LONDON, AUG 7, 2023 — ComplyCube, the global KYC and IDV platform, has fortified its Document Authentication services to tackle “screen replay attacks”, in which fraudsters present ID documents displayed on monitors, smartphones, or tablets screens to gain access to products and services illegally.

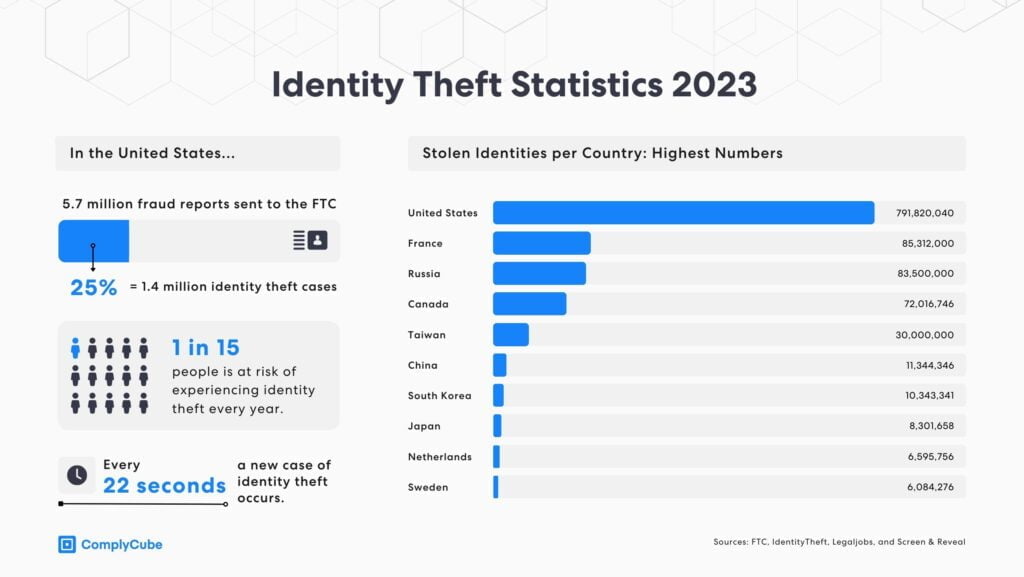

This announcement comes amidst an increase in identity fraud incidents, which are being boosted by the technological evolution of AI-powered image alteration tools. In the US, there is a new identity theft incident every 22 seconds. Meanwhile, in the UK, close to 70% of the cases submitted to the National Fraud Database (NFD) are due to identity fraud. The alarming numbers emphasize the immediate necessity to bolster ID verification systems, a vital step in combating the extraordinary escalation in identity fraud cases.

In the US, there is a new identity theft incident every 22 seconds.

Leveraging cutting-edge Presentation Attack Detection (PAD)

ComplyCube currently offers passive (i.e., still photos) and active (i.e., action-based) biometric checks to verify the presence of customers and deter bad actors. It leverages cutting-edge Presentation Attack Detection (PAD) technology, which uses 3D face maps and other proprietary techniques to detect photos of a screen, printed photo attacks, video-replay attacks, and 3D mask attacks.

“For years, we’ve been researching, building, and deploying AI models to detect the presence of customers in photos and video accurately and indiscriminately. This has helped establish us as a leading liveness detection service provider, heavily relied upon by some of the largest organizations in the world “, says Harry Varatharasan, Chief Data Scientist of ComplyCube. “We have now extended our proven technology to detect liveness on ID documents, boosting the unrivaled identity assurance level our award-winning platform already provides.”

New Standards in Liveness Detection

The AI company says that Document Liveness Detection has been seamlessly baked into Document Checking Service. As such, it is available to all users across various channels, including SDKs, no-code solutions, and its outreach platform. By enabling it, users can ensure that their customers’ identity documents are present and in possession of their rightful owners during their onboarding journeys.

Based on trial runs with select businesses, it has proven to thwart over 80% of fraudulent attempts.

“These spoofed documents are typically spotted much later in the customer lifecycle, which unfortunately can hurt a business’s reputation, lead to fines, and complicate their internal processes”, added Mohamed Alsalehi, Chief Technology Officer at ComplyCube. “While some solutions in the market offer some liveness detection on selfies, they do fall short when it comes to ID documents. We’re confident that our latest solution will set the bar.”

ComplyCube combines thousands of data points, a state-of-the-art Machine Learning (ML) stack, and expert human reviewers to create a new AML and KYC compliance standard. Its globally compliant products include Biometric Verification, Document Authentication, Address Verification, AML Screening, and Multi-Bureau Checks.

About ComplyCube

ComplyCube is a market-leading SaaS platform for Identity Verification (IDV), Anti-Money Laundering (AML) & Know Your Customer (KYC) compliance with customers across financial services, transport, healthcare, e-commerce, cryptocurrency, FinTech, telecoms, and more.

ComplyCube’s ISO-certified and award-winning platform boasts the fastest omnichannel integration turnaround in the market with Low/No-Code solutions, API, Mobile SDKs, Client Libraries, and CRM Integrations.