Hong Kong’s status as a financial hub has been questioned in recent years due to its apparent failure to capitalize on economic trends. Hong Kong crypto regulation aims to counter this. With recent advances in the Crypto Travel Rule and legislative infrastructure, Hong Kong is positioning itself at the top for Web3 and crypto innovation.

This Hong Kong cryptocurrency guide sets out the fundamental legislative policies implemented in recent years. These regulations, coupled with a Western inability to capitalize on this fast-paced industry, could potentially see the key players move East. Perhaps more specifically, move to Hong Kong.

Who Regulates Cryptocurrencies in Hong Kong?

The cryptocurrency industry is vast and swift, with hundreds of billions of dollars flowing in and out of it each year. Acting swiftly can put entire regions ahead in the industry. What is particularly pertinent to Hong Kong (HK) is the government’s quick-witted and comprehensive approach to regulation.

One reason this could be so significant for Hong Kong is that other nations appear to have taken quite a contrary approach. As this guide will explain, HK’s government is already providing Web3 and crypto firms with the tools to build responsibly.

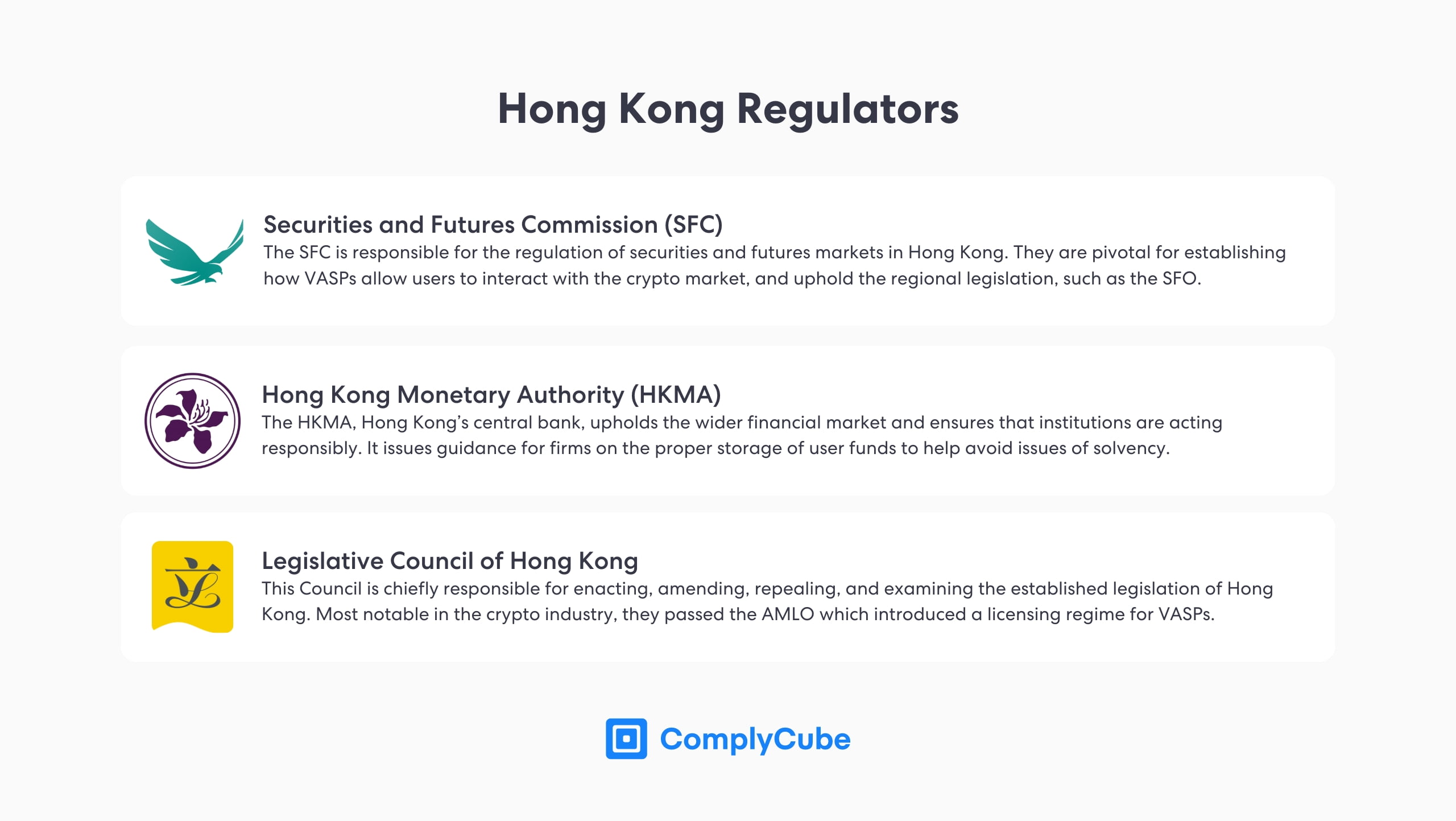

Securities and Futures Commission (SFC)

The SFC regulates the securities and futures markets in Hong Kong. As no specific council is designed to regulate the cryptocurrency market, the Securities and Futures Commission plays a pivotal role in the industry’s legislation.

Cryptocurrencies are traded like securities. However, despite the US’s attempts to label them as such, they are not registered securities in any country. For this reason, multiple organizations in Hong Kong share the responsibility of crypto market regulation.

The SFC plays the most hands-on role regarding how users are allowed to interact with the crypto industry, such as the procedures new users must undergo at the point of client acquisition. Therefore, the agency is instrumental in KYC and AML crypto compliance.

Hong Kong Monetary Authority (HKMA)

The HKMA, the Central Bank of Hong Kong, ensures that financial institutions are and continue to operate efficiently and transparently. They were traditionally responsible for ensuring that banks and other payment systems were financially stable and solvent.

For Virtual Asset Service Providers (VASPs), the Hong Kong Monetary Authority ensures that crypto institutions, such as Centralized Exchanges (CEXs), act properly with user funds. Some of the HKMA’s key legislation that impacts the crypto industry relates to where and how user deposits are held.

This topic has garnered an increasing level of scrutiny following the collapse of Sam Bankman-Fried’s FTX exchange in 2022. The exchange was found to be misusing client funds via a sibling company known as Alameda Research. For more information on unregulated crypto exchanges, read The Dangers of a No KYC Crypto Exchange.

Legislative Council of Hong Kong

The Legislative Council of Hong Kong plays a fundamental role in regulating cryptocurrencies and Virtual Asset Service Providers. It is the core body for approving and passing legislation related to financial markets.

This regulatory body ensures that the established regulatory framework is up to date with the cryptocurrency industry’s dynamic standards. One core crypto policy established by the Legislative Council of Hong Kong was the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO).

What Does Hong Kong Crypto Regulation Look Like?

Hong Kong’s updated framework, the AMLO, is the core legislative piece that all VASPs must adhere to. Firms must also comply with international Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations.

Crypto companies must obtain a license from the SFC and be compliant with the AMLO to ensure their safe and continued operations. Hong Kong’s set of crypto asset standards is poised to catalyze the region into an industry leader, fostering innovation by attracting new start-ups and individual talent.

Hong Kong aims to position itself as a leading global hub for digital asset innovation and investment.

This new framework aligns with the Financial Action Task Force (FATF) and its Recommendation 16—the crypto travel rule. According to the international agency, when crypto assets are transferred between Virtual Asset Service Providers (VASPs), the two VASPs must provide additional information about the user and the nature of the funds.

Recommendation 16 implementation bolsters the need for a Customer Due Diligence (CDD) and travel rule compliance solution. For more general information on the travel rule, read The Crypto Travel Rule: The Need for AML Compliance Software.

The AMLO

The Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO) complements the SFO and SFC’s work. However, it focuses directly on AML and CTF policies across the region’s industries. It mandates comprehensive CDD, ongoing monitoring, and specific requirements for banking services, including virtual asset transfers.

Therefore, the AMLO directly relates to money laundering, counterterrorism financing, and crypto travel rule requirements. Recommendation 16 is quickly becoming one of the leading metrics in gauging a region’s crypto compliance standards.

This framework helps mitigate risks associated with money laundering and terrorist financing, making Hong Kong a safer and more attractive hub for crypto-related activities and investments. The AMLO protects investors and enhances the legitimacy and stability of Hong Kong’s financial market.

The Provision of Custodial Services for Digital Assets in 2024

In February 2024, the HKMA released its guidance for digital asset custodians to ensure they have the correct information to manage digital assets properly. These include a range of procedures:

Proper governance and risk management to ensure VASPs only operate once an adequate risk assessment has occurred.

Segregation of client digital assets to the firm’s funds to protect users from insolvency.

The safeguarding of client digital assets against theft, fraud, or other misappropriation.

Firms may not outsource custody functions to custodians outside the SFC’s jurisdiction.

Transparent disclosure of the custodial arrangements of user digital assets.

Thorough recordkeeping and reconciliation of client digital assets, including both off-chain and on-chain data.

Proper AML/CTF policies, including contemporary Know Your Customer (KYC) strategies such as Identity Verification (IDV), CDD, and continuous monitoring.

Compliance with many of these points overlaps adherence to the crypto travel rule and, therefore, will require a KYC and AML solution for the storage, accessibility, interpretation, and reliability of client data. While this particular policy relates to how a VASP operates, all crypto firms must rely on a comprehensive KYC solution to combat money laundering and maintain compliance.

Virtual Asset Service Providers and SFC Licensing

The Securities and Futures Commission is the primary regulator that establishes the rules for investor protection and enables a financial institution’s risk management. The SFC must license every firm dealing with the transfer of virtual assets to provide their services to Hong Kong citizens.

By obtaining a license with the SFC, VASPs demonstrate their commitment to operational integrity and adherence to AML policies. This is vital in building a cryptocurrency ecosystem based on trust and stability.

The Securities and Futures Ordinance (SFO)

The SFO provides the regulatory requirements that dictate the principles the SFC enforces. It is the rulebook that outlines the expected standards from market participants and permits the SFC to act accordingly if they are broken.

Therefore, the SFO is instrumental in creating a fair, regulated, and hospitable environment for Hong Kong’s financial markets, including the crypto industry and VASPs. The most extensive crypto policy established by the Securities and Futures Ordinance is that every VASP—or Virtual Asset Trading Platform (VATP) — must be licensed with the SFC.

Hong Kong’s Spring 2023 Legislative Updates

Between May and June 2023, the SFC distributed a “circular on implementation of new licensing for virtual asset trading platforms.” This included updated regulatory requirements on:

The Guidelines for Virtual Asset Trading Platform Operators

The Guidelines on Anti-Money Laundering and Counter-Financing of Terrorism (AMLO)

The Prevention of Money Laundering and Terrorist Financing Guidelines issued by the SFC

These were released to prevent money laundering and terrorist financing for licensed corporations participating in crypto asset services, forming the foundation of Hong Kong’s updated cryptocurrency legislation.

Stablecoin SandBox

On March 12, 2024, the Hong Kong Monetary Authority launched a regulatory sandbox for the development and issuance of stablecoins following a discussion paper that started in 2022.

The sandbox is designed to encourage the safe development of stablecoins in a controlled environment, where regulatory decisions can be iterated as required. Companies interested in taking part in the initiative must:

Show a genuine interest in issuing a fiat-referenced stablecoin in Hong Kong

Demonstrate a suitable plan of action for the project’s development

Provide a roadmap of how the project aims to participate in the sandbox

Demonstrate how the firm will adhere to the proposed regulatory requirements and principles

The proof here is in the pudding, as ZA Bank, the first mover in the Hong Kong NeoBank industry, is actively pursuing a stablecoin strategy. The bank’s Chief Executive has frequently expressed his admiration for stablecoins, labeling them as a multi-faceted application of blockchain technology, with use cases including “wholesale or retail markets, tokenization, settlement for exchange trading, or to tackle overseas remittance pain points.”

We are keen to explore how to put them [stablecoins] into real-world use with the potential issuers.

These developments show a genuine drive in Hong Kong to develop a crypto economy full of diverse utilities. This sandbox puts the region ahead of much of the rest of the world regarding stablecoin legislation, with most major economies lagging behind.

List of SFC Licensed VASPs

Quite interestingly, the Securities and Futures Commission has only legally licensed 2 crypto exchanges (at the time of writing, May 2024) for operation in Hong Kong. This is despite many well-known CEXs being headquartered in the very same region. The two licensed exchanges are:

However, 23 VATP applications remain open and are awaiting a response. The SFC’s licensing list is a great example of the transparency the Hong Kong government instills throughout the industry.

The purpose of this list is to enable any member of the public to ascertain whether a virtual asset trading platform has made untrue or misrepresentations regarding its licence application status with the SFC.

There has been speculation about how effective the new Hong Kong crypto regulations will be at attracting overseas exchanges and investors. King Leung, head of FinTech at Invest Hong Kong, has stated that the government wants to develop a “more complete ecosystem” by attracting other market contributors, such as market makers and developers, to Hong Kong. These new regulations are designed to do just that.

The Financial Action Task Force and Crypto Travel Rule

The term travel rule was coined by the Financial Crimes Enforcement Network (FinCEN) and the Bank Secrecy Act (BSA) in 1996/7 and later adopted by the FATF. Financial Institutions and now Virtual Asset Service Providers that operate in FATF member countries must adhere to Recommendation 16.

The crypto travel rule states that any crypto transactions exceeding a certain threshold, typically 1,000 (USD, EUR, or GBP), must be accompanied by certain customer information. This measure has been implemented to address the growing concern about crypto anonymity and its inherent links with money laundering.

Every country, however, is implementing the crypto travel rule at different rates and with varied levels of success. This problem is known as the ‘sunrise issue’. As the travel rule requires two VASPs to communicate client data with each other, it can only be successful if both services are fully compliant and have implemented robust KYC processes.

Hong Kong Crypto Travel Rule Specifications

The crypto travel rule became obligatory on June 1, 2023. All virtual asset transfers that exceed 8,000 HKD (1,000 USD) must be subjected to the terms of the rule. This means certain information must be obtained and shared with the participating VASPs:

The name of the business or individual making the transaction (the originator).

The account details of the originator (the VASP or financial institution should store these.)

The originator’s address and customer identification details, including beneficiary information.

The name of the business or individual receiving the transaction (the recipient).

The recipient’s account details.

Crypto transactions that do not exceed 8,000 HKD do not require the same level of accompanying data. However, basic information is still required, including the name and account number. The SFC states that all travel rule checks must be completed before the transaction is submitted due to blockchain finality.

When crypto assets are transferred via the blockchain (on-chain), they are final and cannot be reversed. Therefore, VASPs must be certain in their due diligence that the transaction is not threatening or connected to bad actors, further signifying the cruciality of KYC and CDD processes.

Crypto Travel Rule Implementation in Hong Kong

The Securities and Futures Commission gave a 6-month window following the new crypto legislation. In an attempt to give firms a grace period, VASPs were allowed to process transactions before they received the accompanying information as long as they submitted the customer’s data as soon as possible. This was likely to allow time for firms to find and integrate with a travel rule solution.

This meant that the crypto travel rule could be gradually integrated into the region’s industry without upsetting the operation of crypto firms. The FATF released a status update of Recommendation 15 (governmental collaboration with FATF AML and CTF guidelines for VASPs) in March 2024, finding Hong Kong Partially Compliant with the travel rule. The data from this report, however, pertains to 2023, before Hong Kong’s travel rule grace period had concluded.

The 5th Round of Mutual Evaluations, which is due in 2025, will include a more comprehensive update of all 40 FATF Recommendations. The cryptocurrency industry has witnessed far greater media attention in 2024, likely extending into 2025. The Mutual Evaluations will contribute significantly to many regulatory discussions, including the sunrise issue. Read the FATF Recommendations in 5th Mutual Evaluations for more information.

Where does this place Hong Kong Globally?

HK has swiftly developed an extremely expansive set of cryptocurrency legislation, which has put the region in one of the key driving seats on the crypto grid. Since 2023, Hong Kong has made impressive strides to provide regulatory clarity to entice the industry to its jurisdiction.

The first country to implement the crypto travel rule was the US in 2019, following the FATF’s introduction of the rule to the crypto industry in the same year. FinCEN also issued guidance that clarified the rule’s application to virtual assets, which is also used as a global standard.

This was the start of a global recognition of the importance Virtual Asset Service Providers can have over the financial system. In February 2024, the EU officially recognized VASPs’ significance as financial system safeguards, labeling them as ‘obliged entities’.

CASPs will need to apply customer due diligence measures when carrying out transactions amounting to €1000 or more.

Furthermore, Singapore — a region Hong Kong is frequently compared to — implemented the crypto travel rule in 2020. Singapore beat much of Asia in the race to regulate crypto, fostering its early lead in the crypto industry.

Now that Hong Kong is officially enforcing the travel rule coupled with perhaps the most contemporary structure of cryptocurrency legislation, the region is likely to harness a heightened share of the global market. The only caveat to this is that the suite of regulations Hong Kong has introduced is so comprehensive that it is reportedly very expensive to comply with. The same goes for license applications.

At a Glance

Hong Kong’s regulatory regime looks set for success. Its comprehensive cryptocurrency legislation instills transparency and trust in an industry that, more frequently than not, lacks it. A regulatory sandbox for stablecoin development also shows great initiative and commitment — as well as putting their money where their mouth is — to developing a healthy crypto ecosystem beyond just hosting the headquarters of numerous CEXs.

While the stablecoin market is certainly dominated by the likes of Tether and Circle (USDT and USDC, respectively), that by no means rules out the rise and adoption of other more efficient protocols. This places Hong Kong in good stead to develop its own stablecoin infrastructure with the potential for deployment on a global scale. There is, however, the aforementioned caveat.

While comprehensive, the region’s regulations are possibly too strict, intricate, and expensive to adhere to. This could pose problems in attracting the vast majority to its jurisdiction. When compared to Singapore, the new and developing regulatory landscape in Hong Kong might not be seen as favorably as it wants to be. Only time will tell.

About ComplyCube

The development of Hong Kong’s crypto legislation over the past year underscores the region’s determination to establish itself as a crypto hub for years to come. Compliance with these regulations, in particular the travel rule, is fundamental for VASPs that wish to operate in the region without incurring fines.

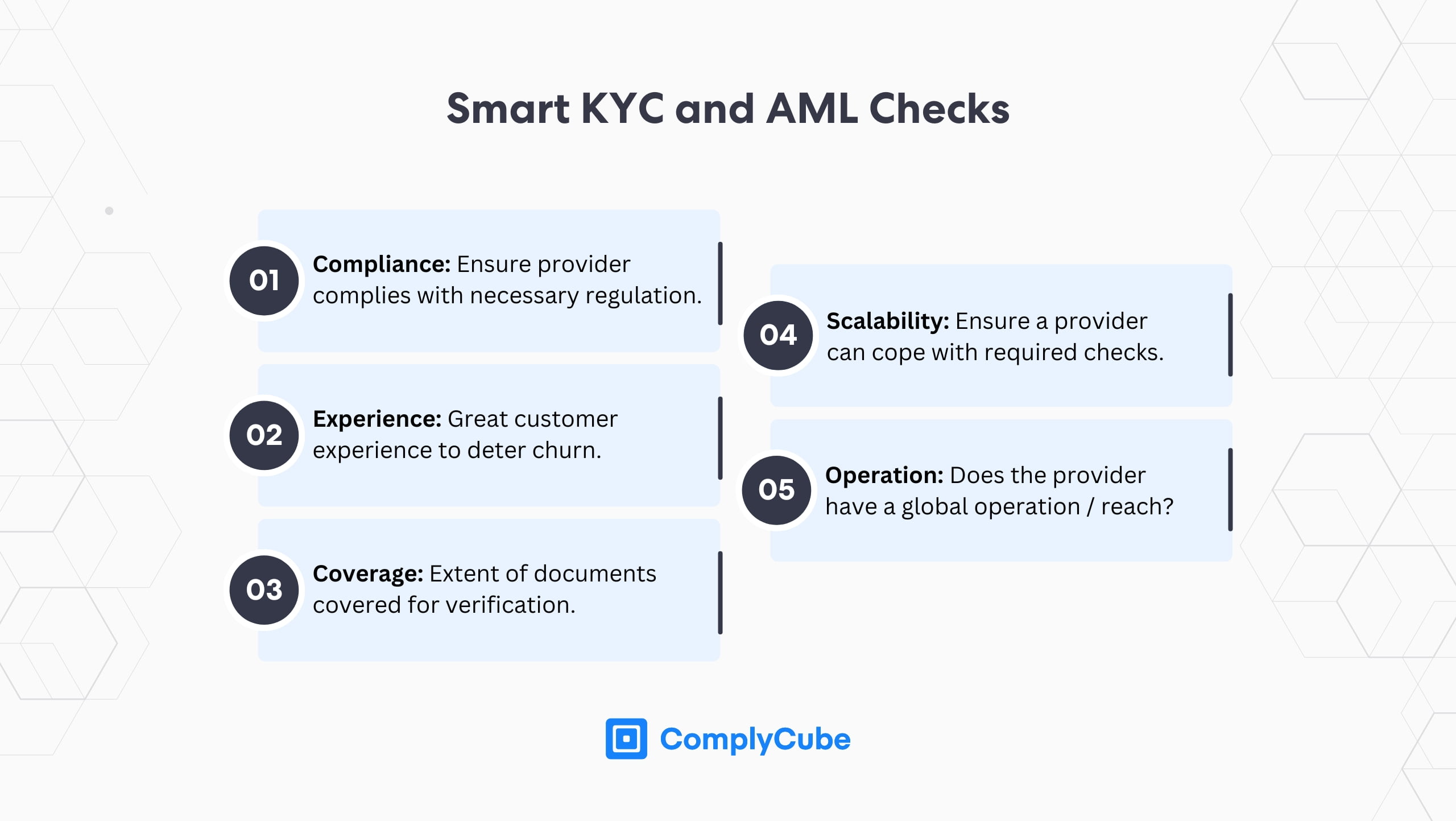

These regulations have successfully aligned Hong Kong’s compliance program with that of the FATF and international best practices. However, the VASP has discretion over how a firm achieves compliance with these protocols.

Crypto KYC and AML Solutions

This is why KYC and AML tools are becoming increasingly important to the success and regulation of the crypto industry. Advanced Identity Verification methods, such as document verification and biometric authentication, are used at the client acquisition stage to ensure that firms form a reasonable belief that users are who they say they are.

Once a Virtual Asset Service Provider has established who the user is, they will subject them to a host of background vetting processes in the Customer Due Diligence phase. All of this information must be collected, stored, and checked to ensure exchanges and other crypto providers comply with the travel rule.

Where ComplyCube excels is automating this entire process into one seamless workflow. Users can be verified in under 30 seconds with CDD performed in the background. This produces a risk score for compliance executives in minutes. Clients also have full control over friction thresholds, allowing for tightened or loosened ‘fast-fails’ depending on the region’s regulatory leniency.

These solutions give ComplyCube a market-leading compliance platform that is swiftly becoming a growth enabler for crypto firms. Businesses looking for a crypto KYC solution also use the ComplyCube platform to monitor transactions on and off-chain for an all-encompassing global solution.

If you’re interested in learning more about ComplyCube’s crypto KYC solutions, contact a specialist today.