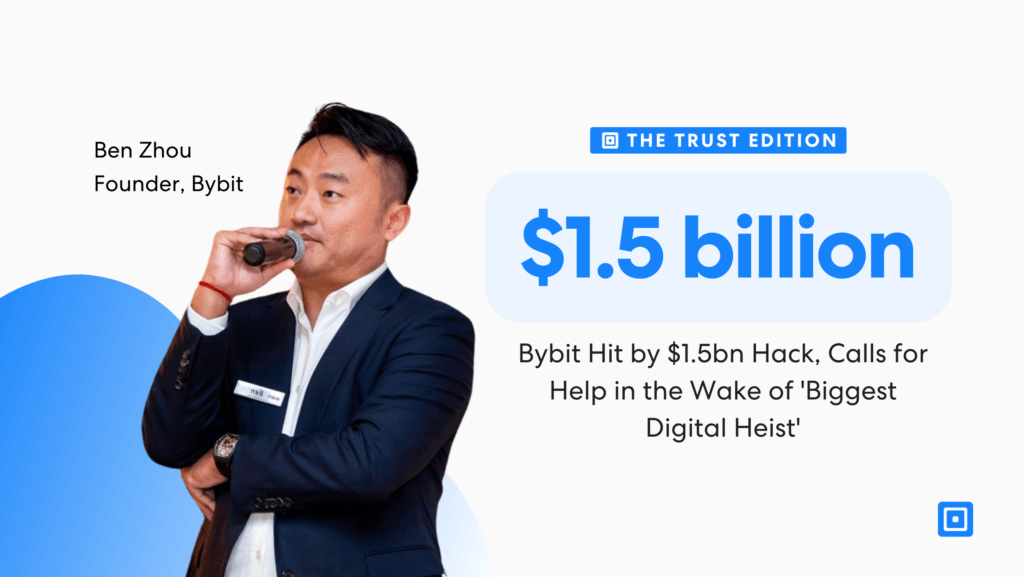

In what is being described as the largest digital crypto scam ever, the cryptocurrency exchange Bybit has fallen victim to a massive hack, losing an estimated $1.5bn in Ethereum. The Dubai-based platform reported that a North-Korean attacker gained control of an Ethereum wallet and transferred the funds to an unknown address, causing alarm amongst the crypto sector as a whole.

Despite the scale of the breach, Bybit assured its customers that their individual holdings remained secure. Co-founder and CEO Ben Zhou emphasized that the company had the financial strength to cover the loss, even if the stolen funds were not recovered. The company holds $20bn in customer assets, providing a buffer against the loss.

The attack occurred during a routine transfer of Ethereum from an offline “cold” wallet to a “warm” wallet used for daily trading. While all other wallets were unaffected, the hack led to a surge in withdrawal requests, causing delays for some users. Ethereum’s price dipped nearly 4% following the news but has since regained much of its value.

In response, Bybit has sought assistance from cybersecurity experts and crypto analytics specialists to recover the stolen funds. The exchange has also promised a reward of up to $140m for the recovery of the full amount. This breach marks a significant setback for the cryptocurrency industry, just as it had started to gain momentum amid favorable political conditions in the U.S.

North Korea is the most sophisticated and well-resourced launderer of cryptoassets in existence, continually adapting its techniques to evade identification and seizure of stolen assets.

As the investigation continues, speculation about the perpetrators has pointed to groups like North Korea’s Lazarus Group, which is known for its involvement in similar large-scale heists. Bybit’s commitment to strengthening its security infrastructure is crucial in restoring trust within the crypto space.

The Need for Increased Security for Large Transactions

When dealing with transactions of significant value, like the $1.5bn hack in Bybit’s case, robust identity verification should be a standard practice. Large transactions should be treated with extra scrutiny for any financial institution, whether traditional banks or cryptocurrency exchanges. With such large sums involved, additional layers of verification should ensure that only authorized individuals can approve or execute these transfers. This is a safeguard against fraud and essential to mitigating the risk of internal or external breaches.

Many traditional financial institutions already use enhanced identity verification for high-value transactions, so expecting the same from cryptocurrency exchanges wouldn’t be unreasonable. Financial services often use methods like identity verification for wire transfers over a certain threshold or additional scrutiny for international transfers, and this could be implemented more widely in the crypto space.

The hack occurred when an attacker exploited security controls during a routine transfer from a cold wallet to a warm wallet. This suggests a vulnerability in the access management process. By implementing more stringent identity verification measures for accessing high-value wallets, Bybit could have ensured that only authorized personnel could initiate such transfers.

As the cryptocurrency industry matures, customers and regulators alike are increasingly expecting these measures. In fact, regulatory bodies may require stricter identity verification protocols in the future to combat money laundering, fraud, and other illicit activities in the space.

The Extent of Crypto Scams: Wallet Hacks Are Not a New Occurrence

Unfortunately, crypto wallet hacks are not new, pointing to a strong need for increased identity verification protocols. Implementing stronger identity verification systems, increasing transparency in security protocols, and staying ahead of emerging threats will be critical for reducing the risk of future attacks.

In 2024, funds stolen increased by approximately 21.07% year-over-year (YoY) to $2.2 billion, and the number of individual hacking incidents increased from 282 in 2023 to 303 in 2024.

The Chainalysis 2025 Crypto Crime Report underlines the increase in crypto scams. “Crypto hacking remains a persistent threat, with four years in the past decade individually seeing more than a billion dollars worth of crypto stolen (2018, 2021, 2022, and 2023). 2024 marks the fifth year to reach this troubling milestone, highlighting how, as crypto adoption and prices rise, so too does the amount that can be stolen. In 2024, funds stolen increased by approximately 21.07% year-over-year (YoY) to $2.2 billion, and the number of individual hacking incidents increased from 282 in 2023 to 303 in 2024.”

With the amount of stolen funds rising by over 21% in 2024, it’s clear that we cannot afford to take these threats lightly. Identity verification is no longer just a regulatory checkbox—it’s a vital tool to safeguard assets and protect the integrity of the entire industry.

Moving forward, both crypto exchanges and users need to be more proactive in securing their digital assets. Bybit’s commitment to improving security may help restore trust, but it’s up to the entire crypto ecosystem to learn from this breach and take necessary steps to ensure that this “largest theft” remains a thing of the past.

Fortifying Crypto Wallets in 2024

As scammers become increasingly sophisticated, wallets must fortify their defenses. The key is to identify potential threats when onboarding new customers and continuously monitor them to identify any risks that may arise. Crypto wallets must prioritize KYC and IDV to protect both businesses and customers.

Critical checks include:

Identity Verification: Identity verification should be included within all crypto wallets and high-value transactions. Ensuring that customers are who they claim to be by analyzing biometric data points ensures security at all times. IDV checks can be ran during customer onboarding, during wallet login processes as well as throughout high value transfers.

KYC Fortified Onboarding: A full KYC check, including document verification, identity verification, multi-bureau checks and more to ensure that new customers are trustworthy. This reduces the chances for bad actors to use the platform.

AML Infrastructure: Preventing financial crimes, such as money laundering and terrorist financing, is also critical to ensure that your crypto wallet is free from fraud. This protects not just individual customers, but your organisation as a whole.

If you’re looking to fortify your Crypto business from fraud, implementing these checks are a necessary first step to ensuring compliance and security. For more information, reach out to our expert compliance team today.