Customer onboarding software represents the beginning of a user’s journey and could define the nature of a new business relationship. However, facilitating smooth client acquisition while meeting KYC onboarding regulations is a steep operational barrier in 2024. This guide discusses businesses’ regulatory challenges and why AML software is now a leading force in corporate compliance.

What is AML and KYC?

Anti-Money Laundering (AML) and Know Your Customer (KYC) are fundamental practices in identifying potential risks and preventing the escalation of fraud, financial crimes, and other illegal activities. When integrated effectively, KYC and AML software will improve operational efficiency and reduce the risk of non-compliance.

Anti-Money Laundering Regulations

AML refers to the set of policies businesses must adhere to to meet money laundering regulations. These are typically jurisdictional regulations that promote the Financial Action Task Force’s (FATF) recommendations.

The FATF’s Recommendations, as updated in November 2023, denote financial institutions’ responsibilities to detect and prevent money laundering and terrorist financing. These AML regulations are recommended globally, but it is up to jurisdictional bodies to implement them locally. Such national regulators include:

The Financial Conduct Authority (FCA) in the UK

The Financial Crimes Enforcement Network (FinCEN) in the US

The Monetary Authority of Singapore (MAS) in Singapore

The Securities and Futures Commission (SFC) in Hong Kong

The Anti-Money Laundering Authority (AMLA) in the European Union (International Bloc Regulator)

All member states of the FATF must adequately comply with the FATF Recommendations. National regulators must, therefore, style their policies on these recommendations. For more information on FATF developments in 2024, read the FATF Recommendations in 5th Mutual Evaluations.

The 21st Century has seen the financial industry expand into technologies that underpin greater inclusivity. This digitalization has increased the pertinence of the FATF’s Recommendations, which have become increasingly integral to the successful operation of companies beyond traditional finance.

Many of the FATF’s policies involve heavily scrutinizing customer data, but it is challenging to accomplish this without sacrificing user experience. KYC onboarding solutions enable compliance with these demands without compromising with poor customer experience.

Know Your Customer Compliance

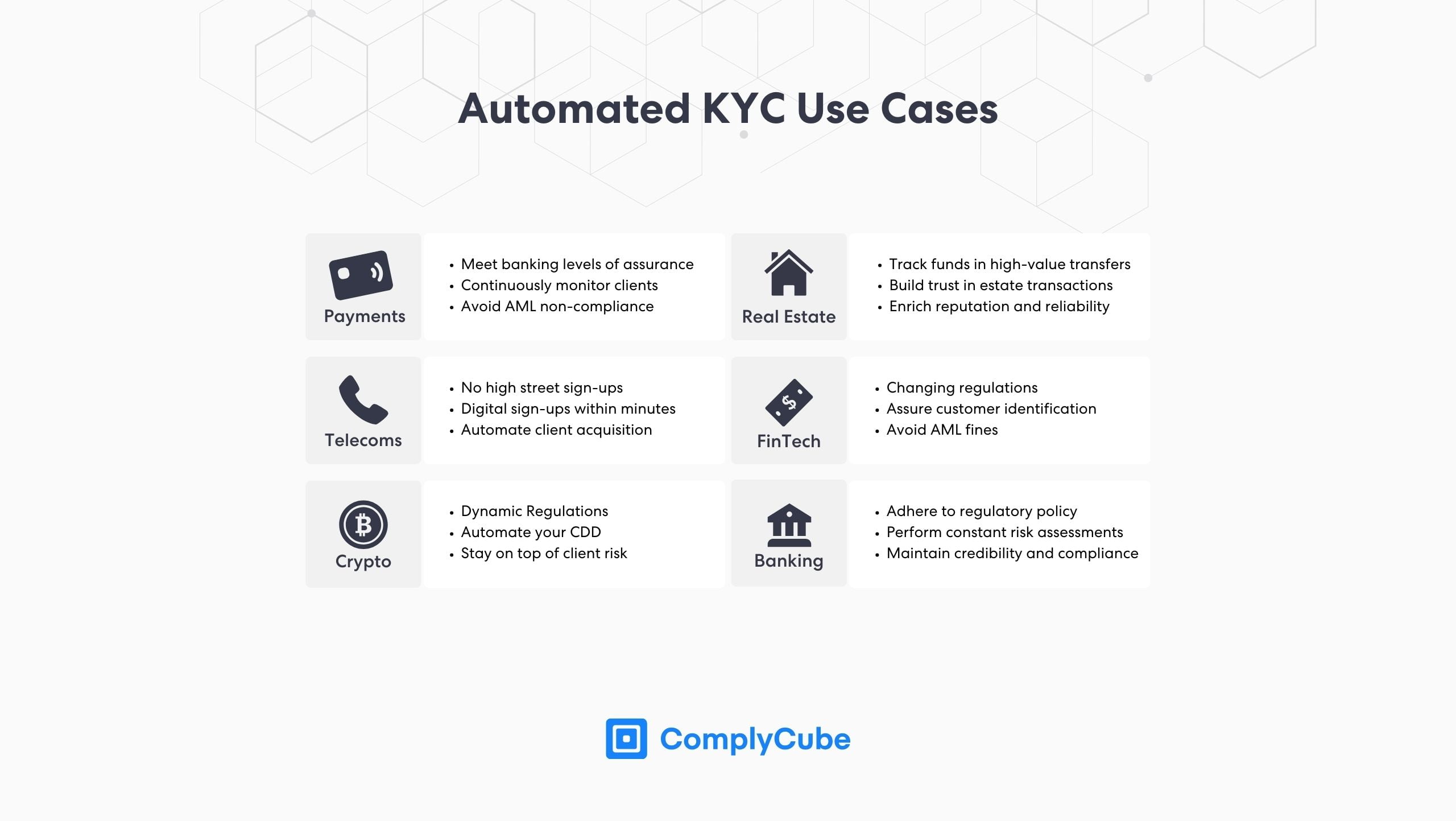

KYC is an all-encompassing term for the processes involved in attaining and monitoring customer information. This includes the necessary information to make AML decisions on low-risk to high-risk clients. Complying with national regulations and international KYC standards is becoming a global business imperative, regardless of a company’s sector.

Much of the information required to approve new customers is obtained during the customer onboarding process. Automated KYC solutions that incorporate AML software have emerged to foster a seamless onboarding process that drives customer satisfaction. These solutions perform the necessary Customer Due Diligence (CDD) checks in the background, contributing to a sleek user experience.

KYC Onboarding

A KYC onboarding process refers to the workflow that a new user completes when signing up for a new service. Every company has a unique Risk-Based Approach (RBA) that demands specific qualities from their risk assessment. This makes KYC requirements per industry very flexible, demanding versatile onboarding software.

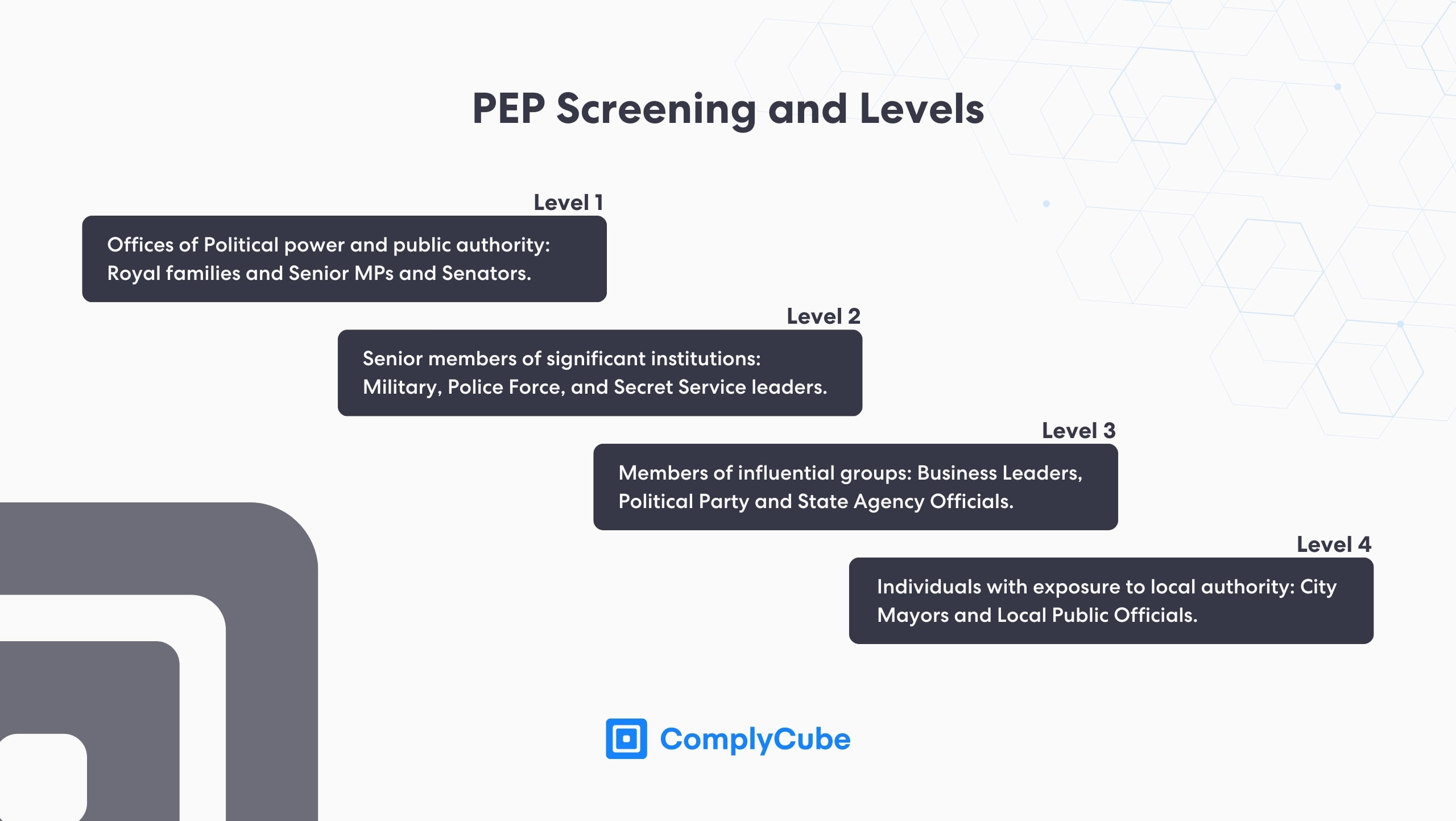

A Know Your Customer strategy goes much further than simply the initial user experience and client acquisition stage. Following the IDV and KYC onboarding checks, the user is subject to a host of CDD practices, including Politically Exposed Person (PEP) screening, watchlist screening, and adverse media checks, which are conducted in real-time to strengthen their validity. This process is known as ongoing monitoring.

This KYC process allows a company to regularly monitor a customer’s risk level to make informed decisions around the clock and understand which users might need to be monitored for suspicious activity. To learn more about ongoing or continuous monitoring, read What is an Ongoing Monitoring Process?

KYC Onboarding Process: The Details

Customer onboarding processes are the initial point of contact between a user and a business. A KYC onboarding process provides a streamlined route for businesses to onboard new customers while simultaneously extracting and analyzing user data.

Customer Acquisition Tools

KYC solutions have become increasingly automated. To accomplish this, KYC services leverage machine learning technologies to carry out tasks that would have previously been completed by a human. Over the next 3 years, 91% of firms in finance, aviation, telecommunications, and many other industries are expected to increase their spending on Identity Verification (IDV) systems. By 2027, the IDV market is expected to double in size from its 2024 valuation.

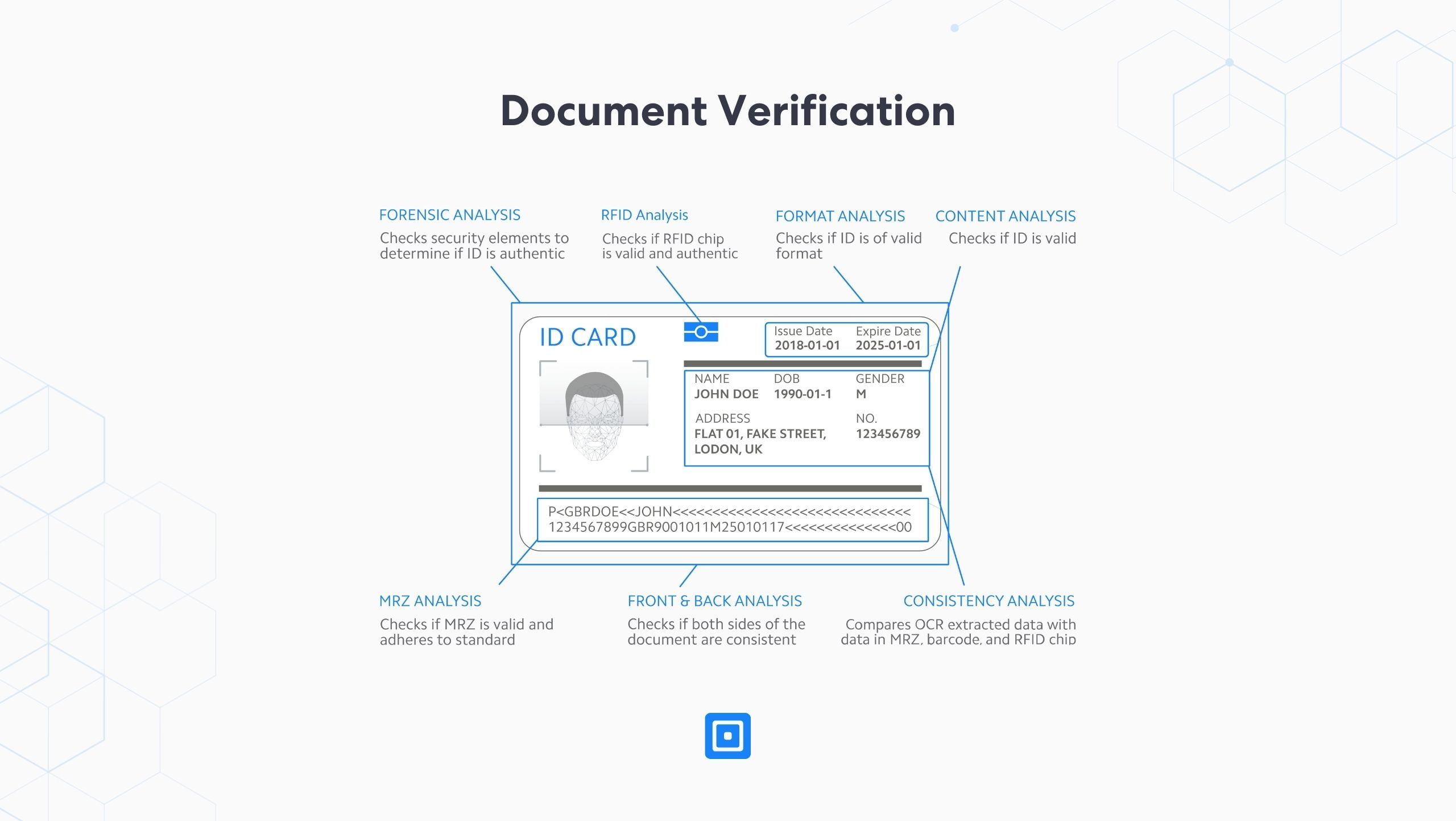

Document Verification

Utilizing advanced Artificial Intelligence (AI) mechanisms, KYC documents, such as a passport or a driver’s license, can be analyzed in seconds. Document verification analyzes this data at a far greater speed than a human could while providing a greater level of precision.

Authenticating identification documents involves 7 categories of analysis, and while human operators have been trained to identify fraudulent documents, human error cannot be completely eradicated. For more information on document verification, read What is Document Verification?

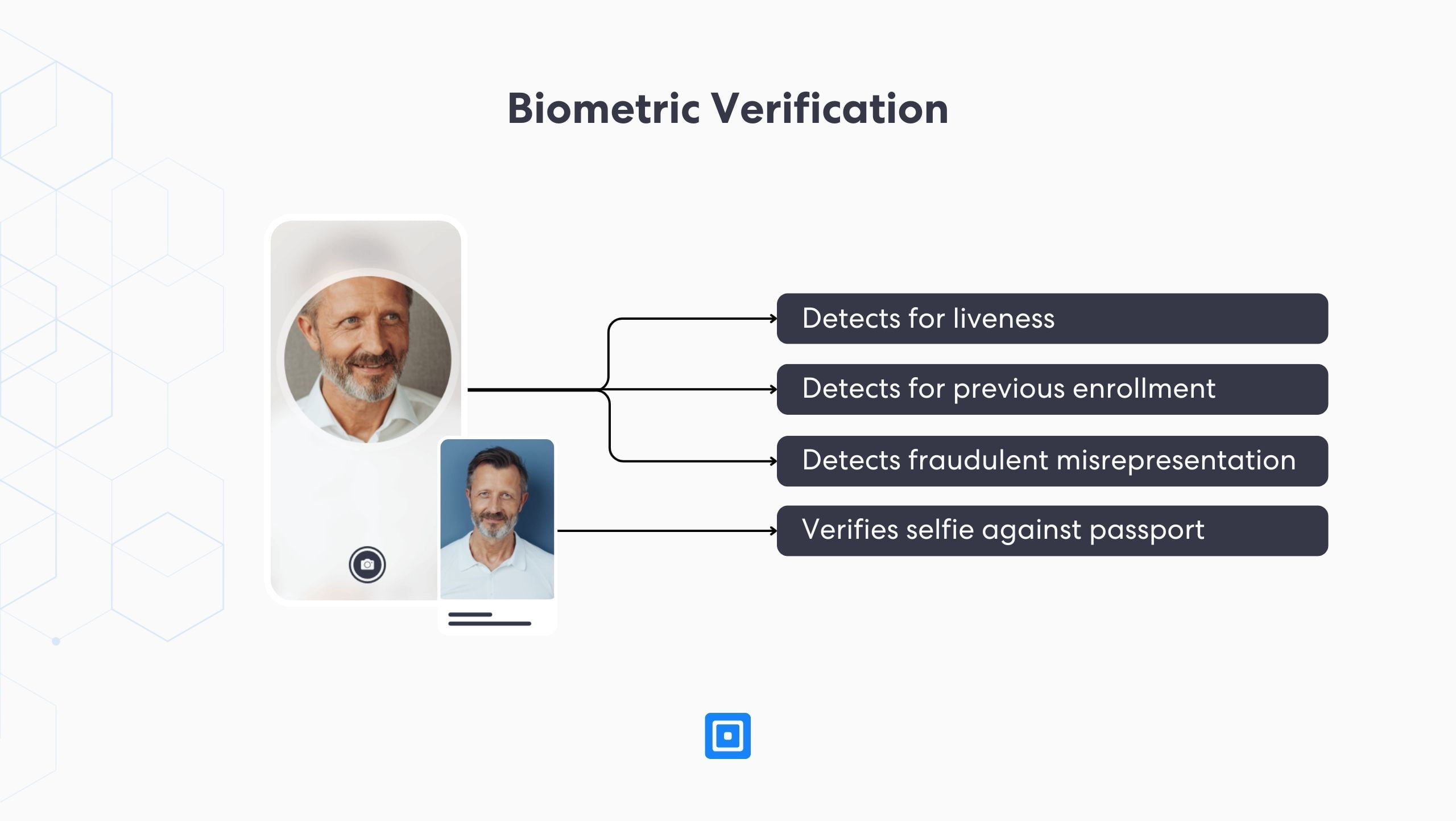

Biometric Verification

Biometric verification strengthens a new user’s legitimacy by examining a selfie upon signup. Utilizing a facial recognition engine and a technology known as Presentation Attack Detection (PAD), these systems create a powerful verification machine.

PAD is the technology that detects the liveness of an image, assessing whether it is real, fake, or tampered with. The technology can authenticate a limitless number of selfies every day, ensuring that scalability does not forsake reliability and that the process will not hinder a business’s customer onboarding strategies. For more details, read The Advantages of Biometric Verification.

These technologies are capable of handling a huge amount of transactions every day without reliability suffering as a consequence of laborious throughput. Verifying users via automated processes dramatically reduces the rate of failed customer acquisition. Both processes are fundamental in modern client acquisition and significantly contribute toward the two core concepts of KYC onboarding processes:

Efficiency, and

Accuracy.

Efficient Customer Onboarding Process

KYC onboarding processes are much more than an AML compliance tool. A wealth of competition in the space has meant that KYC vendors must also supply their customers with client acquisition workflows that are sleek and frictionless.

User experience must be at the heart of the process development, meaning customer onboarding must be easy for users to complete. 87% of users believe that businesses don’t do enough to deliver a seamless customer onboarding experience. Integrating with a KYC onboarding process is the catalyst that satisfies the other 13%.

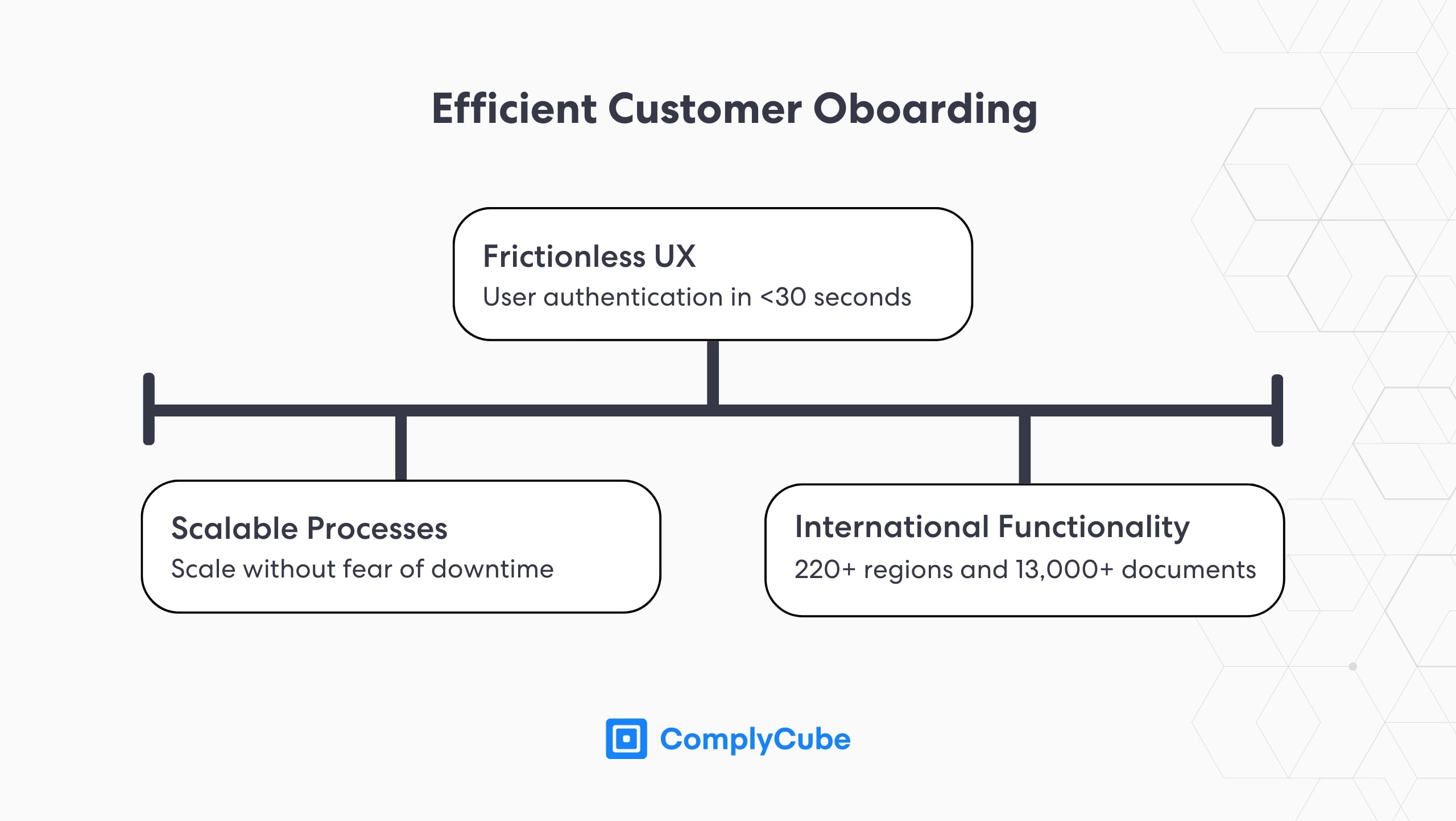

Frictionless User Experience

A robust KYC onboarding process should encourage users to sign up during the process, not deter them. As mentioned above, a client acquisition system defines a user’s first impression; businesses must make it count.

Document and biometric verification can be completed jointly in under 30 seconds, and the visual workflow on the customer side can personalized to your firm’s brand image. This impresses clients with a sleek and stylized process that will mitigate failed signups.

Scalable KYC Processes

Advanced KYC onboarding tools are designed to be able to handle the ever-increasing volume of customer transactions and throughput. Scalability is a crucial element driving businesses’ success, particularly in industries with demanding growth, such as crypto, neobank, and gaming platforms.

Without integrating with a KYC onboarding process, high-growth enterprises will struggle to cope with the volume of customers they need to onboard to remain competitive. Traditional KYC and onboarding methods are too inefficient and do not maximize resource allocation.

The popular dating app Tinder takes a few hours to verify identity documents. While this is not currently impeding their growth, it does give rise to new market opportunities from competition that can provide a more seamless KYC and induction strategy.

Broad Range of Functionality

Compliance with local jurisdictions is crucial to every business. Learning about the nuances of international, national, and local regulations can be extremely time-consuming, but Know Your Customer solutions do the heavy informational and compliance lifting.

ComplyCube offers its customers an exhaustive solution spanning 220+ regions and accepting over 13,000 KYC documents. Traditional client acquisition methods are rendered obsolete in comparison to the efficiency and comprehensiveness of the modern KYC onboarding process. Such strategies make meeting global regulatory standards effortless while also simplifying the customer onboarding journey.

Accurate Tools to Ensure Compliance

KYC onboarding solutions provide tools to streamline more than operational efficiency. They facilitate an infrastructure that dramatically increases the precision of the collected data upon client acquisition, making ensuring compliance with industry-specific AML regulations far smoother.

Verification Precision

KYC onboarding processes provide a superior level of precision at scale to traditional IDV methods. A 2018 report by the National Institute of Standards and Technology found that the development of AI has significantly advanced the capabilities of Identity Verification.

The rapid advance of machine-learning tools has effectively revolutionized the industry.

This trend continues into 2024, which is swiftly becoming a watershed year for AI technologies. Document and biometric verification are powered by state-of-the-art machine learning technologies, which enable the extraction and authentication of client data to a degree unattainable by a human.

AI-powered precision empowers businesses in customer experience and regulatory compliance. The accuracy of the checks helps prevent the creation of fraudulent accounts without compromising a sleek user process.

The KYC Cost of Hesitation

A KYC onboarding process is proving to be a far more reliable strategy than traditional methods. Data from every industry that has integrated these advanced methods exemplify this. However, the real adoption and uptake of KYC onboarding into client acquisition remain slow.

Some industries, like banking, have been slow to adapt to the digital transformation, meaning those same industries witness languid onboarding processes. Industries’ reluctance to embrace digital transformation has enabled more agile competition, in this context, neobanks, to exploit this and flourish.

Firms should re-engineer their Anti-Money Laundering (AML) systems and controls to refocus on Know Your Customer (KYC) processes.

Hesitations over integrating with a KYC partner represent a potentially substantial cost. Traditional industries that do not leverage KYC onboarding strategies forfeit the added benefits of streamlined operations, enhanced customer experience, and improved reliability and precision of data extracts.

More agile competitors who embrace these innovations are then allowed the space to capitalize on market share. This is the KYC opportunity cost that will become increasingly significant in the digitalized era.

Should Your Business Embrace KYC Onboarding?

In an increasingly competitive market, customer trust can dictate business success. KYC onboarding processes are proving to be extremely influential in fostering trust from the beginning of a client and business relationship and mitigating financial crime. Failing to adapt to increasing digitalization could result in regulated entities, such as banks, committing more resources than ever to their AML obligations.

Reluctance to adopt such technologies hinders operational efficiency and compromises customers’ safety and trust in institutions. In contrast, entities that embrace these innovative solutions secure a significant advantage, setting new standards for customer experience and adherence to regulatory requirements.

Institutions that choose to employ KYC onboarding technologies will take significant strides ahead of their competition, enabling greater growth, expansion, and operational efficiency. If your business faces challenges in complying with AML requirements, ComplyCube’s KYC offering can help. Contact one of their agents and find a solution today.