Identity fraud is on its way to becoming the leading form of bank-reported fraud, with projections forecasting it will represent 50% of all cases by 2025. The need for facial biometric verification that leverages AI-powered technology has taken the UK by storm, as nearly 2 million people were victims of banking-related identity fraud in 2023. Biometrics in banking also offer an essential tool for staying competitive in a rapidly evolving market where regulatory frameworks are re-determining industry leaders.

Global Banking Takes a Hit

The banking sector has been one of the most targeted by fraud. Synectics Solutions, the UK’s largest syndicated risk intelligence database, conducted research that found 45% of all adverse contributions within the finance sector was related to ID fraud in 2023.

The same trend seems to be taking place in the US, with the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) issuing a notice that highlighted a “concerning increase in U.S passport cards being used to impersonate and defraud individuals at financial institutions across the country.” Yet, many banks have not taken the necessary measures to end these illicit practices, such as investing in defensive technology.

Banking and Fintechs Vulnerable

Organizations within the financial services sector are often the targets of large-scale fraud attempts. Banks and fintechs often have access to financial assets, making them lucrative targets. With a falsified or stolen identity, fraudsters drain funds from existing accounts, make fraudulent purchases, or even take out loans. A common example of this is a fraudster applying for a credit card with a stolen or synthetic identity only to then max out the card’s limit and disappear.

A very recent case that exemplifies the extent of possible losses due to lack of robust biometric verification can be found in the BBC’s piece on a scam carried out through Revolut. The article highlights a case in which £165,000 was stolen from a Revolut business account by fraudsters, as the victim states that bad actors were able to bypass the identity verification process and gain access to his account. The article reads, “Criminals managed to bypass facial-recognition software to gain access to his account on their device. If an account is set up on a new device, Revolut asks for a selfie, which Jack says he did not provide.”

Criminals managed to bypass facial-recognition software to gain access to his account on their device.

Sophisticated biometric verification checks, that include liveness detection, coupled with an advanced document check, are crucial for organizations like Revolut to protect their customers. All businesses handling financial accounts and/or sensitive data must secure processes in place to effectively deter criminals. Otherwise, firms risk real reputational damage from cases such as this one, with potential customers possibly opting for a competitor when opening future accounts.

The Case for Biometric Verification in the UK

In 2023, nearly two million people in Britain had their identities stolen and used by bad actors to create new financial accounts. As these crimes have continued to hit banking giants, customers have become weary. 73% of respondents in a survey carried out by FICO ranked fraud protection as one of the top 3 priorities when deciding which financial institution to open an account with.

Regulatory compliance continues to become increasingly complex within the banking space as national and international watchdogs buckle down on enforcing rigorous mandates. In the UK, the Financial Conduct Authority (FCA) outlines clear mandates for the financial service sector: “Firms must identify their customers and, where applicable, their beneficial owners and verify their identities.” Their handbook outlines examples of good practice, including but not limited to:

- A firm that uses electronic verification checks or PEP databases.

- Catering for customers who lack common forms of ID.

- A firm that understands and documents the ownership and control structures of customers and their beneficial owners.

Recent updates in the sector include the world’s first scam reimbursement rule, which went live on October 7th in the UK. The FCA now requires banks, building societies, payment institutions, and e-money institutions to reimburse victims for their losses to digital fraud, paying up to £85,000 per case. This increases the pressure on financial services to prioritize investing in technologies that can leverage facial biometrics, protecting online banking and fortifying customer onboarding.

Deepfake Technology

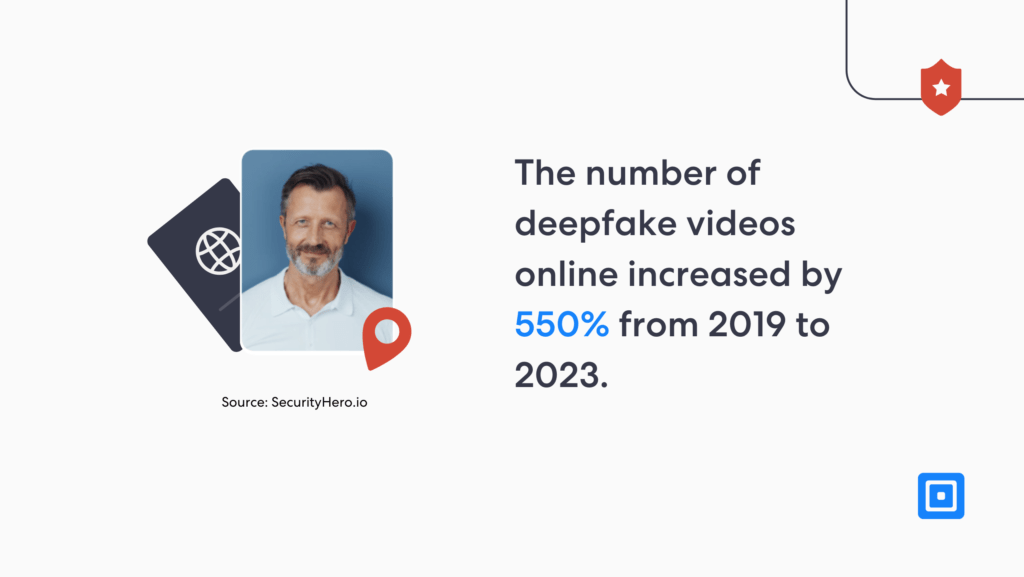

Bad actors are often able to subvert a facial recognition system by using deepfake technology. Several reports have already pointed towards the risk of AI fraud, with Deloitte recently publishing a piece headlined “Generative AI is expected to magnify the risk of deepfakes and other fraud in banking.” The piece argues that generative AI isn’t just providing fraudsters with highly sophisticated tools; rather, it’s also reducing both the price and effort of carrying out these attacks.

Potential for fraud-related losses to hit $40 billion in the US by 2027.

Deloitte’s 2024 Financial Services Industry Predictions positioned generative AI as the biggest threat to banks and fintechs, with the potential for fraud-related losses to hit $40bn in the US by 2027, having increased up from $12.3bn in 2023. Worryingly, a recent US Treasury report recently found that “existing risk management frameworks may not be adequate to cover emerging AI technologies.

Deepfakes are certainly at the heart of these projections. In 2023, the number of deepfakes across all industries multiplied by 10 – a statistic that is quite hard to ignore. Increased security against deepfakes must start with accurately verifying an identity document and carrying out a biometric facial scan before a user can gain access to a new bank account.

Biometric Verification with ComplyCube

ComplyCube’s liveness detection technology ensures that the individual presenting an identity is genuinely present, reducing the risk of AI-generated or spoofed identities. By integrating facial recognition with document verification, their solution authenticates identity details to prevent fabrication. Through a combination of biometric, document, and behavioral analysis, synthetic identities are detected early, preventing fraudsters from building fake credit histories or gaining unauthorized access. Their solutions include:

- Advanced Facial Recognition: ComplyCube’s cutting-edge biometric liveness detection, certified to ISO 30107-3 and PAD Level 2 standards, ensures that the individual presenting an identity document matches the submitted details. Their Identity Verification (IDV) system leverages biometric and behavioral analysis, providing robust security against fraudulent or synthetic identities.

- Comprehensive Document Verification: ComplyCube combines AI-driven technology with expert reviews to thoroughly verify identity documents. This process ensures documents are not altered, forged, expired, or blacklisted, covering a range of document types like passports, driver’s licenses, national IDs, residence permits, visa stamps, and travel documents—offering extensive protection against identity fraud.

For more information on safeguarding your business from fraud, reach out to one of ComplyCube’s compliance experts.