For years, fraudsters have been able to set up fraudulent companies on company houses without any barriers to entry. A lack of stringent identity verification processes (IDV checks) led to a surge in business identity theft in 2024, with fraudsters “cloning” existing businesses on Companies House to fraudulently take out loans. Many leading UK restaurants were “cloned” as part of this emerging scam. The BBC reported that more than 750 fake firms had been registered within a 6 week period in early 2024, often with misspelled names.

However, it seems as though change is finally on the horizon, with the Economic Crime and Corporate Transparency Act (ECCTA) set to enforce necessary Identity Verification checks in 2025. ECCTA’s new regulations will be especially pressing for Authorised Corporate Service Providers (ACSPs), businesses or individuals that offer corporate services such as company formation or administrative support. From the 25th of February 2025, solicitors, accountants, and other ACSPs carrying out ID checks on behalf of Companies House will need to register as ACSPs to increase the oversight of Identity Verification (IDV) practices.

Early 2024: Business Identity Theft On The Rise

Business identity theft became a serious issue in the UK in early 2024 after hundreds of incidents of “company cloning” scams occurred. Several media giants, including BBC News, reported on these incidents.

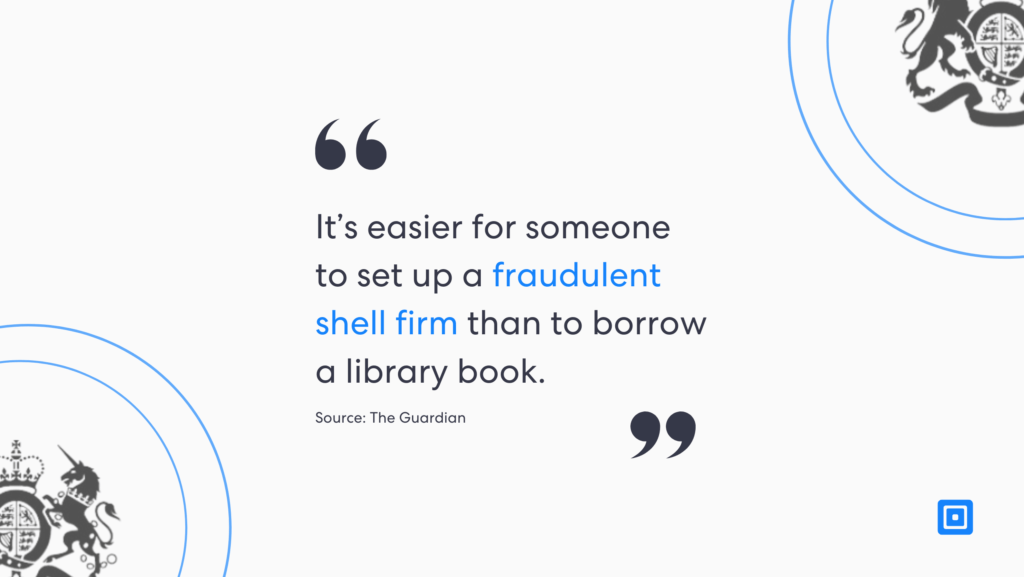

For only a small sum, scammers can register a business online with Companies House – usually within 24 hours.

A piece from BBC News, written in February of 2024, stated, “For only a small sum, scammers can register a business online with Companies House – usually within 24 hours. After that, they are then able to steal overdraft money from bank accounts set up in the name of the fake company they have cloned and order high-value goods from suppliers keen to fulfill lucrative orders from a new, high-profile client. Goods are then delivered and invoices left unpaid.”

This was labeled as scandalous, with fraud expert Graham Barrow stating to the BBC that getting a library ticket from your local council was more difficult and required increased verification than registering a business on Companies House. A wide variety of UK restaurants, from Zizzis to the Ritz, have been targeted by these scams, resulting in costly losses.

Business identity fraud can have devastating financial consequences for both the targeted company and its stakeholders. When fraudsters “clone” a legitimate business, they gain access to the company’s name, credit, and sometimes its entire operational profile, allowing them to take out loans, open bank accounts, and place fraudulent orders under the guise of an established business.

The financial losses can be significant, especially when criminals use the stolen identity to order high-value goods from suppliers or rack up overdraft debt in the company’s name. These activities can lead to financial institutions holding legitimate businesses responsible for unpaid debts, damaging credit ratings, and making it more difficult for the business to secure financing in the future. In some cases, the damage is so severe that it leads to insolvency.

In addition to the direct financial costs, business identity fraud can also result in reputational harm. For instance, if a business’s name is associated with fraud or criminal activity, customers, partners, and investors may lose trust in the brand. This can cause long-term damage to relationships with suppliers, clients, and the wider market. The cost of re-establishing trust and restoring a damaged reputation can be astronomical, often requiring extensive public relations campaigns, legal efforts, and significant time to rebuild consumer confidence. The cumulative effects of financial losses and reputational harm can cripple a business, sometimes irreparably.

Change On the Horizon? Identity Checks in 2025

An article from July 2024 by Samantha Bowley, a UK solicitor, underlined that movement was on the horizon. Bowley outlined that the Economic Crime and Corporate Transparency Act 2023 (ECCTA) amended the Companies Act of 2006 in 2023. However, these changes could not yet be implemented as secondary legislation was needed. Bowler stated in her piece that “The identity verification requirements are intended to improve the reliability of the information on the register at Companies House, as well as to make it challenging for individuals to create a fictitious identity, or fraudulently use another person’s identity, to set up or run a company. Companies House has indicated an intention for these measures to come into force from early 2025.”

Bowley was correct, as The Economic Crime and Corporate Transparency Act (ECCTA) is about to drastically change the identity verification process involved in setting up a limited company on Companies House. By the spring of 2025, Companies House will run comprehensive identity checks on Authorised Corporate Service Providers (ACSPs). ACSPs are businesses that offer corporate services, including company formation or administrative support, such as accountants or solicitors. Starting February 25, 2025, third-party providers conducting identity checks for Companies House on behalf of clients must register as ACSP.

Companies House will introduce a new identity verification process to help deter those wishing to use companies for illegal purposes. Anyone setting up, running, owning, or controlling a company in the UK must verify their identity to prove they are who they claim to be.

Looking ahead to summer 2025, Companies House will also introduce the ability to grant access to specific trust information from the Register of Overseas Entities upon request, providing greater transparency for those seeking to verify corporate structures and ownership. Then, by autumn 2025, more significant changes will take place. Identity verification will become a mandatory part of the incorporation process for new companies and for new appointments of directors and Persons with Significant Control (PSCs). Furthermore, Companies House will initiate a 12-month transition phase requiring over 7 million existing directors and PSCs to verify their identity, which will be done as part of the annual confirmation statement filing.

These changes are part of a broader effort to enhance corporate transparency and combat economic crime. As the regulations evolve, companies and individuals will need to stay informed and prepared for the upcoming requirements.

The Importance of Identity Verification

Identity verification checks are necessary for all kinds of onboarding and registration processes, whether setting up a business on Companies House or onboarding a new customer onto your platform. For accountants, solicitors, and other corporate service providers, staying informed and adapting to these changes will be critical. Ensuring that customers are who they claim to be is critical for deterring fraud.

Expert identity checks must include both advanced document checks that leverage AI technology such as Optical Character Recognition (OCR) and biometric facial verification. Biometric verification that uses liveness detection technology can provide the highest level of security against identity fraud when onboarding customers, analyzing subtle microexpressions and skin textures to confirm that the user is not a deepfake or using another sophisticated spoof to bypass security measures.

Organizations are also required to conduct RFID (Radio-Frequency Identification) analysis as part of the document verification process to ensure the highest levels of assurance in the UK. This advanced feature leverages NFC (Near-Field Communication) technology for more secure and accurate identity verification.

If you’re an ACSP, Accountant, Solicitor, or any other regulated company that needs to safeguard against identity fraud, comply with the new ECCTA bill, or keep up to date with the UK’s latest AML policies, contact one of our compliance experts for more information.