With over 5 billion users on social networks worldwide, the internet is every fraudster’s best friend. Fake names, profiles, and email addresses are scattered across social networks, chatrooms, and websites, luring in the trust of millions of people. The challenge of maintaining digital identity verification becomes more crucial as cases of social media and identity theft continue to increase. Know Your Customer (KYC) procedures prove to be a needed first step for balancing anonymity and identity online, ensuring that users can withhold their privacy for security in social networks.

Some of the most prominent types of fraud include investment and romance scams, both of which can happen across all different kinds of social networks and often go hand-in-hand with a lack of stringent identity verification processes. There’s really no way of knowing who we’re speaking to on these platforms, yet this fails to alarm us as it should. Social networks are not often perceived as being dangerous or heavily-associated with fraud, and perhaps it’s because we aren’t fully aware of the extent of these practices online.

The need for enhanced protection by implementing Identity Verification (IDV), Know Your Customer (KYC) and Anti-money Laundering (AML) amongst these platforms is certainly an urgent one, and will help to stop these networks from becoming breeding grounds for sophisticated fraud.

Security in Social Networks: Uncovering Global Scams

Social media platforms, chat rooms, communities and networks have completely reshaped how we communicate and connect with other people, as well as creating a new professional working environment online through platforms like LinkedIn. The countless ways in which these networks have benefitted our lives are undeniable, yet they’ve also become a lucrative landscape for fraud. The Federal Trade Commission noted that the US faced $770 million in losses at the hands of social media fraud in just 2021. In addition, over 25% of fraud cases in the United States involving monetary losses in 2021 had began on a social networking platform, highlighting how lucrative these networks can be for scammers.

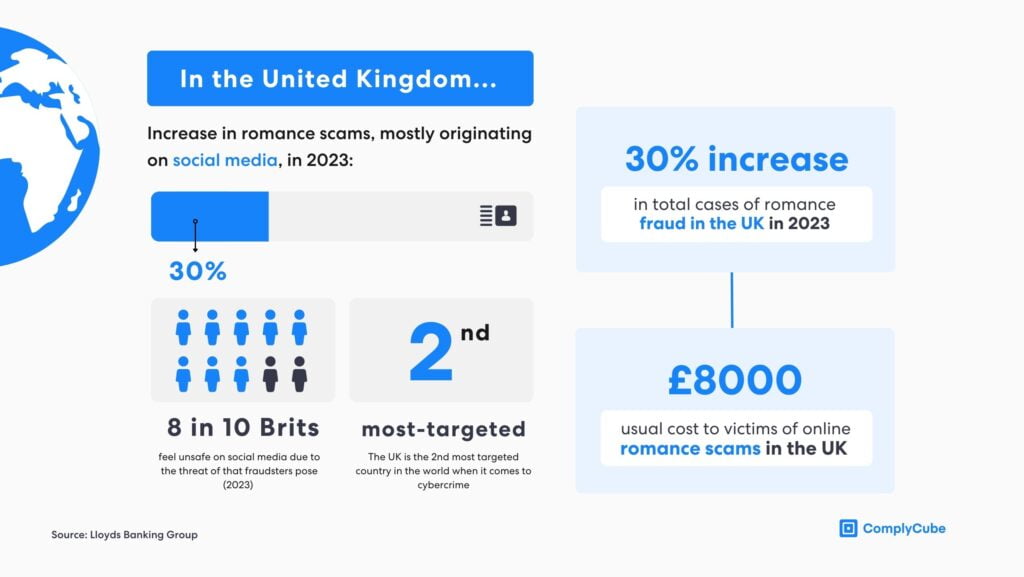

Some of the most prominent forms of fraud include investment, romance, and online shopping scams, with most of these scams being heavily reliant on remaining anonymous. Romance fraud has been quickly escalating across the globe, with mainstream media picking up individual cases, such as the famous 2022 “Tinder Swindler” documentary on Netflix.

The reality is that cases of romance fraud have increased by 30% in 2023, with victims loosing £8,000 on average – an uncomfortable reality that needs to be addressed.

These scams often begin with a seemingly innocent friend request, which quickly escalate to requests for money under various pretences. Verifying the identities of users will form a key part of ensuring that these forms of fraud are halted, safeguarding the integrity of these networks from fraudsters.

The Danger of Misinformation

Another consequence of these prevalent forms of fraud is the spread of misinformation, which can often have devastating worldwide effects. With users being able to create a fake profile under any identity that they like, they’re then able to speak on behalf of anyone, claiming unsubstantiated authority with the expertise of the fake identity.

A great example of this is the 2011 Twitter case in which multiple users created fake Twitter accounts which pretended to be the former Alaskan governor, Sarah Palin. They tweeted misinformation and confused the general public. Identity theft in this form is certainly not uncommon, with a similar occurrence taking place during the 2016 U.S. presidential election, in which fake accounts similarly spread false information in an attempt to influence the voting public.

Applications used for texting and chatrooms have also been infiltrated with users spreading fake news several times over the past few years. Such was the case for WhatsApp in 2018, as the app experienced several users forwarding misinformation in India, which actually led to violent attacks within the country founded on anti-Muslim sentiment.

Sadly some people also use WhatsApp to spread harmful misinformation. We believe this is a challenge that requires action from technology companies, civil society and governments.

A WhatsApp spokesperson commented at the time, “Sadly some people also use WhatsApp to spread harmful misinformation. We believe this is a challenge that requires action from technology companies, civil society and governments. That’s why we’ve stepped up broad education with ads on the radio and online to encourage people not to share rumours, and have created limits on how forwarded messages can be sent.”

There is only so much these networks can do, as responsibility also lies in the hands of national and international regulatory bodies to ensure that there are regulations in place that can ensure users are verified, helping to prevent the anonymity that fraudsters cling to. Some regulatory bodies are helping to combat these forms of fraud with regulations already in place:

European Union’s Digital Services Act (DSA): The DSA mandates KYC procedures, ensuring that platforms collect and verify the identities of their business users. The body also requires that platforms give reports on how they moderate content.

UK Online Safety Bill: The bill became law in late 2023 and aims to keep users, especially children, from accessing content that might be unsafe online.

Australian Online Safety Act: This regulation mandates that social media networks should ensure that users are safe while using the platform, and should include digital identity verification practices. Platforms are therefore required to verify users and remove harmful content quickly.

Like a car, alcohol or a gun, we need to treat social media in a way that respects the power its users can wield, good or, more importantly, bad.

Will Burns, Forbes Contributor, stated, “Facebook, Twitter, Instagram and YouTube, through no fault of their own, have become weapons of another state against this one. We can no longer just sit back and allow this to happen, nor can we expect the FBI or Justice Department to catch every fake person or every fake post. Like a car, alcohol or a gun, we need to treat social media in a way that respects the power its users can wield, good or, more importantly, bad. Some form of identity verification in social media would guarantee that every account is linked to a registered user.”

Digital Identity Verification as a First Step For Security in Social Networks

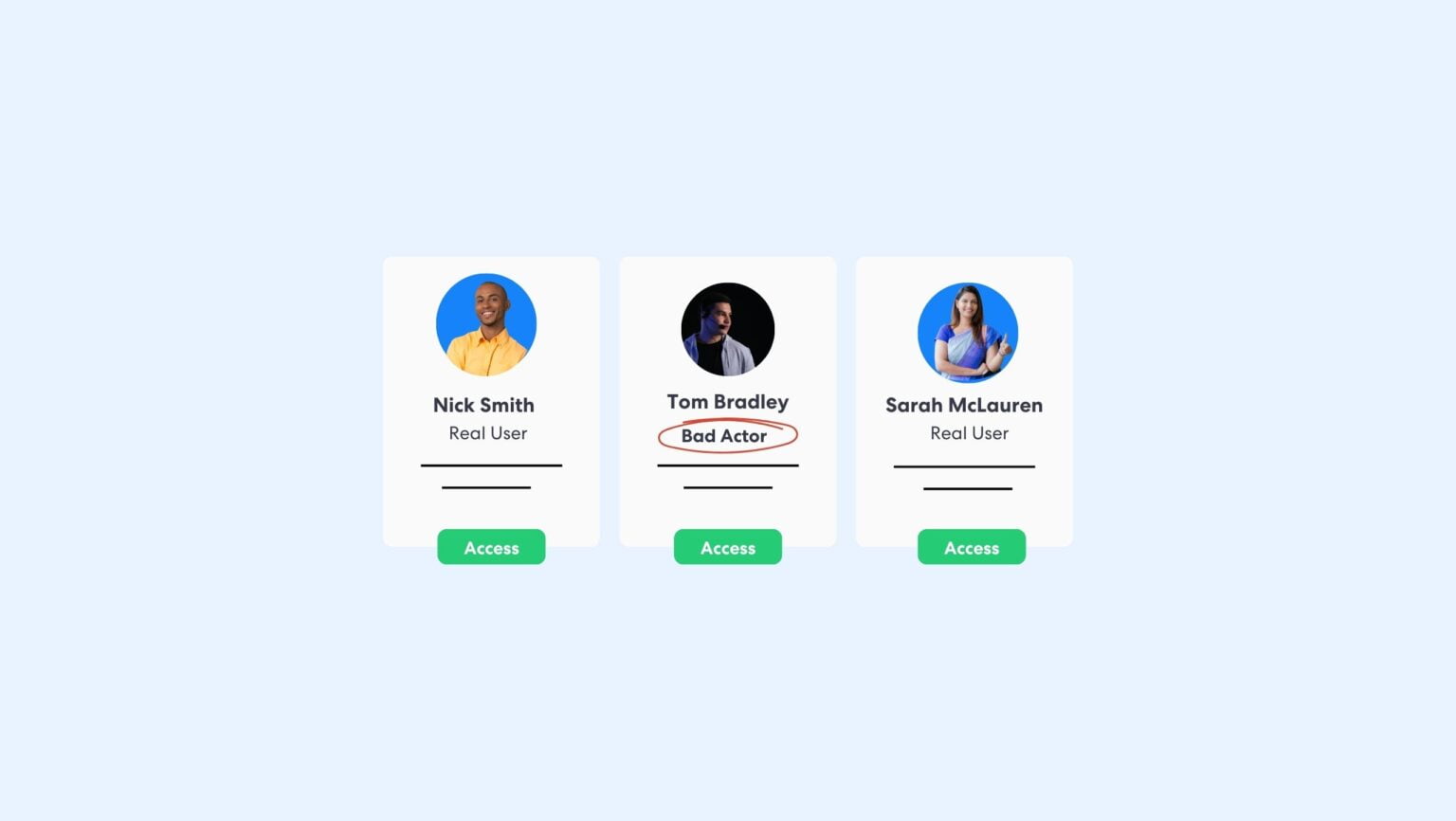

Fraudsters often rely on identity theft or creating a fake profile, allowing them to spread misinformation or gain trust from other users in order to then carry out a scam. By eliminating anonymity, social networks can begin to really combat this problem and enhance user safety online.

Verifying government-issued IDs through a document check, as well as incorporating a biometric check that analyzes facial data points, would be a substantial help to safeguarding users online. In addition, digital identity verification will help social networks ban repeat offenders from creating new profiles, putting a stop to recurring scams.

Protect your platform with ComplyCube. We offer market-leading IDV, KYC and AML bespoke solutions. Head over to our website and get in-touch.