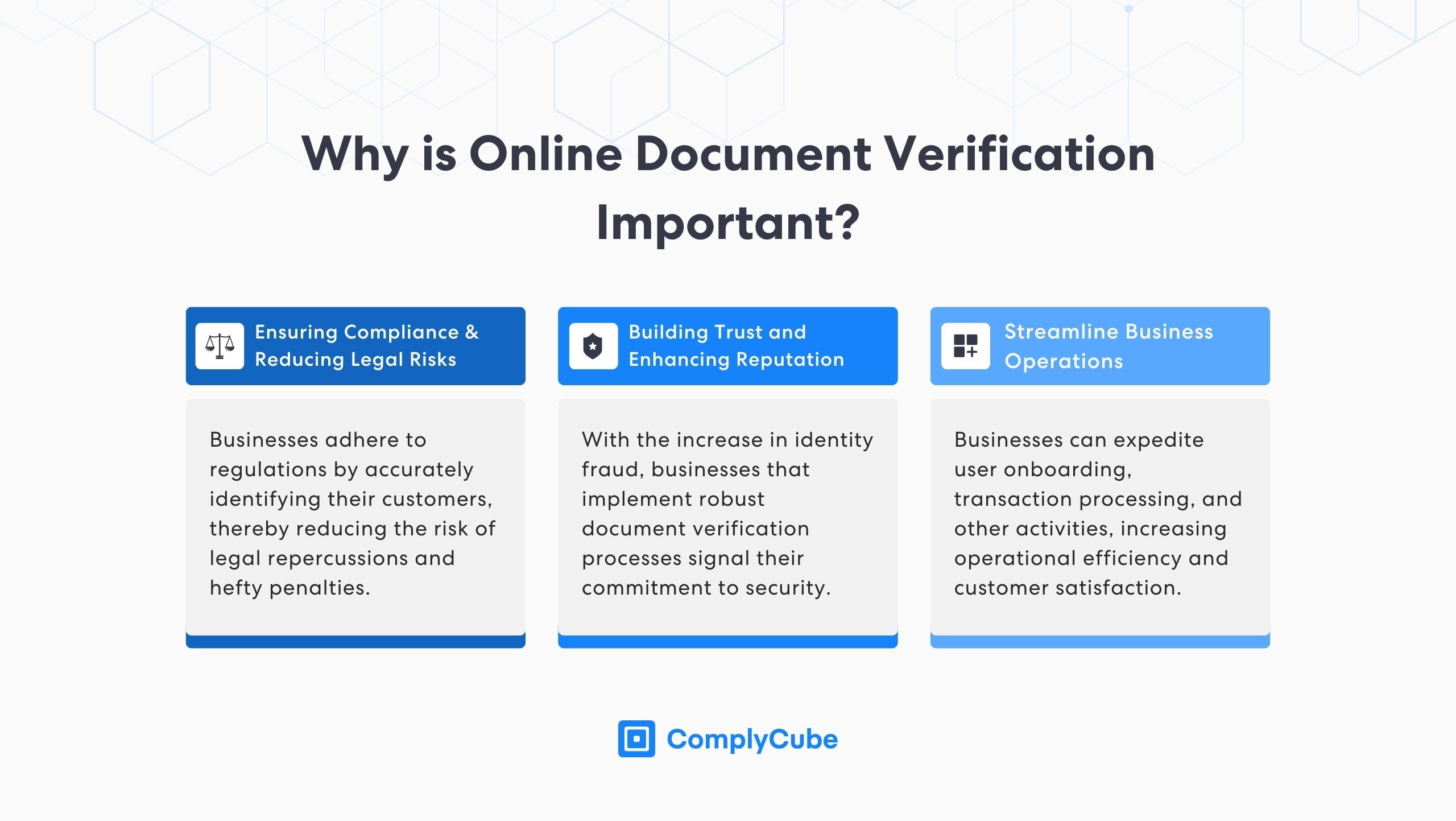

Trust in digital identity verification has failed to match the digital economy’s rapid growth. International regulators are working on bridging this gap by enforcing increasingly rigorous regulations, boosting the demand for KYC compliance software. One area of demand in particular is automated document verification and NFC ID authentication.

This guide examines the use cases and benefits per industry that AI-powered document verification brings to firms’ compliance and tech stacks.

What is Automated Document Verification?

Document verification is the process used to authenticate new users. It is designed to ensure that clients are who they say they are by validating their identity documents. Traditionally, this would have been completed by a human employee. However, this is no longer feasible in the modern day:

Training costs

Human error

Poor scalability

Advanced technologies, such as AI, are increasingly being employed to streamline corporate processes. AI-powered document verification is far superior to its more traditional counterpart. Modern businesses face an ever-expanding client base, which demands a higher throughput of new users.

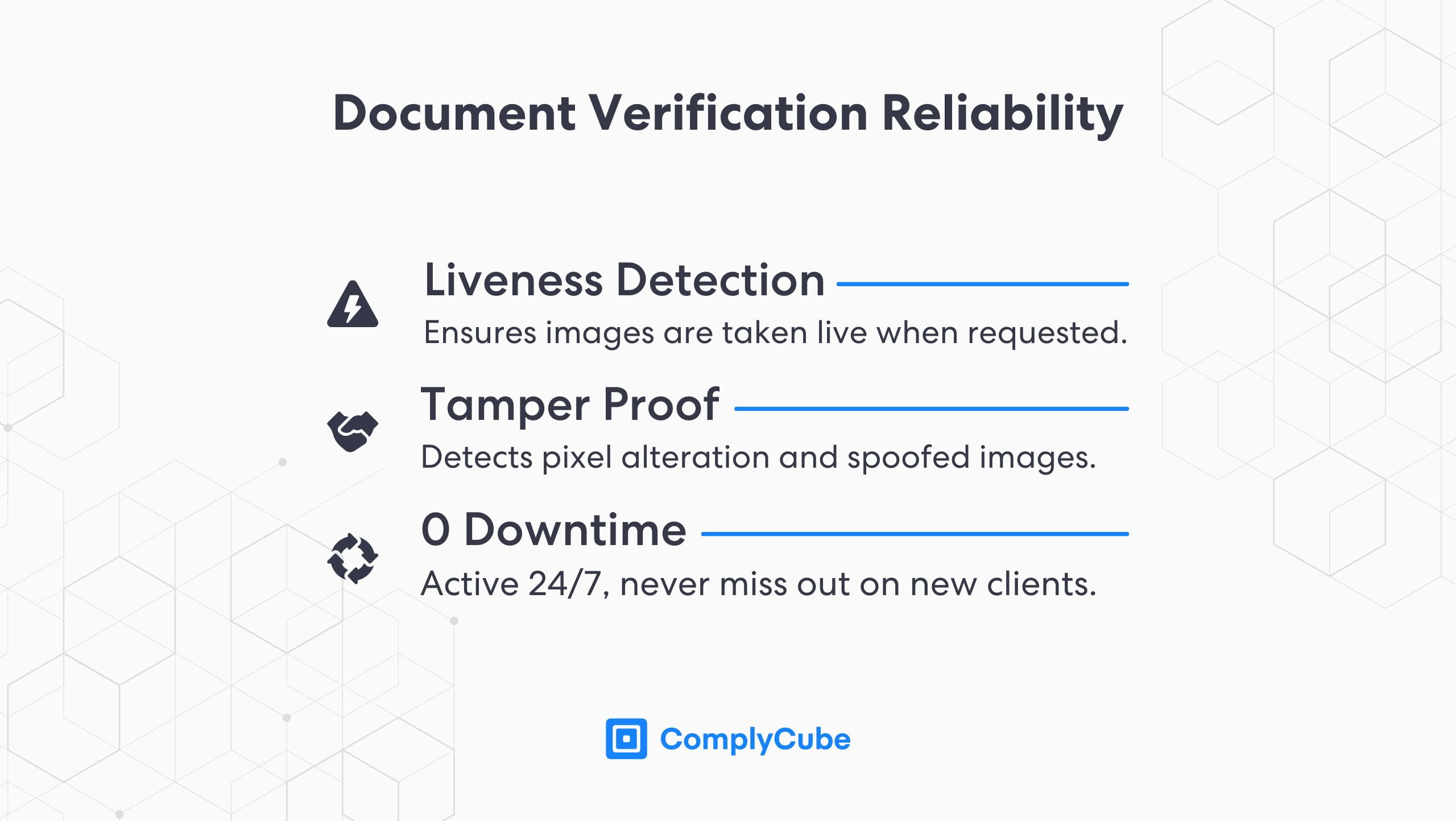

Such a development requires a process that can handle large quantities of data without compromising the quality of the verification. ComplyCube’s document authentication process is capable of handling an unlimited number of new users with extremely reliable results. For more information, read What is Document Verification?

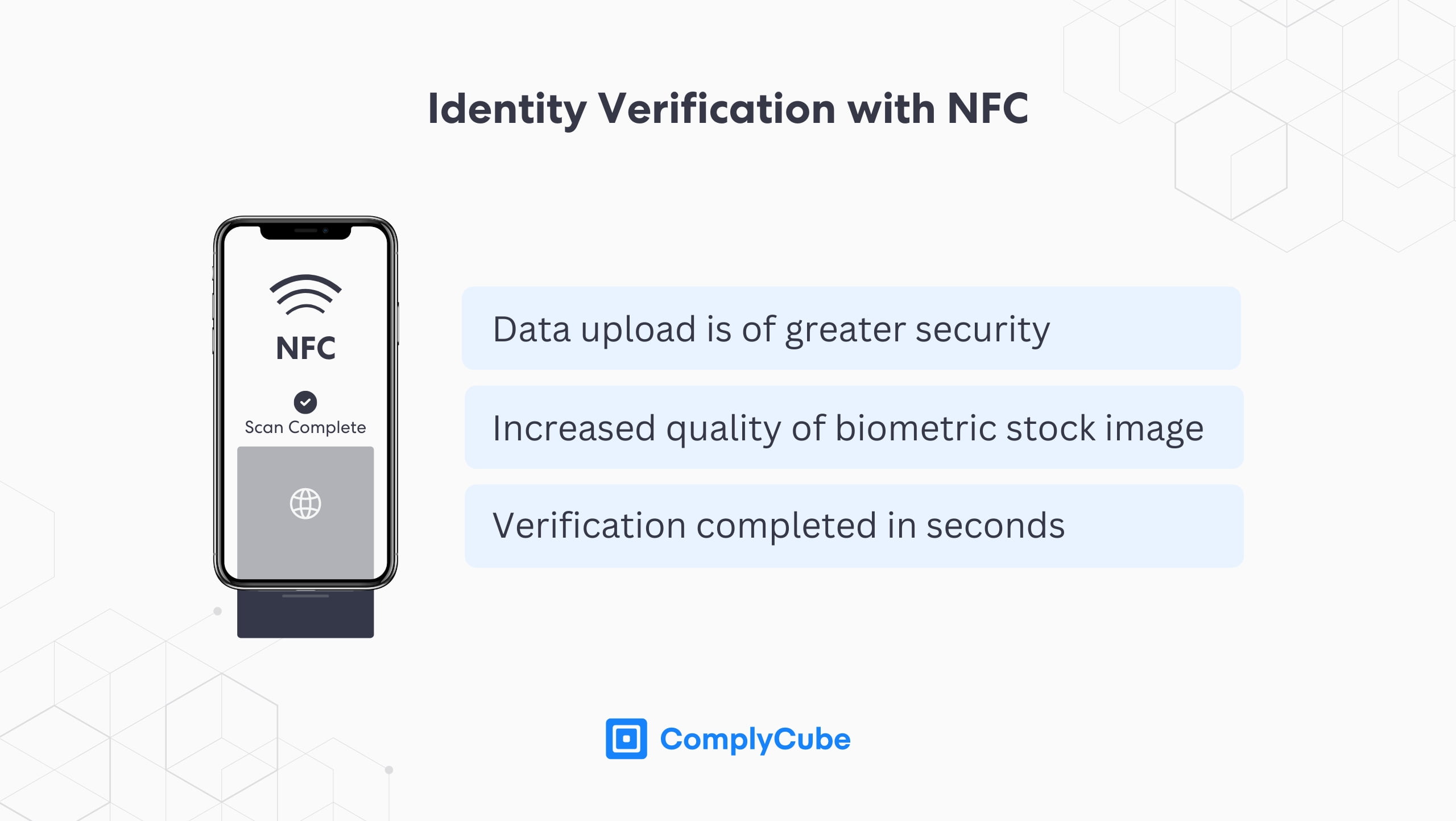

NFC ID Verification

Near-field communication (NFC) is a short-range wireless technology that is commonly used in retail payments, ticket verification, and the KYC process. NFC chips can be found in most bank cards, modern passports, and NFC-enabled ID cards.

In document authentication, NFC ID verification produces an enhanced result because the data transfer is more precise. This, in turn, creates a stronger matching performance if a firm makes use of biometric verification due to the higher resolution image from the document.

Financial Services

Traditional financial (TradFi) services, such as banks, wealth management, accounting firms, and many others, must adhere to the tightest regulations. These services define the bridge between illicit finance and the security of the financial system and must, therefore, have some of the most robust safeguards in place.

The Financial Action Task Force (FATF) dictates much of the global financial regulation and enforces it via its 40 Recommendations. It acts as the focal point of many different regulators, combining national policies on an international stage.

The adoption of technology-backed compliance tools is an increasingly prevalent topic and is something that is being discussed across the globe under many regulatory bodies, including:

The Department of the Treasury (DoT, US)

The Securities and Futures Commission (SFC, Hong Kong)

European Banking Authority (EBA, European Union)

These regulators endorse automated document verification. In the financial services industry, it can significantly streamline new client onboarding processes while actively increasing the reliability of the verification.

This global trend is driven by the reliability of the verification, which eliminates the possibility of human error or corruption. Many of the regulations that are put in place for the financial industry are increasingly being carried into other industries that require a Know Your Customer (KYC) process.

Cryptocurrency

The crypto scene is one of the fastest-growing industries by value, volumes, and users. Scalable IDV and KYC solutions are fundamental to remaining competitive. Automated document verification is becoming the bread and butter of crypto onboarding processes.

Completed in < 15 seconds

13,000+ documents accepted

Tamper proof

The blockchain sector experienced dynamic regulatory shifts in 2024, which are likely to continue into 2025 and beyond. Virtual Asset Service Providers (VASPs), such as crypto exchanges, are now being perceived as institutions with similar financial responsibilities as TradFi institutions.

The new rules will cover most of the crypto sector, forcing all crypto-asset service providers (CASPs) to conduct due diligence on their customers.

This increasing regulation demands flexible and precise KYC procedures. Advanced document verification, particularly NFC ID verification, is an affordable way of meeting these obligations while remaining competitive.

Telecoms

The telecommunications sector encompasses the internet, mobile, and communication services and is therefore subjected to stringent regulations that are designed to protect against fraud, misuse of services, and privacy. Some of the core regulators include:

The Office of Communications (Ofcom, UK)

The Federal Communications Commission (FCC, US)

The European Telecommunications Standards Institute (ETSI, EU)

Mobile phone retail has nearly moved entirely online, with many new firms disrupting the industry by providing a 100% digital service. A core reason behind their success is the ability to verify new clients from anywhere, remotely.

Benefits of automated Identity Verification:

Reduced operational costs

Increased sales exposure (24/7 accessibility)

Document verification, which would typically be followed by biometric verification, permits new client authentication anywhere in the world. Crucially, this process can be automated, meaning that new contract sales can be executed around the clock without the need for a sales team.

Social Media

In 2023, more than 38% of cases where money was lost to fraud began on social media. Such a statistic is driven by the anonymity that social media permits at scale. Anyone can create a new account, usually in seconds and with very limited personal information requested, and conduct malicious behavior.

Currently, this is a relatively unregulated market, meaning that KYC on most social media platforms is unheard of. Dating apps have been some of the first social sites to implement IDV measures, primarily age verification procedures via document and sometimes selfie verification.

Over the next few years, communications regulators are likely to endorse tighter regulations around Identity Verification to safeguard the industry against bad actors. Adopting KYC solutions, such as automated document verification, will place platforms ahead of the rest of the industry. For more information about Social Media IDV and KYC services, read The Catfishing Crisis.

ComplyCube’s Automated Document Verification Solutions

ComplyCube, a leader in digital Identity Verification and Know Your Customer solutions, provides IDV services to firms worldwide. Their proprietary suite of services is empowering trust in identity online.

If your firm needs to verify client credentials, contact a ComplyCube specialist today. With industry-leading flexibility of packages and customizability of solutions, the company can meet the demands of any firm looking for onboarding solutions.