Cryptocurrency regulation in India has not been subjected to crypto-specific legislation. What the government has done, however, is modernize existing policy to incorporate financial technologies, such as cryptocurrencies. Therefore, KYC crypto regulation in India is still emerging. While there is sufficient crypto AML and related policy, there is a lack of specific legislation designed for Virtual Digital Assets (VDAs).

This crypto guide digests the regulatory landscape of the Indian blockchain industry, providing clarity on some of the core regulations and how they have shaped the nature of the crypto industry in India.

Is Cryptocurrency Regulated in India?

In 2021, India’s central bank, the Reserve Bank of India (RBI), updated its policy on the National Strategy on Blockchain to lay the groundwork for a national blockchain infrastructure. Such an infrastructure was to facilitate “production grade applications of national interest” relating to streamlining payments and settlements for businesses and individuals across the nation.

The Indian government recognized the value of the underlying technology and its applications early on, which spurred this primary legislation. The National Strategy on Blockchain was written to foster a digital platform and enable the country’s academic research into blockchain and AI.

June 2023 witnessed an increased federal recognition of digital currencies, or Virtual Currencies (VCs). The RBI addressed the growing dangers and associated risks of VDAs under its “Regulatory Initiatives in the Financial Sector” report.

Indian regulators saw the greatest threat in the further adoption of crypto assets as the negative connotations they could have on monetary policy. The greater the use of cryptocurrency exchanges and cryptocurrencies themselves, the less leverage the RBI has over its currency.

The Securities and Exchange Board of India (SEBI) believes that crypto regulation should come under the jurisdiction of multiple national and international regulators. The regulatory body took the issue of cryptocurrency regulations to a government panel tasked with convincing the authorities that crypto legislation should be a democratic affair between multiple regulators.

This shows continuity with the RBI’s thinking, which believes that it would take the international cooperation of multiple major financial regulators to provide an enforceable regulatory framework, with a particular focus on taxable crypto income.

Such an initiative, in theory, would work well:

- The SEBI could monitor crypto assets that behave similarly to that of traditional securities

- The RBI could monitor asset-backed cryptocurrencies, including stablecoins

- The Insurance Regulatory and Development Authority of India could regulate pension-related Virtual Assets (VAs), and so on

Despite this, and despite the view that blockchain technology is innovative, the crypto regulatory landscape in India is cautious. Although they are not explicitly banned, there is not a complementary set of rules that is catalyzing the industry. This has led to a tumultuous time for crypto firms operating in the country.

Indian Crypto Regulations

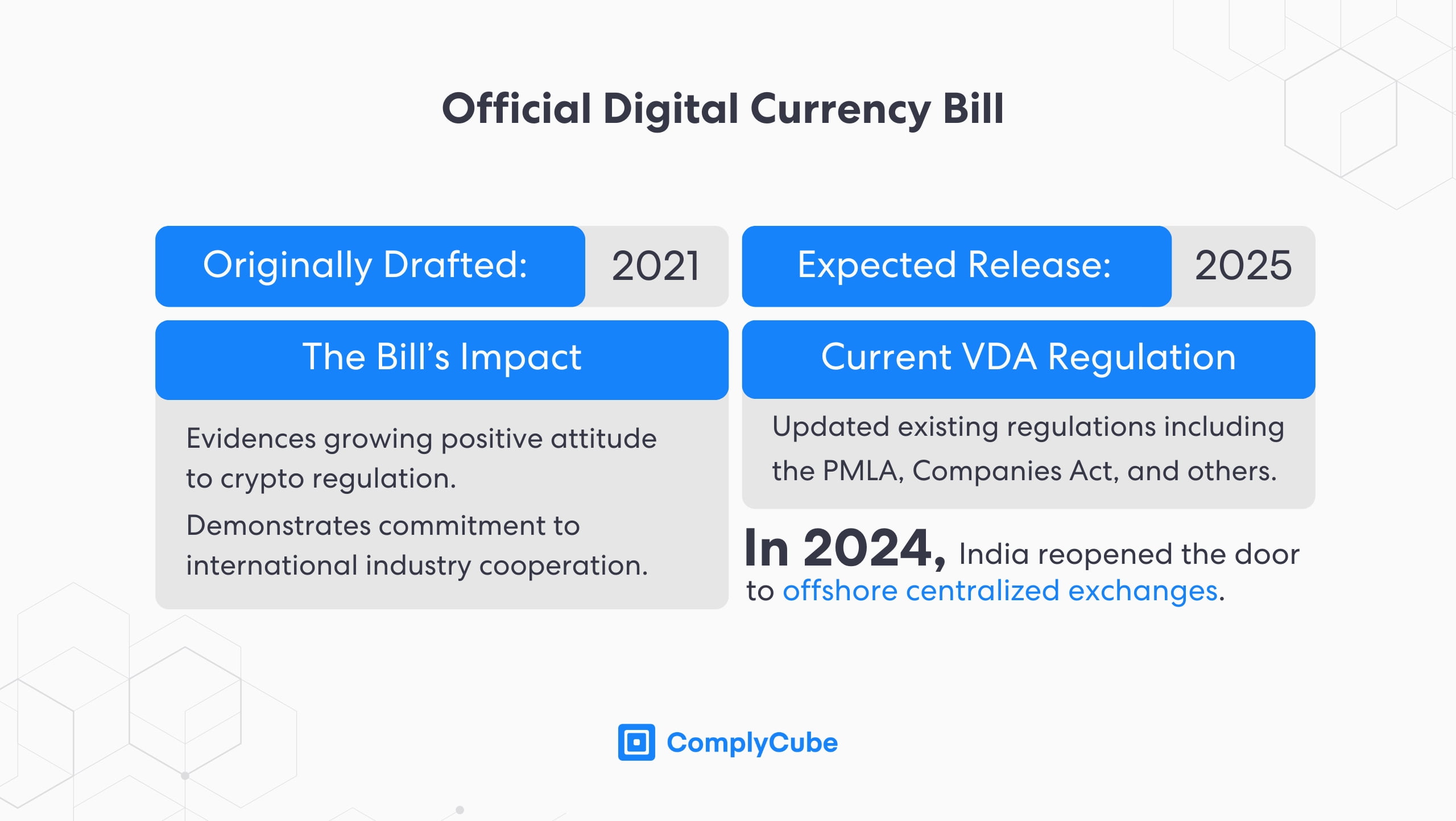

The Cryptocurrency and Regulation of Official Digital Currency Bill was initially introduced in 2021 by the RBI to create a favorable industry environment with regulatory clarity. However, the Bill never made it through parliament, leaving India lacking a purposefully written set of legislation for crypto.

However, the Official Digital Currency Bill is still a significant mark of policy development on a federal level and aligns India’s VDA domestic policies with international standards. While the bill has not been passed, industry leaders and policymakers expect it to emerge in the future, possibly in 2025.

Therefore, despite a delayed launch, it represents a development towards a more globally holistic sector. When the Bill is live, it should catalyze India’s VDA sector. For more information on the significance of crypto regulation, read The Dangers a No KYC Crypto Exchange Can Bring.

The Prevention of Money Laundering Act

The Prevention of Money Laundering Act (PMLA) was initially drafted in 2002 and came into full effect in 2005. The Act created clear Anti-Money Laundering (AML) obligations for banks, Financial Institutions (FIs), and intermediaries to verify clients’ identities, maintain records, and furnish information to FIU IND.

The act defined money laundering as any of the following acts that were engaged with the illicit proceeds connected to crime:

- Concealment

- Possession

- Acquisition

- Use

- Projecting as untainted property

- Claiming as untainted property

The Act also requires FIs and related services to verify the Aadhaar identification numbers of individuals and perform the necessary Customer Due Diligence (CDD) on users and beneficial owners. This is a similar regulatory framework to the Financial Crimes Enforcement Network (FinCEN) in America. FinCEN endorses a Customer Identification Program (CIP) for all American FIs, a regulation that has now been adopted by the Financial Action Task Force (FATF) and across the globe.

In March 2023, the Finance Ministry extended the PMLA to the use of VDAs, fostering a new wave of crypto AML legislation. This gave authorities greater influence to enforce Know Your Customer (KYC) crypto rules to help prevent money laundering.

Under this amended Act, all crypto businesses must now obtain a license with FIU IND and comply with its AML policies. This involves substantial verification of users’ identities and maintaining reporting records.

India’s Consumer Protection Act

The original Consumer Protection Act (1986) provided a regulatory framework for safeguarding consumer rights in India. It is designed to regulate how businesses operate and provide goods and services to consumers or users.

This Act was reintroduced in 2019 to address new market dynamics in the 21st century. It now provides legislation around digital and crypto transactions with enhanced enforcement mechanisms to ensure that crypto platforms are not misleading their users and to protect users from fraud and malicious practices.

The Consumer Protection Act of 2019 now plays a vital role in the country’s policies for crypto investor grievances and ensures that crypto exchanges, along with other VDA services, are being transparent to their users.

Crypto Pension and Tax Regulations

There is a 1% tax deduction at source on crypto transactions over ₹50,000 or ₹10,000 ($600 or $120) in certain cases. Furthermore any profits made on trading cryptocurrencies are taxed at 30%, regardless of an individual’s profession or salary.

Is Transferring Crypto a Taxable Event in India?

Any typical crypto transaction, including purchasing goods and services, swapping crypto assets on centralized or decentralized exchanges, receiving crypto in return for a service, and mining cryptocurrencies, is taxed at 30%.

The Indian government does not support the use of cryptocurrencies as a substitute for fiat currency and has long believed that crypto poses a threat to federal monetary policy. This could change in the future as the country begins adopting more favorable legislation.

Is India Pursuing a Pension Fund Regulatory Framework?

The original bill to block crypto assets (in 2021) suggests such a framework could be on the cards, with SEBI suggesting that independent regulators should create policies that pertain to their fields of expertise.

This initiative has since been disbanded as the region looks to adopt more favorable regulations to endorse the industry’s growth. Such a pivot since 2021 has brought about moderate success so far, but such a significant shift in attitude will always take time.

Regulating Cryptocurrency Exchanges in India

The Indian government has two core concerns about regulating Virtual Asset Service Providers (VASPs): non-compliance with AML, KYC, and tax regulations and concerns about customer protection.

AML and KYC Non-Compliance

India’s crypto regulation has been turbulent, with Centralized Exchanges (CEXs), VASPs, and other VDA services finding it hard to forge a way through the regulatory fog. However, a leading voice in the Indian crypto industry believes it will not be long before there is a cleaner regulatory framework.

They want to make sure that the laws of the land are being followed, including AML, KYC and CFT guidelines, if they are followed, they are very bullish on the industry.

Sumit Gupta, the co-founder and CEO of the CoinDCX CEX, believes that the AML and KYC regulation that the government is working on ‘now’ is fundamental to the industry’s success. Mr Gupta stated that “India is trying to unify that [the regulations] right now” to standardize a set of guidelines to follow.

In the same interview, the CEX founder reiterated his core belief that the only way to succeed in this industry was to abide by federal regulations. Notably, he referenced Coinbase as the leader in this regard.

When asked about the cost of AML and KYC solutions, he stated that it was negligible as they enabled compliance with federal regulations and provided a methodology for ensuring longevity in the industry. For more information on the kinds of Crypto KYC solutions he was talking about, read How KYC Crypto Regulations Safeguard the Industry.

9 CEXs Banned in December 2023 for AML Breaches

The Financial Intelligence Unit India (FIU IND) blocked the URLs of 9 leading offshore crypto exchanges, including Binance, Kucoin, Huobi, Kraken, Gate.io, Bittrex, Bitstamp, MEXC Global, and Bitfinex. All exchanges were reported to be operating illegally without “complying with the provisions of the PML Act in India.“

All Virtual Digital Asset Service Providers (VDA SPs) must be licensed with the FIU IND and, therefore, adhere to its regulatory framework. In 2024, both Binance and KuCoin received licenses from the FIU, allowing them to re-enter the market, evidencing a growing positive attitude towards the industry.

How to Comply with Indian Crypto Regulations

Compliance with Indian crypto regulations starts with obtaining a license from the FIU IND. All VDA SPs must register with the Financial Intelligence Unit and, therefore, comply with its increasingly comprehensive crypto AML regulations.

As displayed above, this involves the regular reporting of crypto transactions and adherence to KYC requirements:

- Identity Verification: Firms must implement stringent KYC processes involving the collecting and verifying of identification information such as Aadhaar numbers and other authorized information. Digital Identity Verification can significantly streamline this process, ensuring compliance while minimizing friction for new users.

- AML Checks: Crypto exchanges and other VASPs must conduct thorough Anti-Money Laundering checks to ensure users are not going to take part in malicious and illicit activities. This includes verifying the sources of funds, conducting risk assessment and Customer Due Diligence (CDD) checks, and verifying this information in real time. AML protocols should align with the Prevention of Money Laundering Act (PMLA) to avoid legal repercussions

- Transaction Screening and Monitoring: VDA services must have an infrastructure in place to screen and monitor transactions as mandated by the PMLA. ComplyCube’s Trust Node Level 2 provides a one-stop shop for all AML, VASP, and transaction due diligence.

- Ongoing Monitoring: Crypto platforms must continuously monitor users to track user activities and transactions. This helps identify and mitigate risks as they emerge. Regular audits and compliance checks should be conducted to ensure all regulatory requirements are consistently met, and this can be done from the comfort of the ComplyCube compliance platform.

Choosing ComplyCube for KYC Crypto Regulation in India

ComplyCube is a leading provider of crypto KYC and AML solutions. With clients worldwide in banking, crypto, financial services, telecoms, and many other industries, it has become a distinguished compliance leader.

If your crypto exchange, VDA platform, or other financial institution lacks the infrastructure to comply with Indian or international regulations, ComplyCube can help. Get in touch with one of their experts today to find out how.