Identity fraud is driven by increasingly advanced techniques used to forge documents and exploit gaps within verification systems. These falsified documents serve as gateways for financial fraud, illicit transactions, and even terrorism financing. The December 2025 Fraudscape report by CIFAS underlines critical concerns regarding the increase in quality of false documentation (including synthetic identities) in the UK. As AI tools become more widespread, fraud attacks increase in sophistication and quality, meaning that organisations must have the necessary tools to identify these attacks. This guide examines how organizations can strengthen their document verification and identification processes within their Know Your Customer (KYC) frameworks. It also explores the technologies and strategies essential for staying compliant with global regulations while effectively using data extraction to reduce risks.

What Are Document Checks?

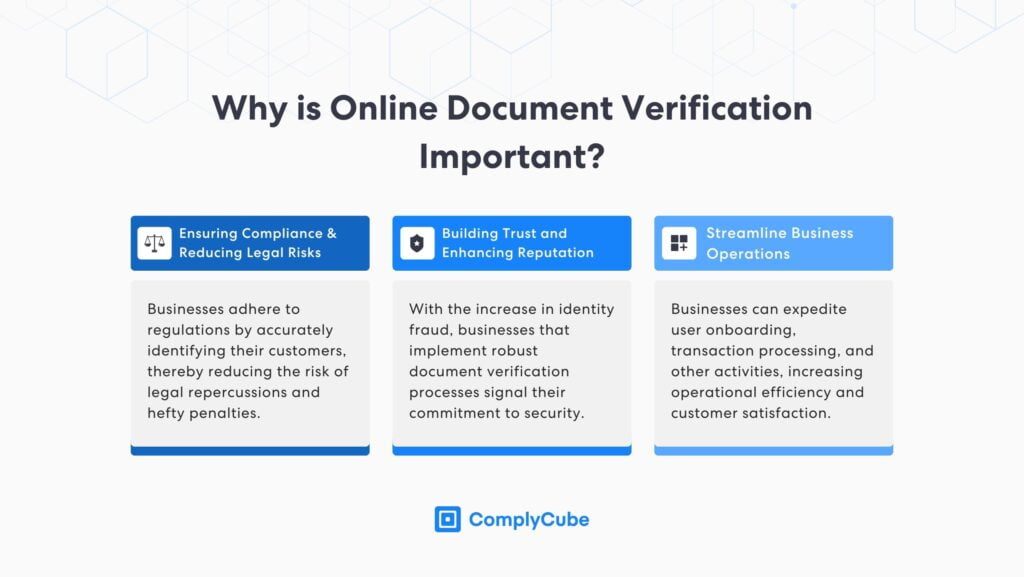

Document checks are a core element of Know Your Customer (KYC) compliance, a regulatory framework requiring businesses to verify customer identities to prevent forgery and other financial crimes. With identity-related crimes having increased by 23%, now accounting for 68% of all reported fraud cases, businesses that overlook these measures risk severe financial and reputational damage.

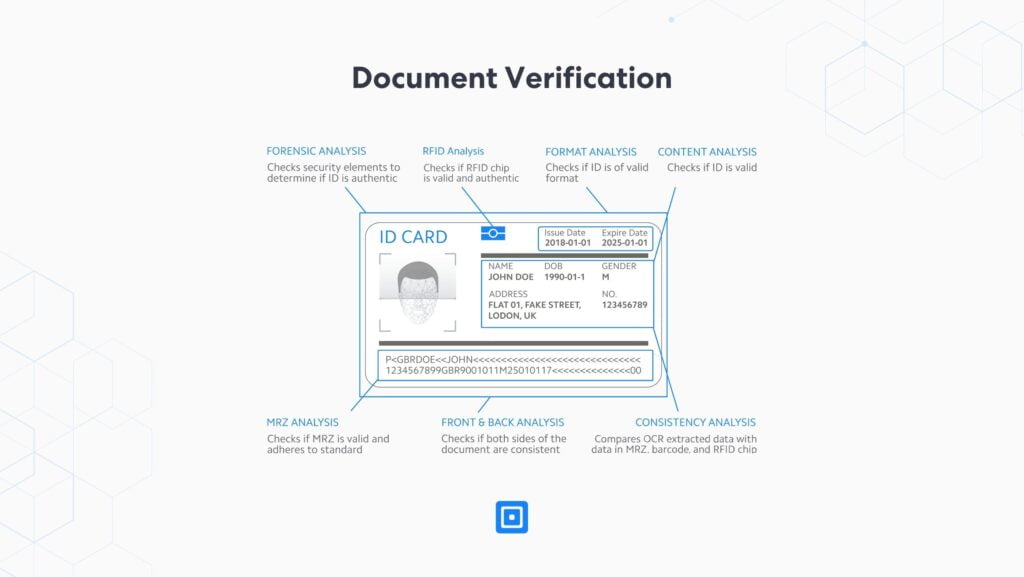

By validating user identity through document checks, document verification helps organizations ensure accuracy, reduce fraudulent activity, and strengthen secure operational processes. These processes typically involve verifying:

- Government-issued IDs: Passports, driver’s licenses, and national identity cards.

- Proof of Address Documents: Utility bills, bank statements, and lease agreements.

- Company Registration Documents: Certificates of incorporation and business licenses.

Why Document Verification is Vital for KYC Compliance

Falsified documents remain a key enabler of financial crimes, allowing bad actors to manipulate systems, execute scams, and bypass security protocols. These activities undermine business assets, disrupt operations, and erode customer trust. As fraud tactics grow more advanced, financial institutions (such as banks) and other high-risk sectors are turning to automated document verification methods to stay ahead. These tools provide a scalable and reliable way to validate identities and verify documents online, minimising gaps for fraudsters to exploit vulnerabilities.

Avoiding Severe Financial Consequences

The financial consequences of failing to address such vulnerabilities are immense. A 2024 Deloitte report shows how advancements in AI, including tools used to create hyper-realistic fake documents, contribute to the growing scale of financial scams.

Fraud-related losses could grow from $12.3 billion in 2023 to $40 billion by 2027.

The report predicts that fraud-related losses could grow from $12.3 billion in 2023 to $40 billion by 2027, representing an annual growth rate of 32%. These rising costs urge businesses to adopt robust document verification measures to mitigate fraud and counter advanced fraud tactics.

Anti-Money Laundering (AML) Regulations and Document Verification

Regulatory frameworks such as the Financial Action Task Force (FATF) ensure that national bodies, such as the Financial Conduct Authority (FCA) act according to AML mandates. These standards require businesses to implement stringent identity document verification methods to prevent illicit financial activities, such as money laundering and terrorism financing.

Additionally, regulations like the General Data Protection Regulation (GDPR) verify that personal data collected during the identity verification process is handled securely and transparently. While AML focuses on detecting and preventing financial crime, GDPR safeguards how customer data is managed and stored. Together, these frameworks create a comprehensive structure where document verification not only helps businesses meet legal obligations but also verifies operational integrity and data privacy.

Reinforcing Customer Loyalty and Credibility

Transparent document verification builds customer confidence by demonstrating a clear commitment to privacy and security. Research by FasterCapital shows that reliable document verification systems not only reduce risks but also strengthen trust in a business’s data-handling practices. This proactive approach reassures customers that their information is protected, reinforcing long-term credibility and loyalty.

Document Verification Contributes to Risk Mitigation in Financial Institutions

One of the world’s most prominent examples is the 2012 HSBC Holdings (HSBC) scandal, where inadequate AML controls and poor document verification procedures allowed Mexican drug cartels and other criminal organizations to launder approximately $881 million through the bank’s U.S. branches undetected. Since then, many cases just like this one have taken place, with increasingly sophisticated attacks. These gaps in oversight exposed the vulnerabilities of banks with weak compliance manual verification systems and proved the critical role of robust checks in preventing financial crimes on a global scale.

AI-Powered Document Verification Encourages Streamlined Onboarding

AI-powered document verification tools simplify customer onboarding by automating identity checks. This reduces manual workloads and accelerates approval times without compromising security protocols. This form of advanced document verification works by leveraging machine learning technology to analyze and authenticate various document types, such as passports and social security cards, in real time.

The system cross-references extracted data with trusted databases, detecting anomalies and ensuring accuracy. Whether a user takes a photo with their phone or manually submits a scanned photo or document, the process delivers fast and reliable verification results.

With the exploitation and automation of AI-generated content and advanced forgery techniques to produce fake documents, traditional verification methods have become far less reliable. Additionally, stolen personal documents circulating on black markets continue to fuel scams and other illicit activities.

Tools & Technologies That Enhance Identity Document Verification

Biometric Verification

Biometric verification uses tools such as facial recognition, fingerprint scanning, and other unique biological identifiers to validate and determine an individual’s identity. This tool verifies that individuals presenting identity documents – such as driver’s licenses, ID cards, and passports – match the information recorded in the associated databases. By relying on physical characteristics rather than traditional credentials, ID verification becomes significantly more secure and less prone to manipulation.

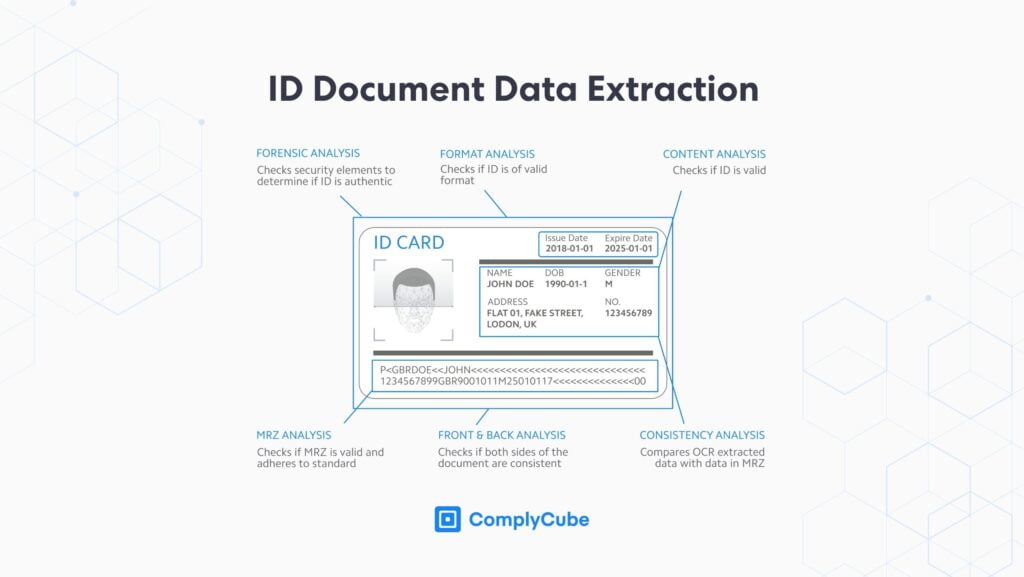

Optical Character Recognition (OCR) Technology

Optical Character Recognition (OCR) plays a vital role in identity document verification by converting printed text on documents – for instance, bank statements, utility and phone bills – into digital formats. This enables automated data extraction from scanned documents, allowing businesses to cross-reference extracted information with official databases in real time.

When verifying an ID card, OCR can quickly detect the expiration date and validate and verify the document and user‘s authenticity. Additionally, OCR can identify inconsistencies or discrepancies in details such as names, addresses, and dates of birth, flagging them for further manual verification if needed.

Machine learning algorithms are often integrated with OCR systems, enhancing their ability to detect patterns and anomalies in ID documents. By analyzing historical data, these algorithms improve the accuracy of identity verification processes and adapt to new types of scamming attempts over time.

Adverse Media Checks, PEP Screening, and Sanctions Screening

Adverse media checks, Politically Exposed Person (PEP) screening, and sanctions screening are essential components of document verification frameworks. These tools go beyond analyzing the document itself and look into the background and potential risks associated with the individual presenting the identity document.

- Advanced Media Checks: These scans search public records, news articles, and media databases to uncover associations with financial crimes or illegal activities.

- PEP Screening: Identifies individuals in politically influential roles who may present higher risks of involvement in corruption or financial fraud.

- Sanctions Screening: Cross-references data from ID verification processes against international sanctions lists, such as those maintained by the Office of Foreign Assets Control (OFAC).

Machine Learning for Fraud Prevention

Machine Learning has revolutionized identity document verification by automating complex data analysis processes and increasing accuracy. When paired with OCR, it can predict malicious attempts based on identification patterns in scanned images of utility bills, bank statements, and ID documents.

Conduct Identity Verification Checks with ComplyCube’s OCR Technology

With the world’s most complete KYC platform tailored to businesses of all sizes, ComplyCube helps you streamline compliance, prevent fraud, and build customer trust with cutting-edge OCR technology.

ComplyCube achieves this through advanced automation, seamless integration, and AI-driven anomaly detection for accurate verification across various document types. Whether a user takes a photo with their phone or submits documents for manual review, ComplyCube’s solution delivers reliable results in real-time. This approach reduces errors, accelerates onboarding, and improves overall customer experience.

Reach out to a compliance expert and explore how our tools can safeguard your operations.