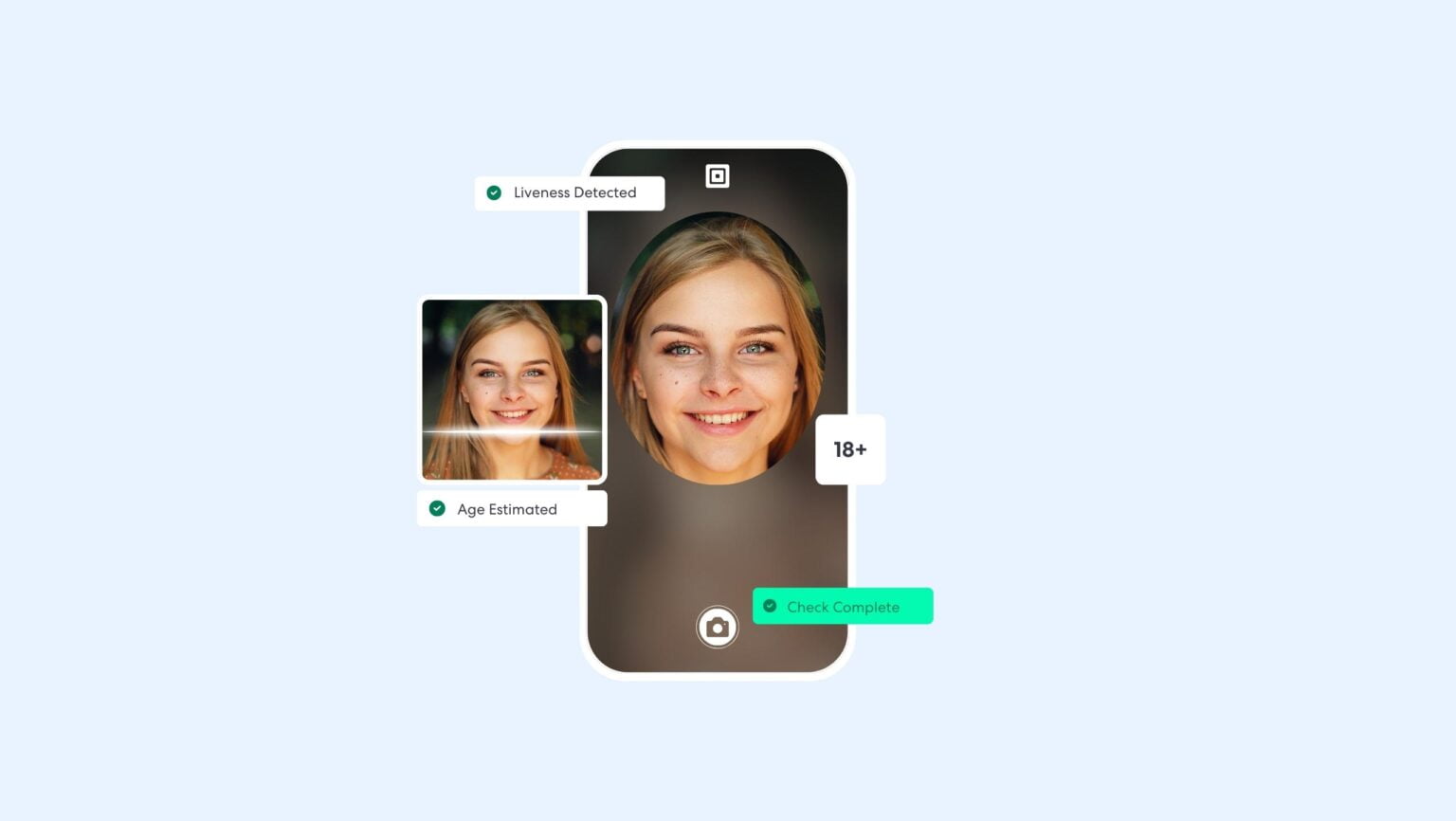

LONDON, AUG 30, 2023 – ComplyCube, the leading Identity Verification (IDV) provider, announced the release of AI Age Estimation, a no-ID verification solution that streamlines UX for age-gated products while shielding the vulnerable online. This feature supplements its existing Age Verification capabilities, a seamless selfie check option for entities seeking a less stringent form of identity assurance.

1-Step Verification Process

Tapping into advanced biometric technology, ComplyCube’s age estimation tool can swiftly show reliable age estimations in seconds using just one selfie. The AI-powered solution is equipped with a bias-tested engine that actively checks for genuine liveness signals, guarding against potential threats such as deepfakes, 3D masks, and screen replays.

ComplyCube’s age estimation tool can swiftly show reliable age estimations in seconds using just one selfie.

Privacy-Centric Design for Global Age-Gating

Incorporating a privacy-focused design, the feature streamlines compliance with the help of automatic selfie redaction, adjustable to specific regional rules and use cases. This flexibility enhances global age-gating processes while providing an extra barrier against spoofing.

Harry Varatharasan, ComplyCube’s Chief Data Scientist, remarked, “Our comprehensive data-focused strategy allows us to address variances in ethnicity, genetics, age, and gender, providing our partners with a reliable age estimation.”

Tackling Digital Safety Concerns

The rollout of the Age Estimation solution is timely, given the rising apprehension surrounding minors’ easy access to unsuitable online content. Current verification methods, which often rely on mere date of birth entries or are susceptible to VPN workarounds, are becoming alarmingly ineffective.

Data reveals that 23% of minors can effortlessly bypass VPN restrictions, while 56% of children aged 11 to 16 have stumbled upon explicit content online.

Amid escalating concerns, multiple jurisdictions are rolling out stringent regulations to mandate enhanced age verification processes, ensuring online safety for minors. Notable legislative initiatives include the UK’s Online Safety Bill, the European Union’s Digital Services Act, and California’s Age-Appropriate Design Code Act. These regulations seek to set tighter standards and responsibilities for digital platforms.

ComplyCube’s CEO, Dr. Tarek Nechma, comments, “Our Age Estimation tool underscores our commitment to curate a safer online space for minors while enhancing the overall user journey and building trust at scale.”

Universal Age IDV Applications

Beyond online safety, the feature offers multiple advantages to businesses in sectors with lower scrutiny than financial institutions. Whether it’s dating, e-commerce, gaming, or other age-gated products and services, businesses can now:

- Optimize User Journey: The feature facilitates quicker age verification, leading to quick onboarding.

- Easier Regulatory Compliance: Businesses can seamlessly adhere to age-based regulations, preserving their brand image and minimizing legal pitfalls.

- Prioritize Data Safety: Age estimation prevents excessive data gathering, aligning with top-tier data privacy norms.

ComplyCube’s Age Estimation feature provides a seamless method for age verification. By minimizing user barriers and boosting conversion rates, it harmoniously merges efficiency with reliability.

About ComplyCube

ComplyCube is a leading award-winning SaaS platform offering a wide range of Identity Verification (IDV), Anti-Money Laundering (AML), and Know Your Customer (KYC) solutions. The AI platform caters to a diverse spectrum of industries and use cases, including financial services, telecommunications, transportation, healthcare, e-commerce, cryptocurrency, FinTech, among others.

The ISO-certified platform provides a quick omni-channel integration facilitated by Low/No-Code tools, API, Mobile SDKs, Client Libraries, and CRM Integrations.