There are a plethora of KYC vendors that have emerged over recent years, providing seemingly comparable services. KYC software vendors are becoming increasingly vital for the safe operation of businesses from many industries. This guide provides a KYC checklist for financial institutions and other services to help identify which KYC services are best optimized for your business.

What is KYC Software?

Know Your Customer (KYC) software, sometimes known as eKYC, is a technology service that enables regulatory compliance and fraud prevention initiatives. A wealth of tools are used to help businesses mitigate money laundering and other financial crimes, such as terrorist financing. Identity Verification (IDV) and KYC solutions are becoming common practices for achieving Anti-Money Laundering (AML) compliance.

Finding the Right Identity Verification Service

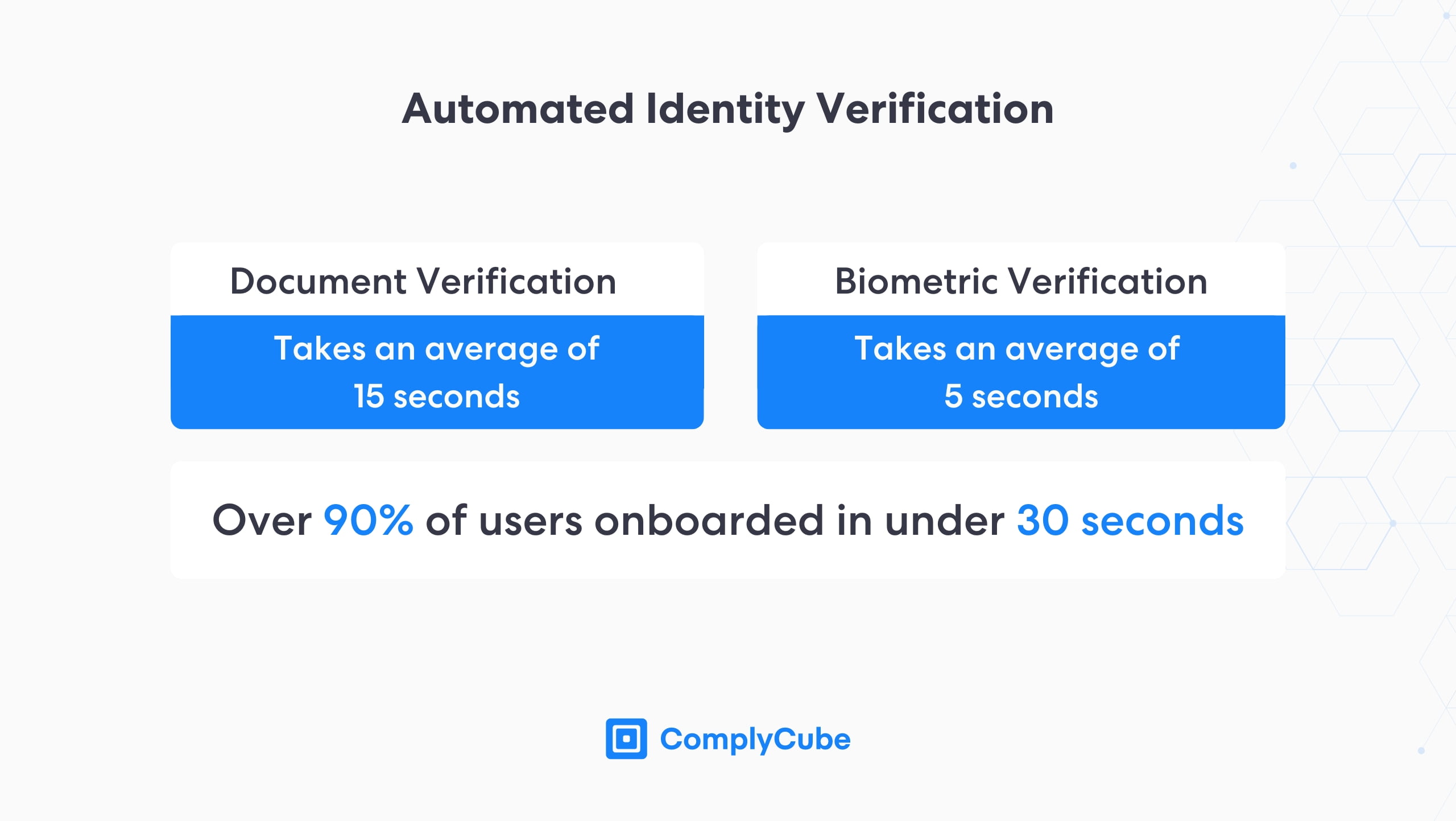

KYC and AML solutions provide a streamlined path for client acquisition and relevant compliance. This starts with scalable digital IDV solutions (eIDV), including document and biometric verification, which can be completed with extreme precision in under 60 seconds.

These solutions use state-of-the-art artificial intelligence to analyze multiple data points on KYC documents and leverage biometric authentication engines to match the document to the user in one workflow.

These KYC tools offer businesses a superior mechanism for client identification and further due diligence measures. Leveraging modern technologies means human error cannot creep into the verification process, and payment fraud can be minimized. This ensures a far higher level of precision at a far greater speed is brought to KYC processes.

Customer Due Diligence: Reimagined

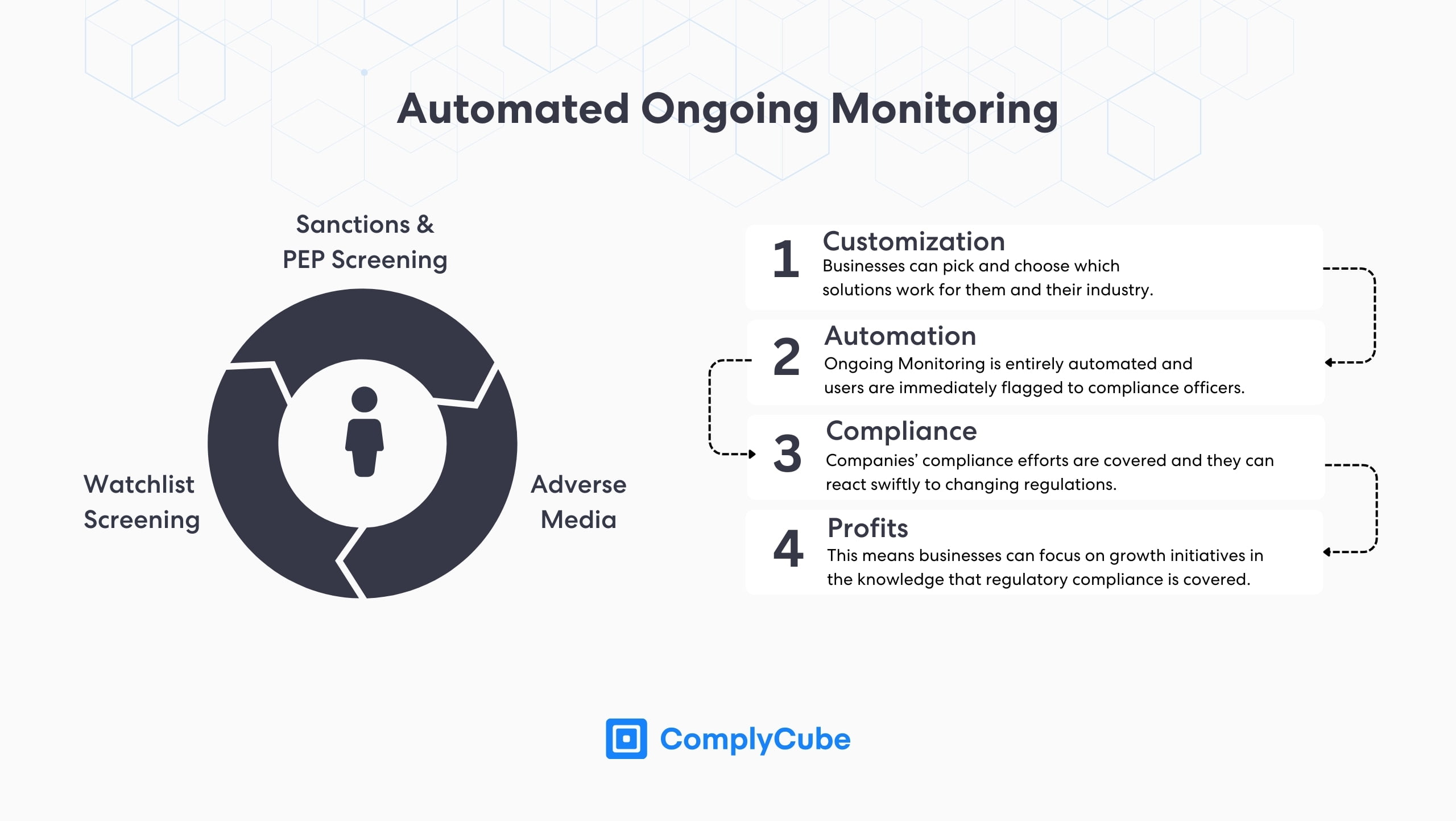

These KYC processes are not just an innovation in the IDV (identity verification) systems. They are typically provided as part of a more comprehensive platform integration and with a complete suite of related solutions. Customer due diligence (CDD) and ongoing monitoring greatly benefit from advanced AI, enabling the automation and vast customizability of KYC and customer onboarding processes.

These platforms provide full KYC functionality from start to finish. Manual due diligence strategies historically spend too much time and money on CDD and continuous monitoring. In the modern day, these resources need to be allocated toward growth and expansion plans to remain competitive.

CDD services provide a comprehensive list of solutions that enable customers to be thoroughly vetted in real time. This makes Know Your Customer vendors fundamental to modern business strategy, particularly for financial institutions. For more details on KYC vendors and verification processes, read KYC Verification in 3 steps.

Continuous Monitoring for Enhanced Risk Scoring

KYC vendors perform ongoing monitoring of user accounts to ensure that user accounts are updated in real time. However, this is extremely difficult without an automated infrastructure that will alert enterprises to changes in one of their client’s welfare or situation.

These changes could come in any shape or form, such as an appearance in the press in an obscure foreign newspaper, developments of a political or aristocratic nature, and many others. If this occurs, the platform will instantly form an alert on its risk profile, giving compliance officers the required information to make informed and correct user decisions.

Continuous monitoring services enable real-time data feeds to KYC analysts, enabling swift decisions on clients. Due to the speed at which risk profiles are updated and acted upon, a business’s risk of money laundering is dramatically reduced.

KYC Checklist: What to Look for in KYC Vendors

Numerous KYC and AML software services have come to market in recent years. However, not all can supply the scalability that modern-day FinTechs, crypto firms, financial institutions, and other industries demand.

When determining the KYC provider that a business should integrate with, the below KYC checklist should be consulted.

1 – Their Identity Verification Solutions

KYC compliance requirements center around the identification of a new customer. IDV solutions, such as document and biometric verification, are becoming the go-to in KYC software. Ensuring a provider has a leading range of these services is paramount before integrating.

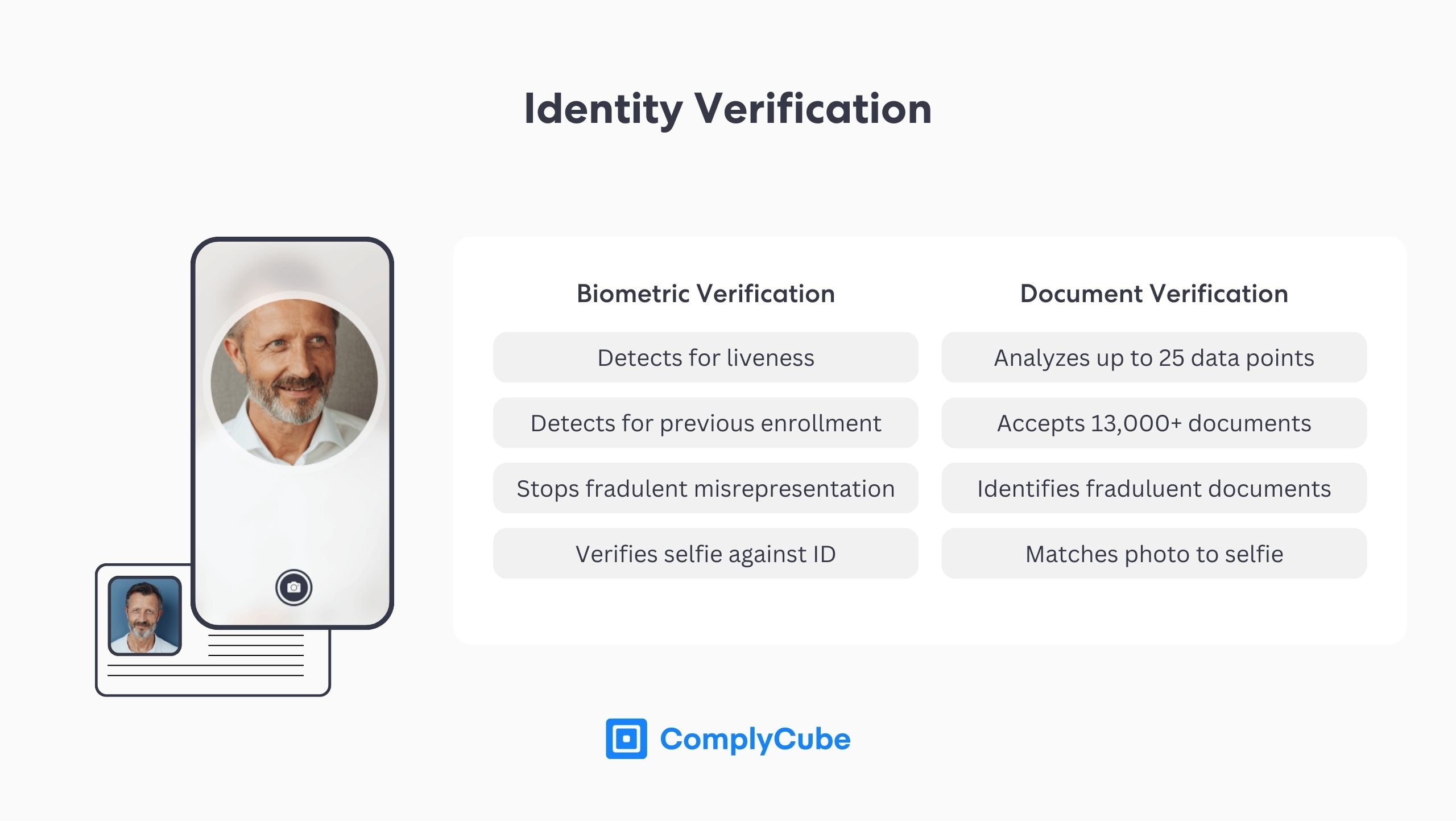

Document Verification

This is the first step in customer identification and typically analyzes ID documents, including driver’s licenses and passports, to scan for fake or fraudulent documents.

Modern AI-powered document verification is far superior to manual verification. It can analyze up to 25 data points from 7 categories and achieve heightened precision on a time scale that would be impossible for a human to replicate. For more information on document authentication, read What is Document Verification? An In-depth Look at ID Verification.

Biometric Authentication

Biometric verification ensures that the identity of the individual presenting the document is the same person shown in it. This advanced security measure uses unique physical and behavioral traits to verify an individual’s identity.

This creates a higher confidence level in the authentication process; the technology that powers this is known as Presentation Attack Detection (PAD). For more information on biometric authentication, read The Advantages Of Biometric Authentication.

- Liveness detection

- Printed photo detection

- Mask (and 3D mask) detection

- Video attack detection

- Network spoof detection

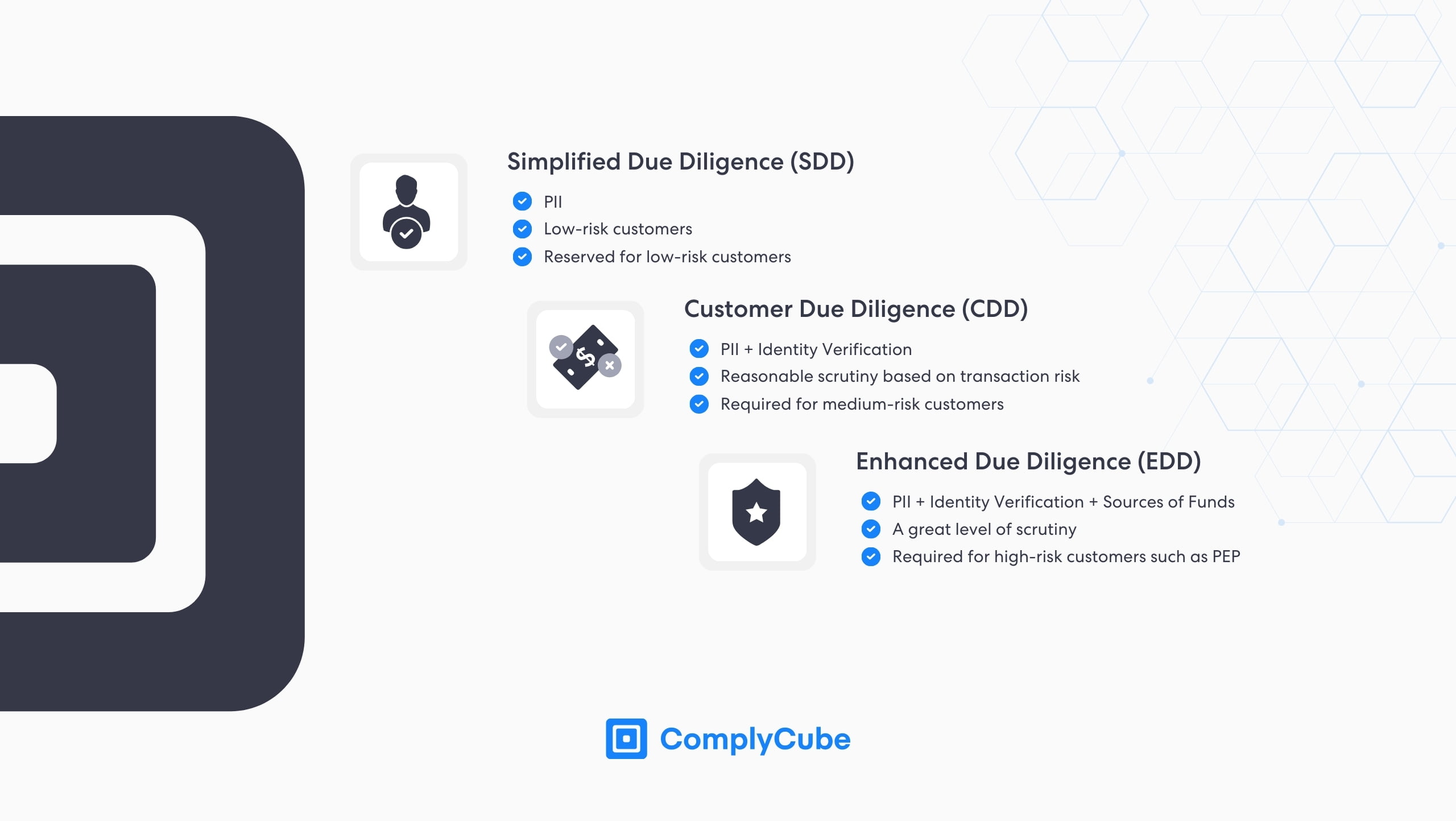

2 – Breadth of CDD and AML Services

Customer due diligence is pivotal in a business’s compliance with anti-money laundering regulations and in preventing financial crimes. A KYC vendor should provide a comprehensive range of tools to ensure a business can sufficiently perform KYC checks. These should include:

Multi-bureau Checks

Firms can leverage a host of partnered databases to achieve a higher level of identity assurance. For example, they could verify user credentials against a proprietary database like a bank’s.

Sanctions and PEP Screening

Quickly identifies individuals associated with positions of authority (such as an MP or Senator) or clients who appear on federal and regional lists, such as UN and EU lists.

Adverse Media Monitoring

KYC vendors must be partnered with thousands of global and local news sources. This ensures that businesses can identify potential bad actors immediately and act accordingly. This process would be nearly impossible without partnering with a KYC service.

Watchlist Screening

Engulfing a broad range of global data points, watchlist screening allows expansion into new territories without fear of breaking local compliance regulations. These services utilize AI to match client names in any language, using advanced fuzzy matching to find accurate matches without compromising low false positives.

These checks contribute to a client’s risk score, which enables compliance officers to swiftly identify the level of risk a user might expose a business to. This gives institutions all the information required to make informed decisions and, crucially, which users might require further and specialized due diligence. For more information on CDD processes, read What is Customer Due Diligence (CDD)?

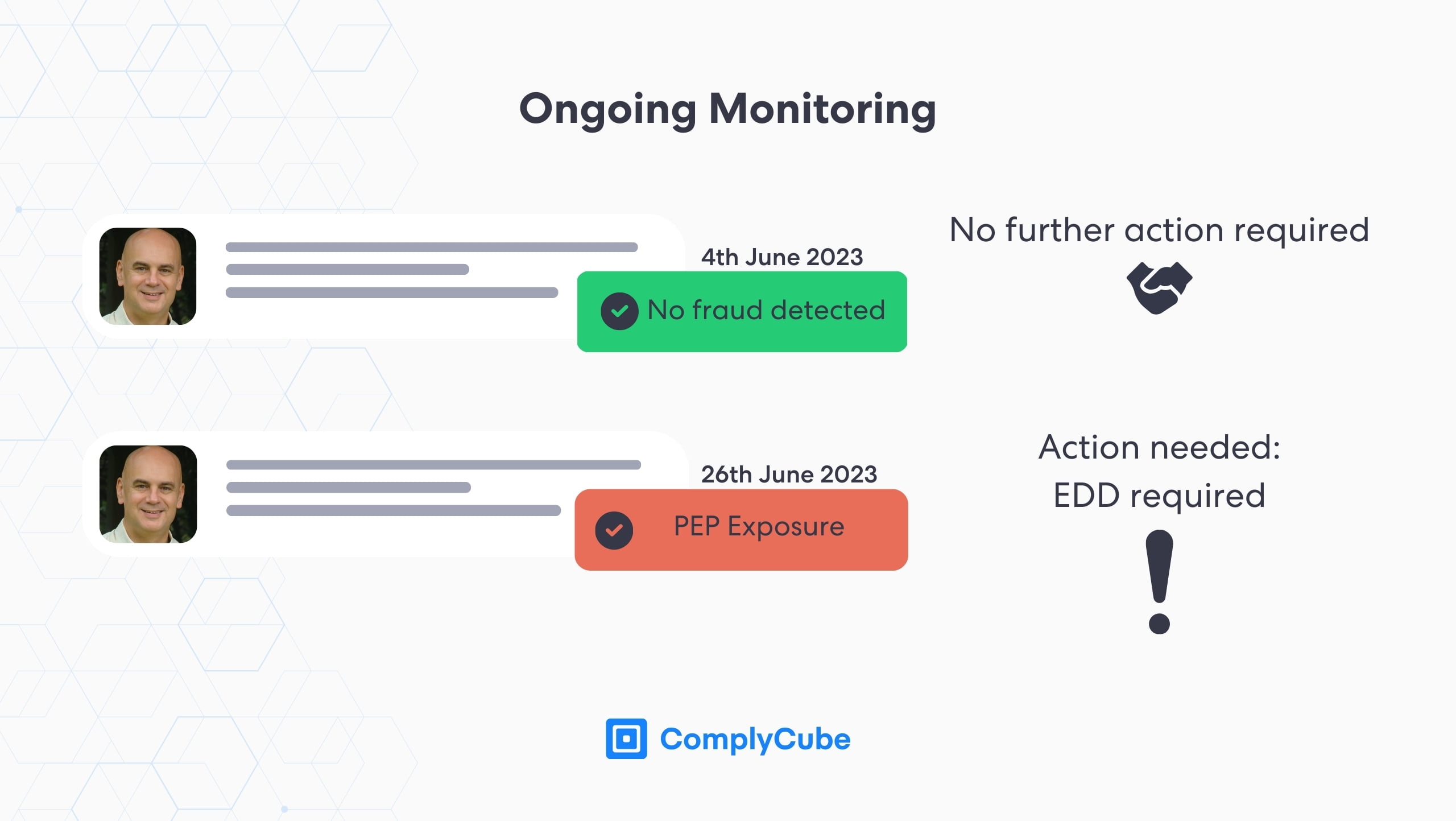

Ongoing Monitoring

Customer due diligence, however, is an ongoing process. Client situations change, and these potential movements must be monitored, particularly in the financial services industry. Continuous monitoring of a user profile ensures the business can take immediate remedial action.

For example, if a cryptocurrency exchange’s client appeared as a PEP level 1, the firm in question might decide to begin monitoring that user’s account for suspicious financial transactions. Ongoing monitoring is an essential part of a sound risk management strategy.

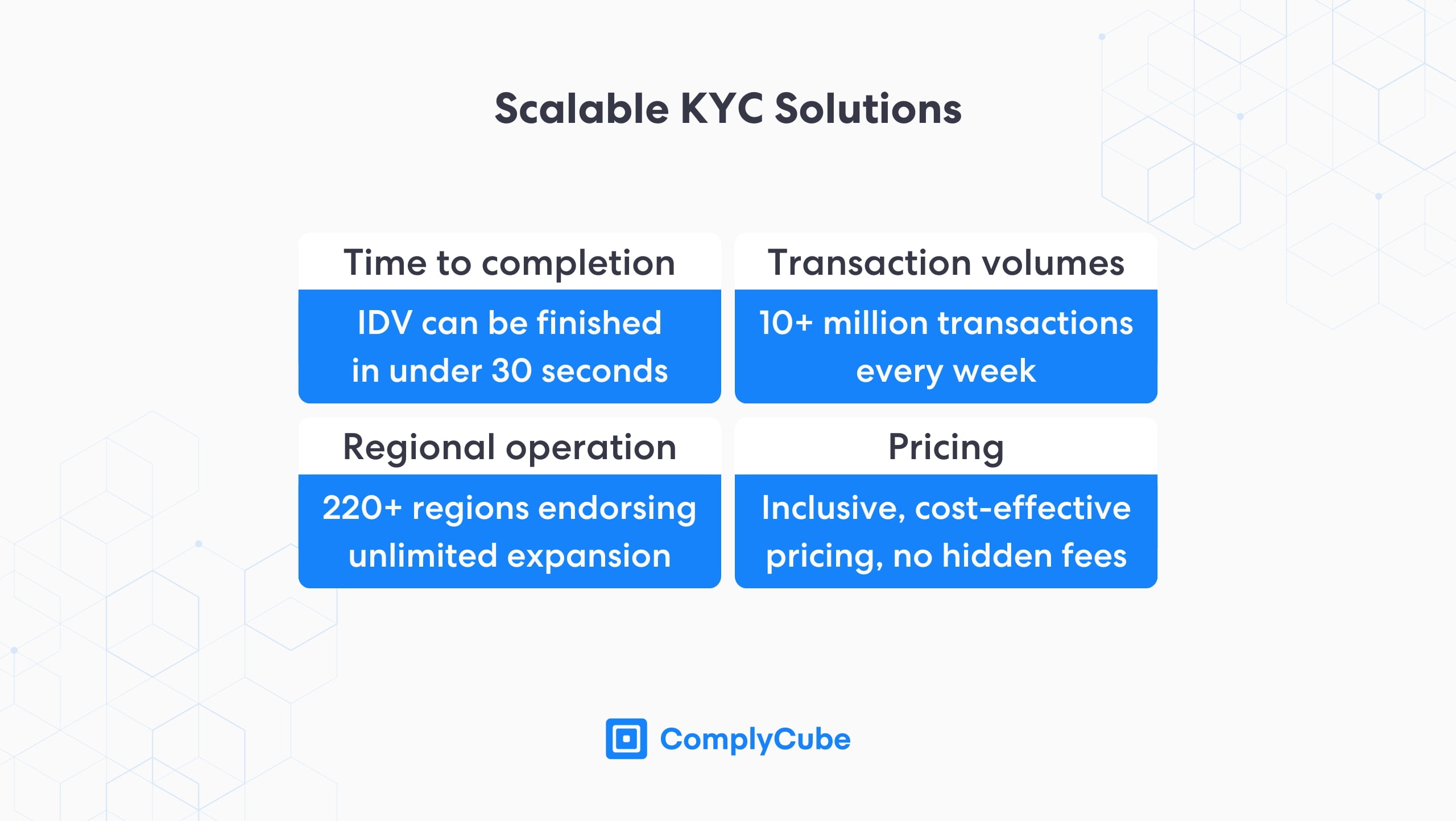

3 – How Scalable are These Solutions?

These IDV and CDD solutions must be precise, but precision can not come at the price of forsaken scalability. Scalability does not just refer to the volume of checks that can be done simultaneously; it is also defined by the service’s price structure, the breadth of regions it can operate in, and the efficacy of its technology.

Robust customer identification solutions ensure KYC compliance. However, these must operate in a seamless client onboarding process. Document and biometric verification can be completed in seconds, helping create effortless customer acquisition processes while endorsing precision at scale.

Client identity verification is then strengthened with a range of AML solutions, which KYC vendors should conduct in the background immediately and continuously. The best KYC software will be able to supply these services in multiple regions, allowing expansion into new territories with ease.

Check a KYC provider’s pricing and the discrepancies between packages. Some providers do not build their own proprietary technologies to meet their customers’ demands, meaning the price of specific solutions can vary.

ComplyCube has built its entire suite of solutions in-house, partnering only where necessary, such as with database providers and screening institutions. This means many of its solutions are available at relatively lower prices but remain an extremely scalable, precise, and multi-regional solution.

4 – Is the KYC Software Malleable and User-Friendly?

Integrating with a KYC provider is one thing, but it is paramount to ensure that the system can be tweaked and upgraded in response to changing developments. Malleable KYC systems also ensure that customer data management does not become a burden. This means that anti-money laundering initiatives can be conducted efficiently as part of an AML solution.

These include case management, customizable ‘fast-fail’ thresholds, KYC data accessibility, and much more. They allow common industry pain points, such as excessive false positives, to be solved from the comfort of an all-encompassing platform.

Furthermore, KYC services should be developed with customer satisfaction in mind. Solutions encompassing ID verification and biometric authentication must be seamless and precise, exposing the user to a swift workflow with minimal hiccups.

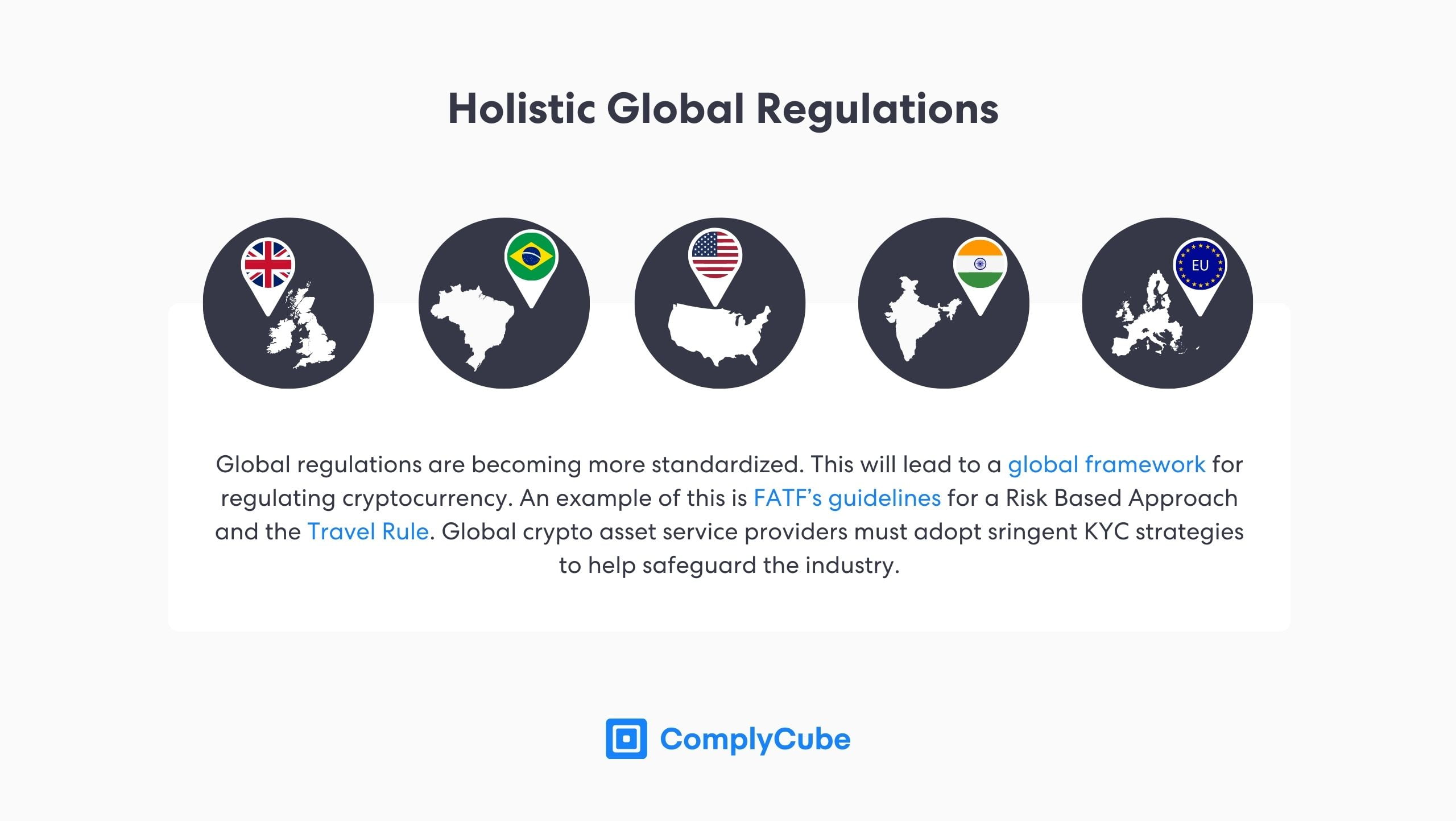

KYC Software for Cryptocurrency Exchanges

Centralized Exchanges (CEXs) in the crypto industry are intermediaries that hold a wealth of crypto tokens and provide significant liquidity sources for users to trade. These trading platforms are targets for malicious activities that break global and local Anti Money Laundering (AML) regulations.

This has called for a more international and holistic approach to cryptocurrency regulation, which is slowly materializing in 2024. The most notable example is the FATF’s crypto travel rule. For more information on this, read The Crypto Travel Rule.

Crypto KYC Regulations in the US

A CNBC reporter claimed that while 2023 was a year of legislative progress for the United States, 2024 will unlikely see continued progression in a presidential election year, particularly when the federal government is so divided.

While this is not necessarily a negative thing for cryptocurrency services in America, it means businesses must ensure their crypto KYC and compliance strategies are:

- Watertight, and

- Flexible.

KYC regulations and compliance today are likely to be different tomorrow, begging the need for dynamic KYC solutions. Having said this, solutions for Identity Verification and customer and transaction screening capabilities will always be required.

It is imperative for KYC solutions to provide the means for a crypto business or platform to identify which clients require transaction monitoring. As global cryptocurrency regulations evolve and adapt to the industry, flexible AML strategies are paramount to ensure firms don’t break compliance regulations.

KYC Vendors for Financial Institutions and Banks

Banking KYC systems must adhere to the tightest of standards. Banks represent the pinnacle of financial security as they facilitate the world’s transactions and wealth. This makes fraud detection and prevention an utmost priority for the financial sector.

As banks embrace digital transformation, employing digital KYC software to verify user identification and customer risk is crucial to ensure market share is not lost. KYC vendors enable banking services to vastly increase their range of accessibility.

This could be part of an overseas expansion plan, an elderly accessibility initiative, a campaign targeting young professionals or teenagers, and many more. However, the rate at which banks adopt eKYC solutions remains slow.

Financial institutions still rely on manual KYC processes for many KYC activities, and 2% of businesses and financial institutions have automated over 90% of their KYC process.

About 28% of firms still carry out 41-60% of tasks manually.

This shows that there is still a large gap in the financial services industry for automated KYC software to disrupt the status quo. Integrating with a provider early could put you at a severe competitive advantage.

KYC Compliance for FinTech

The disruption of traditional financial services underpins the FinTech sector. However, it faces unique challenges and opportunities regarding regulatory compliance, identity theft, and fraud prevention.

As FinTech firms bridge the gap between technology and financial services, the importance of robust Know Your Customer solutions cannot be overstated. These solutions are pivotal in ensuring FinTech platforms operate within particular jurisdictional and legal boundaries while offering secure and trustworthy services to their users.

Growing at a compound annual rate of over 25% over the next four years.

The FinTech market is expected to grow to a valuation of $346 billion by 2027, according to a 2023 report, emphasizing the growing need for the adoption of KYC vendors to facilitate mass Financial Technology compliance.

When rapid expansion and capitalizing on empty market space can differentiate success and failure, scalable and international solutions are vital. FinTech KYC vendors are likely to be increasingly important as this industry matures.

About ComplyCube

ComplyCube ties up a suite of industry-leading proprietary KYC solutions in one user-friendly platform. These include IDV, AML, and CDD services. Once integrated, this platform significantly streamlines a compliance officer’s workload, enabling KYC process customization, case management, delegation, and much more.

Working with a range of clients in FinTech, cryptocurrency, banking, telecoms, payments, and more, ComplyCube is one of the leading KYC vendors on the market.

If your business, FinTech startup, or multinational is looking for a new partner in one or multiple of these services, get in touch with today to find out how your KYC processes can be upgraded.