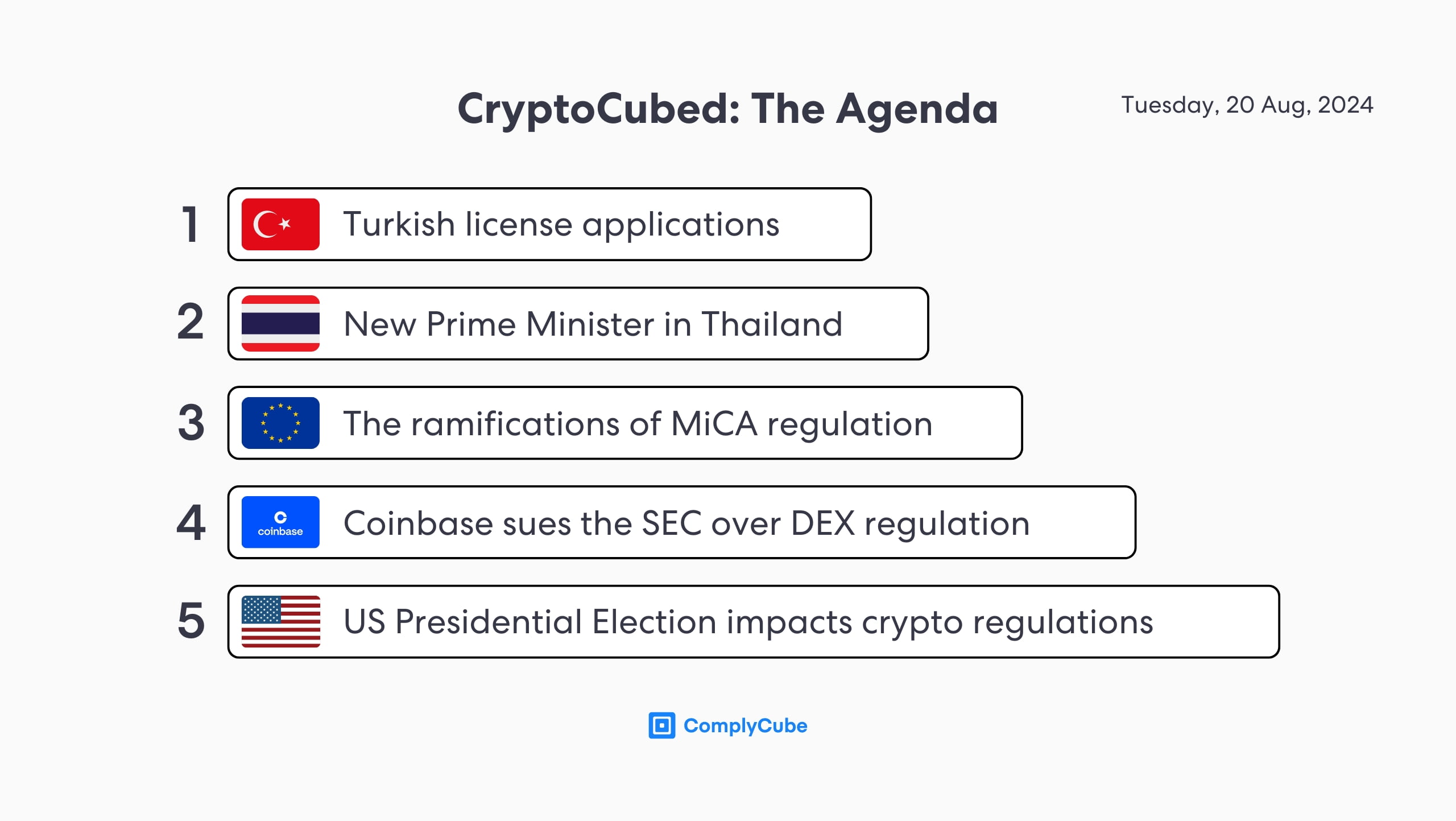

The ComplyCube crypto newsletter for August, bringing you key insights into AML crypto regulations from around the world.

The month’s news and regulatory updates from around the crypto world. Featuring:

Turkish license applications

New Thailand PM

MiCA entries and exits

Coinbase x SEC drama

Harris vs Trump and crypto’s impact on the US election

76 Companies Pursue Turkish Licenses Under New Regulatory Framework

Over the last 3 years, the population of Turkey that holds cryptocurrencies has risen from 16% to 40%, placing Turkey near the top of the list for both growth and adoption rates. The country’s trading volume is now ranked 4th, trading an estimated $170 billion in 2023.

In response to the sector’s growth, Turkey’s Capital Markets Board (CMB) has taken significant steps to fine-tune its crypto regulation and infrastructure. 76 crypto service providers are now seeking licenses under the newly established “Law on Amendments to the Capital Markets Law.”

This law, signed into effect by President Recep Tayyip Erdoğan in July 2024, marks a critical turning point in Turkey’s approach to digital assets. Among the companies on the CMB’s list are industry giants like Binance, OKX, Coinbase, and KuCoin, each vying for a foothold in what is rapidly becoming a key crypto hub.

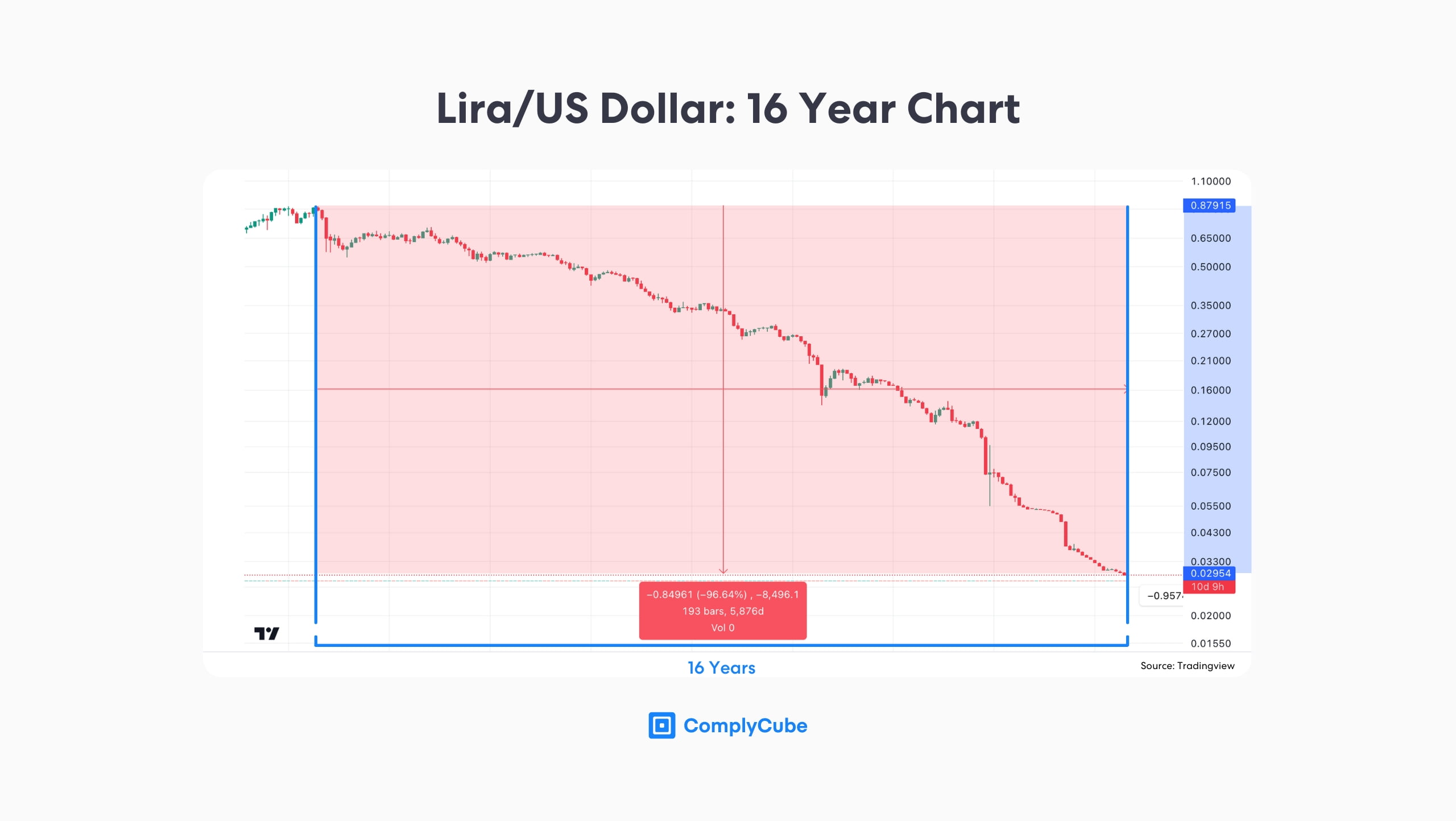

Turkey’s accelerated adoption of cryptocurrencies can be inextricably linked to its economic context. With the Turkish lira having lost more than 95% of its value against the US dollar over the past 16 years, digital assets offer an attractive alternative for both investors and ordinary citizens seeking to protect their wealth.

This surge in demand has made Turkey a critical market for global crypto exchanges to win, as depicted through the booming applications for licenses in the region. In Turkey, as is true in many other countries, digital assets are increasingly seen as a safe haven for individuals and investors to protect their wealth against inflation.

Regulatory compliance is of utmost importance, as exemplified through Binance’s recent changes. The global exchange has enhanced its operational transparency in Turkey, limiting marketing efforts, and Turkish language options will be phased out to ensure regulatory compliance in the local jurisdiction. This also exemplifies the importance of winning market share in this particular country to capitalize on the revenue available from rapidly increasing trading volumes.

Secondary legislation

The next set of regulations is expected to define some of the key industry terms to reduce ambiguity in the industry. These include typical terms such as:

Crypto assets

Crypto wallets

Crypto Asset Service Providers (CASPs)

There is likely to be a grace period until this legislation is in effect, giving exchange firms time to develop the infrastructure to comply with these regulations. For firms looking to gain a crypto license in Turkey, time is of the essence.

The Turkish government’s proactive approach to crypto regulation, coupled with the significant interest from major players, serves as great evidence.

New Thailand Prime Minister Aims to Strengthen the Thai Crypto Industry

Paetongtarn “Ung Ing” Shinawatra, the leader of the Pheu Thai Party, has just become the country’s 31st Prime Minister. Her vote saw 319 in favor, 145 against, with 27 abstentions, evidencing a significant majority in her favor.

Immediately after her win, she declared her commitment to the country’s continued digital policies, particularly its digital wallet initiative. Regulators in Thailand have advocated for the crypto sector for many years, most notably the Thai SEC, who have endorsed the industry regardless of which party was running the country. The SEC recently launched a sandbox policy for crypto-related businesses.

Such developments continue to aid the industry’s growth in the continent of Asia. For more information on crypto regulations in Asia, read:

Will MiCA Force Tether out of the EU?

Markets in Crypto Assets (MiCA) is now complete. This European Union (EU) policy has caused a slight shift in stablecoin bragging rights, with Circle, the issuer of USD Coin (USDC) taking the first win. The two largest stablecoins, by far, are Circle’s USDC and Tether’s USD Tether (USDT).

On July 1st, Circle announced that it was the first stablecoin issuer to meet MiCA’s compliance demands, being granted an Electronic Money Institution (EMI) license from French banking regulator Autorité de Contrôle Prudentiel et de Résolution (ACPR).

This development brings about the first major Euro-backed stablecoin for mass use across the EU zone. Tether, on the other hand, looks doubtful regarding achieving MiCA compliance, primarily due to its supposed ill-reported details on its reserve assets.

A fundamental aspect of the MiCA stablecoin policy is ensuring that issued stablecoins are backed by sufficient reserve assets, with regular reporting to maintain transparency. Without adequate reserves, a stablecoin cannot be effectively supported or trusted.

Coinbase Challenges the SEC on DEX Regulation

The Securities and Exchange Commission (SEC) has attempted to pass a new regulation that regulates Decentralized Exchanges (DEXs) according to the same rules as traditional financial exchanges. Ultimately, a DEX would require a license to operate as a trading system under the SEC.

While this displays some movement in American crypto policy, Coinbase executive Paul Grewal (Chief Legal Officer) expressed major concerns over the SEC’s ambitions and intentions. Labeling the regulatory move as a ‘poorly researched’ proposal, he requested that the SEC withdraw it and conduct further research into the logistics of DEX regulation.

This move further strengthens Coinbase’s position as a regulatory thought leader, suggesting that industry players should be consulted and included in policy creation rather than excluded from discussions.

Tether’s lack of transparency has already cost them dear, with Bitstamp delisting their Euro-backed stablecoin due to noncompliance with MiCA regulations. It appears this could become an increasingly common pain for the world’s largest stablecoin issuer in the Eurozone.

The American Presidential Election & Crypto Regulation

American crypto policy has been a pivotal narrative for some time. The US election battle, now between Donald Trump and Camala Harris, could prove to be the decisive focal point in American policy.

The Biden administration, through the SEC and Gary Gensler, has taken a tough stance on the industry, deciding that further regulation was not necessary. As the election approaches, however, Donald Trump has made it extremely clear that if elected President, he will pass further regulation, ensure regulatory clarity, and make America a ‘crypto hub.’ Whether Trump truly believes in the crypto sector is neither here nor there. Even if his advocation for the sector is purely a political tool, it has given him a clear USP versus his opposition in the Democratic party.

Quite contrary to the Republican stance, Democratic opinion remains ambivalent. Major Democrats are endorsing a stance similar to Trump’s, but the Democratic presidential nominee, Harris, has not publicly or definitively taken a stance.

This is best depicted through the discourse around the Financial Innovation and Technology for the 21st Century Act (FIT21). FIT21 is the first time a major crypto bill has been cleared in a Congressional chamber. The US Senate must now decide whether or not to pass this into an official Act. However, the odds for its approval remain low.

Views on the bill in the Democratic party remain murky and divided. Senator Elizabeth Warren continues to believe that digital assets are a danger to the US economy, but others are beginning to turn and see the benefits that a thriving American digital asset sector could bring. Congressman Brad Sherman also retains his stance that FIT21 could endorse increased competition for the US dollar as the global reserve currency and that criminals could exploit the policy.

It’s clear that crypto policy in America remains a divisive topic, with no clear conclusion and certainly no immediate respite in sight.

For more information about our range of crypto AML, KYC, and IDV solutions, get in touch with a regulatory specialist today to find out how we can help.