Identity Verification (IDV) and eKYC solutions have streamlined multiple business processes, from client onboarding to ongoing compliance. Digital document verification and biometric verification (selfie verification) are the first layer of protection for businesses against fraud, money laundering, and other financial crimes.

This guide discusses the contemporary issues that have demanded a process for verifying KYC documents digitally, securely, and swiftly.

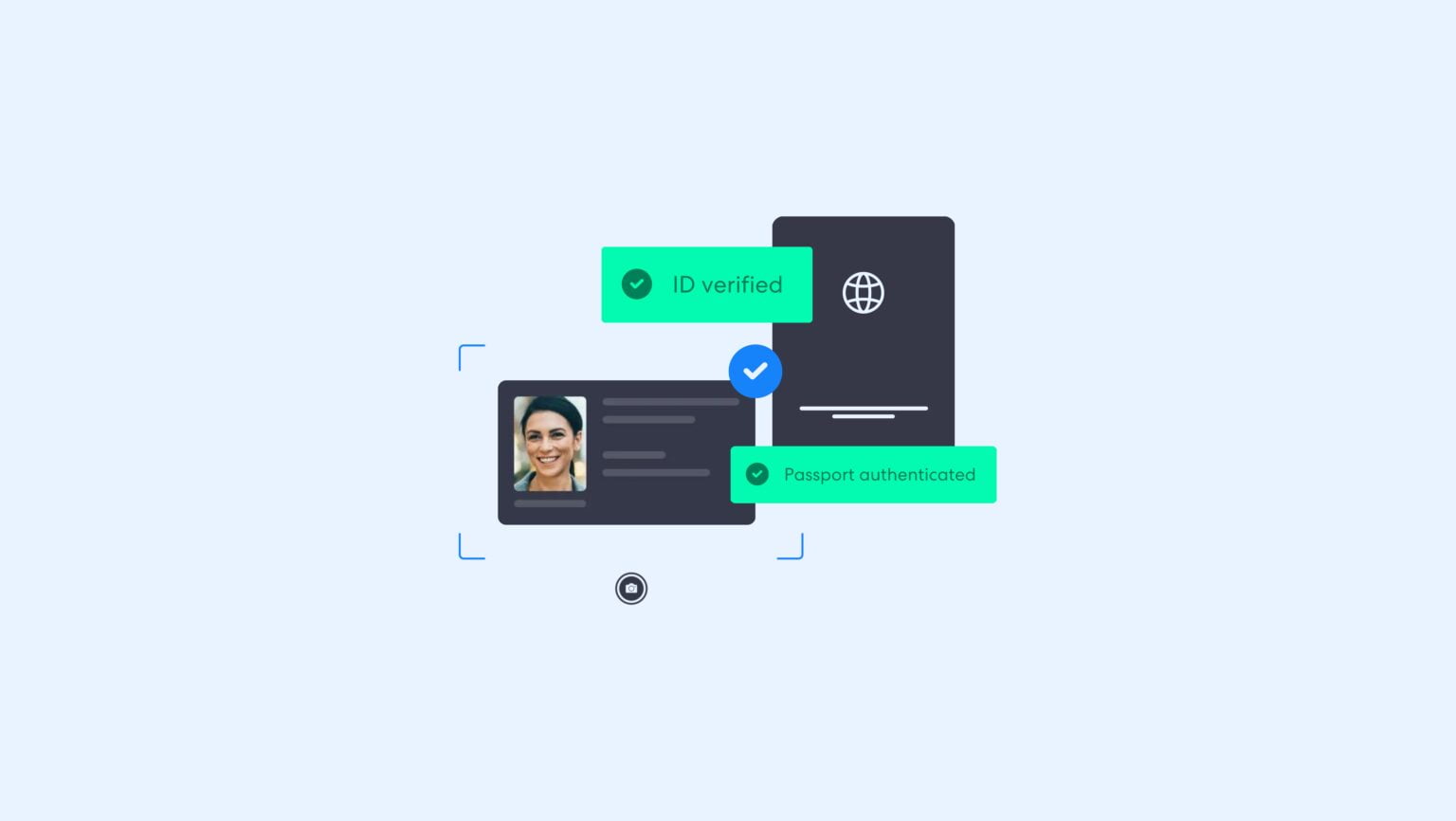

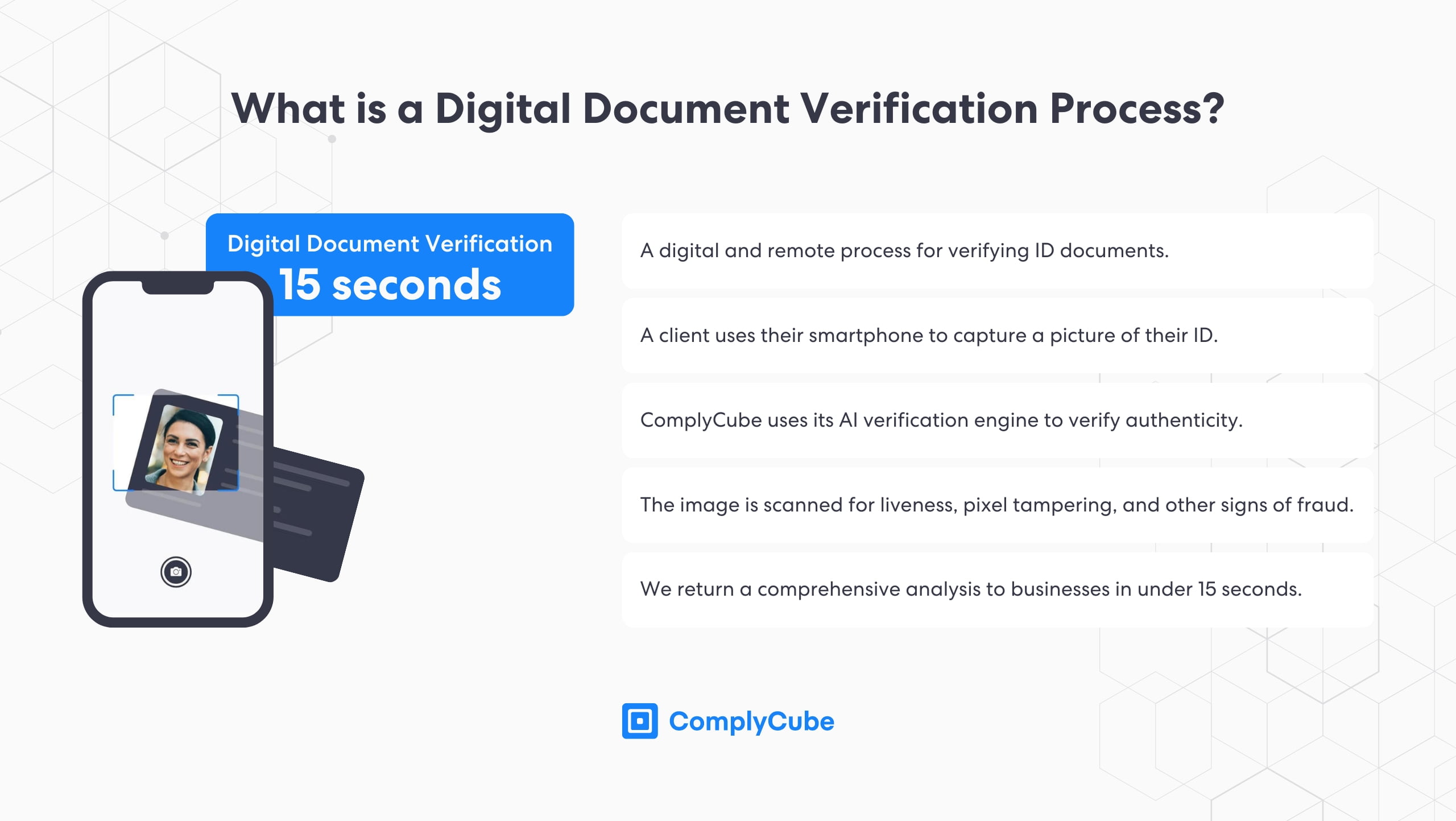

What is a Digital Document Verification Process?

Online document verification processes involve the methodical analysis of an identity document, such as a driver’s license, passport, or any other official government-issued document. Digital verification via eKYC processes far exceeds the utility of manual document verification.

Automated KYC solutions can verify identity documents with a higher level of accuracy than traditional methods, doing so in a fraction of the time. This creates huge benefits for businesses that require the authentication of new customers and the detection of fraudulent documents.

Why is Digital Document Verification Relevant Today?

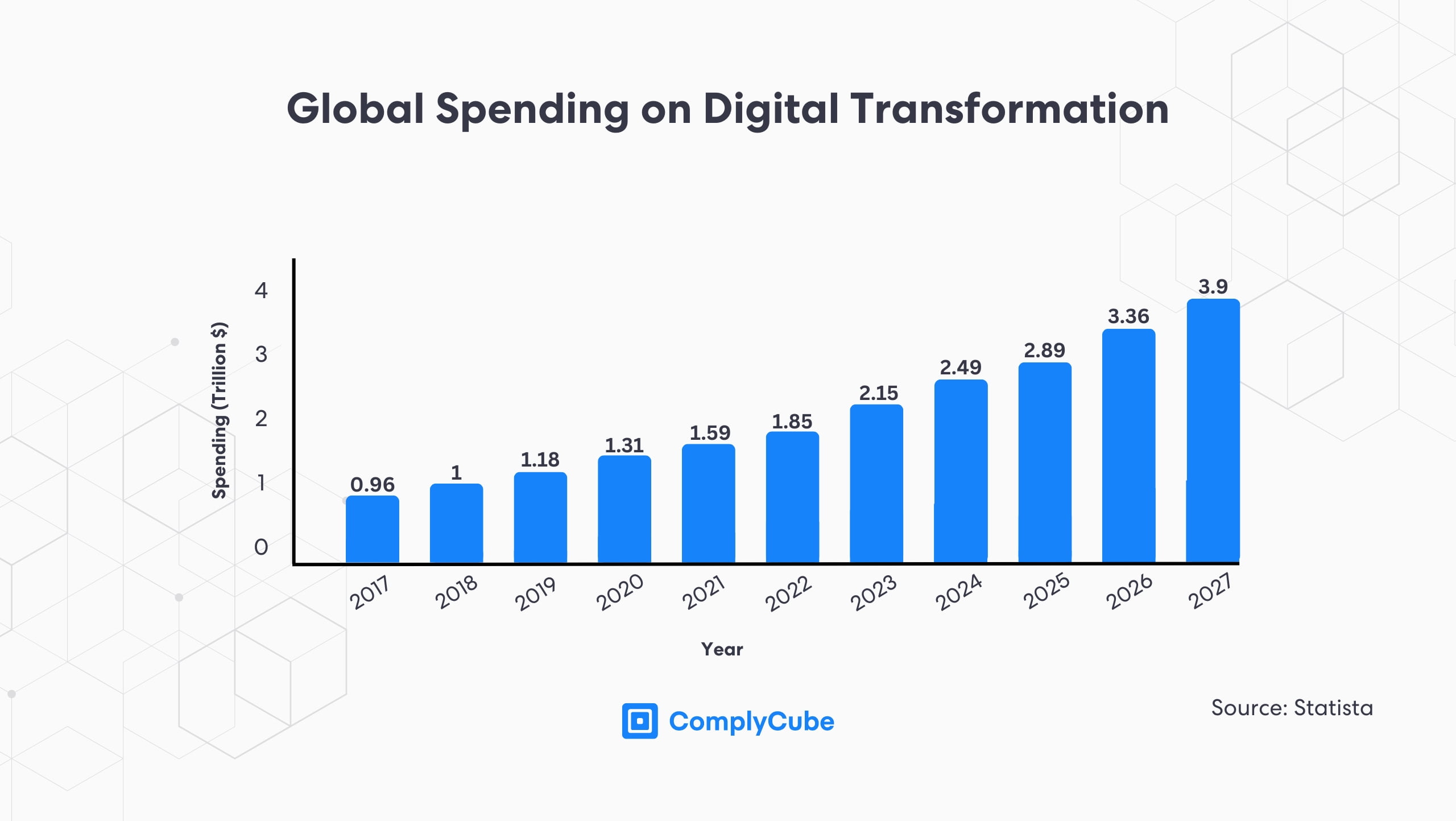

The internet has transformed how we interact with each other and revolutionized global economies through the introduction of e-commerce. The coronavirus pandemic catalyzed this transfer to a digital socioeconomic culture, forcing digital transformation among many businesses.

Identity Verification solutions were critical to this shift, and firms that adapted quickly benefited from being able to onboard users digitally and remotely from anywhere in the world.

The coronavirus pandemic increased the rate at which businesses are developing and adopting remote and digital technologies by 7 years.

This dramatic shift is here to stay and infers the significance of digital technologies that empower remote communications between users and businesses alike.

Digital Transformation

Almost overnight, companies had to find digital transformation solutions to enable continued business operations. This event catalyzed the rate at which companies had to embrace digital commerce, processes, and administration.

In Barclays’ 2023 annual report, the company highlighted how the development of digital utilities will boost their competitiveness and, importantly for the consumer, continue to break down financial barriers.

[We are] creating an enhanced digital customer experience to build a more efficient business.

eKYC solutions, such as digital document validation, are now essential tools for enabling businesses to adapt to and succeed in today’s fast-paced digital world. They ensure secure and seamless customer interactions while breaking down traditional accessibility barriers.

Battling Improved Fraudulent Methodologies

A more recent development since the advent of Generative Artificial Intelligence (Gen AI) is highly sophisticated fraud attacks using powerful AI technology. The most famous instance is known as a deepfake, which is an attack on an individual’s identity by creating an image or video of their face.

These attacks can be carried out on anyone and are one of the greatest threats that Gen AI poses to business security.

Only 20% of insurance firms have taken action against deepfake threats.

Deepfakes pose a substantial threat to all kinds of financial institutions. This is how an attack might play out against an insurance firm.

A fraudster obtains the details of a legitimate policyholder and submits a claim for a large life insurance payout.

As part of the insurance eKYC process, the individual claiming must complete a video to verify their identity and confirm outstanding details.

The fraudster creates a hyper-realistic video of the individual who is insured, detailing all the information required.

Because the deepfake is so realistic, the insurance company passes the claim and pays out the claim, resulting in a profitable deepfake attack.

Mitigating deepfake attacks is an utmost priority for all financial institutions. However, there has been limited adoption of sophisticated KYC and fraud detection tools, particularly in the insurance sector.

Enhanced Security and Compliance

These fraudulent innovations are making advanced KYC tools a necessity for modern businesses. Manual verification of client details is proven to be far less accurate than an AI-powered verification system.

Digital Document Verification

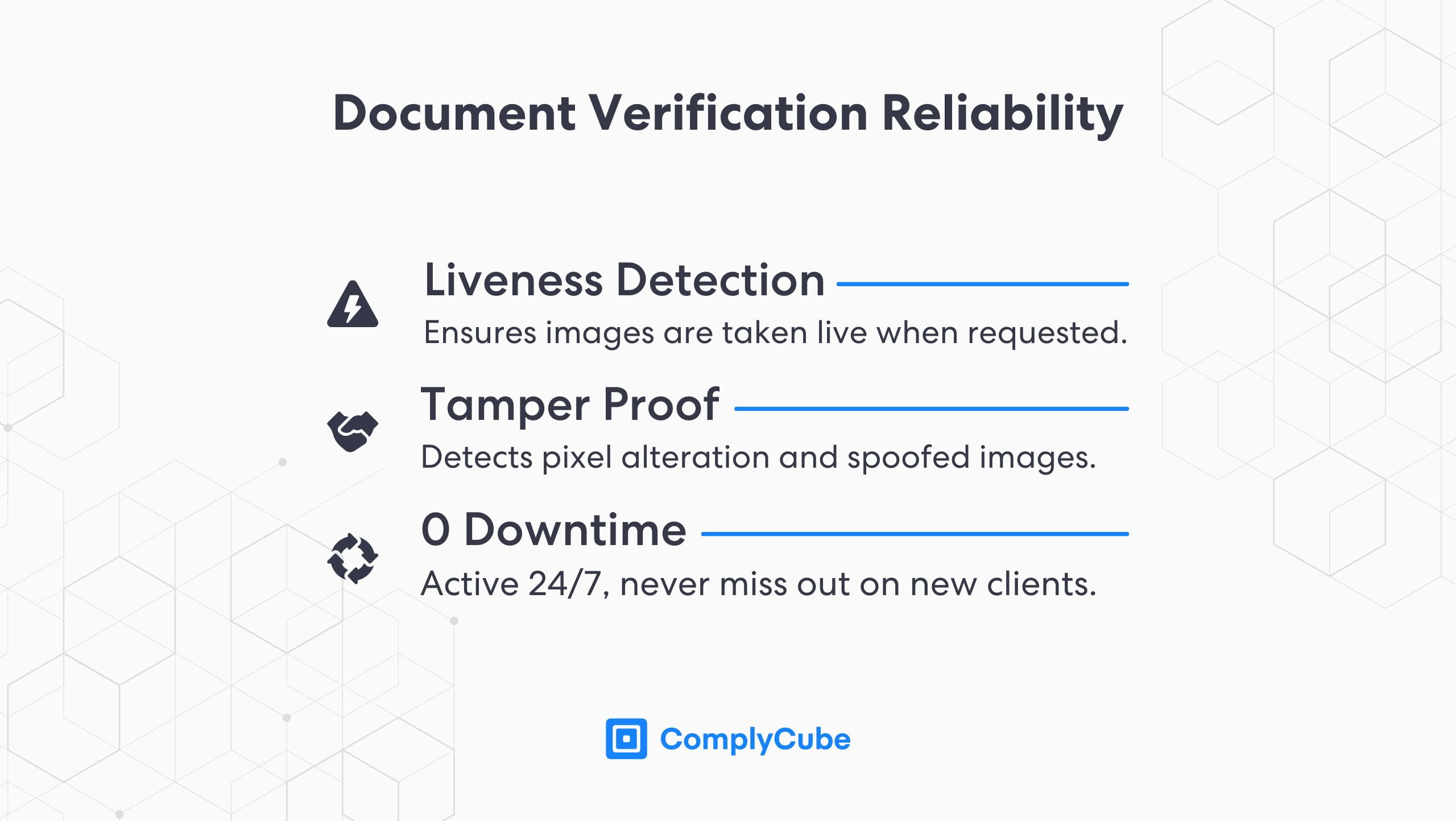

AI, Machine Learning (ML), and Optical Character Recognition (OCR) technologies have significantly advanced digital document verification. Together, these create a powerful verification engine that extracts and analyzes a large amount of document data in a very short period of time.

Common document checks include ID Verification, which confirms an individual’s identity using official government-issued KYC documents, and Proof of Address (PoA) Checks, which validate addresses through documents like utility bills.

For ID verification, Near-Field Communication (NFC) technology adds further layers of security by accessing encrypted data on ID chips with an NFC-enabled device, such as modern smartphones. Read more about ComplyCube’s document verification solution by reading What is Document Verification?

Selfie Verification

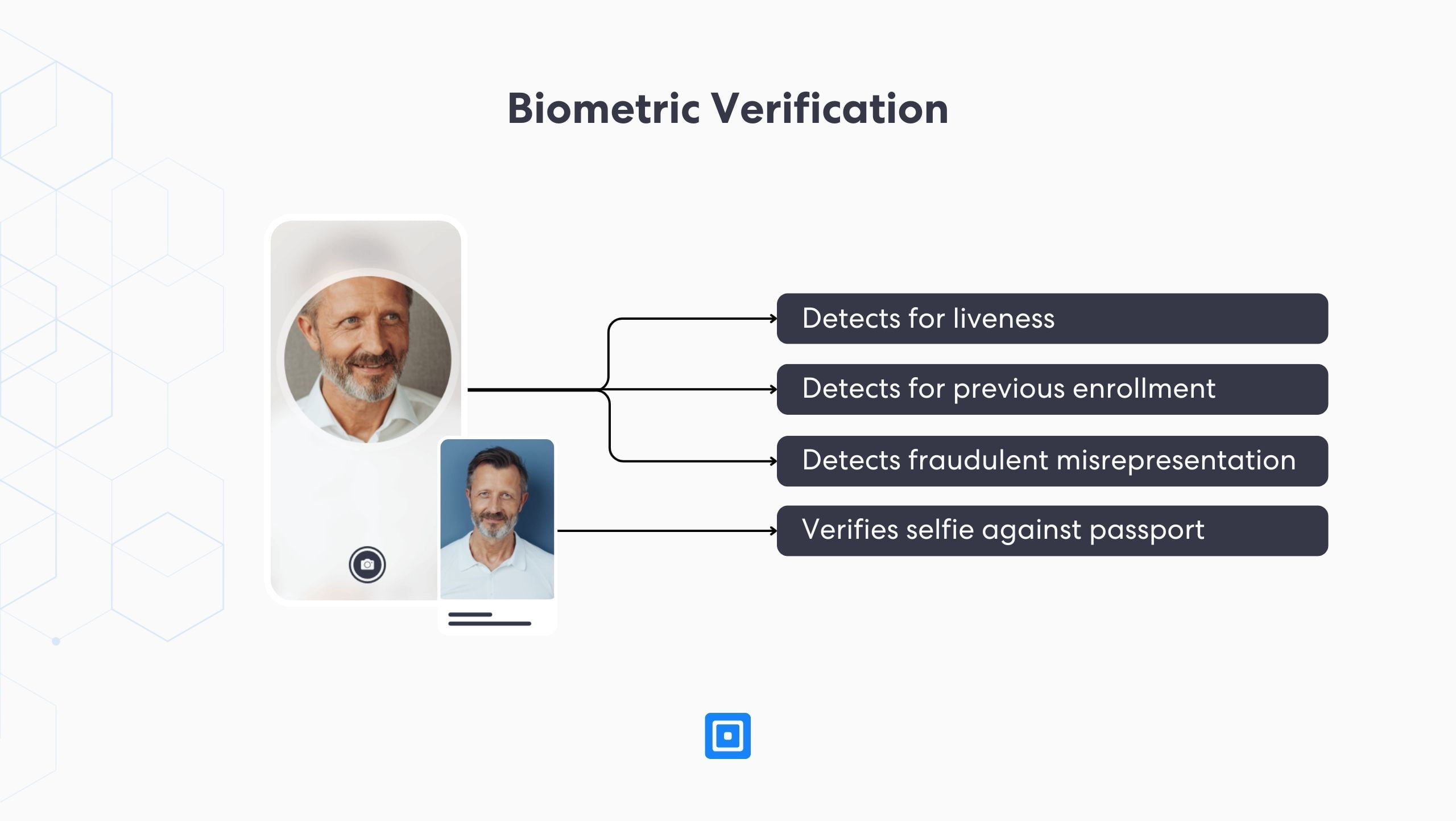

Biometric verification uses facial biometrics and features to verify a user’s identity and detect fraudulent methodologies as they are carried out, such as deepfake frauds. Selfie verification uses a state-of-the-art technology called Presentation Attack Detection (PAD), which builds 3D face maps, analyzes skin tone and micro expressions, detects pixel tampering, and ensures that the selfie image has not been tampered with in any way.

If your business is looking for a solution, ensure that the provider is ISO-certified with PAD level 2 liveness detection to ensure you are partnering with a market-leading solution. This ensures that your business has maximum protection against any kind of fraudulent attack, ensuring compliance requirements around the world are met. Learn more by reading The Advantages of Biometric Verification.

Regulatory Recommendations

In its report on the ISO-certified with PAD level 2 liveness detection, the Basel Committee on Banking Supervision (BCBS) discusses while digitalization brings plenty of innovations and perks to the banking industry, it also creates certain vulnerabilities for frausters to exploit.

Major regulators worldwide endorse compliance technologies as a holistic Anti-Money Laundering (AML) remedy to these vulnerabilities. From the BCBS to the Financial Action Task Force (FATF) and local and national regulators, compliance technologies are heavily advocated to empower compliance in the face of increasing digital fraud.

Many banks are investing heavily to improve their own digital capabilities and to improve their overall cost efficiency.

This quote comes from BCBS’s report on the digitalization of finance and relates to how digital systems are improving efficiency throughout financial institutions’ operations, particularly in providing a sleek User Experience (UX), reducing Client Acquisition Costs (CAC), and enhancing regulatory compliance.

Therefore, regulators are not just thinking about how digital technologies can help streamline compliance efforts but also come together as an all-in-one solution for increasing margins, productivity, and UX.

Cleaner UX and Streamlined Customer Onboarding Process

Digital identity verification helps mitigate human error, increasing the accuracy of checks. The verification is also completed multiple times quickly, resulting in a superior onboarding process for new clients.

A standout feature of electronic Identity Verification (eIDV) is that it can be completed in less than 30 seconds, reducing the time spent onboarding new users from multiple days to less than 1 minute. Furthermore, automated processes can be customized to suit your business’s Risk-Based Approach (RBA).

For firms dealing with large quantities of associated risk, automation settings can be tweaked to send new users to an Enhanced Due Diligence (EDD) process if their risk score is below a configurable threshold. This allows partnered businesses to take the initiative when it comes to their compliance arrangements.

About ComplyCube’s Digital Document Verification Solutions

If your business is looking to verify documents online, contact ComplyCube today. With industry-leading verification solutions, unbeatable scalability and precision, and configurable compliance settings, they are becoming the go-to solution for regulatory adherence.

Providing services worldwide, they operate in 220+ regions and accept over 13,000 KYC documents, giving an unmatched level of AML and KYC coverage. If these are challenges your business faces, get in touch with a regulatory specialist today.