It might seem like the risk of identity fraud is a small threat to your organization, with many individuals and businesses believing that these crimes only affect a small percentage of businesses – a simple misconception that could cost you millions. Almost two million people in Britain were victims of identity theft in 2023, with many of their identities being stolen to open fraudulent financial accounts. Without a sophisticated biometric presentation attack detection process in place that leverages liveness detection software, there’s no way of knowing whether your customers are who they claim to be, and there’s no way of finding out before it’s too late.

Sophisticated presentation attacks often bypass biometric systems, leaving firms vulnerable to fraud. Businesses must protect themselves with liveness detection software to ensure intelligent biometric presentation attack detection processes as we enter an age in which deepfakes infiltrate the internet and become more accessible than ever.

The Growing Threat of Identity Theft

Each year, the identity theft and fraud statistics become more alarming than the last, and the latest are no exception. 552,000 identity theft cases were reported in the first half of 2024 in the United States, with forecasts expecting the overall 2024 count to exceed the number reported in 2023.

According to a Javelin Strategy & Research report, identity theft cases resulted in losses of $23 billion in 2023, having increased from $20 billion in 2022, and are on track to surpass this once again in 2024. The reason that identity theft keeps creeping up on a global scale is simply the fact that it has become easier and easier to steal an identity. The use of the internet and the proliferation of the dark web have certainly enabled these practices. The dark web has become a marketplace for sensitive identity information stolen during data breaches. Scammers can then create synthetic identities leveraging this stolen information in order to subvert authentication processes.

The anonymity offered by the dark web makes it attractive to malicious actors who use it to carry out criminal activities such as identity theft and fraud.

A piece written earlier this year by the cybersecurity company Acronis stated that “The anonymity offered by the dark web makes it attractive to malicious actors who use it to carry out criminal activities such as identity theft and fraud. Criminals can steal personal data such as credit card numbers, passwords, and Social Security numbers without being detected or traced. This type of activity can be extremely damaging to both individuals and businesses alike.”

However, while the dark web offers a great way of accessing sensitive data, it certainly isn’t the only available source for fraudsters. Social media is full of information regarding personal identities, with many users divulging information regarding their full name, address, and close relationships online. A fraudster only really needs to open Instagram to find what they need, as has been the case with the company cloning scandal in the UK.

Both businesses and individuals are at risk of identity fraud, with the company cloning scandal regarding Companies House in the United Kingdom having shone a light on the prevalence of business identity fraud. This consists of a form of fraud in which fraudsters register a false company, cloning an existing business. Information on the identities of key stakeholders is often taken from social media.

Due to a lack of stringent checks, hundreds of fraudulent companies are registered each month. The scammers then take out loans, receive investments, and more in order to monetize their scams. With all businesses at risk and reports of these fraudulent practices have gone on for several years now, a necessary next step is the implementation of a sophisticated biometric check that includes liveness detection to be carried out while anyone registers a company. While there might be an initial cost to setting this up, the return on the money and time invested would be insurmountable. It would be the integrity of the British entrepreneurial economy.

Identity Theft and Credit Card Fraud

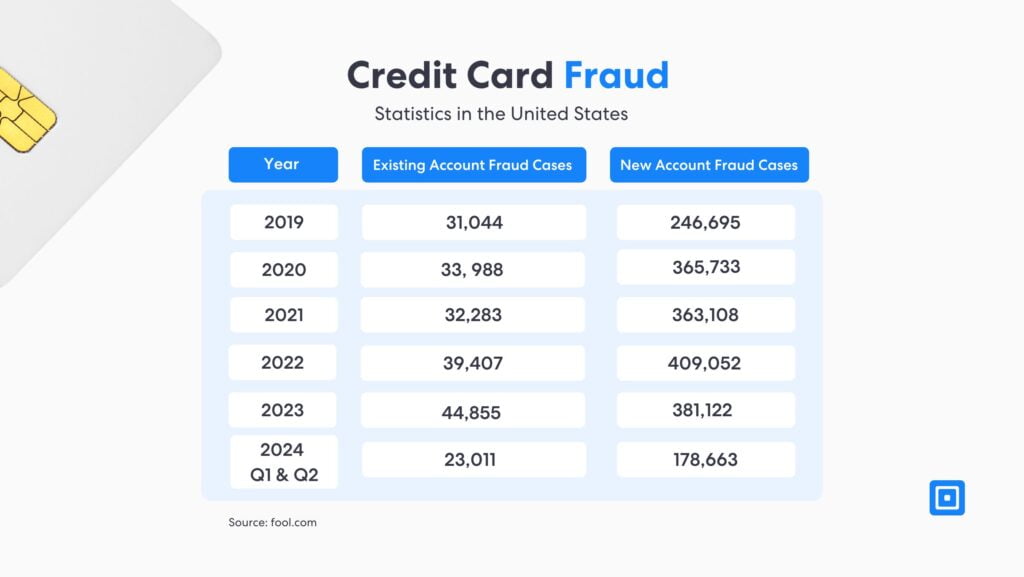

A leading motive for identity theft is credit card fraud, with roughly 215,000 cases reported to the FTC in the United States in the first half of 2024. Worryingly, this figure is 6% higher than the last 6 months of 2023, showing a continual rise in these practices.

The two main types of credit card fraud include a fraudster opening a new credit card in the victim’s name or using a credit card that the victim had already opened. The latter involves stealing credit card details as well as personal information. 90% of the cases involve new account fraud, although existing account fraud is also on the rise.

Biometric verification and liveness detection can be implemented to end these criminal practices. For existing account fraud, these solutions ensure that only legitimate cardholders can perform sensitive actions, such as changing account information, requesting a new card, or approving transactions. For new account fraud, biometric liveness detection would check whether the person attempting to create the account is physically present and that their biometric identity matches results from a document check, ensuring submitted information is accurate.

New Research Conducted in the UK by FICO

Liveness detection technology has become increasingly demanded by consumers when considering opening a new bank account. A new study conducted by FICO underlines that 73% of people consider comprehensive fraud protection a primary concern when creating their accounts.

Fraud protection isn’t just a safety measure; it’s a competitive advantage.

The study found that the kind of fraud that British citizens worry about most is their identity being stolen to create a fraudulent account. This concern is certainly understandable, as identity theft can lead to significant financial loss and long-term damage to one’s credit history. This growing demand for liveness detection offers organizations the chance to secure a competitive advantage, as by offering it as part of their security processes, they can set their offering apart from their competition.

Data Suggests Deepfakes on the Rise

Deepfakes have become an increasing threat to businesses, as biometric authentication systems are often unable to detect these presentation attacks unless liveness detection is leveraged. While this is a concern for all industries with sensitive information, governments and the financial sector have been heavily targeted.

In 2021, fraudsters in China purchased high-quality photographs of faces through the internet. They then created deepfakes that tricked the Chinese government’s facial recognition technology. The group stole $175 million USD through fake tax invoices.

Since then, these attacks have only increased. In just 2023, the use of deepfakes to subvert face authentication processes increased by 704% in the US. The US Department of Homeland Security warned that “deepfakes and the misuse of synthetic content pose a clear, present, and evolving threat to the public across national security, law enforcement, financial and societal domains.”

Liveness Detection Technology in Demand

With the high demand for robust fraud prevention when opening new accounts, state-of-the-art presentation attack detection processes are not just a safety net for users but should be seen by businesses as a competitive advantage. James Roche, a principal consultant at FICO, states, “Customers are looking for providers they can trust, so institutions should shout about the excellent fraud protection they provide.”

However, 18% of people answered that they would abandon opening a current account if identity checks were too difficult or time-consuming. Liveness detection and sophisticated processes must, therefore, be balanced with a positive user experience.

Choosing the Right Provider

At ComplyCube, we pride ourselves on our state-of-the-art IDV and AML checks, offering both advanced checks and positive user experiences. We streamline onboarding processes to less than 30 seconds while ensuring accurate IDV, AML, and KYC checks.

Get in touch with our expert compliance team to learn more about how you can implement liveness detection and protect your organization from sophisticated attacks.