As new forms of fraud continue to unravel security processes at major financial institutions, stronger defenses must be implemented to ensure the safety of customers and businesses alike. Traditional methods like passwords, PINs, and security questions are no longer sufficient to protect sensitive data and prevent identity theft in an increasingly digital world. To stay ahead of fraudsters, businesses must adopt more advanced, robust, and user-friendly security technologies—this is where biometric identity verification comes in.

Advanced biometric identity verification systems leverage AI-powered liveness detection. Through AI models that analyze subtle eye movements, blinking, head shifts, micro-expressions, depth perception, and changes in lighting, these systems can differentiate between a real, living person and a fake or spoofed input. Liveness detection ensures that identities are verified with the highest accuracy. AI-powered 3D face maps are also used for secure identity authentication. These systems use AI and machine learning to analyze the unique contours and features of a person’s face in three dimensions. By capturing detailed depth information, 3D face recognition technology creates a 3D map of the face, which is then used to compare and verify identities.

Understanding AI-Powered Facial Liveness Detection

Facial liveness detection refers to the process of ensuring that a person presenting their face for biometric authentication (e.g., in face recognition systems) is a real, living person rather than a static image, video, or other spoof. Spoofing attempts, like using a photo, 3D mask, or video playback, have become more common as face recognition technology has grown. To counter this, liveness detection techniques rely heavily on AI-driven models that can detect subtle cues indicating life and genuine human interaction.

Biological Indicators of Liveness

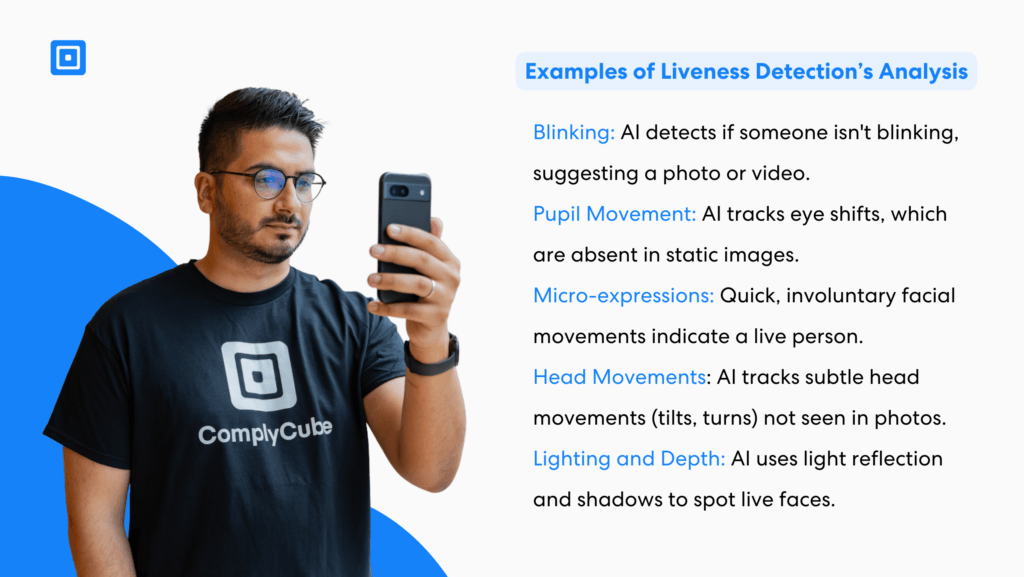

Human faces exhibit a variety of natural, involuntary biological behaviors that are extremely difficult to replicate in photos or videos. AI models use these cues to detect liveness, identifying deepfakes or spoofed images quickly. Some biological indicators of liveness include:

Blinking: Humans blink automatically and regularly. An AI model trained on facial features can identify the rhythmic movement of eyelids. For example, if a person faces the camera for a long time without blinking, this is an indicator that the face might be a photo or a video because it does not blink or respond as a live person would.

Pupil Movement: In the context of liveness detection, some systems also track pupil movement or eye movement patterns. People look around, shift focus, and exhibit small eye movements. AI can detect any anomalies in these behaviors, as static images or videos do not have the same depth or range of eye motion.

Micro-expressions: These are rapid, involuntary facial expressions that often occur in response to emotional stimuli. These small movements are difficult to mimic convincingly with photos or videos. AI models can detect subtle shifts in the face, such as muscle contractions or slight changes in facial features (like a corner of the mouth twitching, a brow furrowing, etc.), which indicate a live, reactive human being.

Head Movements and Orientation: Live humans also perform subtle head movements invisible to the naked eye. These movements are especially carried out when interacting with a face recognition system. They might consist of tilting or turning their heads. AI systems track movements of key facial landmarks such as someone’s eyes or nose, helping to track subtle motion detection and speed of head movement.

Lighting and Depth Perception: AI models can also use light reflection and shadows to detect liveness. Human faces reflect light differently than a flat photo or video would.

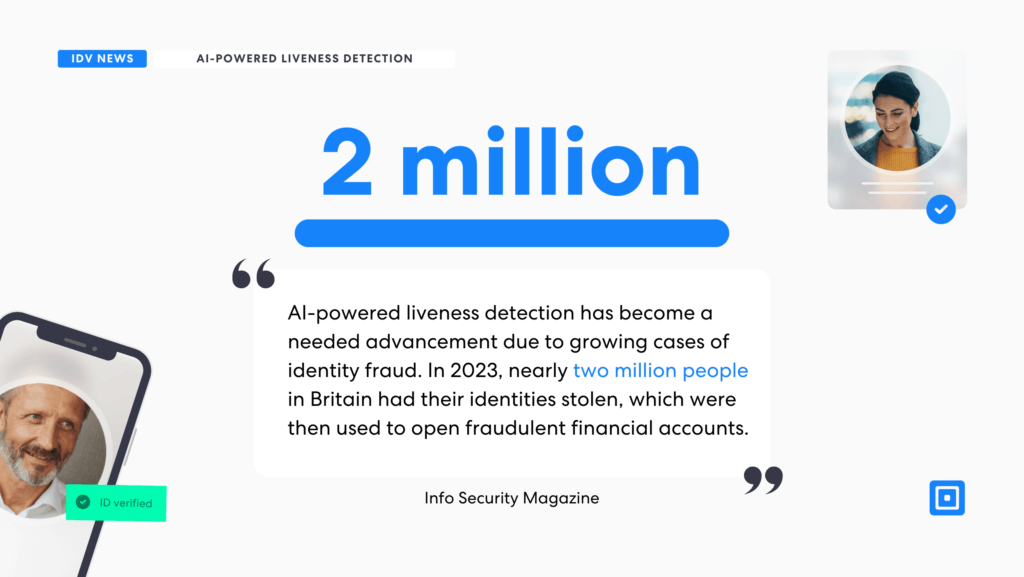

The Growing Threat of Identity Fraud

AI-powered liveness detection has become a needed advancement due to growing cases of identity fraud. In 2023, nearly two million people in Britain had their identities stolen, which were then used to open fraudulent financial accounts.

Fraud is evolving rapidly, and financial institutions are a prime target. According to the latest statistics, identity theft remains one of the most common and costly forms of fraud, with criminals leveraging stolen personal data to access financial accounts, make unauthorized transactions, and establish fake identities.

Biometric Verification Technology

Digital biometric verification enables the secure verification of anyone from anywhere. Facial biometric checks utilize advanced machine learning and facial recognition algorithms to quickly detect presentation attacks. In these attacks, bad actors attempt to impersonate others to gain access to financial accounts.

How is Identity Fraud Affecting Businesses?

For businesses, this growing threat presents a risk not just to their customers’ safety but also to their own financial stability and reputation. As digital transactions and online services become the norm, ensuring that only legitimate users can access financial accounts and sensitive data is essential. Traditional methods of verification, such as SMS codes or static passwords, have proven vulnerable to breaches and exploitation. This is where biometric identity verification offers a revolutionary solution.

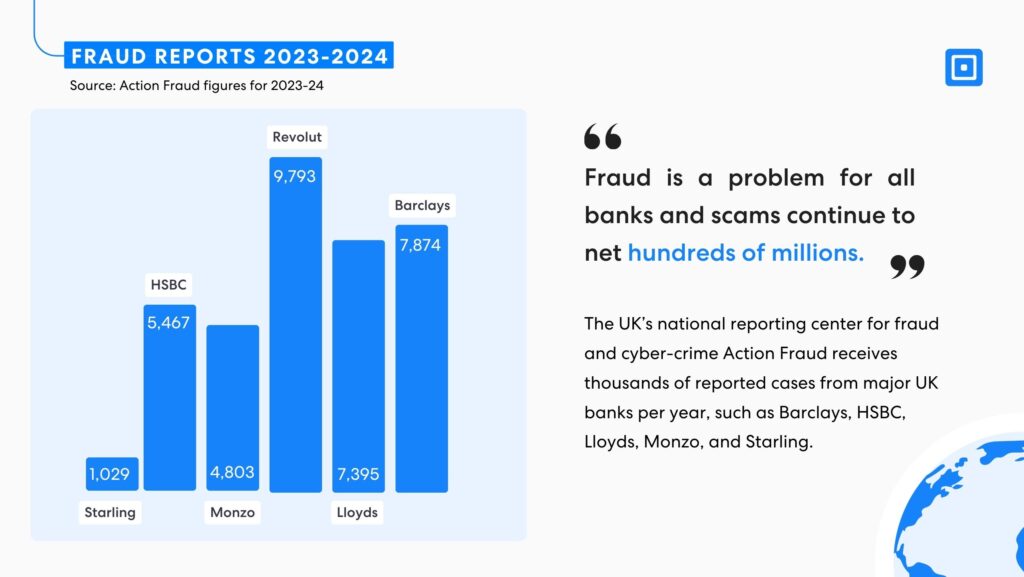

Criminals managed to bypass facial-recognition software to gain access to his account on their device. If an account is set up on a new device, Revolut asks for a selfie, which Jack says he did not provide.

A recent example highlighting the significant risks of inadequate biometric verification is a BBC article about a scam involving Revolut. The report details a case where fraudsters stole £165,000 from a Revolut business account.

The victim revealed that the criminals managed to bypass the identity verification process, gaining unauthorized access to his account and stealing the funds. This incident underscores the critical importance of robust biometric security measures to prevent such fraudulent activities.

The article reads, “Criminals managed to bypass facial-recognition software to gain access to his account on their device. If an account is set up on a new device, Revolut asks for a selfie, which Jack says he did not provide.” For more on this case, read “Revolut Falls Victim to Identity Fraud.”

The Benefits of Biometric Identity Verification in Fraud Prevention

Implementing facial biometric verification for robust security has several key benefits. These include compliance with regulatory standards, increased security, a drastic reduction in fraud risk, and a seamless user experience.

Enhanced Security

Biometric identity verification with liveness detection significantly strengthens security by analyzing facial biometric data. With traditional authentication methods like passwords, attackers can use brute force methods or phishing techniques to gain access. In contrast, biometrics are linked directly to an individual’s physical characteristics, making it exponentially harder for fraudsters to gain unauthorized access.

Reduced Fraud and Identity Theft

Financial institutions can drastically reduce the risk of identity theft by incorporating biometric checks into the verification process. Biometric solutions can detect fake identities by checking for signs of tampering or a mismatch between physical traits and stored data. This helps prevent fraudsters from impersonating legitimate users, making it harder for them to gain access to sensitive information or make fraudulent transactions.

Seamless User Experience

Biometric authentication offers a seamless, frictionless experience for customers. Instead of having to remember complex passwords or PIN codes, users can simply use their face, fingerprint, or voice for secure access. This reduces the likelihood of customers abandoning transactions or struggling with password resets—issues that are common with traditional authentication methods. As the demand for a frictionless user experience grows, biometric authentication provides a practical solution that ensures security without compromising convenience.

Selfie verification empowers global compliance. These solutions verify users in seconds and are typically entirely cloud-based. Running on a software-as-a-service (SaaS) business model, Identity Verification solutions can be distributed worldwide, meaning the same solution can be used by the same company worldwide.

Lastly, facial recognition offers greatly reduced business costs, particularly the Cost of Client Acquisition (CCA) and Customer Due Diligence (CDD). CDD, a wider part of an Anti-Money Laundering (AML) process, can take business hours per customer when manual methods are used. Automated KYC solutions, however, reduce the time and cost of these business operations.

ComplyCube: A Leader in Biometric Verification

ComplyCube’s advanced liveness detection technology ensures that the individual presenting an identity is physically present, effectively reducing the risk of AI-generated or spoofed identities. Their solution cross-checks identity details by combining facial recognition with document verification to prevent fabrication. Through seamless integration of biometric, document, and behavioral analysis, ComplyCube’s platform detects synthetic identities early, helping prevent fraudsters from gaining unauthorized access.

Key features of ComplyCube’s solution include:

Advanced Facial Recognition: ComplyCube’s cutting-edge biometric liveness detection, certified to ISO 30107-3 and PAD Level 2 standards, ensures that the person presenting an identity document matches the details provided. The Identity Verification (IDV) system leverages both biometric and behavioral analysis, offering robust protection against fraudulent or synthetic identities.

Comprehensive Document Verification: Combining AI-powered technology with expert reviews, ComplyCube meticulously verifies identity documents to ensure they are genuine and unaltered. This process checks for expired, forged, blacklisted, or tampered documents and covers a wide range of document types, including passports, driver’s licenses, national IDs, residence permits, visa stamps, and travel documents—providing extensive protection against identity fraud.

For more information on how to protect your business from fraud, reach out to one of ComplyCube’s compliance experts.