Asia has multiple hot spots vying for leadership in the crypto market. Singapore crypto regulation has catalyzed the region’s web3 and blockchain industry, propelling the country forward as an industry leader. This cryptocurrency Singapore guide digests the region’s regulatory framework and evaluates its position as a crypto hub in 2024.

Competitive regions in Asia, including Hong Kong and larger countries such as South Korea, now facilitate the infrastructure needed for crypto adoption. Their respective governments have implemented legislation that safeguards the industry and its users by deterring the irresponsible or illicit use of cryptocurrencies. So, where does Singapore rank?

Singapore Crypto Regulation Overview

In Singapore, individual cryptocurrencies are classified based on their characteristics. They can be regulated as securities, e-money, or Digital Payment Tokens (DPTs). However, if a cryptocurrency is used strictly for utility purposes, it remains unregulated.

The Monetary Authority of Singapore (MAS) does not back any cryptocurrencies for retail use but is actively pursuing an institutional stablecoin program. Such programs involve Central Bank Digital Currencies (CBDCs) via initiatives such as Project Ubin, Project Dunbar, Project Orchid, and Project Guardian.

- Project Ubin focuses on blockchain settlements for payment security transactions and is designed to streamline cross-border payments.

- Project Ubin+ is a collaborative effort between Singapore and international organizations using wholesale CBDCs (digital currencies designed for institutional use only) for cross-border foreign exchange settlements.

- Project Dunbar explores how financial institutions could use CBDCs to facilitate direct transfers via a shared platform, bypassing traditional and inefficient intermediaries.

- Project Orchid looks at establishing an infrastructure for a retail CBDC system. This retail-centric approach is viewed as a less significant development as issues of financial inclusion and transparency for users are not deemed urgent.

- Project Guardian is a tokenization initiative that researches the efficacy and utility of tokenizing Real-World Assets (RWAs) such as bonds, bank liabilities, and asset-backed securities. Tokenization could reduce users’ barriers to finance and increase liquidity in financial markets.

Deutsche Bank has recently joined Project Guardian to explore the applications of tokenization in traditional financial markets. Bridging RWAs on-chain is a quickly developing trend between the crypto industry, Decentralized Finance (DeFi), and Traditional Finance (TradFi).

The collaborative initiative is dedicated to testing the feasibility of asset tokenization applications in regulated financial markets.

Singapore was an early mover in cryptocurrency regulation, establishing comprehensive legislative coverage in 2019 through its Payment Services Act (PSA). Arriving at the crypto regulation game ahead of many other global regions gave the province an advantage for its industry development. Some of these projects represent industry-leading innovation and adoption of blockchain technology.

Who Regulates Crypto in Singapore?

The Monetary Authority of Singapore is the leading voice of authority in Singaporean financial markets and is the chief regulator in the cryptocurrency industry. The federal organization has released various regulatory frameworks, many of which are frequently praised for their innovation.

The MAS frequently updates the regulatory landscape to ensure the region stays aligned with the developments of the broader crypto industry. One example of this resides in the 2023 consultation papers issued by Singapore’s central bank, which reevaluated and reformed DPT service providers’ use and custody of client funds under a statutory trust.

The government in Singapore does not have some of the inefficiencies of other financial hubs. While democratic, the leading party has a vast majority in parliament, allowing policies and laws to be passed swiftly. Singapore has a much more efficient mechanism for creating and implementing complex regulations and laws than the UK, US, or Hong Kong.

The Payment Services Act

The PSA, passed in 2019, is Singapore’s leading framework for the crypto market. It is designed to provide regulatory certainty in what is sometimes a loosely defined industry. All payment service providers must obtain a license with the PSA.

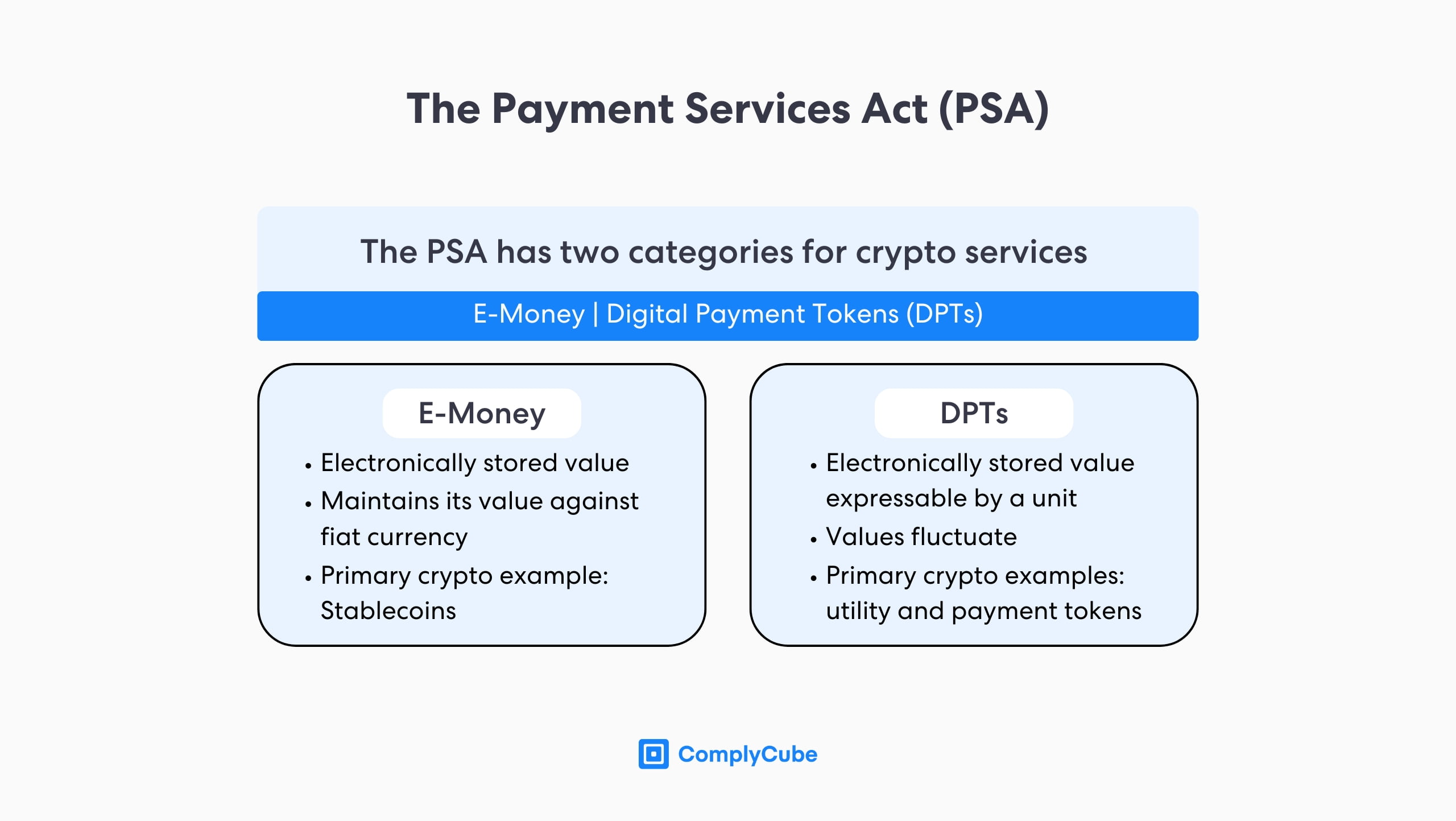

The PSA divides cryptocurrencies into two categories. Some Virtual Assets (VAs) may be outside the PSA’s jurisdiction and regulated under Singapore’s Securities and Futures Act (SFA). This would be the case if a VA displayed characteristics similar enough to assets in Singaporean capital or securities markets. It is the SFA’s prerogative to define the security-like VA class. The two categories under the PSA are:

- E-money is electronically stored monetary value that keeps its value against any chosen fiat currency, such as a Singapore Dollar, euro, or Pound. In the context of cryptocurrencies, these can be compared to stablecoins.

- Digital Payment Tokens are any digital model of value that can be identified and expressed as a unit. They are not pegged to or remain in constant value against a fiat currency. In the crypto industry, these can be viewed as utility and payment tokens.

The PSA requires all businesses categorized as payment service providers, including Virtual Asset Service Providers (VASPs) and Digital Payment Token service providers, to obtain a license. 2 out of the 3 PSA licenses relate to cryptocurrencies.

PSA Licensing Requirements

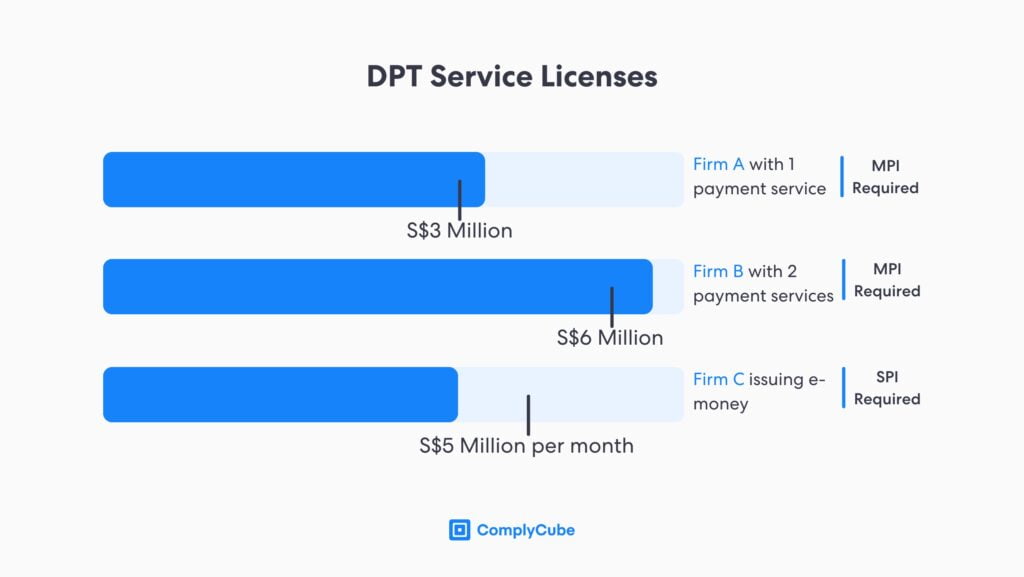

The 2 licenses are the Standard Payment Institution (SPI) license and the Major Payment Institution (MPI) license. If a VASP’s monthly transaction value exceeds S$3 million (3 million Singaporean Dollars) for any single payment service, the firm must gain a major payment license.

Additionally, an MPI license is also required if a firm’s monthly transactions surpass S$6 million for 2 or more payment services. MPI licenses are also needed for e-money providers if the value per annum of all e-money issued by the license holder exceeds S$5 million per day on average. Any values under these thresholds require only an SPI license.

Getting a Singapore Crypto Regulation License

A third type of financial license is available in Singapore—the Money-Changing license—but this does not relate to VASP or DPT services. To obtain an SPI or MPI license, the following applies:

Standard Payment Institution License application:

- Be a Singapore-incorporated company or Singapore branch of a foreign firm

- Have a permanent place or office for your business where company records can be held safely

- The office must have a minimum of 1 individual present to help with potential consumer issues

- Own a minimum base capital of S$100,000, with a sufficient excess buffer for profit and loss

- A minimum of 1 executive director with Singaporean citizenship or permanent residency

For a Major Payment Institution License application, the same criteria apply with the exception of the value of base capital required. Firms wishing to gain an MPI license require S$250,000.

Payment Services Act Notices

Notice PSN01 pertains to Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) policies for payment service license holders. Under this notice, the payment service provider must perform certain prescribed Customer Due Diligence (CDD) measures if it facilitates a transaction over S$5,000 for a customer who has not established a relationship with the institution.

Notice PSN02 specifically relates to Digital Payment Token Services and references advanced measures to prevent money laundering and the financing of terrorism. These notices were posted in 2019, amended in 2021, and restructured again in April 2024, where the definitions of DPT service providers were expanded.

Following the update, various cryptocurrency-related activities, including the provision of wallet services for DPTs, custodial services, and the facilitation of DPT exchanges without requiring the service provider to hold the funds or tokens, were now included in the regulatory framework. This measure helps impose user protection throughout the industry.

These measures ensured that the cryptocurrency industry would be encompassed by the PSA and that all aspects of the market were regulated and supervised sufficiently to encourage a secure and integral industry.

Financial Services and Markets Act (2022)

The Financial Services and Markets Act (FSM Act) regulates financial institutions in Singapore that provide a Digital Payment Token Service both in and outside of the country. This ensures that all VASPs operate consistently, regardless of where their target market resides. It is fundamental in engaging Singaporean crypto businesses with the regional regulatory framework for AML and CFT policies.

FSM Act Core Functions:

- Facilitates digital token exchanges: Firms providing a digital token exchange (crypto exchange or VASP) must comply with regulatory requirements to mitigate financial abuses and acts of money laundering. This also extends to firms that market or promote activities relating to buying, selling, or holding digital assets.

- Provides financial advice on digital tokens: Businesses providing investor or financial advice relating to DPTs also fall into the jurisdiction of the FSM Act, with a view to ensuring advice is only given by trained, professional, and regulated individuals.

- Comprehensive scope: The act is designed to encompass the entirety of the digital asset market, including exchanges, custody services, and more, to create a framework that attracts crypto firms catering to a diverse range of utilities.

- Global compliance reach: Ensuring the FSM Act regulates firms operating outside of Singapore affirms the region’s position as a leading international crypto hub.

- Periodically implemented: Phasing the framework in slowly ensures that VASPs can integrate into (or adapt their existing processes for) the regulations. By the end of 2024, the framework is anticipated to be fully integrated.

Adhering to money laundering regulations is crucial to being compliant with the Financial Services and Markets Act. Many, if not all, DPT services leverage some kind of KYC and AML solution provider to enable adequate compliance. If your firm requires one, learn more about crypto KYC solutions by reading How KYC Crypto Regulations Safeguard the Industry.

Singapore AML Requirements

According to the updated PSN02 Notice from the MAS, Digital Payment Token services are required to put in place stringent mechanisms to detect and prevent the flow of illicit funds into Singapore’s financial system through digital assets. To do this, VASPs and DPT services must employ:

- A Risk-Based Approach (RBA) and thorough risk assessment and mitigation strategies,

- Rigorous Customer Due Diligence (CDD) procedures, including Enhanced Due Diligence (EDD) and Simplified Due Diligence (SDD),

- Third-party technologies to ensure adequate protection against illicit finance,

- Corresponding accounts and deposit/withdrawal information with thorough record-keeping,

- Transaction Monitoring and the infrastructure for a suspicious transaction reporting office,

- Internal compliance and audit training policies.

These requirements are easily followed when a firm uses a third-party KYC and AML solution. Crypto exchanges worldwide and most medium—to large-scale enterprises use a KYC onboarding solution to remain competitive.

Without compliance technology, firms and DPT services would find it impossible to comply with demanding legislation while onboarding the volume of customers necessary to remain competitive. The most popular crypto exchange by users and trading volumes, Binance, signed 30% more customers in 2023 than in 2022, displaying exceptional year-on-year growth.

Over 40 million new users.

Onboarding this volume of clients would be impossible without a highly scalable, accurate, and automated KYC solution. Leveraging AML solutions to streamline client acquisition is one of the many reasons crypto exchanges have achieved such notoriety over the past years.

ComplyCube’s compliance platform provides DPT services with an all-in-one solution for client acquisition and real-time Anti-Money Laundering monitoring. This collection of products ensures that VASPs have a comprehensive compliance program.

Singapore Crypto Regulation: The Crypto Trave Rule

The crypto travel rule is a pivotal regulation in Singapore, deriving from the Financial Action Task Force’s (FATF) Recommendation 16. It requires the collecting and sharing of client data when transactions exceed a certain threshold. While the threshold is open to the discretion of local regulators, it is S$1,500 in Singapore. For more information about how to comply, read The Crypto Travel Rule.

Singapore Travel Rule Requirements

Before a transaction can be submitted, DPT providers must collect and share the personal data of each user involved in the transaction on behalf of the originator or the beneficiaries of the transaction. This includes the names and account numbers of both users/parties involved in the transaction as well as the transaction ID (transaction hash if it is on the blockchain).

For transactions below S$1,500, only the following information is required:

- Name of the originator

- The originator’s account number

- Name of the beneficiary (or the individual receiving the funds)

- The beneficiary’s account number

For transactions exceeding S$1,500, further data is required on top of the above-mentioned information:

- The originator’s address

- A government-issued identification number, such as a passport number

- Date of birth, along with any other pertinent personal information

Enforcing this rule is much more difficult when an unhosted wallet is involved in the transaction. Unhosted wallets do not require any sort of KYC or client acquisition process to sign up, making compliance with the travel rule more challenging as there is no customer information to transfer.

While the crypto travel rule is increasingly being adopted globally, there remain several challenges to its full adoption. Unhosted wallets are identified through only a series of numbers and letters. The MAS offers advice on best practices when unhosted wallets are receiving or sending transactions.

Asian Crypto Cooperation at a Glance

Various Asian regions, particularly Hong Kong and Singapore, have been perceived as rivals for some time. While both vying for the top spot in Asian finance, Singapore has certainly been the relative winner in recent decades.

However, recent reports in 2024 suggest that there might be future cooperation between these provinces in the crypto industry. Hong Kong’s advances with crypto ETFs, particularly in Ethereum and Bitcoin financial products, set the stage for an altcoin Exchange Traded Fund.

A strategic partnership between Harvest Global (Hong Kong ETF administrator) and Metacomp (Singapore-based digital assets group) could extend these ETFs to the Singaporean market, marking a significant and revitalized financial relationship between the two provinces.

Furthermore, Hong Kong and Singapore crypto regulations are both comprehensive enough to attract talent to a bustling crypto industry but nuanced enough to attract different firms/institutions for different reasons. For more information on Hong Kong crypto regulations, read Hong Kong Crypto Regulation in 2024.

Should you Integrate with a KYC and AML Solution?

Partnering with a compliance provider will significantly streamline your operations. Client acquisition, solutions, customer case management, and real-time AML monitoring are just some of the beneficial solutions that DPT services in Singapore and VASPs worldwide are already using to remain competitive.

Furthermore, the MAS heavily endorses the use of 3rd-party compliance technologies to optimize internal processes and assure compliance with the region’s crypto regulatory framework. ComplyCube offers a suite of KYC and AML compliance services used by cryptocurrency firms to grow around the world.

Wherever your DPT, VASP, or crypto firm is based, ComplyCube’s global reach catalyzes local compliance, national growth, and international expansion efforts. If you’re interested, start a conversation today and request a demo from their team of experts.