Financial Conduct Authority (FCA) crypto compliance is imperative in the United Kingdom, and firms must adhere to FCA crypto regulation and its crypto AML policies to operate in the region. This guide examines the challenges the UK faces with FCA crypto regulations and advocates for integrating with KYC crypto solutions to help with FCA crypto registration.

In the UK, cryptocurrency adoption has begun to exceed regulatory developments, creating a vacuum between crypto firms and federal regulation. This makes the legislative landscape in the UK extremely dynamic, open to change, and, inevitably, hard to predict.

Crypto Compliance Challenges in the UK

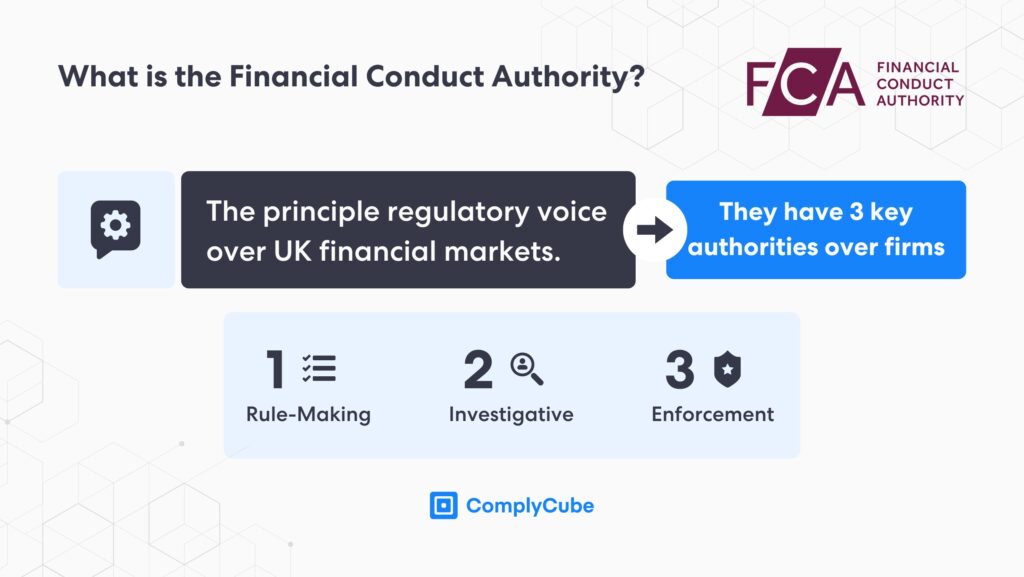

These factors have created a somewhat challenging environment for cryptoasset firms, leading many to actually evacuate the region. This is partly because the FCA, Britain’s leading regulatory authority, is the only body that creates rules for digital asset firms to follow.

The FCA ultimately has too much financial ground to cover to enact a comprehensive set of crypto regulations, particularly regulations that will attract firms ashore rather than usher them out.

A Digital Finance Agency is needed to shepherd the UK into a leadership position.

Gilbert Verdian, founder and CEO of Quant Network, has stated that the UK needs an independent digital asset regulatory authority. A regulatory body that only focuses on the administration of cryptocurrency regulation to ensure the UK keeps pace with other major powers and can become a digital asset hub.

Such a move would mimic the UAE and Dubai and likely contribute to, as it has done in Dubai, more comprehensive legislation. The Virtual Asset Regulatory Authority (VARA) was created in the independent state of Dubai and given sole authority to regulate digital assets in the Emirate. For more information on this, read UAE and Dubai Crypto Regulations in 2024.

FCA Crypto Regulation

The FCA has a customer-centric regulatory domain, meaning the body is most interested in consumer-side issues of compliance. This includes:

- Know Your Customer (KYC) and Anti-Money Laundering (AML)

- Correctly licensing compliant firms

- Marketing strategies and approving cryptoasset financial promotions

- False advertisement of risks involved

- Other consumer protection initiatives

Adhering to consumer-side regulations is extremely important in the cryptocurrency industry. Digital assets can be extremely volatile, and the incorrect description or marketing of crypto services can lead to UK consumers investing in assets beyond their risk tolerances.

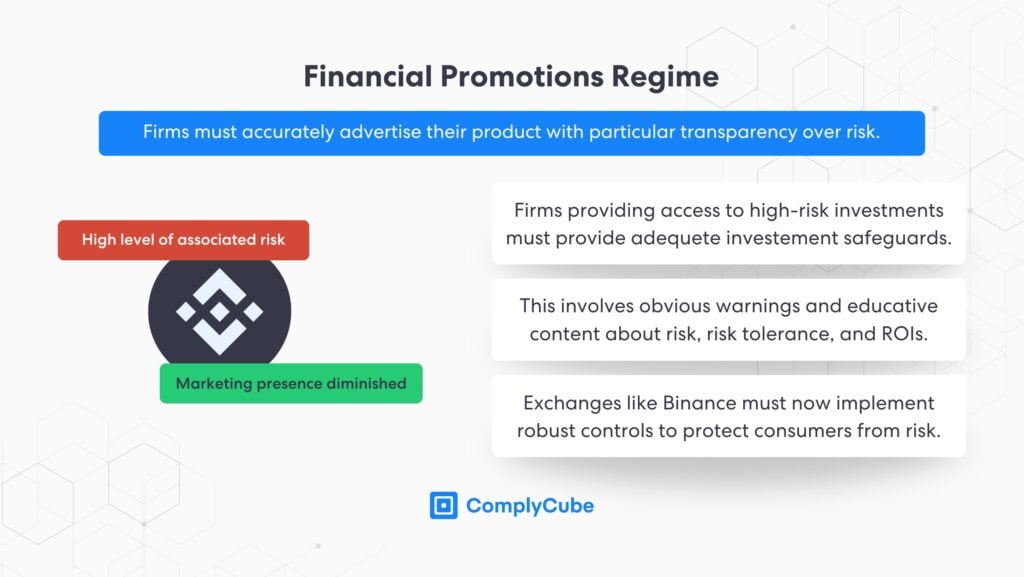

The Consumer Duty sets the standard for consumer protection across the UK’s financial services industries, including the crypto market. The FCA is responsible for approving financial promotions relating to how retail consumers are sold cryptoasset services, known as financial promotion rules, as well as adhering to payment services regulations.

Furthermore, cryptoasset firms must employ rigorous KYC and AML processes to help mitigate the use of digital assets in terrorist financing, money laundering, and other malicious financial activities. For more information about the Financial Conduct Authority’s rules and regulatory regimes, including specific information about FCA crypto registration and the financial promotions regime, read FCA Compliance for UK Cryptoasset Firms.

The Significance of FCA Crypto AML Policies

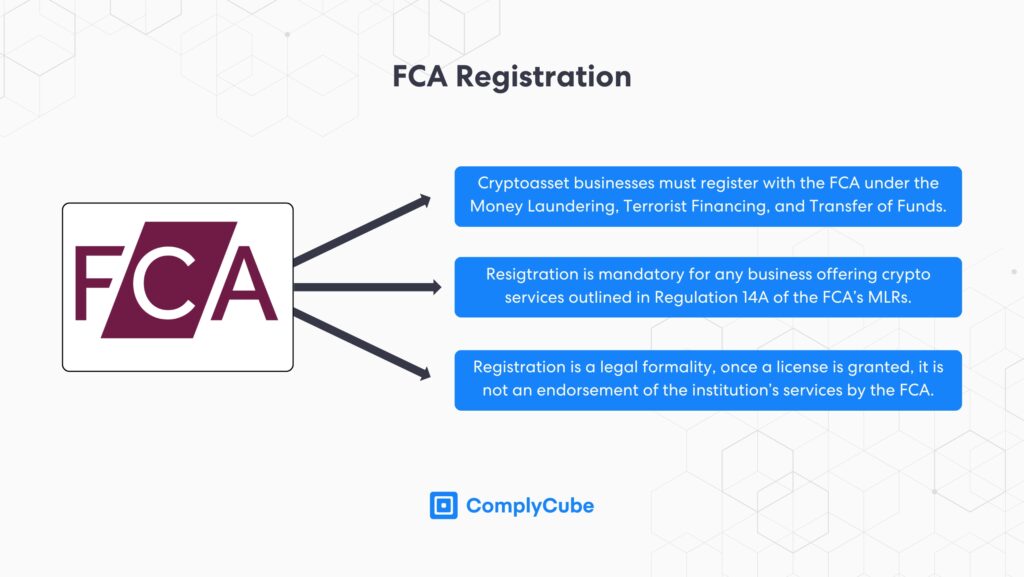

Under the regulations cited in the UK’s Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, firms must register with the FCA, and thus comply with its crypto AML and KYC regulations. These regulations are designed to mitigate the association of cryptocurrencies with money laundering and general misuse of digital assets.

Crypto AML Legislation

The Financial Conduct Authority strongly endorses the use of a Risk-Based Approach (RBA), which is creating a suitable compliance program that aligns with the associated risk your company holds in your industry. An RBA must mitigate risks of money laundering, terrorist financing, and other financial crimes through thorough identification and due diligence on consumers conducted around the clock.

This includes Enhanced Due Diligence (EDD) on higher-risk individuals, which could take the form of Politically Exposed Person screening (or PEP screening), adverse media checks, and sanctions screening. These AML processes are known more broadly as a Know Your Customer workflow and are vital in safeguarding the national and international financial systems.

KYC Crypto Process

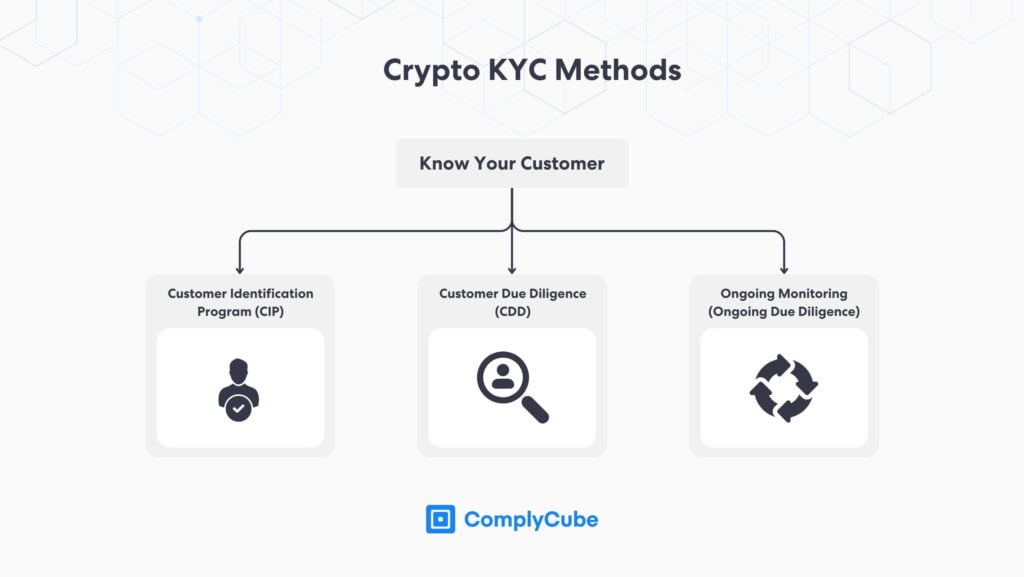

As discussed, a robust KYC workflow is a vital component of a firm’s AML compliance program and should produce a high level of assurance in a user’s identity and level of risk. The FCA’s crypto AML regulations align with the Financial Action Task Force’s (FATF) Recommendations, particularly around conducting an RBA, Identity Verification (IDV), and Customer Due Diligence (CDD).

Integrating with a KYC solution provider is the most assured method of obtaining an FCA crypto registration, and the regulatory authority strongly advises using these kinds of technologies. Able to automate the client acquisition process, crypto KYC services greatly reduce the cost spent on customer onboarding, reduce regulatory probing, and generate a heightened sense of customer security with users.

KYC solutions are now internationally recognized as the leading compliance enabler. A large reason behind this is the development of fraudulent methodologies, particularly related to Generative AI. For more information on why, read Online Fraud Prevention with IDV Solutions.

The Future of FCA Crypto Regulation

Crypto regulations are likely to significantly evolve over the coming years, potentially exceeding the current jurisdiction of the Financial Conduct Authority. Below are key areas that will likely be iterated.

Enhanced Consumer Duty and Protection Rules

The FCA’s Consumer Duty will likely expand into enhanced transparency that prioritizes consumer protection even further. This will likely involve clear communication of the risks associated with using certain services.

One key issue is the poor permissions controls associated with particular crypto trading services. For example, the futures market in crypto relates to perpetual and fixed-date contracts on regulated Centralized Exchanges (CEXs).

Futures trading enables the use of margins and leverage, and there is very little regulation as to which users are granted access to these features. Crypto futures are a highly volatile market and, on an exchange like finance, can account for over triple the trading volume of the spot market. They can be likened to standard trading with no advanced finance tools.

Expansion into Decentralized Utilities, such as DeFi

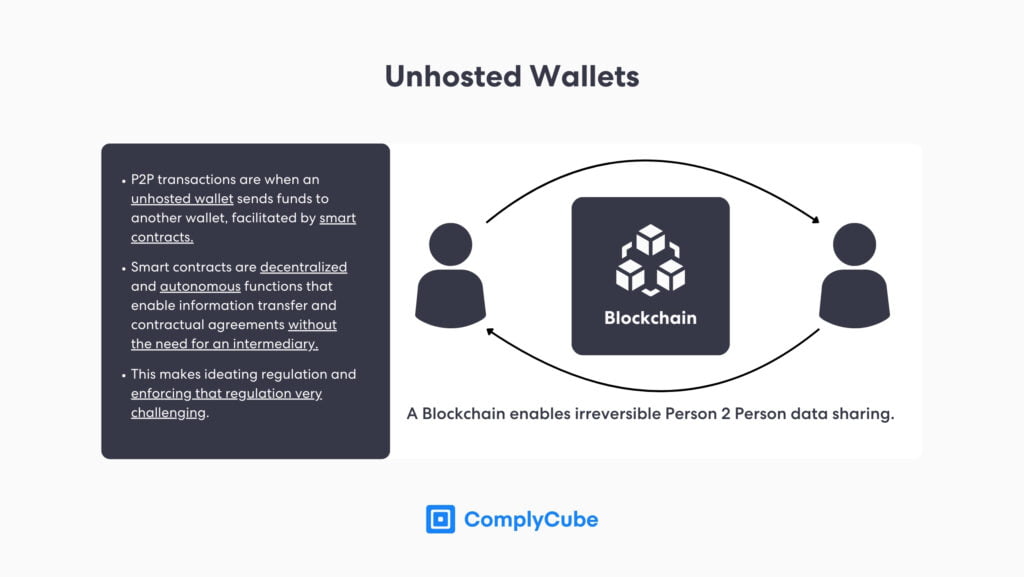

As Decentralized Finance (DeFi) becomes less volatile as the world adopts blockchain, the FCA is likely to expand its regulatory oversight into this emerging sector. DeFi presents unique challenges for regulators because it operates without intermediaries, often relying on smart contracts to facilitate financial transactions.

The decentralized nature of these platforms can make traditional regulatory approaches ineffective, prompting the need for new frameworks to govern lending, staking, and liquidity provision. The FCA may seek to enhance consumer protections in DeFi by focusing on smart contract auditing and ensuring AML/KYC compliance across DeFi protocols, such as Decentralized Exchanges (DEXs).

Continued alignment with global standards set by the FATF

The FATF remains the global regulator for AML and CTF policies, and the FCA has consistently aligned its crypto regulations with FATF guidelines. One key rule is the FATF’s Travel Rule, which requires crypto firms to share information about transactions and is increasingly being adopted worldwide.

As the FATF refines its guidelines to address new challenges in the crypto space, the FCA is expected to follow suit, ensuring that UK regulations remain consistent with international standards. This will help mitigate risks related to money laundering and terrorist financing.

FCA Crypto Regulation at a Glance

Adhering to FCA crypto regulations is a must for digital asset services. Noncompliance with the body’s regulations will result in (and has already resulted in) significant AML fines, along with potential barring of operation in the region.

Certain firms’ responses to the FCA rules have been to leave the region completely until further notice, something which is actually a negative consequence for the UK. If Britain wants to develop its digital asset sector, it wants to attract the industry heavyweights ashore. It seems that the most sure way to ensure this happens is to create regulatory certainty through the creation of a sector-specific digital asset regulatory authority.

For 2024 onwards, however, firms wishing to obtain a crypto license with the FCA must adhere to its set of regulations. For cryptoasset services and businesses that are looking to obtain such a license, contact ComplyCube to ascertain how its range of compliance solutions can help.