Compliance with Anti-Money Laundering (AML) regulations is no longer optional for businesses, as regulators have made it clear that the consequences will be severe. Organizations are under substantial pressure to ensure that their processes are robust, their clients are legitimate, and their transactions are transparent. However, many fail to understand what factors drive up the cost of AML processes. Businesses find themselves faced with unforeseen expenses due to an initial lack of transparency regarding an AML check cost breakdown.

Financial institutions should understand the justification behind AML compliance costs as they implement comprehensive AML programs to mitigate financial crime and adhere to AML regulations. Manual checks may seem straightforward and cost-effective, as businesses do not need to pay a KYC or AML platform subscription fee. However, unforeseen expenses can quickly add up, often making these checks more expensive. These hidden costs, from labor-intensive processes to the potential for human error, can significantly impact a business’s ability to scale. Automated AML solutions leverage technology that can handle much of the heavy lifting, allowing businesses to streamline their compliance efforts and ensure they remain ahead of regulatory demands without draining resources.

Similarly, several factors must also be considered when choosing an AML platform to partner with. Many AML check providers don’t include all necessary features within their standard package, leaving businesses needing to pay several add-on fees. In this guide, we’ll break down the pricing of manual and automated AML checks, dive into the often-overlooked hidden expenses, and provide insight on how to choose the right AML platform.

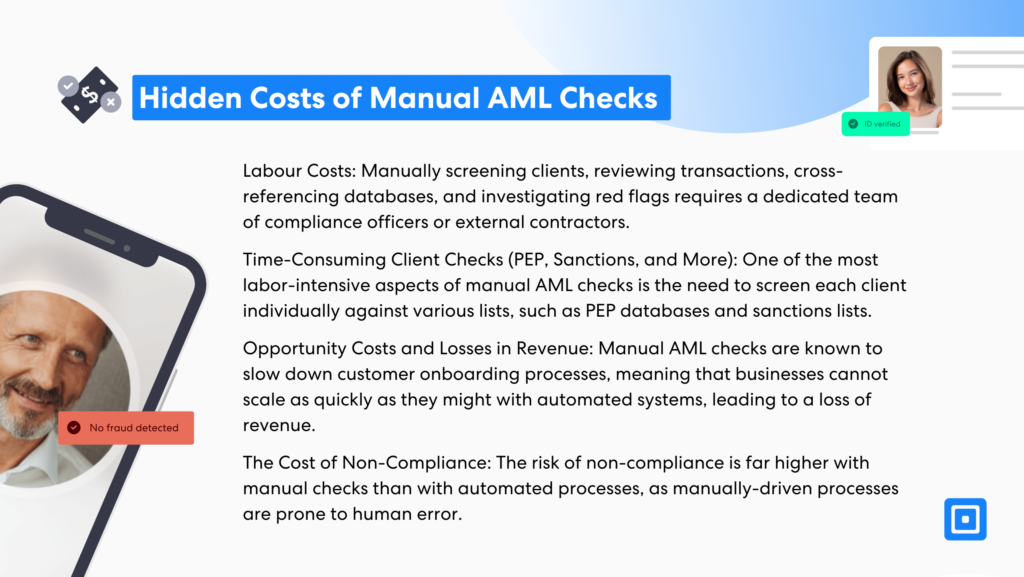

The Hidden Costs of Manual AML Checks

The cost of AML compliance includes the investment in technology and the training required to minimize human error. By leveraging technology, institutions can streamline their compliance processes, reducing the associated risk of non-compliance and improving efficiency, though the AML check cost remains a considerable challenge. However, businesses may feel obligated to use manual processes to achieve AML compliance, especially if their budget is tight and they’re looking for an affordable solution.

Yet, the hidden costs associated with manual checks can quickly spiral out of control. A long list of unforeseen expenses can very quickly drain resources and put organizations at serious risk of non-compliance. Some of the hidden costs associated with these kinds of checks include:

Labor Costs: The most obvious hidden cost of manual AML checks is the labor required to carry out the checks themselves. Manually screening clients, reviewing transactions, cross-referencing databases, and investigating red flags requires a dedicated team of compliance officers or external contractors. This means ongoing wages and benefits for staff performing these tasks, along with the added administrative costs of managing them. Over time, this can become a significant recurring expense that many businesses underestimate when first considering manual AML processes.

Time-Consuming Client Checks (PEP, Sanctions, and More): One of the most labor-intensive aspects of manual AML checks is the need to screen each client individually against various lists, such as PEP databases and sanctions lists. For businesses with high volumes of clients, this means going through each person’s profile, cross-referencing them against national and international lists, and often conducting a deeper dive into adverse media reports or their sources of wealth.

Opportunity Costs and Losses in Revenue: Manual AML checks are known to slow down customer onboarding processes, meaning that businesses cannot scale as quickly as they might with automated systems, leading to a loss of revenue. Similarly, time spent on investigations on high-risk customers can take long periods, with manual collection and analysis of additional information, such as the client’s transaction history, geographical links, and political affiliations. Team effort and resources are put into carrying out these manually-intensive processes, once again leading to a loss of revenue due to the opportunity cost of placing efforts into these checks.

The Cost of Non-Compliance: The risk of non-compliance is far higher with manual checks than with automated processes, as manually-driven processes are prone to human error. A team member may easily miss a flagged transaction or fail to identify a suspicious pattern that an AI-powered process would never miss. These mistakes, however minor they may seem, can lead to serious penalties and legal fees due to non-compliance.

Many more examples of hidden problems in manual AML processes can be named, including fragmented record-keeping and reporting, lack of real-time monitoring, and proactive risk management. All of these examples can lead to hefty penalties, proving the importance of investing in a trusted platform that can provide expert checks.

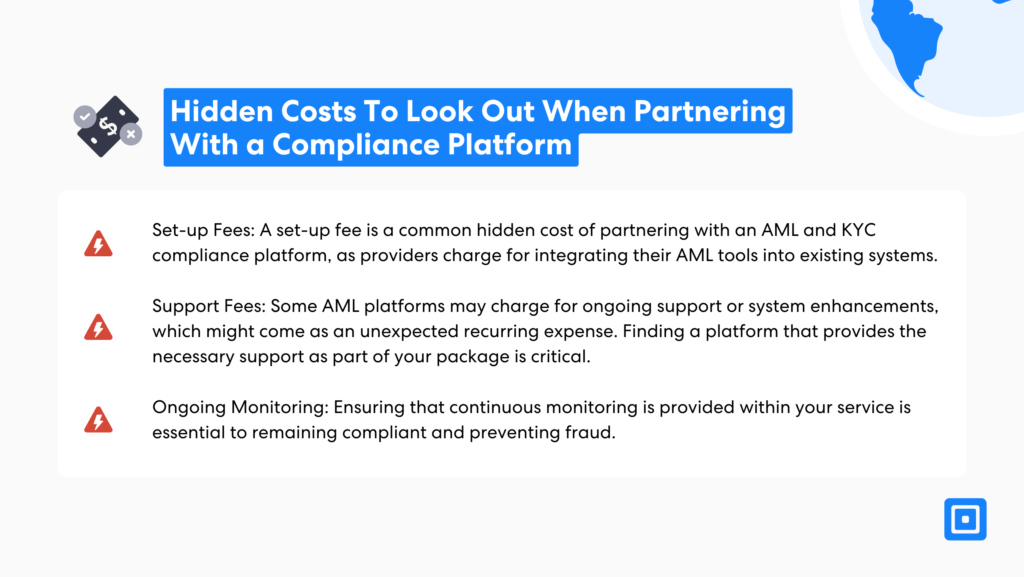

Hidden Costs to Look Out for When Partnering With A Compliance Platform

The AML compliance process typically includes customer due diligence, risk scoring, and onboarding processes to assess high-risk customers and identify suspicious activities. These measures are essential for creating a secure financial environment, but they also drive up compliance costs, particularly when considering the cost of AML compliance across all stages of the AML compliance program.

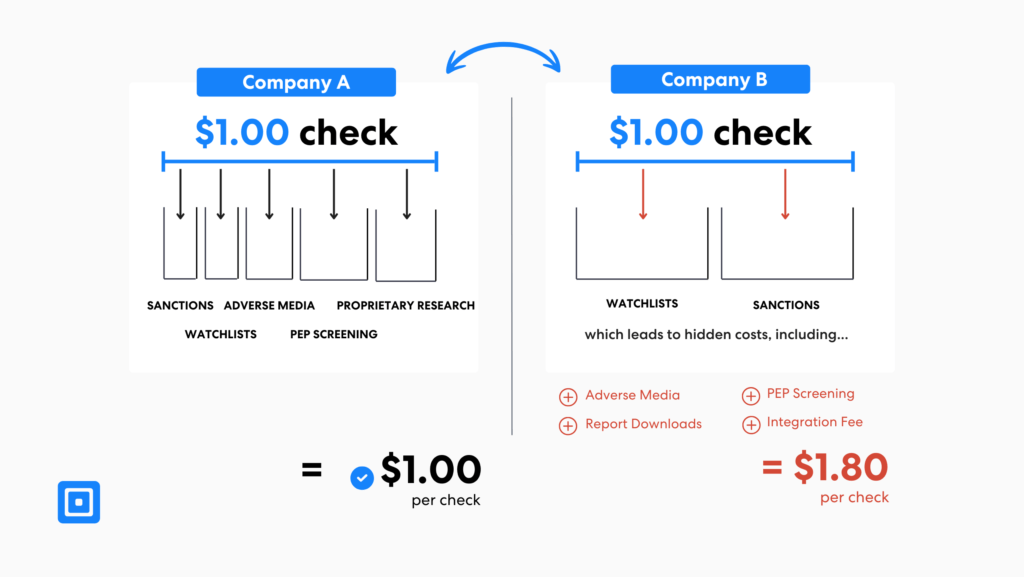

Whilst partnering with an automated platform is definitely necessary, it’s important to be aware of hidden fees within different pricing structures to ensure an optimal return on investment. Whilst checks may be priced similarly, for example at $1.00 per check, when businesses break down what is incorporated within that bracket they often find that necessary features are not included. Therefore, checks are far more expensive than anticipated.

Set-up fees can amount to £20,000.

Some examples of hidden fees to look out for are:

- Set-up fees: A set-up fee is a common hidden cost of partnering with an AML and KYC compliance platform, as providers charge for integrating their AML tools into existing systems. Set-up fees can amount to £20,000, a noteworthy expense for most businesses.

- Support fees: Some AML platforms may charge for ongoing support or system enhancements, which might come as an unexpected recurring expense. Finding a platform that provides the necessary support as part of your package is critical.

- Lack of Proprietary Data: Some providers access only public sanctions data, with propriety data increasing AML screening costs a drastic 5x.

- Data Retention and Report Downloads: Another hidden cost is not including data retention and the ability to download reports in a standard package. Some providers offer this only as an add-on, which can be an unexpected expense for the customer.

- Lack of Volume-Based Pricing: Providers that offer volume-based pricing are often far more economical for businesses that need to carry out a large number of checks.

- Ongoing Monitoring: Ensuring that Ongoing Monitoring is included within your package is critical, as trying to do this manually can be extremely expensive and time-consuming. is essential to conduct a new screening in accordance with your ongoing monitoring policy. This may require performing a new manual check on a daily basis.

Harry Varatharasan, Chief Product Officer at ComplyCube, states, “Many AML providers market their services as cost-effective solutions, but businesses are often caught off guard by hidden expenses that escalate quickly. From third-party fees to unexpected setup and support costs, these hidden charges can turn what initially seemed like an affordable option into a significant financial burden.”

As Harry notes, businesses must thoroughly understand the full cost structure before committing to an AML provider, as overlooking these expenses can lead to compliance challenges and unanticipated financial strain. Transparency regarding the pricing breakdown is critical to making the right decision.

Maximizing ROI With the Right Provider

Choosing the right AML and KYC provider is a critical step for businesses to ensure they maintain a positive return on investment in their solutions. Providers that lack transparency around pricing, such as what might be classed as an “add-on” or an ongoing support fee, often lead to businesses avoiding adding critical services to their package that they would otherwise have included with another provider. Or, if they do decide to add additional services, they are often paying an unnecessarily high price point.

For more information about ComplyCube’s AML platform and pricing, get in touch with one of our compliance experts.