VC funds invest large amounts of capital into high-risk deals, with venture capital due diligence processes forming a critical part of the success of these investments. Without a doubt, risk is the name of the game. However, what many VCs overlook is not the risk of failing to bet on a unicorn but rather the risk of betting on a fraudster instead. Similarly, the risk of accepting illicit funds from an unverified Limited Partner (LP) is also often present. Implementing stringent founder and investor due diligence processes is therefore essential, with adequate venture capital compliance solutions requiring comprehensive AML and KYC checks.

Investors partaking in high-risk investments need to feel assured not just of the product-market fit or of the identified gap in the market, but also that they know exactly who they are investing in. Similarly, they must have full transparency of who their investors are. In accepting investment from LPs, VCs can become vulnerable to illicit capital injections, with bad actors attempting to disguise laundered money with legitimate capital.

The U.S. Federal Bureau of Investigation believes firms in the nearly $10-trillion private investment funds industry are being used as vehicles for laundering money at scale, stating that this allows for the reintegration of “dirty money into the legitimate global financial system.”

Risks Encountered

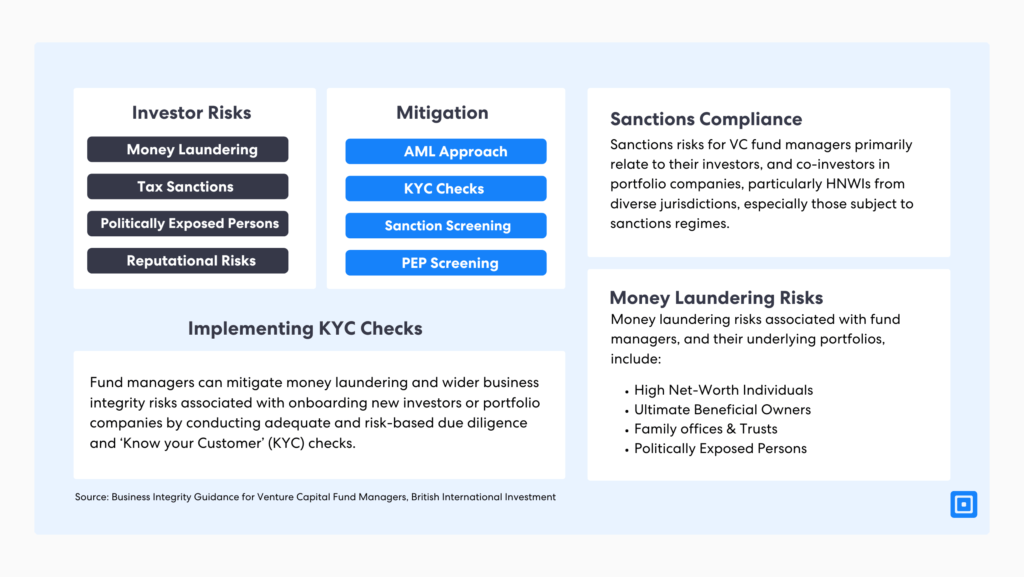

Venture Capital investors face several risks when making and receiving investments due to the lack of KYC and AML checks. Some include investing in founders who pose a reputational or compliance risk for the VC, the risk of laundered capital being invested into the fund, and investing or receiving investment from politically exposed individuals or individuals facing tax sanctions.

The Journal of Financial Crime’s paper “Fraud in Startups: What Stakeholders Need to Know” states, “The pressure of keeping the startup growing and consistently raising new funds is therefore crucial for both the entrepreneurs and the existing VC investors. Therefore, startups oftentimes resort to questionable or fraudulent activities to achieve these milestones in the pursuit of growth.”

Startups oftentimes resort to questionable or fraudulent activities to achieve these milestones in the pursuit of growth.

Some of the risks commonly faced by investors include:

Money Laundering: VC deals involve investing large amounts of capital, which can be particularly attractive for those carrying out money laundering activities. A bad actor may act as an LP and invest illicit funds with a VC fund. As the VC then invests in many portfolio companies, the origin of the funds becomes extremely obscure. False identities may also be used to bury the true origin of the funds further.

Politically Exposed Persons (PEP) Risk: The PEP risk for VCs involves investing in a political figure and being subjected to legal implications, reputational damage, increased compliance standards, increased sanctions risk, and more. PEPs usually experience more dangers of corruption and more regulatory scrutiny.

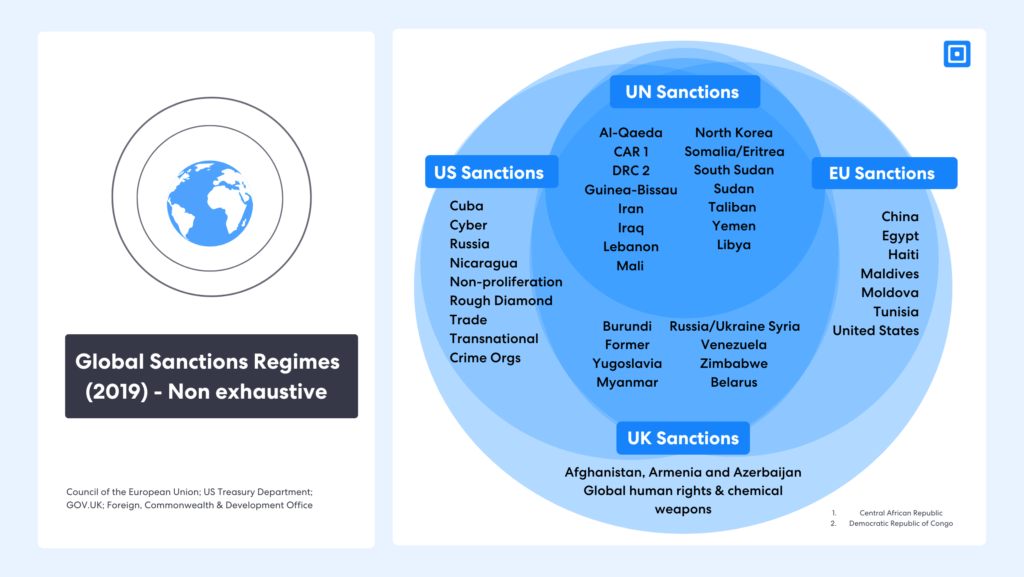

Sanction risks for VC fund managers primarily relate to their investors and co-investors in portfolio companies, particularly High Net-Worth Individuals (HNWIs) from diverse jurisdictions.

Tax Sanctions: Sanctions are imposed by governments and supranational organizations (such as the United Nations) to counter terrorism and criminal activity. They usually enforce restrictions on designated persons. Sanctioned individuals are subject to restrictions on financial transactions and business operations and an increased compliance risk.

Limited Partners and Other Investors

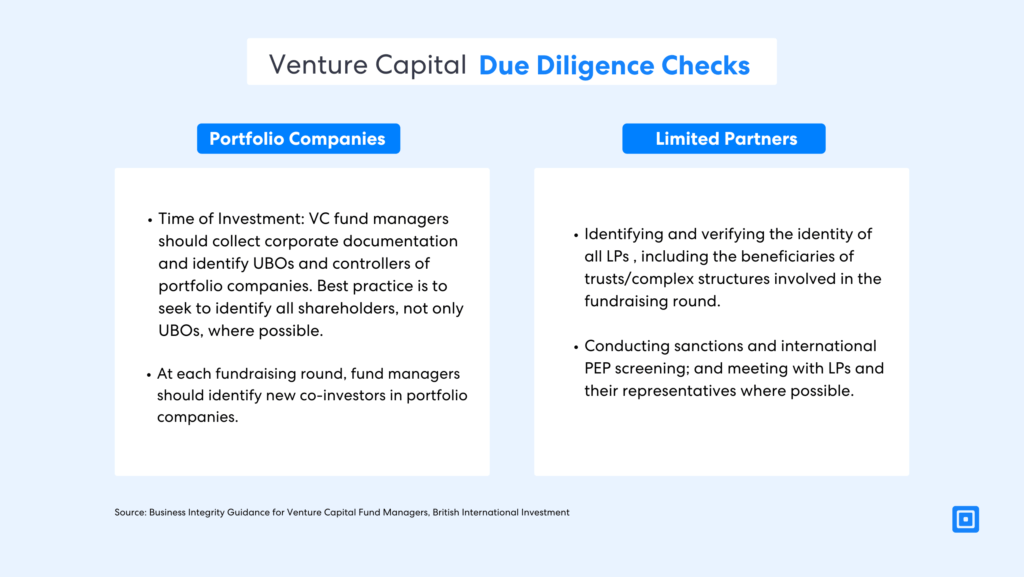

Many of the risks associated with investing or accepting the wrong investment can be counteracted with robust and stringent KYC and AML solutions. All portfolio companies and LPs should undergo an onboarding process in which AML and KYC checks are carried out. According to British International Investment, checks on LPs must include:

Identity Verification: Investors should be verified by obtaining a Proof of Identity and Proof of Address. The identities of the ultimate beneficiaries of trusts/complex structures involved in a fundraising round should also be verified.

Carrying out sanctions and international PEP screening: Associating with sanctioned investors can damage the reputation of a VC, as well as risk non-compliance, which can result in severe legal consequences. The risk of money laundering, corruption, and other illicit activities is also drastically decreased when these checks are carried out.

Meeting with LPs and their representatives where possible: Supports a comprehensive assessment of LPs.

Portfolio Companies

The British International Investment Society states that KYC checks should be completed for all portfolio companies at the following times:

Verification at time of investment: VC fund managers should collect corporate documentation and identify UBOs and controllers of portfolio companies. It’s important to identify all key shareholders.

At each fundraising round: New co-investors and portfolio companies should be verified.

Due diligence must be continuous and not just conducted at the investment stage. The best practice is to seek to identify all shareholders, not only UBOs, where possible.

Identity Verification (IDV) and Anti-money Laundering (AML): Checks must be carried out to ensure regulatory, sanction and global trade compliance, secure investments, and reputational risk management.

AML Compliance in Venture Capital

UK private equity and venture capital firms all face stringent regimes to counter money laundering and terrorist financing. The Financial Action Task Force (FATF) sets international standards.

Within the European Union, the fifth anti-money laundering directive (AMLD V/5MLD) came forth in early 2020, building on the fourth AMLD, which was put in place to prevent the funding of criminal activity and strengthen transparency rules. The fifth version of this directive also clarified PEPs, ensuring that individuals who are potential PEPs must be identified for monitoring.

Other distinctions, such as enhanced due diligence when establishing partnerships across high-risk borders, were also implemented. Currently, the cost of AML compliance in venture capital is higher than expected, with most of the cost being derived from manual tasks.

Research carried out by LexisNexis concluded that verifying an LP can result in over 25 hours of work for a team of 3-4 people. Considering that VCs often have several hundreds of LPs, the amount of work regarding AML verification can be alarming.

It is known that most of the cost associated with AML compliance comes from labor costs. Up to 75% of AML costs are for people doing manual CDD and analyzing cases.

Therefore, the implementation of automated, AI-powered AML and KYC solutions is critical for these organizations to achieve compliance while maintaining a reasonable budget.

KYC, IDV, and AML Compliance with ComplyCube

ComplyCube is a RegTech100 all-in-one platform for automating Identity Verification (IDV), Anti-Money Laundering (AML), and Know-Your-Customer (KYC) compliance. It has global customers in legal, telecoms, financial services, healthcare, e-commerce, cryptocurrency, travel, and more.

Our full suite of AI-powered KYC/AML solutions enhanced with automatic workflows is highly tailored to fit our customers’ compliance requirements. Utilizing machine learning technologies developed and owned by our team, our solutions streamline data extraction while providing a smooth user onboarding experience.

For more information, get in touch with our expert compliance team.