It’s natural to question whether you’re happy in any relationship, even with your KYC provider. Evaluating whether you receive the support and functionality needed to sustain full compliance and seamless operations is necessary for every business, especially within financial services. In this guide, we’ll help you spot the red flags, navigate the tricky process of breaking up with the wrong KYC platform, and how to find the one that’s just right for you.

Spotting Red Flags within Your KYC Service

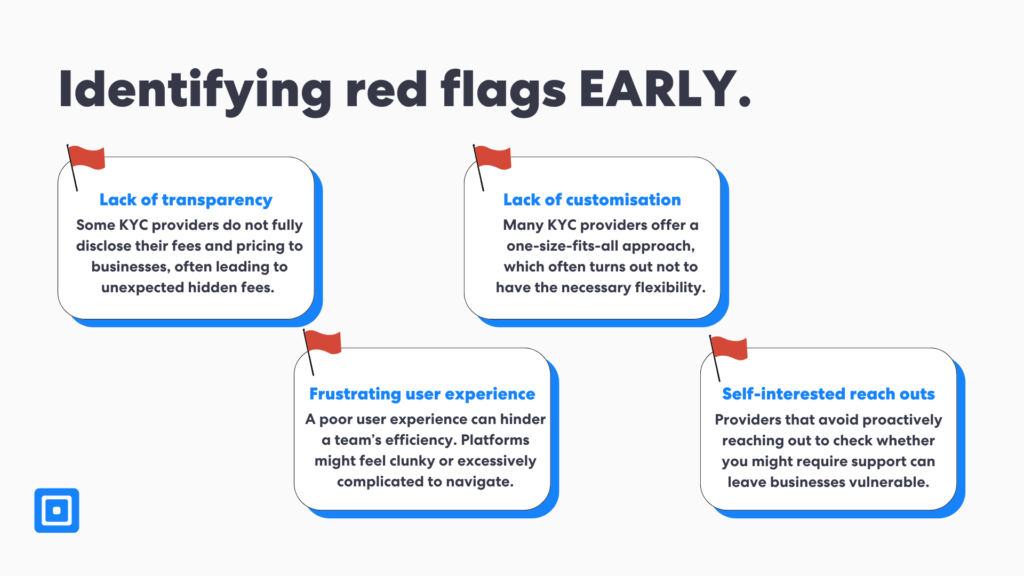

Red flags within KYC services are not always easy to identify. Knowing what to be aware of, both when looking for a new provider or when reassessing your current platform, is key to both remaining compliant and ensuring you’re maximising value.

Lack of Transparency

Some KYC providers do not fully disclose their fees and pricing to businesses, so businesses often pay for packages that do not include the necessary features. Unexpected fees can arise for support, data retention, or report generation. This could indicate a lack of transparency or a focus on maximizing revenue at your expense. The set-up fee is a common hidden cost when partnering with an AML and KYC compliance platform. Providers often charge for integrating their AML tools into your existing systems, with costs potentially reaching up to £20,000, a significant outlay for many businesses. Another often-overlooked expense is data retention and the ability to download reports. These features may not be included in the standard package and could be offered only as paid add-ons, resulting in unexpected costs for the customer. For more information on KYC and AML pricing and common hidden fees, read “AML Check Cost: Hidden Fees in Compliance.”

Poor User Experience

A poor user experience can hinder a team’s efficiency, often when a KYC platform feels clunky or excessively complicated to navigate. Ensuring you’re able to use user-friendly technology that your team feels comfortable using is necessary for seamless operations. When the interface is unintuitive, employees may struggle to access or input the necessary data, increasing the likelihood of errors. This wastes time and can lead to compliance risks if information is incorrectly processed or overlooked. An effective KYC platform should provide an intuitive, easy-to-navigate dashboard, clear instructions, and responsive design across devices. Customizable features that allow you to adjust the interface to fit your needs are also a plus.

Lack of Customization

Many KYC providers offer a one-size-fits-all approach, which often turns out not to have the necessary flexibility for specific requirements. If your provider offers rigid solutions that cannot be tweaked and refined for your specific use cases and compliance requirements, this might be a red flag that your business should not ignore. Additionally, if the platform doesn’t allow you to adjust things like screening thresholds, reporting formats, or user access controls, it could lead to inefficiencies or missed risks. Your compliance needs will change as your business evolves, and a rigid, cookie-cutter solution may struggle to keep up. Without customization options, your operations could become more cumbersome, and you might find yourself using a system that doesn’t align with your processes, potentially causing bottlenecks and increasing the likelihood of errors.

Self-Interested Reach Outs

Providers who ghost you in times of need or avoid proactively reaching out to check whether you might require support can leave businesses vulnerable to non compliance fines due to a lack of seamless operations. Often, providers will reach out only when beneficial to them, asking whether you’d like to renew your package or even with an upsell attempt. Assessing whether your provider is proactively managing your account and even monitoring the health of your compliance process is absolutely critical.

Breaking Up with a Bad Provider

It can be time-consuming to part ways with your current provider and search for a new one that can provide you with increased value. Reviewing your contract with your KYC provider will be a necessary first step, as you’ll need to look for terms related to termination, notice periods, and any penalties for an early exit to ensure that your business is not faced with any unexpected costs.

Securing Compliance Data

Once you have read the fine print and understand these terms, ensuring that all of your compliance data is up-to-date and securely stored is critical. This includes your client records, risk assessments, reports, and any other necessary documentation related to compliance. Check that client records are complete and accurate, and verify whether or not your provider has updated and maintained your data in line with regulatory requirements and national laws.

After validating these points, confirming how you can export this data is necessary. Saving copies of all important compliance documents and records in a secure, accessible format is essential. This ensures that you’ll have full access to the data necessary to remain compliant, even if there is a delay or problem during the transition period.

Looking For a New Provider

Next, it’s time to choose a new provider. After deciding to leave your current plan, start doing some research on what platforms might be able to meet your needs and deliver more value. Focus on finding a platform that offers flexibility and ongoing customer support. It’s important to assess your essential needs at this point, such as risk assessments, system integration, or scalability, and communicate these with possible new providers. Read reviews and ask for recommendations to get a good sense of the provider’s reliability, if possible. In addition, requesting demos to test the platform firsthand and confirm it meets your technical and usability requirements can be very helpful.

Finding “The One”

When choosing a new KYC provider, prioritize factors like up-to-date compliance features, seamless integration with your existing systems, scalability for future growth, and a user-friendly interface. Ensure robust data security, transparency in pricing (with no hidden fees), and responsive customer support. Check the provider’s reputation through reviews and industry feedback, and look for flexibility in contract terms to avoid long-term commitments. By considering these elements, you can partner a KYC provider that aligns with your business needs, supports compliance, and scales with your operations.

Scalability should be top of mind—your KYC solution should grow with your business, offering flexibility for future expansions, whether you’re entering new markets or adding more complex compliance requirements. A user-friendly interface is essential; a platform that’s intuitive and easy for your team to navigate will help reduce errors and training time.

Robust data security is non-negotiable. Look for providers with strong encryption protocols and secure storage for sensitive client information, ensuring you’re protected from data breaches. Transparency in pricing, without hidden fees, is also crucial; ensure the provider is clear about any additional costs for features like data storage, report generation, or customer support.

Responsive and knowledgeable customer support is another factor to consider. Your provider should be readily available to address issues or provide guidance when necessary. To assess a provider’s reliability, review client testimonials, industry feedback, and ask for case studies that demonstrate their ability to handle challenges similar to yours.

If you’re looking for a new KYC provider, have a chat with our expert compliance team to see if our platform can address your needs.