Germany has dumped its $3 billion crypto stash and shut down 47 exchanges that were being “used for criminal purposes” due to a lack of appropriate crypto KYC measures. This marks one of the biggest exchange enforcements in history, with large-scale crypto fraud detection having taken place. The worry after cases such as this is stifled innovation and growth of what was an emerging crypto sector in Germany, as startups or exchanges may now be discouraged – but this should certainly not be the case, as this could have been quite easily avoided with comprehensive crypto AML and KYC verification.

The crypto sector continues to be a prime target for fraudsters. Last month, Crypto News reported that it was the second most targeted industry for ID scams. CEXs attract bad actors as they hold large amounts of crypto in custody, making them lucrative targets for large-scale fraud attempts. To counter this, crypto exchanges must implement strong KYC systems, which not only enhance trust with users but also ensure compliance with regulatory bodies, helping to mitigate risks and maintain legitimacy in the industry. This guide will uncover the regulatory action imposed by BaFin and the German government on the Crypto sector, highlighting key downfalls and the road ahead.

So, what happened?

Germany’s BTC stash was dumped over the summer, from June through July, until all 50,000 bitcoins had been sold. This quickly escalated uncertainty in the crypto sector—BTC prices took a hit while Germany’s hands were tied.

In a report from late March, the International Monetary Fund (IMF) stated that Germany is facing economic challenges. It was the only G7 country to experience an economic contraction in 2023. The IMF also forecasts that Germany will continue to have the slowest growth among the G7 nations this year. A shrinking economy could very well be driving stricter regulatory enforcement in an attempt to stabilize the financial system by reducing the risks that come with unregulated markets.

The crackdown was aimed at weakening and smashing the infrastructure of cybercriminals who had taken funds from the underground economy.

However, Germany’s central criminal investigation agency, the BKA, stated that the crackdown was aimed at “weakening and smashing the infrastructure of cybercriminals” who had taken funds “from the underground economy.” Illicit operations were leading to illegal funds circulating within unregulated crypto exchanges, making the exchanges a prime regulatory target in order to comply with several key financial regulations:

EU Anti-Money Laundering Directive (AMLD5 and AMLD6): This directive enforces crypto exchanges and wallet providers to implement stringent KYC and AML processes to prevent money laundering and terrorist financing.

Markets in Crypto-Asset Regulation (MiCA): This directive has already been passed by the EU but has not yet been implemented as legislation. The regulation will focus on the implementation of a comprehensive framework to monitor crypto assets for consumer protection and financial stability.

Financial Action Task Force (FATF): The FATF is an international watchdog that prevents financial crime globally. Germany follows FATF guidelines to prevent the misuse of cryptocurrencies.

For more information on key crypto regulations across the globe, have a look at ComplyCube’s Crypto Guides.

Crypto as a Prime Target

Despite regulatory pressures from watchdogs, the sector’s nature also makes enforcement inconsistent, creating gaps for fraudsters to exploit where a lack of adequate KYC is present. With exchanges offering a lucrative ROI on fraud, they must implement measures to ensure their own protection.

Nearly 29% of global identity fraud attempts are targeted at crypto-related platforms.

Crypto News released a report in mid-September that highlighted the shocking amount of fraud within the crypto sector. The piece reads, “Nearly 29% of global identity fraud attempts targeted crypto-related platforms, posing significant risks to the sector as criminals exploit the privacy inherent in blockchain transactions.”

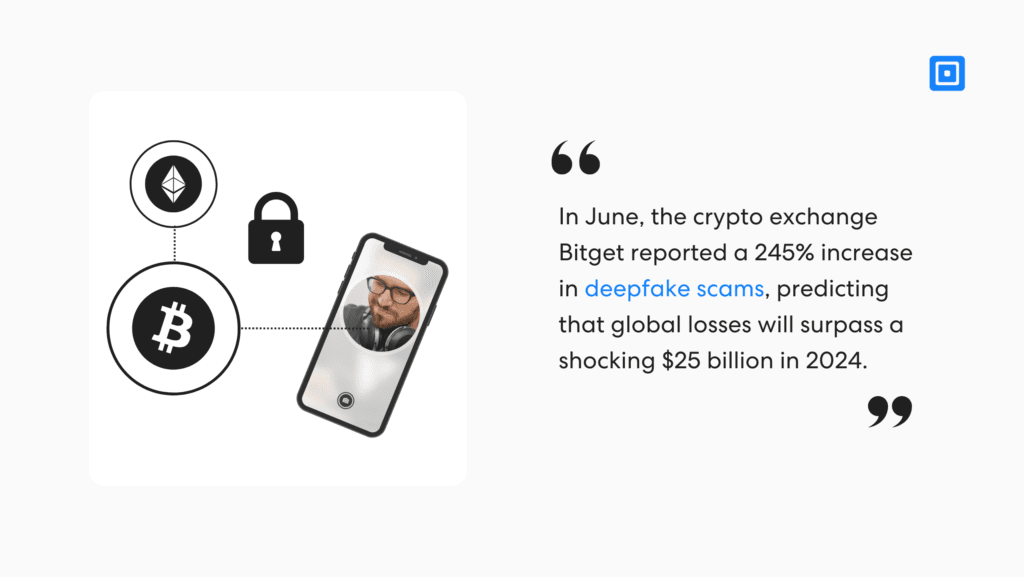

The rise in fraud within the sector is largely driven by the evolution of the technology leveraged by bad actors, such as deepfakes. In June, the crypto exchange Bitget reported a 245% increase in deepfake scams, predicting that global losses will surpass a shocking $25 billion in 2024.

Global losses will surpass $25 billion in 2024.

Bitget’s report highlighted that the most affected countries are the United States, China, Germany, the United Kingdom, Ukraine, and Vietnam. A recent report from the FBI similarly revealed that $5.6 billion was lost to crypto fraud in 2023, with nearly 69,000 complaints filed in the United States.

Crypto exchanges must prioritize implementing comprehensive KYC measures within their platforms. Without AML and KYC infrastructure, they risk not only severe regulatory enforcement, as we’ve seen in Germany, but also the loss of user trust in the platform.

AML & KYC in Crypto

It’s well known that the Crypto sector attracts money laundering practices and other illicit activities due to anonymity at scale and the lack of financial institutions supervising transactions. The need for KYC and AML measures is, therefore, higher than in other sectors. Implementing KYC processes reduces risks of crimes such as terrorist financing and aligns with global standards.

Identity verification can help Virtual Asset Service Providers (VASPs) prevent money laundering and other financial crimes by increasing individual accountability. With a robust KYC framework, exchanges can quickly identify and report suspicious activities to regulatory authorities, which can lead to timely investigations and interventions. Learn more about the dangers of a no-KYC crypto exchange in ComplyCube’s recent guide.

By verifying identities, exchanges can also reduce the likelihood of account takeovers, phishing scams, and other forms of identity fraud that are rampant in the crypto space. However, robust KYC now goes far beyond only implementing Identity Verification (IDV). Market-leading providers offer an all-in-one solution that ensures adherence to global AML and KYC guidelines.

While the recent crackdown in Germany highlights the challenges facing the crypto sector, it also underscores the critical importance of robust KYC and AML measures. By prioritizing these systems, exchanges can not only comply with regulatory requirements but also protect their users and the integrity of the broader financial ecosystem. As the industry matures, embracing these practices will be essential for fostering innovation while ensuring a secure environment for all participants.

If you’re facing compliance challenges safeguarding your platform with AML and KYC measures, contact our expert compliance team.