Tokenization, especially the tokenization of Real World Assets (RWAs), has been enjoying a resurgence in the blockchain space recently, thanks to increasing adoption by financial institutions and MiCA regulation. Goldman Sachs, for instance, recently announced plans to launch three tokenization projects by the end of 2024. But what exactly are tokenized RWAs, and how does new regulation, like MiCA crypto regulation, impact the industry?

Understanding RWAs and their Tokenization

Think of RWAs as tangible and intangible assets from the physical world that we can now represent as digital tokens on a blockchain. These RWAs can be anything from commodities and real estate titles to intellectual property and even art. Tokenization is the process of converting these assets into digital tokens, making them easier to trade, granting increased liquidity, and reducing transaction costs.

What is MiCA Regulation?

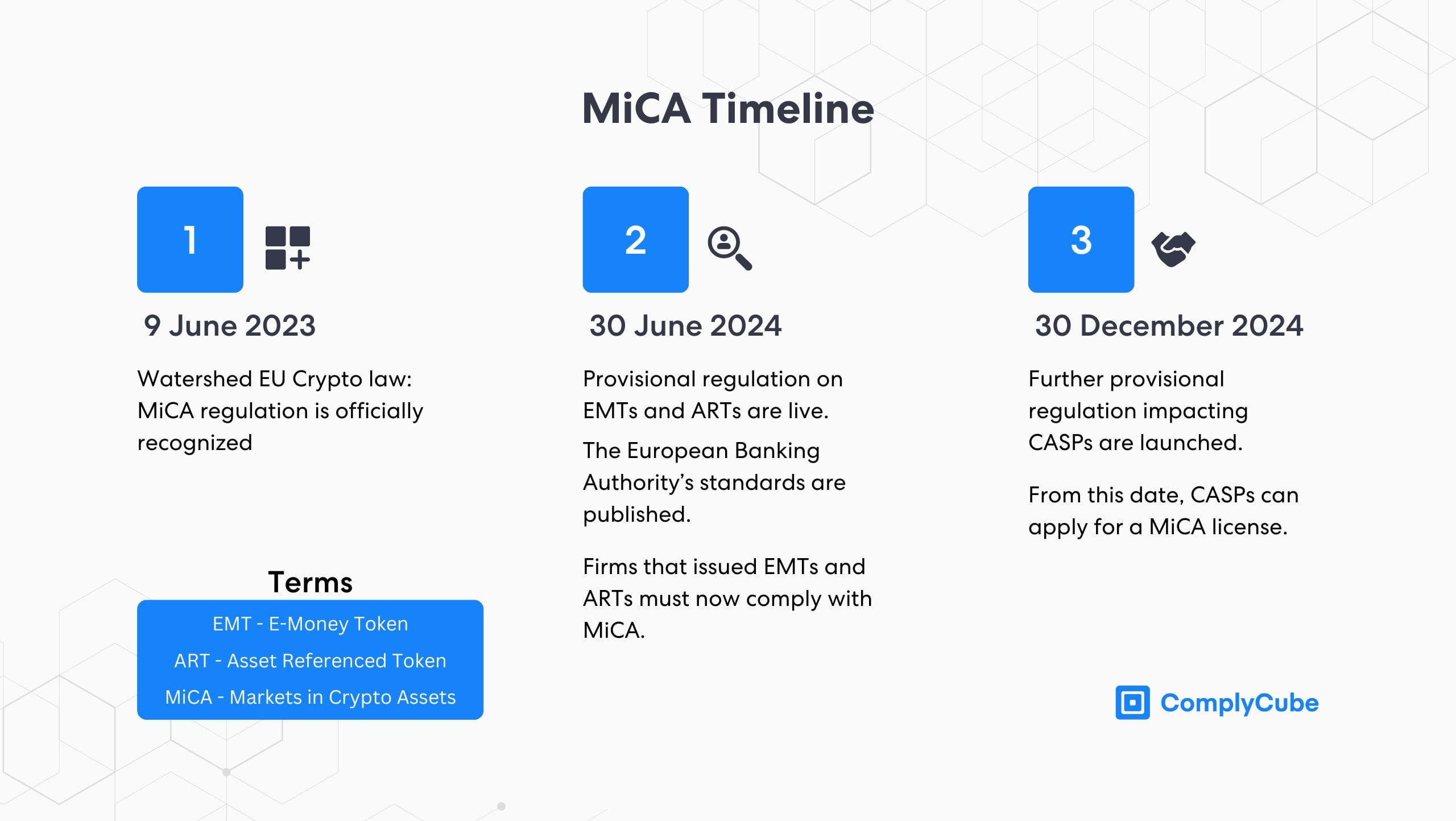

The Markets in Crypto Assets (MiCA) regulation is a move by the European Union to introduce a comprehensive framework to regulate the blockchain industry. The EU has brought about this framework to increase financial stability, reduce the risk the crypto industry could potentially pose to the broader financial system, increase consumer protection, and create an environment that encourages innovative growth in the crypto industry.

Impact of MiCA and RWA Tokenization

Within the MiCA regulation, specific considerations have been made for the Tokenization of RWAs to coincide with their increasing popularity. The first of which is how tokens resulting from the tokenization of RWA’s are categorised. This is because each categorization has slightly different regulatory requirements:

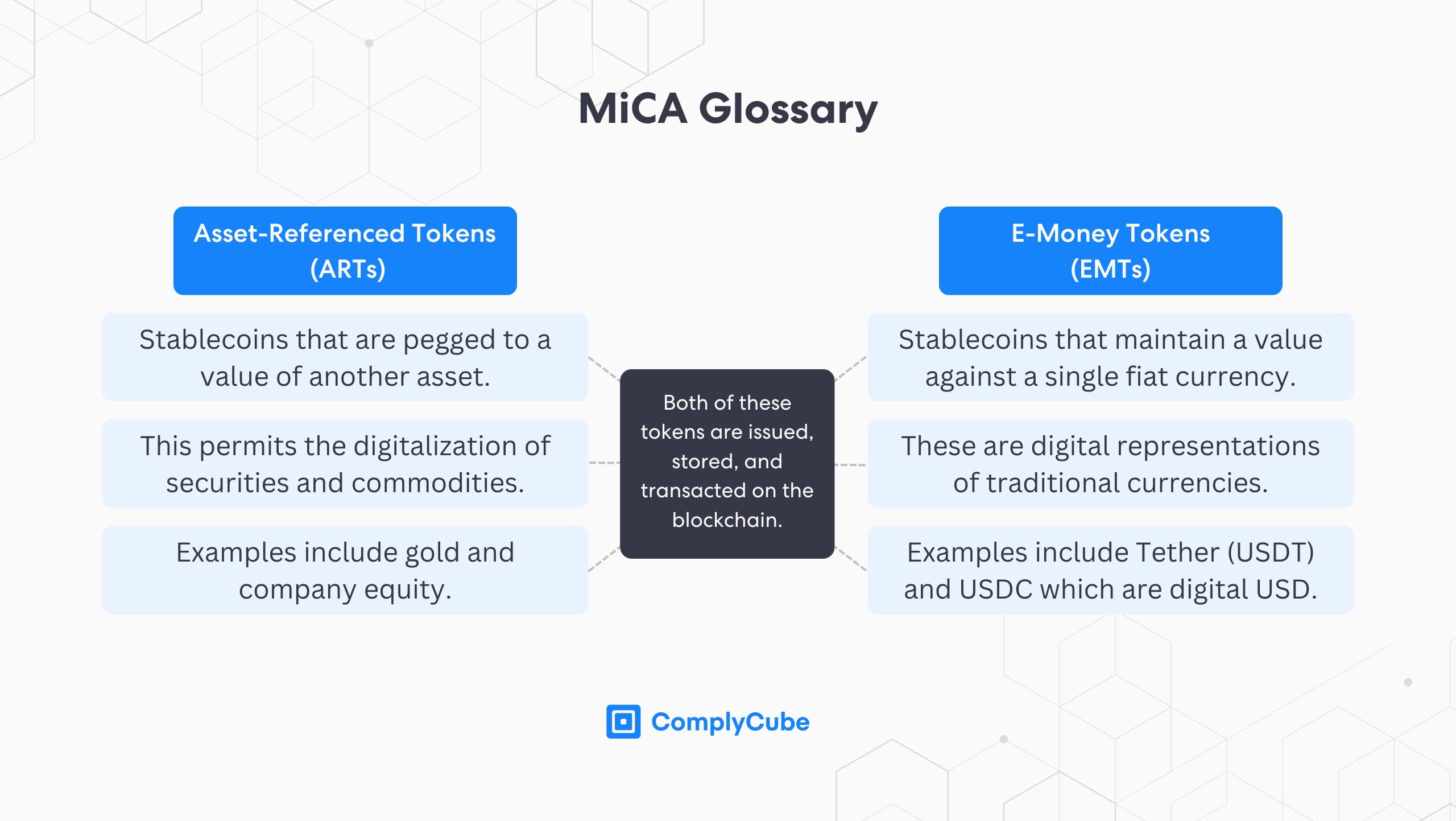

Asset Referenced Tokens (ARTs) – These are crypto assets that have a stable value as they are associated with the value of one or several commodities. Under MiCA, ARTs must comply with strict rules including publishing a detailed whitepaper, obtaining approvals from the competent authorities, and maintaining a robust governance structure. This ensures that these ARTs meet high standards of both transparency and security.

Electric Money Tokens (EMTs) – These are crypto assets which are a digital representation of traditional fiat currency, which are designed to be used for everyday transactions, very similar to electric money. EMTs are also highly regulated and must adhere to even stricter standards than ARTs. As well as having to produce whitepapers, obtain approvals and have a robust governance structure, EMTs must maintain full fiat reserves and ensure liquidity for redemption.

Other Tokens – Tokens such as utility tokens that do not fall under ARTs or EMTs have a significantly lighter regulatory framework. Although these tokens still require a whitepaper and have marketing communication provisions to protect consumers, there are no requirements for internal governance, minimal capital or fit and proper management.

The categorization of tokenized RWAs under MiCA brings regulatory clarity and legitimacy to the industry. This unified regulatory landscape will boost investor confidence and build trust, making tokenized RWAs a more attractive utility.

Furthermore, the regulatory guidebook of MiCA will likely cause a tidal-like shift in global attitudes towards the regulation of stablecoins, digital securities, and cryptocurrencies generally. Notably, the United Kingdom launched a regulatory sandbox for the tokenization of securities. You can learn more about this development by reading the UK Digital Securities Sandbox.

What Impact Could MiCA Regulation Have?

MiCA regulation clearly positions the EU as one of the global leaders in the digital assets market by providing a clear and comprehensive regulatory framework. This framework enhances the legitimacy and security of tokenized assets, paving the way for greater adoption and innovation in the tokenization of RWAs.

What will be interesting to see now is how other regions react. The new Labour Government in the UK has previously stated in the lead-up to the general election that if victorious, Labour would transform the UK into a global centre for tokenized assets.

It is likely that the US will also follow suit should Donald Trump win the Presidential election. America’s current regulatory approach to digital assets has been fragmented, with the SEC cracking down on the industry more harshly than other local securities regulators.

Many regions worldwide have been slowly integrating some kind of regulatory oversight for digital assets and tokenized traditional assets. However, until now (in the West, at least), there has not been a regulatory rulebook for firms to follow.

Ultimately, the successful implementation of MiCA could set a global benchmark for regulating digital assets, driving the industry forward and fostering a more secure and innovative financial ecosystem.