Know Your Customer (KYC) Verification has become increasingly integral to safeguarding against financial system abuse, money laundering, and many other practices that could be detrimental to the operation and reputation of a business. Adopting a streamlined and global KYC verification process helps to retain a competitive advantage.

This guide will dive into the 3 critical steps of the KYC process, underlining the importance of verifying a Customer’s Identity, completing thorough Customer Due Diligence checks, and committing to Ongoing Monitoring.

What is KYC Verification?

Worldwide, financial institutions, alongside other businesses, must thoroughly understand who their clients are. This necessity, mandated by regulations such as the Bank Secrecy Act and the USA Patriot Act in the United States, aims to identify and prevent money laundering, fraud, financing of terrorism, and other financial crimes. The strategies and procedures businesses implement to meet relevant regulations are collectively recognized as Know Your Customer (KYC).

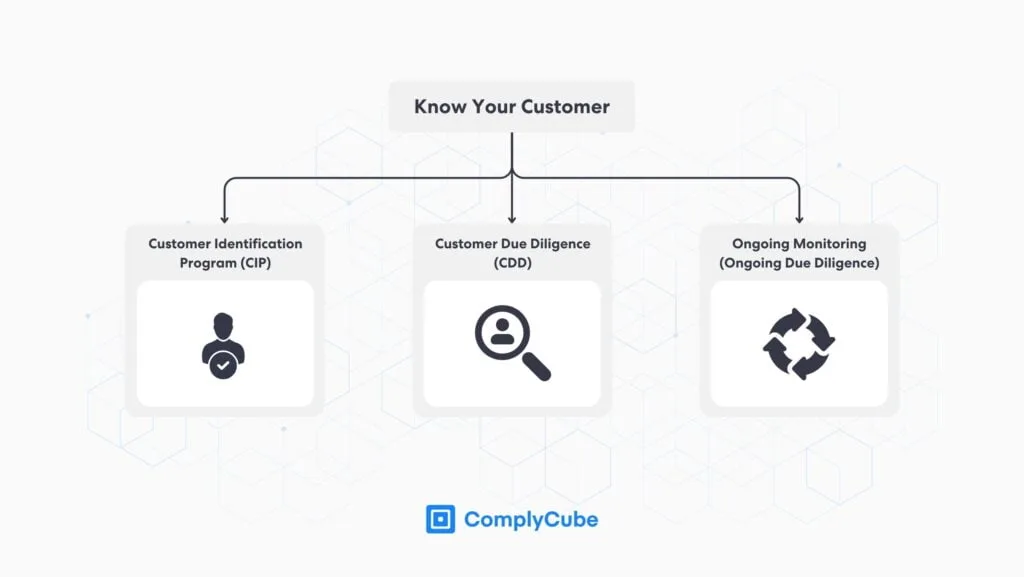

The KYC process involves a series of 3 steps, including a Customer Identification Program (CIP), Customer Due Diligence (CDD), and Ongoing Monitoring. These steps are fundamental in verifying the client’s identity, understanding their behavior, and continuously monitoring their associated risks.

This comprehensive approach is a risk mitigation strategy, ensuring that the financial institution remains vigilant against illegal activities while maintaining accurate information about their customer’s identity. Through KYC verification, these institutions comply with legal requirements and secure their operations against potential threats.

Thus, with an increasingly global economy augmented by the proliferation of digital interactions, a business must meet its KYC requirements to avoid non-compliance with the relevant financial industry regulatory authority. The necessity for KYC compliance has led firms to outsource solutions that provide a smooth customer onboarding experience. KYC solutions help businesses maximize client signups with an integrated KYC procedure that identifies the potential risk factors of new customers.

KYC solution providers offer effective services across a wide range of industries that require customer transparency. These involve financial services that require high levels of identity assurance, as well as enterprises that require more basic customer due diligence.

The 3 Steps to Know Your Customer Verification

There are 3 steps in a KYC verification journey: Customer Identification Program (CIP), Customer Due Diligence (CDD), and Ongoing Monitoring.

Customer Identification Program (CIP)

A CIP is a set of procedures that financial institutions and other businesses execute to verify the identity of their customers. This is a critical process for confirming the accuracy of client information and ensuring the individual in question is actually who they say they are.

The fundamentals of implementing a rigorous set of identity verification methods in a Customer Identification Program are:

Full Name, as displayed on a user’s passport

Date of Birth (DoB)

Residential address, found on a utility bill

Government-issued identification number, i.e. passport number

Customer Due Diligence (CDD)

A Customer Due Diligence Process dives deeper into a customer verification check. Done correctly, CDD will prove identity and help prevent money laundering and other financial crimes. This process uses KYC document verification and acquired user data, which is ratified against 3rd party databases and other consumer reporting agencies. The more an institution knows about who it is dealing with the higher chance it has of avoiding abuse of the financial system.

A robust CDD procedure will allow the company to make accurate predictions about the nature of a client’s business. This will enable the company to diagnose any suspicious activity the user might perform. For example, politically exposed persons (PEPs) require greater scrutiny as the risk of engaging in an illicit activity is higher. Once the customer’s due diligence is complete, a customer is assigned a risk level. Learn more about Customer Due Diligence here: What is Customer Due Diligence?

An enhanced due diligence (EDD) process occurs when a higher risk of money laundering or terrorist financing is detected. This could be alerted by the region and jurisdiction the individual is in, the individual themself, such as a PEP, or the industry-specific products they are accessing.

Businesses must adopt a risk-based approach (RBA) to determine customer risk factors such as the nature of their transactions, their behavior, and other factors. RBAs help companies make decisions on allocating resources to higher-risk areas, which increases the efficacy of Anti-Money Laundering (AML) and counter-terrorism financing (CTF) procedures.

Ongoing Monitoring

Ongoing Monitoring, or Continuous Monitoring, is the real-time verification of an account’s integrity. In essence, it is a perpetual risk assessment. AML regulations require businesses to frequently check and verify the identity of their users to ensure their risk assessment is up to date. Continuous monitoring is one of the key components of a fully compliant KYC verification strategy.

Money laundering and other financial crime methodologies are constantly evolving. An individual can become involved in illicit financial behaviors very quickly. The ongoing monitoring of clients, particularly those requiring enhanced due diligence such as PEPs, ensures that financial institutions remain alert to potential risks and unusual patterns in behavior.

The Benefits of Opting for a KYC Verification Service

Signing up for a service is the beginning of a customer’s journey, and first impressions count. KYC solutions, or eKYC (electronic KYC), facilitate the smooth transition from potential to actual customers. They verify customers’ identity, KYC documents, and multiple other customizable screening measures in the due diligence and onboarding process.

Signing up for a service is the beginning of the customer’s journey and sets a crucial first impression. eKYC (electronic Know Your Customer) solutions facilitate the conversion of potential customers into actual customers. These systems confirm the identity of customers by authenticating their KYC documents along with performing multiple other tailored screening measures. Learn more about eKYC here: What is eKYC (electronic Know Your Customer)?

Increased Operational Efficiency

Efficient KYC providers automate the entire KYC verification process, supporting tens of thousands of instantly verifiable documents. Measures such as Biometric Verification reduce the client acquisition process from weeks to seconds. These automated processes eliminate the middleman, eradicate human error from Know Your Customer verification, and increase efficiency and margins.

Ease of Integration

State-of-the-art KYC solutions offer a variety of methods to integrate smoothly into a business technological stack. These include web and mobile SDKs, powerful APIs, hosted platforms, low and no-code solutions. Customer data can be easily monitored on a friendly UI, automatically alerting potential client risks and when KYC documents need rechecking.

Streamlined Customer Onboarding

87% of customers believe companies could improve their customer onboarding experience. Inadequate onboarding processes often fail to convert prospects into customers, affecting businesses at a crucial juncture. First impressions count, and a streamlined KYC verification procedure is critical. An excellent user experience leads to loyalty, which in turn, reduces churn.

87% of customers believe companies could improve their customer onboarding experience.

A 2022 survey, which included 79 SaaS companies, found that the average conversion rate for their onboarding process was less than 37%. With the help of the right KYC provider, customer onboarding rates can be as high as 98%.

Malleable Data with eKYC

The digitalization of client data makes information tracking and transfers seamless. Before eKYC solutions, banks and other financial institutions manually carried out KYC procedures and stored data on paper. Automated Know Your Customer solutions ensure data is not lost or misplaced and accessible immediately digitally.

Corporate KYC verification

Known as Know your Business (KYB), Corporate KYC verification is the identification and due diligence process required when establishing new business relationships. They are designed to:

Validate the authenticity of a new business partner and ensure that entering a business relationship is safe. For example, in the UK, checking that a company has been registered with Companies House is a bare minimum, where official data can be extracted.

Ensure that the ultimate beneficial owners and individuals running the company, such as directors and chief executives, are not involved in malicious activities such as money laundering. These checks are much like the typical KYC processes discussed throughout this article.

Corporate clients need just as strict KYC requirements to verify the integrity of new business relationships. This involves checks that qualify for proper registration with the necessary authoritative body and ensure they are not connected to illicit activity.

Institutions involved in money laundering will build layers to attempt to hide from regulators and authorities. The intention behind layering is to make money tracking between each company segment much harder to achieve.

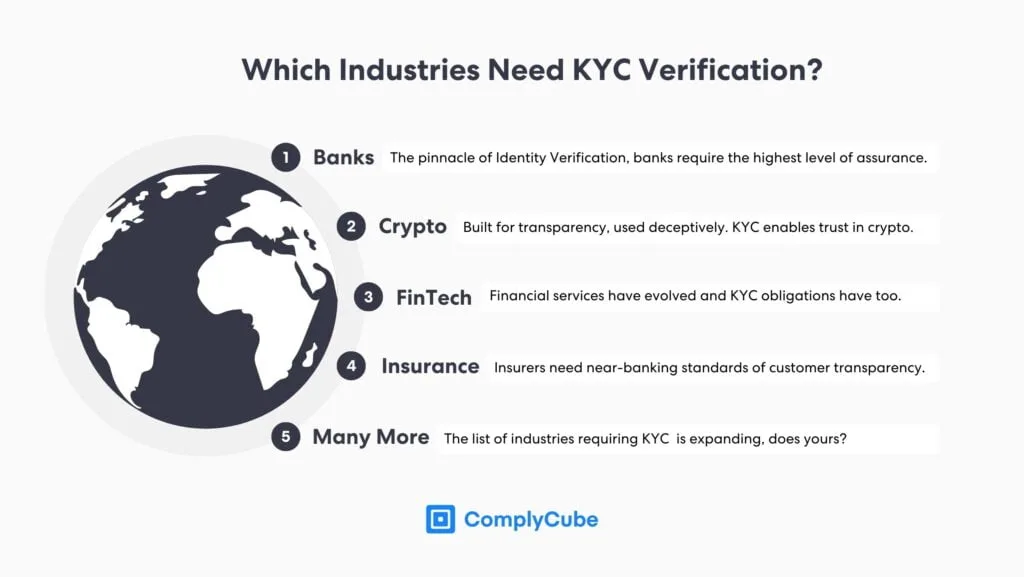

Which Industries Need KYC Verification?

The need for Know Your Customer (KYC) verification isn’t only crucial for financial services companies aiming to curb money laundering risks. It’s essential for any organization that introduces customers via an onboarding process to have a means of authenticating user identity. KYC is designed to protect financial institutions, real estate firms, hospitality providers, and many others.

This underscores the importance of providing various identity assurance options, as different businesses can opt for more stringent screening processes based on their industry, security needs, and the company’s risk tolerance. A valuable KYC service will supply a range of KYC solutions, allowing businesses the flexibility to select a package that best aligns with their specific requirements.

For example, a Bank will require a far higher level of identity assurance than an e-commerce site selling age-restricted products.

An e-commerce site might only require an age estimation check to verify a new user’s identity.

A bank would require far stricter levels of assurance, including but not limited to: document and biometric verification, proof of address checks, and multi-bureau verification.

KYC Verification in Banking

KYC verification in the banking industry requires the highest level of identity assurance. Banks must assess money laundering risks and exposure to terrorist financing when opening new accounts – particularly with higher-risk clients or Politically Exposed Persons (PEPs).

Customer identity data must then be stored, archived, and monitored in case any illicit activity is flagged. If this were to occur, a full report could be commissioned and sent to a suitable authority, such as the Financial Crimes Enforcement Network in the US.

KYC in banking also provides informational clarity between the banking provider and the customer. This enables a more efficient and relevant service.

KYC Verification in FinTech

The Bank Secrecy Act of 1970 requires all financial institutions to help the US government in deterring and preventing money laundering activities. This used to only relate to established financial services such as banks and insurance brokers. However, developments over the last few decades have forced a reappraisal.

The rise of FinTech services and associated technologies has forced this re-evaluation, and this policy now includes a much wider array of financial services. FinTechs are frequently targeted as money laundering vehicles, meaning now, any company that operates in the financial industry must adhere to strict KYC verification requirements.

KYC Verification in Crypto

Cryptocurrency and blockchain technology were designed to build transparency, ownership, and anonymity in the financial industry. Like any new global innovation however, malicious individuals embarked on manipulating this unregulated technology for illicit purposes.

The risks associated with cryptocurrency are much higher due to this anonymity. For each new user, it’s essential to evaluate the money laundering and terrorism financing risks through a thorough KYC process complemented by continuous transaction monitoring.

Following 2 turbulent years of trust in the industry between 2021 and 2023, cryptocurrency is looking to bounce back. KYC verification services will be paramount in building trust at scale in this fast-paced industry. For more information on KYC for Crypto, read How KYC Crypto Regulations Safeguard the Industry.

KYC Verification in Insurance

Similarly to banking, insurance relies on trust. Trust that the user who is purchasing a policy is who they say they are. Plainly, KYC verification helps an insurer identify the individual, ensuring they truly know who is on the other side of the transaction.

Integrated KYC solutions equip businesses with the capability to onboard new policyholders instantly with reliable, accurate, and immediate verification across the globe. This allows insurers to scale into new markets and expand in existing ones without fear of compromising compliance.

Time to Choose a KYC Partner?

The security of financial transactions has a lot of moving parts. KYC processes should help bridge the growing gap between operation and regulation. ComplyCube’s industry-leading AML and KYC solutions ensure businesses are successful in their compliance strategies and remove the headache of onboarding new and higher-risk customers.

Standardizing successful client acquisition at up to 98% onboarding rate in less than 30 seconds, ComplyCube is gaining traction amongst financial services, financial technology, and a wealth of other markets. This is also due to their comprehensive AML solution toolkit, which not only acts as an enabler but significantly cuts operational costs by streamlining compliance workflows.

If you are looking for a new provider or are new to this market, get in touch with ComplyCube’s team of IDV, KYC & AML specialists.