With online fraud at an all-time high in 2024, organisations must provide their customers with safety and security within the digital confines of their platforms. As KYC requirements continue to evolve in differing jurisdictions, financial institutions must ensure that their know your customer procedures (KYC) remain efficient in both deterring bad actors and achieving KYC and AML compliance. This guide will dive into how investing in a state-of-the-art Know Your Customer process will help fight financial crime and create customer loyalty, which businesses can capitalise on in the long-term.

Mitigating Fraud to Protect Customers with KYC

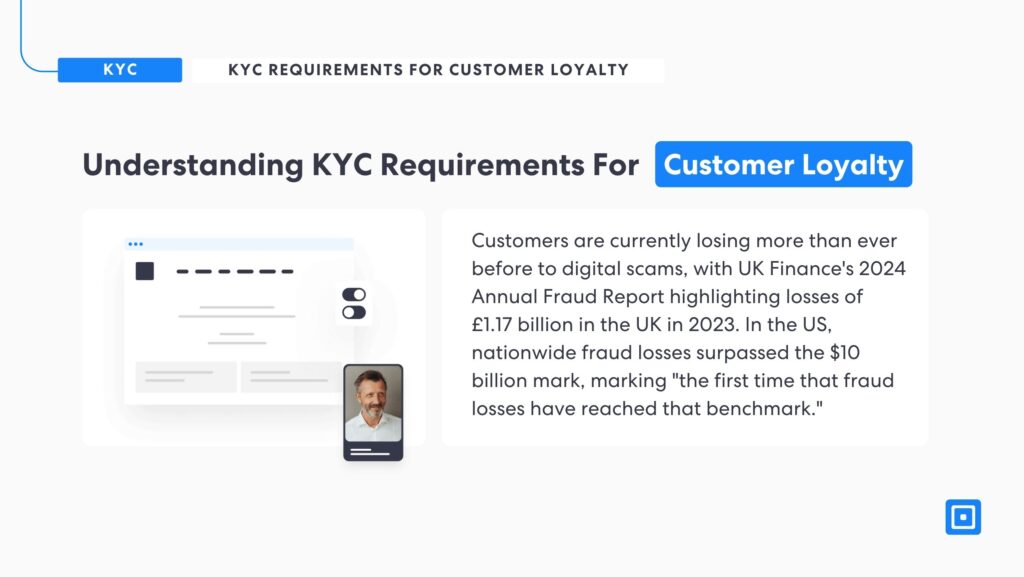

Customers are currently losing more than ever before to digital scams, with UK Finance’s 2024 Annual Fraud Report highlighting losses of £1.17 billion in the UK in 2023. In the US, nationwide fraud losses surpassed the $10 billion mark, marking “the first time that fraud losses have reached that benchmark.”

Consumers reported losing more than $10 billion to fraud in 2023, marking the first time that fraud losses have reached that benchmark. This marks a 14% increase over reported losses in 2022.

Financial institutions have been especially targeted, with money laundering, terrorism financing and other financial crimes taking places within these platforms at an all-time high. KYC standards must be rigorous to quickly detect customer risk profiles and suspicious behaviour, with risk-based customer due diligence being at the forefront of a robust KYC process.

Proactive Risk Management

Fraud risk management is a key reason why a customer might choose one financial institution over another. A recent study found that 69% of consumers now prioritise fraud protection when deciding between financial institutions, highlighting the importance of a secure customer identification program and ongoing monitoring for any risk factors.

There are many kinds of scams that take place on financial platforms, including the creation of new accounts using a false or stolen identity, account takeovers, unauthorised credit or loan applications, and more. Some of the critical protections needed to instil loyalty and trust amongst customers might include:

- Safeguarding accounts with biometric authentication, making account takeovers much more difficult to carry out.

- Secure identity verification leveraging liveness detection technology to identify synthetic identities, stolen identities, or false identities. This allows for businesses to quickly stop fraudsters from applying for credit or loans, as well as stopping them from opening an account in someone else’s name.

- Ongoing monitoring with fraud alerts and notifications. Providing customers with real-time alerts when potentially fraudulent activities are detected on their accounts is crucial to building customer trust.

In addition, strict AML screening which might include sanctions and PEP screening, adverse media checks, watchlist screening and continuous monitoring ensures full AML compliance, fostering increased digital trust.

Advanced Fraud Detection

Fraud detection has come a long way with new AI-powered technologies. Powering KYC processes with market-leading AI tools helps build a trustworthy global reputation. Some of the latest technologies include:

Liveness Detection

Liveness detection can identify stolen or false identities, using AI to pull biometric data from a submitted video during customer onboarding to verify whether or not the individual is a real live person. Leveraging liveness detection ensures that businesses spot deepfake technologies during these onboarding processes, analyzing subtle micro-expressions and skin texture to ensure liveness. The customer’s identity is verified effectively, meeting KYC regulations when used with an advanced document verification check.

Optical Character Recognition

Optical Character Recognition (OCR) helps extract data from images of KYC documents quickly and effectively, verifying a client’s identity. OCR technology extracts key data points (e.g., name, date of birth, address) from identity documents, ensuring no manual errors or inconsistencies occur.

This extracted information can then be cross-checked against databases, such as sanctions lists, politically exposed persons (PEP) lists, and watchlists, to identify high-risk individuals. OCR can identify anomalies within images of government-issued KYC documents, which might indicate fraudulent tampering.

KYC Requirements as a Competitive Advantage

In the past couple of years, sophisticated KYC compliance processes within financial institutions to prevent financial crimes such as money laundering has now become a clear competitive advantage. Customers look for platforms that can protect them at all times, especially since so many financial institutions have recently been victims of large-scale scams.

45% of all adverse contributions in the finance sector in 2023 were linked to stolen identities and identity fraud.

The banking sector has emerged as a key target for identity theft and synthetic identity fraud. According to Synectics Solutions, which manages the UK’s largest syndicated risk intelligence database, 45% of all adverse contributions in the finance sector in 2023 were linked to stolen identities and identity fraud. Fraudsters leverage falsified or stolen identities to drain funds from accounts, make unauthorized purchases, or secure loans fraudulently.

Differentiating Through Compliance

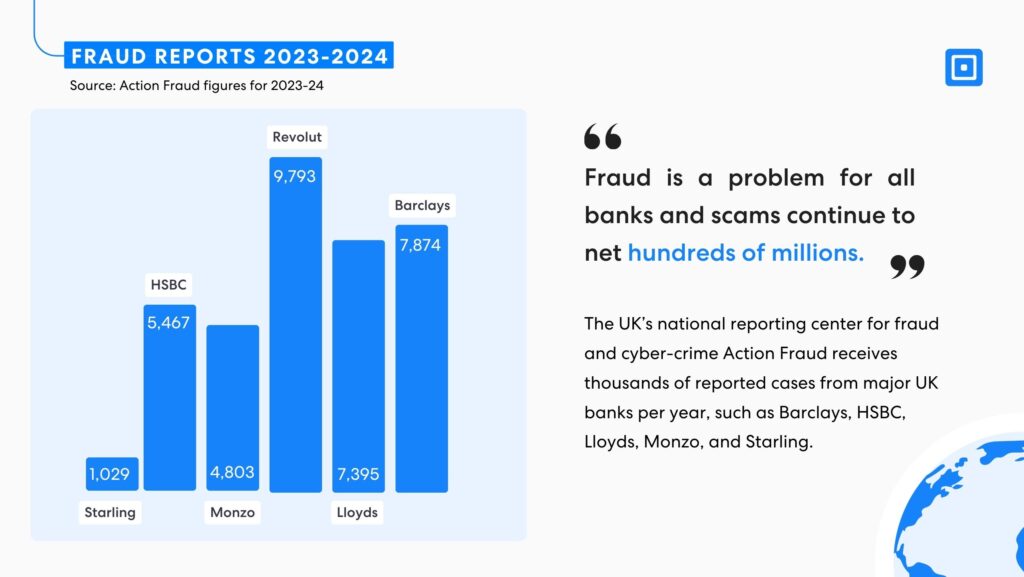

Between 2023 and 2024, fraud reports surged across major financial institutions, with HSBC receiving 5,467 reports, Revolut 9,793, Lloyds 7,395, and Barclays 7,874. These figures highlight the pervasive and sophisticated nature of modern fraudulent practices, underscoring the urgent need for financial institutions to reassess their priorities in order to win over customer trust and loyalty. For more information on identity fraud within UK financial institutions, read “Revolut Falls Victim to Identity Fraud.”

Stringent KYC processes will also enable businesses to operate in highly regulated markets, supporting global market expansion. This positions organisations as reliable international players, providing reassurance for investors and instilling confidence in customers and stakeholders.

Businesses that can differentiate themselves through reliable fraud defences will continue to hold a competitive advantage within their industry, as customers continue to prioritise security. An organisation that remains compliant with worldwide KYC and AML regulations, maintaining a strong reputation of security, is far more likely to win over a customer.

What Does a Comprehensive KYC Process Look Like?

For a KYC process to be a robust defence against fraud and ensure compliance, several key steps must be implemented. Some of these include:

Advanced Document Check: A document check will verify a government-issued identity document, checking for signs of tampering and extracting key information with OCR technology.

Biometric Verification with Liveness Detection: Biometric verification will quickly identify presentation attacks such as those using deepfake technology. Biometric data samples are pulled from submitted images and videos to be examined, as well as analysing details such as skin texture and subtle involuntary movements.

Multi-Bureau Checks: With a Multi-Bureau Check, businesses can verify customer details, such as name, address, date of birth and social security numbers against trusted authoritative sources such as government and credit bureaus.

Compliance with ComplyCube

ComplyCube offers state-of-the-art KYC solutions to help businesses safeguard their customers and their platform from fraud. Achieving compliance across complex regulatory structures enables businesses to scale quickly and seamlessly, which ComplyCube’s platform supports.

For more information on fortifying your business with a robust KYC process, get in touch with one of our compliance experts.