UK accountants face more than just balance sheets and tax returns in today’s increasingly regulated world. Every client brings inherent risks that, if left unchecked, can harm a firm’s reputation, expose it to financial penalties, or even lead to legal repercussions. Knowing exactly who your clients are isn’t just advisable—it’s imperative. The best AML software for accountants will verify all necessary client information, including the legal structure of a client’s organization, the identities of all Ultimate Beneficial Owners (UBOs), and much more. KYC for accountants ensures that firms maintain robust compliance processes and seamlessly align with the mandates set by governing bodies like the Association of Chartered Certified Accountants (ACCA).

AML Obligations for Accountancy Firms

In the UK, several key legislative mandates, such as The Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017, outline AML standards that must be met by all financial institutions. The Association of Chartered Certified Accountants (ACCA) underlines these requirements for accountancy firms and supervises its members, ensuring compliance with AML laws and regulations.

(2017) The Money Laundering, Terrorist Financing, and Transfer of Funds Regulations

The 2017 Money Laundering, Terrorist Financing, and Transfer of Funds Regulations marked a turning point in compliance for accountants across the UK. This legislation imposed a stricter framework of Client Due Diligence (CDD) practices, mandating a more thorough understanding of each client’s business activities, financial history, and ownership structure.

Understanding the nature of a client’s business enables accountants to identify behaviors that appear to be unusual and may amount to suspicious activity when considered in context with what’s known about the client’s background.

In order to fully understand the nature of a client’s business operations and interests, accountants must use the right KYC processes to identify the following:

- The legal structure of the client’s organization. As part of the verification process, the certificate of incorporation, a breakdown of share ownership, or a partnership agreement should be accessed.

- The date that the business started trading.

- The identities of all of the Ultimate Beneficial Owners (UBOs), directors, and any other identities with significant control of the organization must be verified through a document check alongside a proof of address check, as mandated by the Association of Chartered Certified Accountants (ACCA). However, a biometric liveness check can further solidify this process for accountancies, helping to detect more sophisticated cases of identity fraud that might bypass a standard document check.

- ACCA also requires adverse media monitoring to ensure reputational and compliance risks are mitigated.

Adverse Media Checks

Adverse media checks involve searching news and public sources for negative information related to an individual or entity, such as involvement in fraud, financial crime, or other risky activities. These checks help accountancy firms identify potential reputational or compliance risks associated with clients or partners.

If there are any adverse media associated with the client, the best practice is to search the client’s registered name, trading name (if different), and the names of the client’s ultimate beneficial owners/directors.

However, attempting to search for adverse media without a sophisticated solution that can carry this out in an automated and precise manner can be risky. It’s best to work with AML software that can run this process automatically, providing continuous real-time monitoring and notifications on changes in a client’s risk status.

ACCA underlines that additional information on high-risk clients might need to be recorded, such as (but not limited to) identified sources of income, previous yearly turnover, future revenue projections, and an organization’s operational structure.

Risk Assessments for a UK-Friendly Approach

The UK supports a Risk-Based Approach (RBA) when considering the best AML compliance practices. A risk assessment can determine what processes must be carried out to meet AML regulations. The risk-based approach to AML and KYC compliance was first introduced by the Financial Services Authority (FSA) in 2000, an organization that is now known as the Financial Conduct Authority (FCA), the UK’s primary financial watchdog.

Similarly, in 2012, the FATF also officially adopted the RBA as a central regulatory principle. High-risk clients require additional due diligence to ensure AML compliance processes are sufficient according to regulatory requirements. Client onboarding must differentiate between low-risk and high-risk clients according to UK (FCA) and international (FATF) guidance. For more on RBAs, read “What is a Risk-Based Approach (RBA)?“

What Does an Enhanced Due Diligence Process Look Like?

Enhanced Due Diligence (EDD) is a thorough vetting process that accounting firms might apply to high-risk clients to ensure compliance with Anti-Money Laundering (AML) regulations. It involves gathering additional information to assess and mitigate potential risks associated with the business relationship.

ACCA states, “Firms must ensure that they conduct EDD on all clients based in, trading with, or transacting to a high-risk third country as defined by the Financial Action Task Force (FATF) and named in the HM Treasury Advisory Notice: High-Risk Third Countries.”

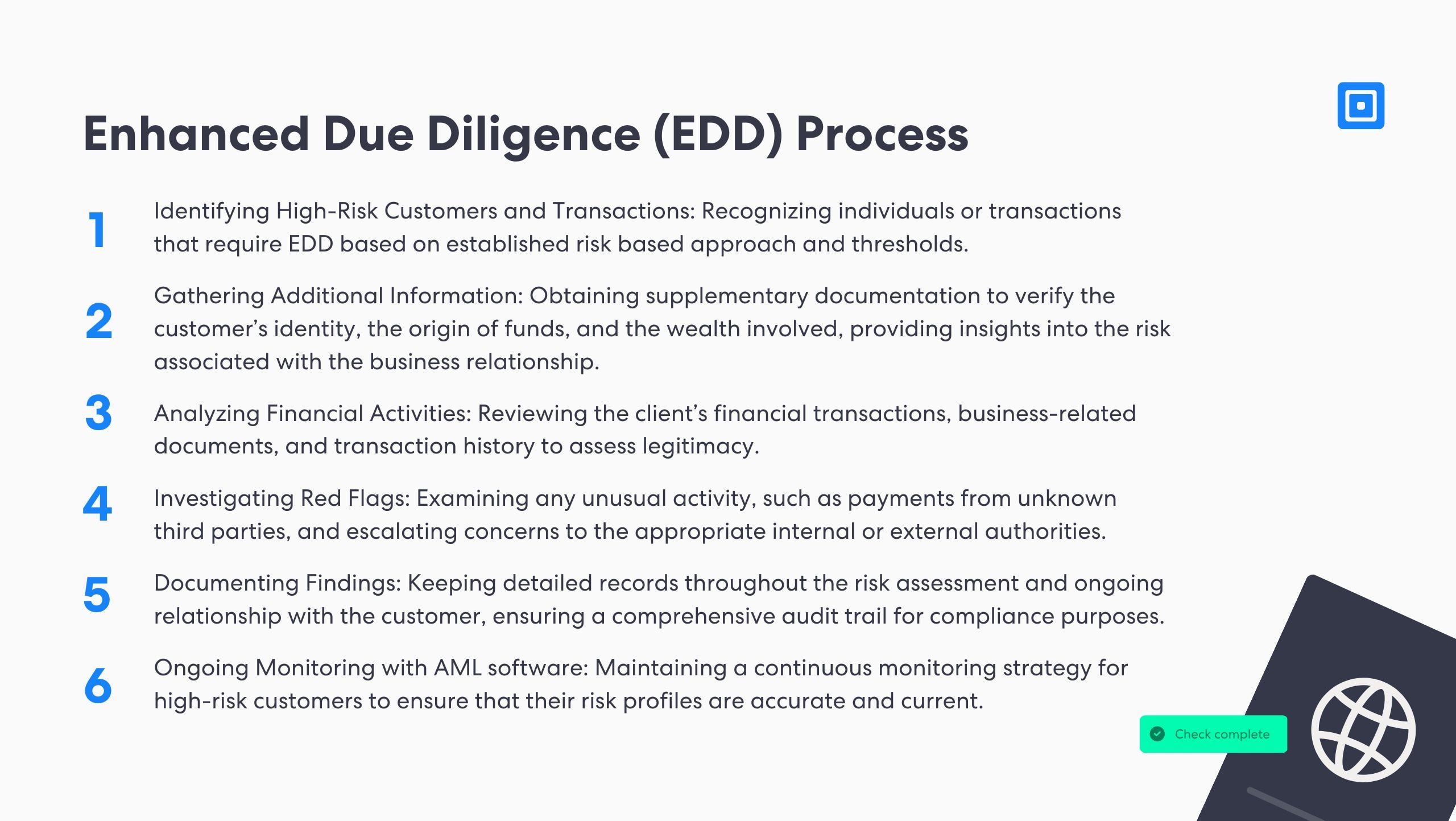

The Enhanced Due Diligence (EDD) process ensures business verification through the following methods:

- Identifying High-Risk Customers and Transactions: Recognizing individuals or transactions that require EDD based on established risk-based approaches and thresholds.

- Gathering Additional Information: Obtaining supplementary documentation to verify the customer’s identity, the origin of funds, and the wealth involved, providing insights into the risk associated with the business relationship.

- Analyzing Financial Activities: Reviewing the client’s financial transactions, business-related documents, and transaction history to assess legitimacy.

- Investigating Red Flags: Examining any unusual activity, such as payments from unknown third parties, and escalating concerns to the appropriate internal or external authorities.

- Documenting Findings: Keeping detailed records throughout the risk assessment and ongoing relationship with the customer, ensuring a comprehensive audit trail for compliance purposes.

- Ongoing Monitoring with AML software: Maintaining a continuous monitoring strategy for high-risk customers to ensure that their risk profiles are accurate and current.

For more information on Enhanced Due Diligence (EDD), read “Navigating the World of Enhanced Due Diligence.“

Finding the Best AML Software For Your Compliance Needs

Each accountancy firm will face its own unique challenges in achieving compliance, which is why a one-fits-all approach isn’t always best. David Winch, a forensic accountant and Director of MLRO Support, states that “Each accountancy firm is unique – not least because its partners have unique experience, knowledge, and interests. In my opinion, each firm’s AML compliance must also be unique.”

Finding a platform with solutions that can be tailored is necessary, as different accountants may differ in needs. Some examples might include:

- Client Base Diversity: Firms serving high-risk clients in sectors like real estate or foreign investments may need more robust adverse media screening and ongoing monitoring solutions than firms primarily working with low-risk clients or individuals.

- Firm Size and Resources: Smaller firms may require more cost-effective, streamlined AML tools that don’t overburden limited resources, while larger firms with broader client bases may benefit from advanced analytics and customizable features that provide deeper insights into client risk.

- Regulatory Jurisdiction: Firms operating internationally need AML software that complies with multiple regulatory frameworks, whereas firms focused solely on UK clients may prioritize local compliance features aligned with ACCA and UK AML mandates.

- Level of Automation Needed: Firms with a higher volume of clients might require automated KYC processes to manage onboarding efficiently, while smaller firms may prefer manual verification to maintain personalized client service.

Customizable AML solutions allow firms to address these varied needs, ensuring compliance that aligns with their unique client profiles, resource availability, and regulatory environments. Finding a platform that offers such adaptability is critical.

ComplyCube’s AML Software for Accountants

ComplyCube offers state-of-the-art Anti-Money Laundering (AML), Know-Your-Customer (KYC), and Identity Verification (IDV) solutions for accountants, easily keeping UK businesses compliant. UK accountants can implement tailored AML software solutions that adapt to the specific diligence requirements for different client types.

The platform offers flexible, customizable checks, such as document verification, biometric authentication, and liveness detection, allowing firms to adapt their approach based on client risk levels and transaction types. By automating these processes, ComplyCube reduces the operational burden on accountants, helping them maintain high compliance standards while focusing on their core advisory and auditing services.

Additionally, ComplyCube’s real-time adverse media and sanctions screening enhances firms’ ability to detect and manage potential risks associated with high-risk clients or entities. The platform’s continuous monitoring feature ensures that risk profiles remain current, alerting firms to any changes in client status, which is crucial for ongoing compliance in an evolving regulatory environment.

For more information on ComplyCube’s services, get in touch with one of their compliance experts.