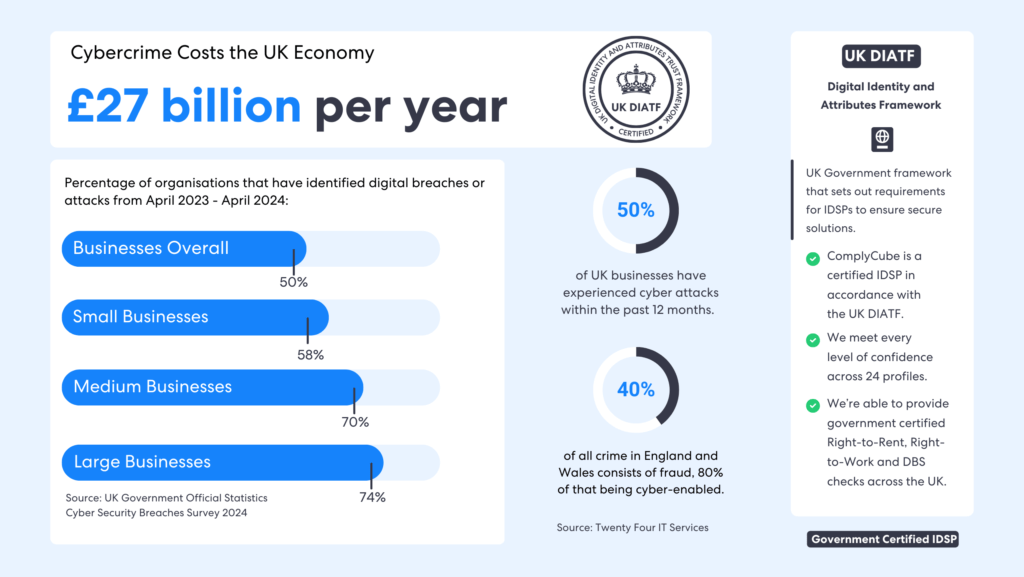

The pursuit of digital trust consumes the ambitions of regulatory bodies across the globe, with frameworks like the UK government’s Digital Identity Attributes and Trust Framework (DIATF) or the EU’s Electronic Identification, Authentication, and Trust Services (eIDAS) focused on countering the threat of sophisticated fraud. Regulations for Digital Identity Service Providers (IDSPs) continue to tighten, ensuring that only robust solutions capture the market.

At ComplyCube, we’re proud to announce that we’re now a UK DIATF-certified IDSP and fully comply with eIDAS regulations for identity service providers with market-leading identity verification software.

What Does the UK DIATF Do?

Published by the Department of Science, Innovation and Technology (DSIT), the UK DIATF looks to encourage trust in digital identity products and recognition of trusted digital identities across borders, introducing the concept of certified reusable IDs.

In doing so, the initiative sets out requirements for IDSPs to adhere to for the provision of secure solutions, ensuring that single-use and reusable digital identities enhance privacy and security beyond traditional, physical forms of identification such as passports.

However, building trust in digital identities within a modern society is certainly quite a task, with fraudulent activity continually evolving and new forms of technology, such as AI, enabling its growth. Hence, the fight against fraud can never be static and requires market leaders to remain innovative in their commitment to digital trust. UK Finance noted in their Annual Fraud Report that in just 2023, payment fraud amounted to a shocking £1.2 billion in the UK – a figure that points to a need for heightened security within identity verification practices.

New IDSP Standards for Secure Digital Identity Verification

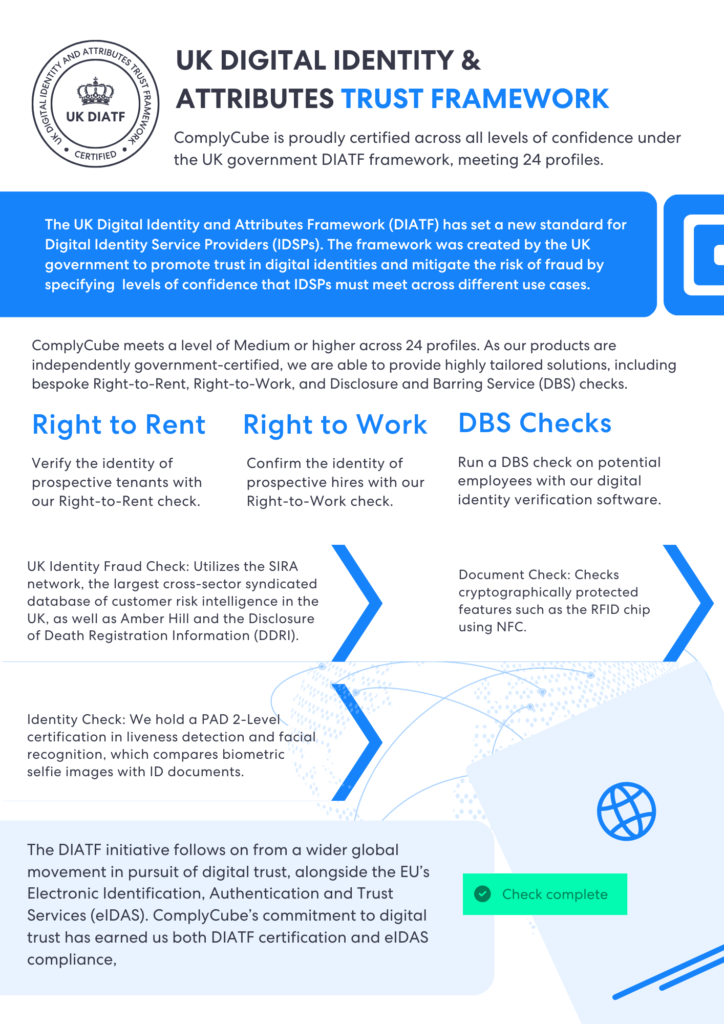

The DIATF presents new standards for Digital Identity Service Providers, mitigating the risk of fraud by specifying standardized levels of confidence that IDSPs must meet across different use cases, referred to as profiles. The Home Office requires a Medium level of confidence as a minimum for IDSPs providing Right-to-Rent or Right-to-Work checks.

At ComplyCube, we’re proudly certified across every level of confidence under the UK government DIATF, meeting 24 profiles. As our products are independently government-certified, we can provide highly tailored solutions, including bespoke Right-to-Rent, Right-to-Work, and Disclosure and Barring Service (DBS) checks.

Introducing Government-Certified Right-to-Rent, Right-to-Work, and DBS Screenings

Our Right-to-Rent, Right-to-Work, and DBS Checks are powered by our market-leading technology and sector expertise. All of these screenings include our sophisticated Document Check, which analyses cryptographically protected features such as the Radio Frequency Identification (RFID) chip using NFC, as well as verifying the validity of passports through the use of Optical Character Recognition (OCR) and Machine Readable Zone (MRZ) analysis. In addition, our Biometric Identity Check and UK Identity Fraud Check also form a part of these screenings.

We hold a PAD Level 2 certification in liveness detection and facial recognition, which analyses selfies captured by end users and compares them with their ID documents. Our UK Identity Fraud Check leverages the SIRA network, the largest cross-sector syndicated database of customer risk intelligence in the UK, and accessing Amber Hill and Disclosure of Death Registration Information (DDRI). Additional services can be added to your solution depending on your use case and required confidence levels, such as an extensive AML screening, Proof of Address, or Multi-Bureau check.

Continuing the Fight Against Fraud with Identity Verification Software

Achieving UK DIATF certification is a significant accomplishment for our team, and it reflects the high standard of our platform. As fraud continues to evolve, so should the robustness of technology, processes, and compliance in place to protect user privacy, security, and trust in regulated organizations.

For information on UK DIATF or IDV, AML, and KYC solutions, speak to one of our experts.