires banks, building societies, payment institutions, and e-money institutions to reimburse victims for their losses to digital fraud, paying up to £85,000 per case. This will surely increase the individual accountability of every business within the sector, making fraud prevention even more of a priority.

Partnering with a reliable IDV, AML, and KYC platform has now become critical to most businesses across the UK in ensuring regulatory compliance and preventing digital fraud. For more information on protecting your business from fraud, contact one of ComplyCube’s compliance experts.