Accountancy firms, like all financial institutions, have a large responsibility on their shoulders regarding AML compliance for accountants. Money laundering is a serious crime that can tarnish an organization’s reputation quickly. International organizations such as the Financial Action Task Force (FATF), the International Monetary Fund (IMF), the International Criminal Police Organization (Interpol), and more ensure that global mandates are met and that under-supported AML schemes quickly come to light. The best AML software for accountants and finance professionals is one that offers AI-powered Know Your Customer (KYC) and Enhanced Due Diligence (EDD) checks alongside ongoing monitoring and individual risk assessments.

Who Regulates AML Compliance for Accountants in the UK?

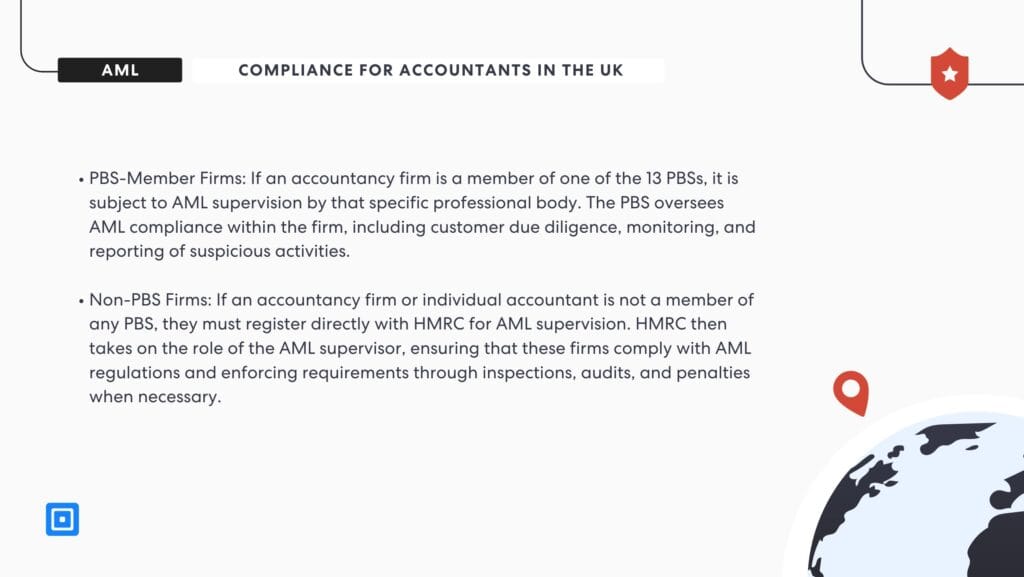

Currently, the UK has 25 AML supervisors, three of which are statutory supervisors. These include the Financial Conduct Authority (FCA), the Gambling Commission, and HM Revenue & Customs (HMRC). These watchdogs hold the legal power to enforce AML rules, conduct inspections, and impose penalties for non-compliance.

In addition to these, another 22 bodies, known as Professional Body Supervisors (PBSs) exist and are responsible for AML supervision of lawyers and accountancy firms in the UK. Nine PBSs exist for the legal sector, and 13 exist for accountancies.

PBS-Member Firms: If an accountancy firm is a member of one of the 13 PBSs, it is subject to AML supervision by that specific professional body. The PBS oversees AML compliance within the firm, including customer due diligence, monitoring, and reporting of suspicious activities.

Non-PBS Firms: If an accountancy firm or individual accountant is not a member of any PBS, they must register directly with HMRC for AML supervision. HMRC then takes on the role of the AML supervisor, ensuring that these firms comply with AML regulations and enforcing requirements through inspections, audits, and penalties when necessary.

AML Obligations in the Sector

Accountancy firms are legally required to comply with the Money Laundering, Terrorist Financing, and Transfer of Funds (Information on the Payer) Regulations 2017 (MLRs), which were amended in 2019. These regulations require identity verification, risk profiling, suspicious activity reporting, customer due diligence, ongoing monitoring, and more. However, different organizations must respond to these requirements with differing processes, as each firm’s specific needs to meet these regulatory demands must be supported.

The Royal United Services Institute (RUSI), the UK’s leading defense and security think tank, states, “The huge variety in size and risk profile of firms operating within both sectors presents significant challenges both to implementation of the MLRs and to AML supervision. While the size of the firm does not necessarily correlate with the risk of the services that it operates, the nature of the money laundering risks that a ‘magic circle’ law firm is exposed to will be very different from the risks that a small high street solicitor is exposed to. The same is true in the accountancy sector.”

The best AML software solution for accountants will be adaptable to the firm’s needs, as a one-size-fits-all package deal simply doesn’t work when avoiding non-compliance. A firm-wide risk assessment may be needed to pinpoint needed compliance measures that are unique to that organization. For example, a large firm specializing in high-net-worth clients or international transactions may prioritize real-time screening against sanctions lists, while a small local practice could focus on efficient Customer Due Diligence (CDD) checks and straightforward identity verification processes.

Each firm’s AML compliance also needs to be unique.

David Winch, the AML & Onboarding Adviser at MLRO Support Ltd, states, “Each accountancy firm is unique – not least because the partners in it have a unique experience, knowledge, and interests,” said Winch. “In my opinion, each firm’s AML compliance also needs to be unique.” For more on UK AML regulation, read “Achieving Compliance: UK AML Regulation.”

Client Onboarding with an AML Software Provider

Client onboarding should always leverage a sophisticated KYC process, as it can help firms quickly flag potential risks. By carrying out ID verification checks, adverse media checks, verifying beneficial owners, sanctions checks, and more, accountants ensure that their clients are not partaking in illicit activities that could tarnish their reputations. For more information on KYC and AML checks, read “KYC vs AML: What is the Difference?”

New clients must undergo AML processes monitored by a Money Laundering Reporting Officer (MLRO). This allows for quick and easy onboarding while minimizing risks by verifying their background and identities.

AML software that effectively screens new customers can empower businesses to scale quickly, as AI-powered KYC can be carried out in minutes. Clients can be onboarded quickly and efficiently without needing to worry about non-compliance. In addition, these platforms can also ensure that data privacy requirements (such as the UK GDPR) are met and respected.

Finding the right balance between holding on to client data, as required by regulatory compliance standards, and respecting data privacy laws can be difficult for firms to do independently. The right AML software provider will protect an organization from having to navigate through this issue.

ComplyCube’s Accounting AML Software Solutions

ComplyCube is a leading KYC and AML platform with a deep understanding of the UK regulatory landscape and the needs of individual companies. UK accountants can find the right software procedures to run AML checks as needed within their solutions, with diligence requirements depending on client types.

Meet regulatory requirements with comprehensive tools to implement the most sophisticated AML procedures, drastically reducing the risks of non-compliance and financial crime. The right AML software solutions for one accountancy firm will differ from those of another, which is why ComplyCube’s solutions are highly customizable.

For more information on how to implement the best AML software for accountants with ComplyCube, get in touch with one of their compliance experts.