Identity Verification (IDV) becomes more complex every year. Advanced spoofing tools can now bypass even advanced verification engines. Generative AI fraud detection is a necessity for combatting this. Document fraud can be mitigated by a rigorous ID fraud check, but finding the right solution to this problem can be challenging.

This guide establishes what a strong solution for document fraud looks like, as well as discusses some of the biggest challenges faced across the world.

What is Document Fraud?

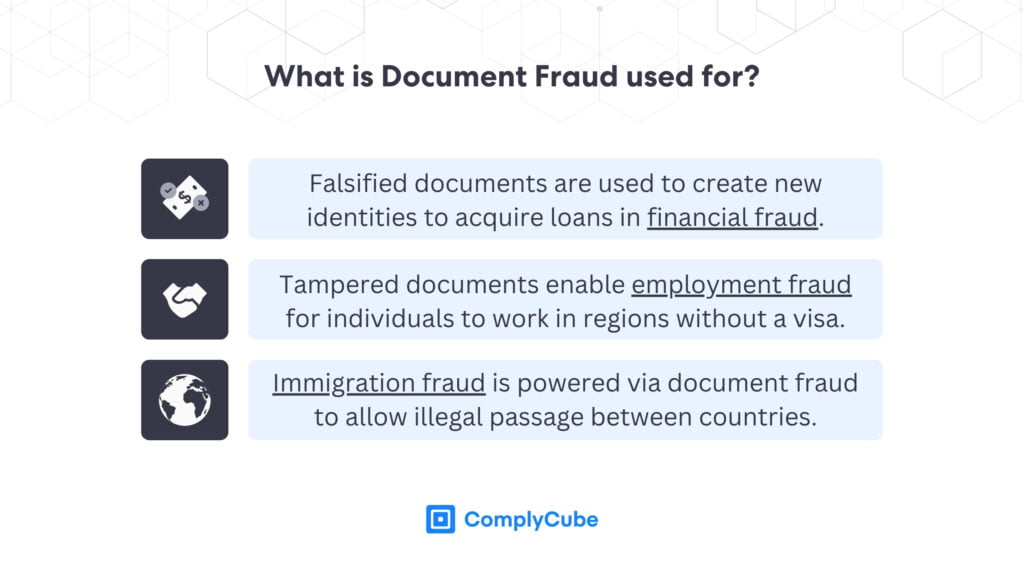

Document fraud is the act of leveraging falsified or tampered documents with the intention of deceiving a business or individual. Forged documents can be used for a range of activities in the modern economy, including but not limited to:

- Financial fraud – using falsified documents (including financial information such as a credit report) to acquire a loan or for tax-related identity theft or credit card theft.

- Employment fraud – tampering with documents or VISA records or records to attain a job you are unqualified for or are not legally allowed to do.

- Immigration fraud – using false documents to gain immigration rights, cross borders, or claim certain benefits.

Victims of any type of fraud should file a report with the Federal Trade Commission (FTC). Reporting identity theft or impersonation scams is crucial so the FTC knows how prevalent these issues are and can implement remedial action and legislation.

Fraud can be conducted in many ways. We’ve all seen Catch Me If You Can, where a young Leonardo Di Caprio makes a fool out of a Tom Hanks detective. In the 1960s, it was far simpler to create counterfeit personal or financial information in the form of IDs, bank statements, or even bank checks.

In the era of digitalization, data scraping, and photo editing tools made it even easier to create counterfeit documents. In the era of Generative AI (Gen AI), however, the task has become even more accessible.

What is Generative AI?

Gen AI is a technology that enables the creation of text, images, film, or any other data using generative artificial intelligence and data models. Typically, fraudulent images are created from written and visual prompts.

Generative AI models learn from the wealth of information they are fed, meaning that particular data patterns generate new but different data patterns. This process is known as data augmentation through machine learning and is commonly used in AI-enabled fraud.

What is Generative AI Fraud?

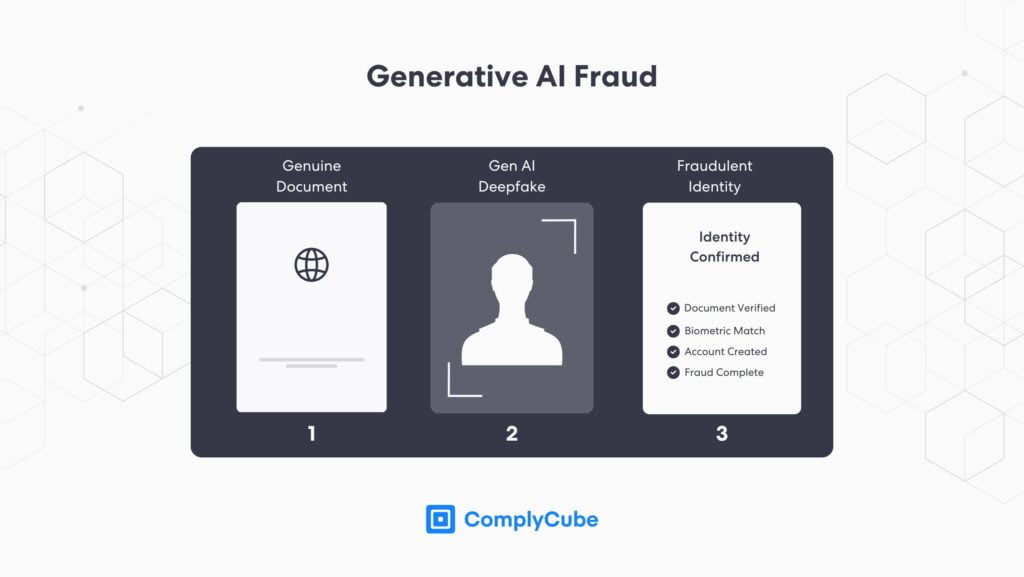

Generative AI Fraud is the use of Gen AI to create counterfeit documents and images with the intention of bypassing security systems. An example of the Gen AI fraud process can be seen below.

As displayed above, Generative AI fraud can be used alongside identity theft for synthetic data generation to create what apear like genuine accounts. Leveraging fraudulently generated images, bad actors can create convincing new accounts with a different individual’s identification documents and bypass security systems used by Financial Institutions (FIs) across the world.

AI could enable fraud losses to reach $40 billion in the United States by 2027.

This Deloitte report suggests that the adoption of compliance technologies is giving criminals the advantage over firms when it comes to leveraging Gen AI to circumvent compliance security programs. If this development continues past 2024, the global financial system could be at risk of exceeding today’s volume of money laundering.

It’s estimated that global money laundering volumes fall just shy of $2 Trillion.

The solution to not only preventing this figure from rising but actively reducing it, is adopting compliance solutions that make use of the same advanced technologies that attempt to breach FIs. This is made clear through many national and international regulatory bodies, such as:

- The US Department of the Treasury (DoT).

- The Financial Conduct Authority (FCA).

- The Monetary Authority of Singapore (MAS).

- The Financial Action Task Force (FATF).

Generative AI Fraud Detection

Detecting Gen AI fraud requires advanced machine learning to leverage similar data sets that are used to create fraudulent documents and images. When verification systems utilize the same – or similar – data sets, they can identify the patterns that Generative AI fraud technologies would create to bypass traditional methods. These tools significantly increase a firm’s fraud detection capabilities.

Document Verification

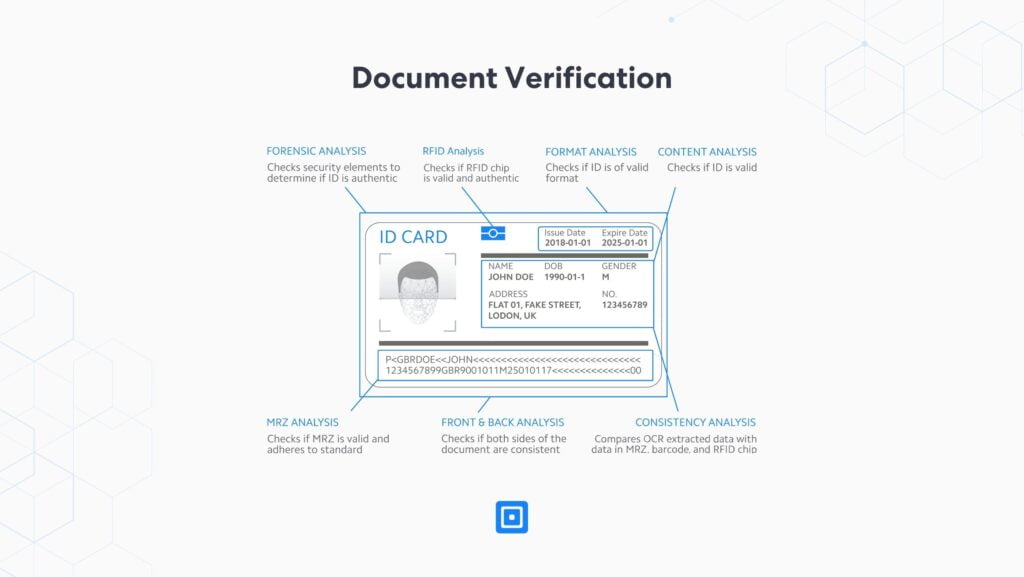

For the most reliable results, document verification processes must be conducted live and during the client acquisition process. Document liveness ensures that the uploaded image will not have been tampered with, as it must have come from a user’s smartphone camera to be completed. The process then examines all available data spots from the ID.

- Visual Inspection Zone (VIZ)

- Machine Readable Zone (MRZ)

- RFID chip

- Barcodes

Near-Field Communication (NFC) verification takes this process even further by reading an embedded chip inside the document that provides an immutable data transfer. NFC verification captures the stock image of a document in far greater quality than an image upload ever could, permitting greater biometric matching and assurance of unadulterated documents. For more information, read What is NFC ID Verification?

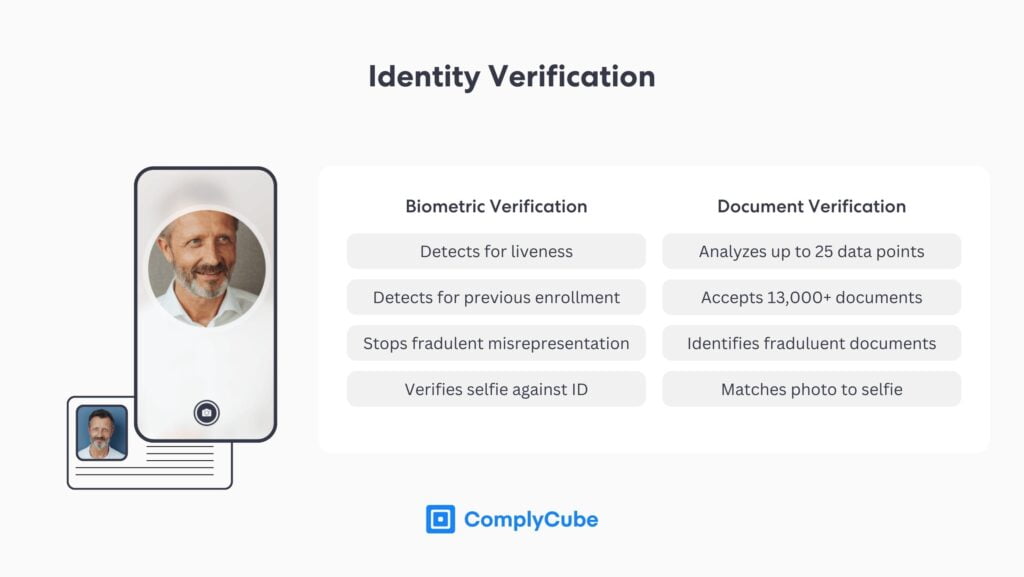

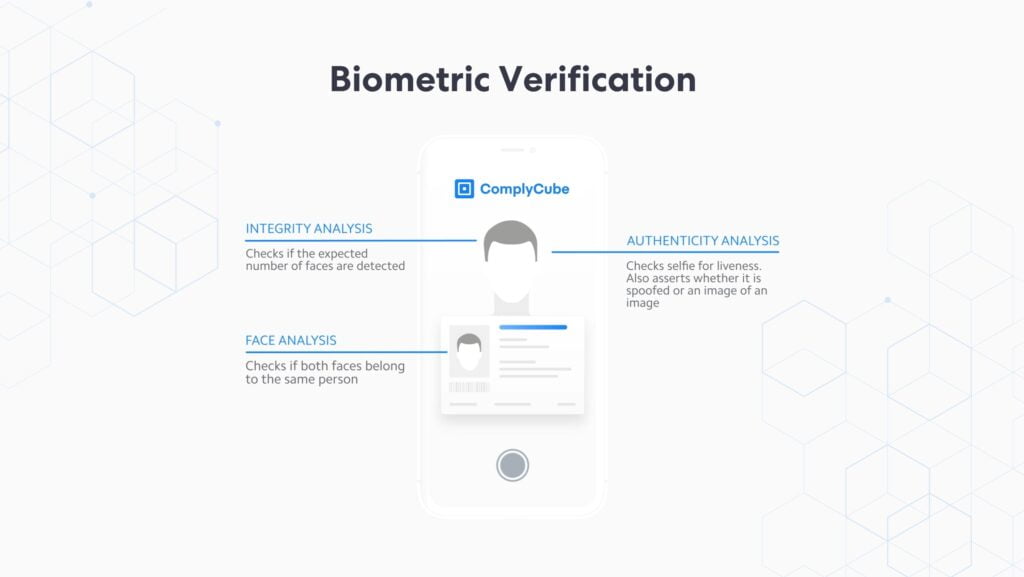

Biometric Verification

Biometric verification, or selfie verification, is used to add a secondary layer of identity assurance for businesses. Following the data capture and verification from the document, biometric verification is used to match for similarities between the stock image in the ID, and the facial biometrics in the selfie.

Again, liveness is crucial, as it ensures that the image has not been edited with or generated by AI. The process used to ensure liveness is called Presentation Attack Detection (PAD). PAD verification builds digital 3D structures around the face to analyze skin tones and micro-expressions, check for masks, and detect pixel alteration. For more information, read Liveness Detection: Best Practices for Anti-Spoofing Security.

ComplyCube’s selfie verification engine can also be used as an age estimation solution. It provides accurate yet frictionless security for age-gated goods while preventing fraudulent individuals from gaining access.

Is Your Platform Protected from Generative AI Fraud?

IDV and document fraud solutions not only provide high levels of identity assurance but greatly reduce the number of false positives. With machine learning-driven anomaly detection capabilities, malicious actors can be spotted even after the Identity Verification process, preventing credit card fraud, along with many other malicious methodologies.

Furthermore, complex fraudulent schemes in today’s era typically make use of numerous different banks, accounts, individuals, and asset classes. The variety of methods used by criminals makes identifying and tracking these complex fraud patterns very challenging for FIs, which must now employ methods for monitoring fraudulent transactions and transaction data.