Ensuring AML compliance is more important than ever. Choosing the right AML software for accountants plays a pivotal role in ensuring accounting compliance and helps to safeguard against illicit activities. Implementing AML checks for accountants is vital for the security of the broader financial system. This guide explores KYC and AML software and introduces an Anti-Money Laundering checklist for accountants.

Money Laundering in the Accounting Industry

Accountants hold the keys to audit trails and financial records, making them fundamental pillars of financial security. Their proximity to the financial ecosystem makes them a prime target for money laundering activity, whether unwittingly facilitated or intentionally executed.

This vulnerability to money laundering activities makes the Accounting industry of paramount importance to ensure adequate safeguard measures are in place. However, a recent report from December 2023 displayed concerning developments in the industry.

Accounting Compliance Struggles

Inspections by accountancy sector supervisors are declining. Major industry bodies, including the Institute of Chartered Accountants in England & Wales (ICAEW) and the Association of Chartered Certified Accountants (ACCA), have reported significant declines in supervisory activity.

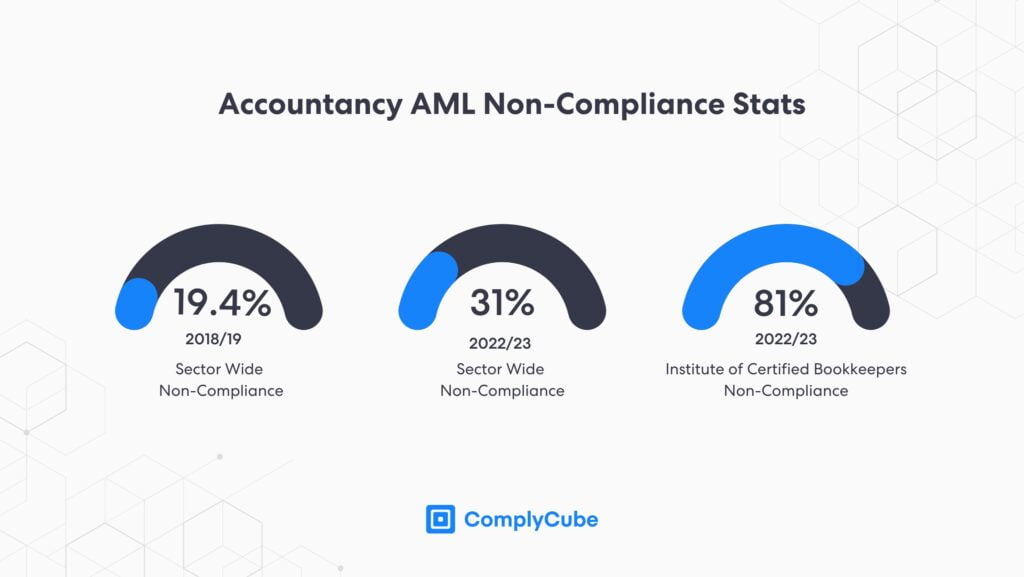

Furthermore, coupled with the declining supervision rates, the rates of non-compliance with core Anti-Money Laundering (AML) regulations are increasing.

Non-compliance across the sector has risen to nearly a third (31%) of the supervised accountancy population in 2022/23, compared to 19.4% in 2018/19.

This is an industry-standard figure. Certain individual supervisory bodies, notably the Institute of Certified Bookkeepers (ICB), witnessed non-compliance rates rise to 81% in 2022/23. The rate at which these figures have risen suggests something in the industry is amiss.

The UK Economic Crime Plan (2023-2026) aims to ‘reduce money laundering and recover criminal assets‘, but the current rate of AML non-compliance does not suggest this has been a success thus far. Furthermore, the UK’s AML compliance program will be under scrutiny in 2025 when the Financial Action Task Force (FATF) conducts its Mutual Evaluations.

Slow Adoption of AML Compliance Software for Accountants

Despite these challenges, research shows that the accounting industry, in particular, is slow to adopt or adapt to new technologies, including Know Your Customer (KYC) solutions.

A report by accountingWEB showed that 60% of accountants grapple with the challenge of using tech to automate administrative tasks.

While fines for financial misconduct are reportedly low in the industry, the limited use of compliance technologies suggests that an industry-wide tech gap fosters these issues. Despite Accounting firms having some of the greatest needs for automated AML and KYC checks, they are some of the last Financial Institutions (FIs) to begin adopting automation, AI, and compliance solutions.

AML Compliance Checklist

Accounting firms and other FIs must conduct a sufficient risk assessment of their clients to adhere to their AML obligations. This involves a set of KYC and AML procedures used to identify clients, perform the necessary background checks on them, and continually monitor them in real-time to ensure the acquired information does not change.

These regulations were initially determined by the Financial Crimes Enforcement Network (FinCEN) via the Bank Secrecy Act (BSA) of 1970 in America. This policy required FIs to help the American government identify and prevent money laundering. FIs, such as accountancy firms, banks, and many other financial services, were required to file a Currency Transaction Report (CTP). These reports are used to increase the transparency around large transactions that are more likely to be affiliated with suspicious activity.

Identity Verification (IDV)

When accountancy firms wish to onboard new clients in the financial sector, they must obtain personal information to comply with KYC and AML regulations. IDV forms the basis of a Know Your Customer and client acquisition process.

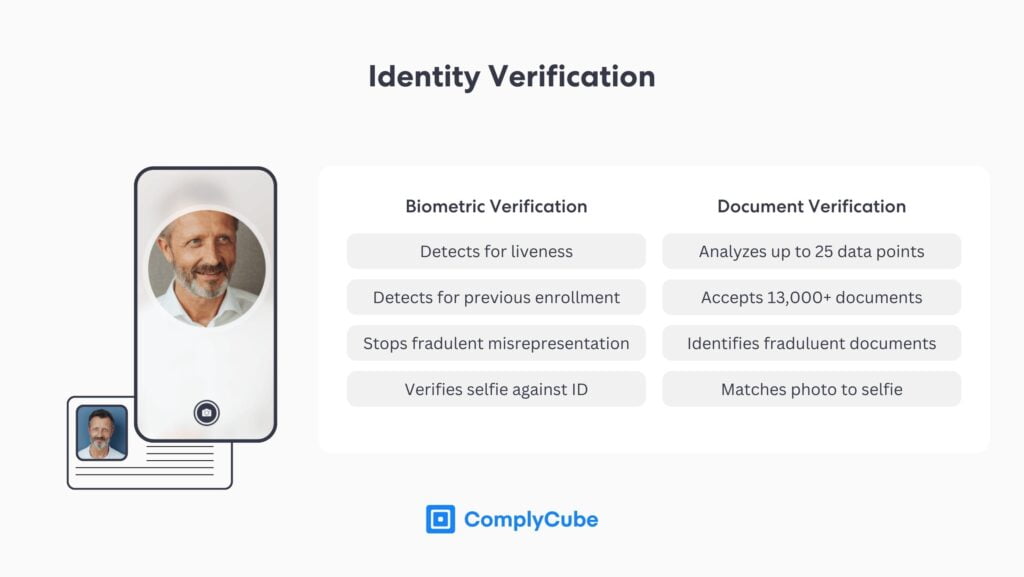

Modern Identity Verification is typically completed in two stages:

- Document Verification captures an image of a new client’s government-issued ID, such as a passport, and verifies the image in seconds. Leveraging high-grade AI technologies, the verification process is extremely reliable and takes a fraction of the time of traditional methods.

- Biometric Verification adds an extra level of identity assurance. Users take a live selfie or video during the onboarding and a similar verification and matching engine scores for likeness between the two images. Biometric authentication takes an average of 5 seconds.

This process covers a comprehensive yet frictionless IDV procedure granting firms a high level of assurance (LOA). This leaves the client satisfied with a streamlined onboarding experience and the firm content that the information they’ve received is accurate. Some institutions do not require the same LOA and can customize their IDV processes accordingly.

Customer Due Diligence (CDD)

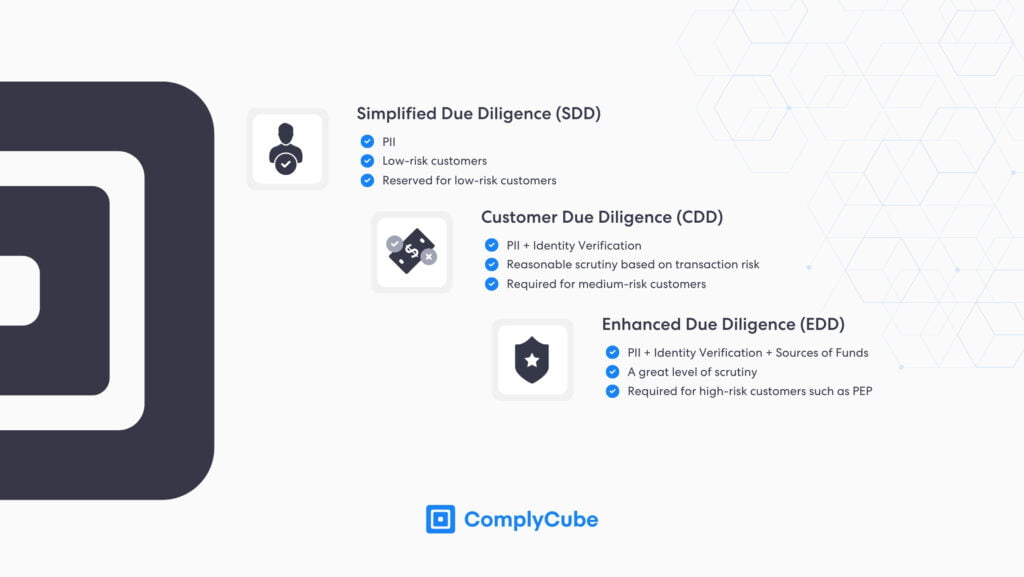

CDD is a pivotal AML procedure in combating money laundering and terrorist financing. For the Accounting sector, the process ensures that new clients are not involved in suspicious activity that could compromise the institution’s compliance with its regulatory obligations.

Customer Due Diligence takes many forms, but the result is always to mitigate the risks of fraud and money laundering. Due diligence tools include Proof of Address (PoA) authentication and multi-bureau verification.

- Sanctions and PEP screening give FIs global coverage of sanctioned and Politically Exposed Persons (PEPs), including sanctioned institutions and terrorists. This helps firms build up an extensive risk profile for new clients.

- Adverse media checks cover thousands of news and media outlets worldwide, ensuring companies are aware of potential threats or risks clients may pose.

- Watchlist screening provides global coverage from institutional and AML watchlists. Data is updated daily, ensuring responses are reliable in real time.

CDD solutions are easy to integrate and typically installed via powerful SDKs or an API to a firm’s existing tech stack. For more information about what these processes involve, read What is Customer Due Diligence?

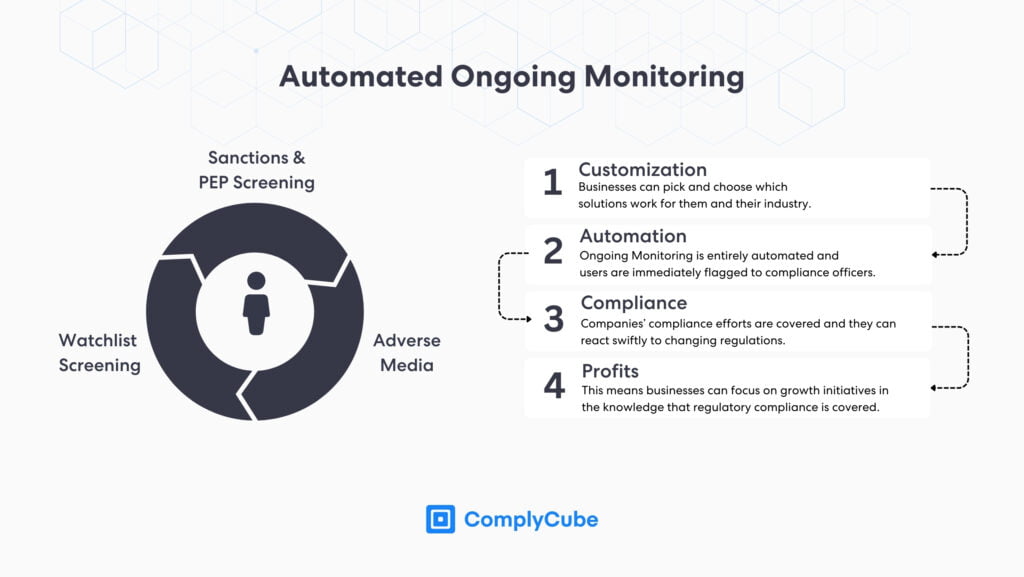

Ongoing Monitoring

Continuous Monitoring combines a chosen set of CDD solutions and performs consistent, around-the-clock monitoring. Ongoing monitoring is key for modern-day risk management. For example, if an accountancy firm verifies a new high-net-worth individual client, there is greater scope for that individual to gain political affiliations through a variety of charitable or sponsorship deals.

If such a development were to occur, it would not be spotted without the application of a continuous monitoring program. In turn, the accountant would not have a contemporary risk score for the client, and there would be a possibility of noncompliance with unique corporate risk tolerances or, more severely, national regulators.

ComplyCube’s Accountancy KYC and AML Compliance Solutions

ComplyCube is an award-winning compliance SaaS firm that provides solutions to firms worldwide in the technology, finance, and telecoms, among many other sectors.

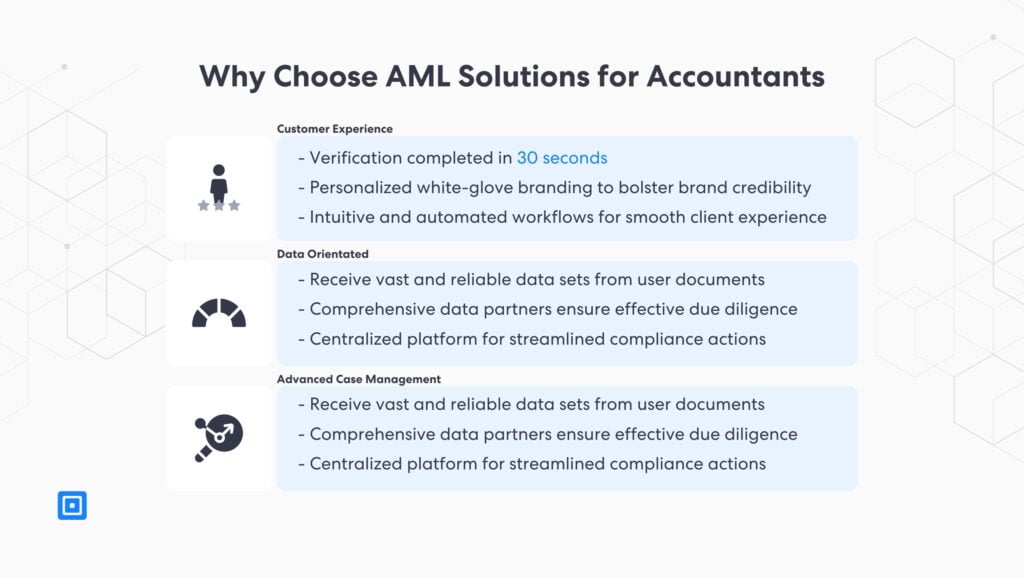

Customer Experience

ComplyCube provides a flawless user experience to its clients, ensuring that new business and customer relationships get off to a strong start. Client relationships in the Accounting industry are an intimate affair, and the first user experience (UX) can determine the success of the relationship.

ComplyCube’s AML solutions are seamless, providing a swift UX without compromising the value of the data obtained. This ensures a win-win for the user and institution. Furthermore, workflows can be personalized to match a firm’s brand, or use ComplyCube’s branding to further enforce a symbol of credibility.

Data Orientated

Once verified, client data is stored in the ComplyCube platform. Full audit trails are available for each check, ensuring compliance analysts and accountants can be sure where and when client data comes from. The platform centralizes all data in one place, maximizing efficiency and data accessibility.

This platform is also where automation and flexibility toggles can be adjusted to increase or decrease friction thresholds. Usually, these are dictated by a company’s risk tolerances and its Risk-Based Approach (RBA).

Advanced Case Management

Customer Due Diligence is about more than vetting users. Sometimes, a case-by-case approach is the best methodology to ensure every client complies with jurisdictional Anti-Money Laundering regulations. To do this, compliance platforms must be malleable.

ComplyCube’s case management function gives direct access to particular compliance teams and enables the orchestration of CDD flows, from basic to Enhanced Due Diligence (EDD). This allows for total control over client acquisition and AML compliance.

If your accountancy firm or other FI is looking to streamline its client acquisition process or faces challenges with its current KYC and AML compliance program, schedule a call with a ComplyCube specialist to learn more.