Financial criminals continue to employ more and more innovative methods to facilitate fraudulent customer identity. Inherently, this leads to the tightening of KYC requirements for banks and the development of anti-fraud solutions. KYC and AML solutions for banks play an increasingly important role in combatting money laundering and terrorist financing.

This guide will evaluate the challenges banks face in the wake of increasingly complex KYC regulations, highlighting some of the key international terrorism financing policymakers.

What is KYC?

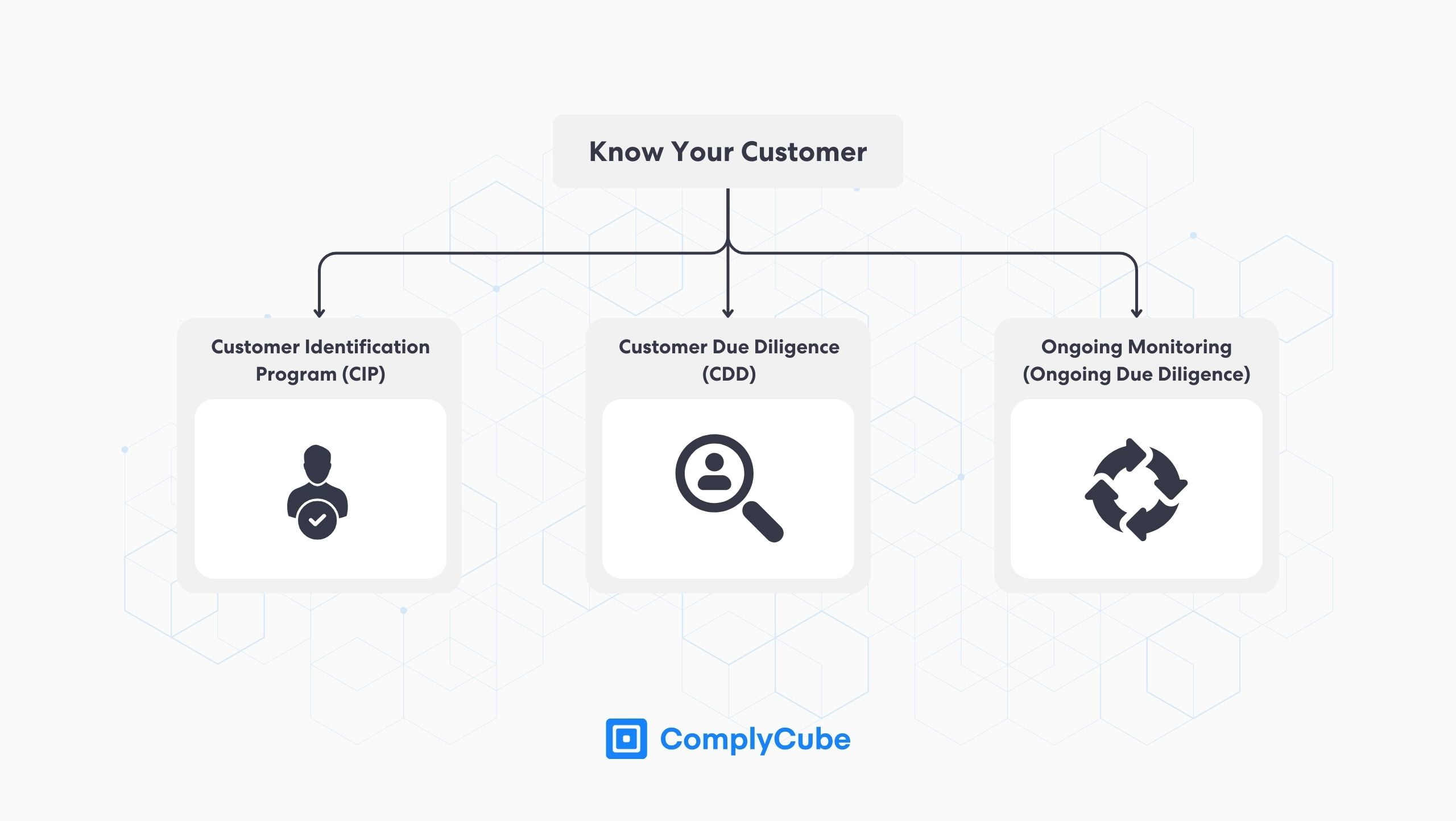

Know Your Customer is a broad term for the true identification of clients. This process includes a number of practices that ensure users are not just who they say they are but do not pose a threat to a company. KYC identifies a user, performs due diligence, and continuously runs monitoring checks on them to ensure they remain someone a business would like to be associated with.

In the case of Know Your Business (KYB), very similar processes are conducted with the intention of discovering the beneficial ownership of an institution. However, this can be an arduous challenge as businesses with something to hide can do so conspicuously through various shell companies.

In the banking industry, Know Your Customer principles are indispensable for maintaining financial integrity and achieving regulatory compliance. Banks spearhead efforts to safeguard the financial industry and, therefore, represent the pinnacle of Financial Institution (FI) security. To learn more about Know Your Customer principles, read Global KYC Verification Process in 3 Steps.

Challenges to Banking KYC

The real challenge to Know Your Customer or Know Your Business verification in the banking industry is the increasing complexity of schemes designed to obfuscate real identity, real beneficial owners, and real motivations.

Global regulators are frequently updating their guidance on how banks should mitigate money laundering risk. Banks must adhere to the tightest financial regulations mandated by federal organizations. In America, these are the Financial Crimes Enforcement Network (FinCEN) and its Bank Secrecy Act (BSA) and Final Rule.

American KYC and AML Regulators

The BSA authorizes the Department of the Treasury to impose particular policies on financial institutions over how they report suspicious transactions, data, and other factors to detect and prevent money laundering.

FinCEN’s Final Rule regarding Customer Due Diligence (CDD) states that banks must:

Identify and verify their customers

Identify and verify beneficial owners of companies that open a new account

Comprehend the nature of the customer relationship to establish an accurate risk profile

Perform ongoing monitoring to prevent and report malicious activity and update user profiles

KYC Requirements for Banks in the UK

In the UK, there are two key regulating forces: the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA). While both are instrumental to British financial policy decision-making, the FCA has a greater impact on AML regulation.

The Prudential Regulation Authority focuses more on the operational well-being of banks, including their solvency, liquidity, and ability to withstand financial turmoil. This means the PRA is responsible for ensuring that British banks have the capacity to aid economic growth at an internationally competitive level.

The Financial Conduct Authority has a far larger responsibility regarding AML and KYC compliance. They are responsible for creating and implementing Counter-terrorist Financing (CTF) and Anti-money Laundering (AML) policies throughout the UK.

The regulator establishes clear laws regarding AML and KYC compliance, such as Customer Due Diligence (CDD) programs influenced by the global standards set by the Financial Action Task Force (FATF). 2024 is already seeing a renewed attitude in the UK to take command of money laundering policy and reduce financial crime.

This is best shown in early 2024 by Companies House who have started rolling out its improved infrastructure for detecting fraud and money laundering. For more information on this development, check ComplyCube’s LinkedIn post.

EU KYC Requirements for Banks

The European Union’s (EU) AML program is governed by two core institutions, the European Banking Authority (EBA) and the European Commission. Both of these policymakers are, again, influenced by the FATF.

The EBA has an inter-jurisdictional responsibility across the European banking sector to ensure that its money laundering standards are being adhered to throughout the EU’s financial system. These include policies like Markets in Crypto-Assets Regulation (MiCAR), but specifically to banking, the EU Anti-Money Laundering Act from 2020, or the AMLD (Anti-Money Laundering Directive).

The European Commission amplifies the work done by the EBA. This body discerns potential gaps in AML compliance by conducting thorough risk assessments into policy implementation on a local and regional scale. This helps to promote the adoption of international anti-money laundering regulations.

How do Banks Adhere to AML Regulation?

Employing a rigorous Know Your Customer process is how a financial institution meets KYC and AML policies. Every year, these international AML requirements get harder to meet. The bad actors behind financial crime continuously employ more innovative methods to bypass banking security measures.

A 2020 report from Deloitte discovered that banks see increasing regulatory expectations as the greatest challenge for AML compliance.

The estimated amount of money laundered globally is in the range of $800 billion to $2 Trillion.

When compared against global GDP, this figure is anywhere between 2-5%. Deloitte cited this as an incredulous problem that governments, banks, and FIs must sort out with the aid of improved KYC technologies.

When considering the escalation of financial technology in the 21st century, it is not hard to fathom the scope of opportunity financial criminals possess. Cryptocurrencies are a prime example of the financial innovations that not only threaten the banking industry, but the security of the financial system with poor regulations. For more information on KYC crypto regulation, read How KYC Crypto Regulations Safeguard the Industry.

This calls for tightened security and precision of KYC services on a global scale. KYC verification employs 3 key steps to verify a client’s identity: a customer identification program, due diligence measures (enhanced due diligence if necessary), and ongoing monitoring.

Identity Verification

The KYC process begins with verifying a customer’s identity and this can be done in several ways depending on the industry in question. In the banking sector, the tightest level of identity assurance is required thus, user KYC documents, such as their passport, are required.

A document verification is strengthened with a selfie taken live during the client acquisition process. Before KYC and customer onboarding services were adopted, this would all have been completed in-house by trained professionals.

Document Verification

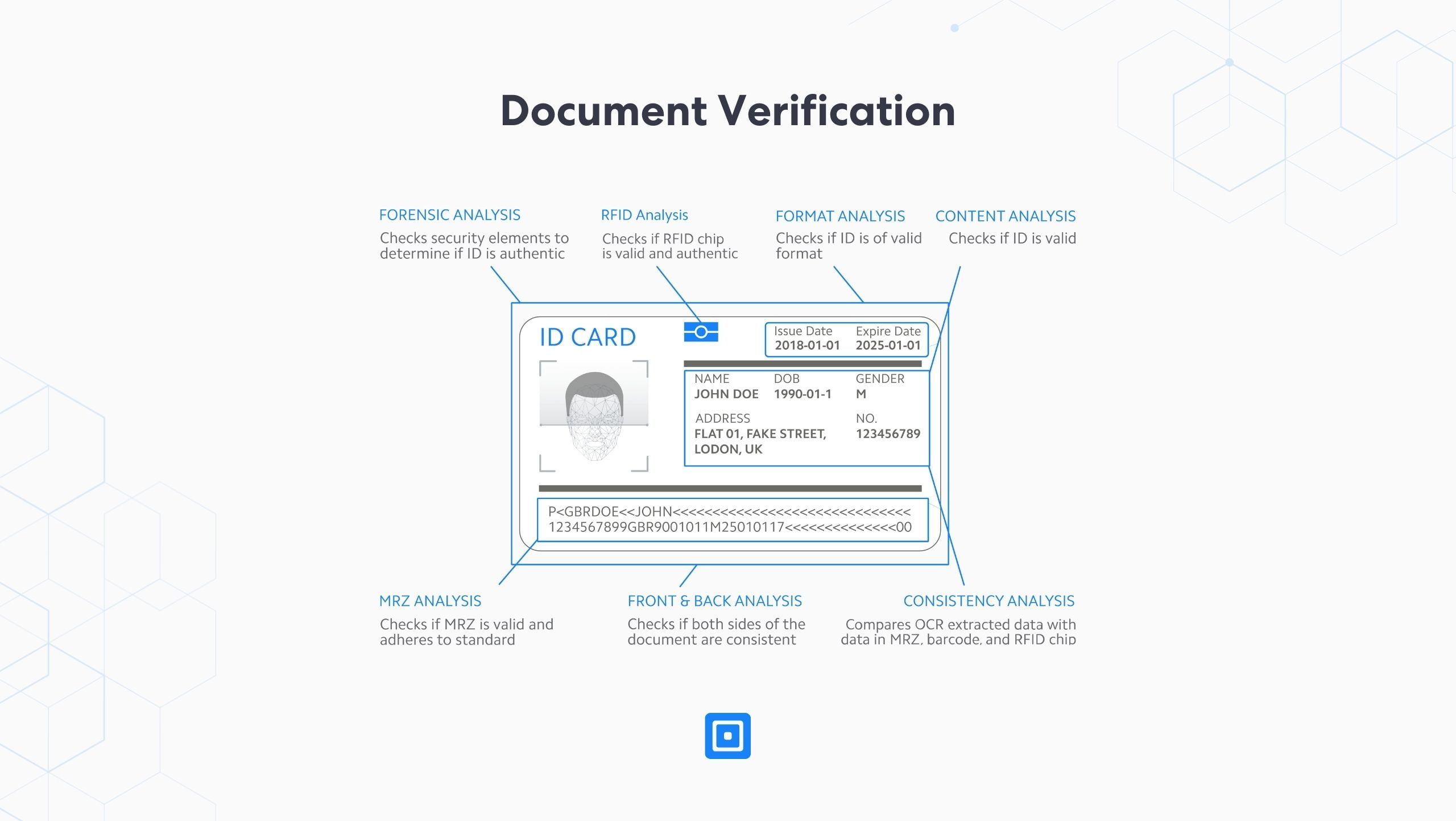

There are multiple data points that must be analyzed in a generally accepted KYC document, such as a government-issued ID or passport. To authenticate all data points manually and with precision is not scalable. This is how the identification process would have been completed before KYC solutions.

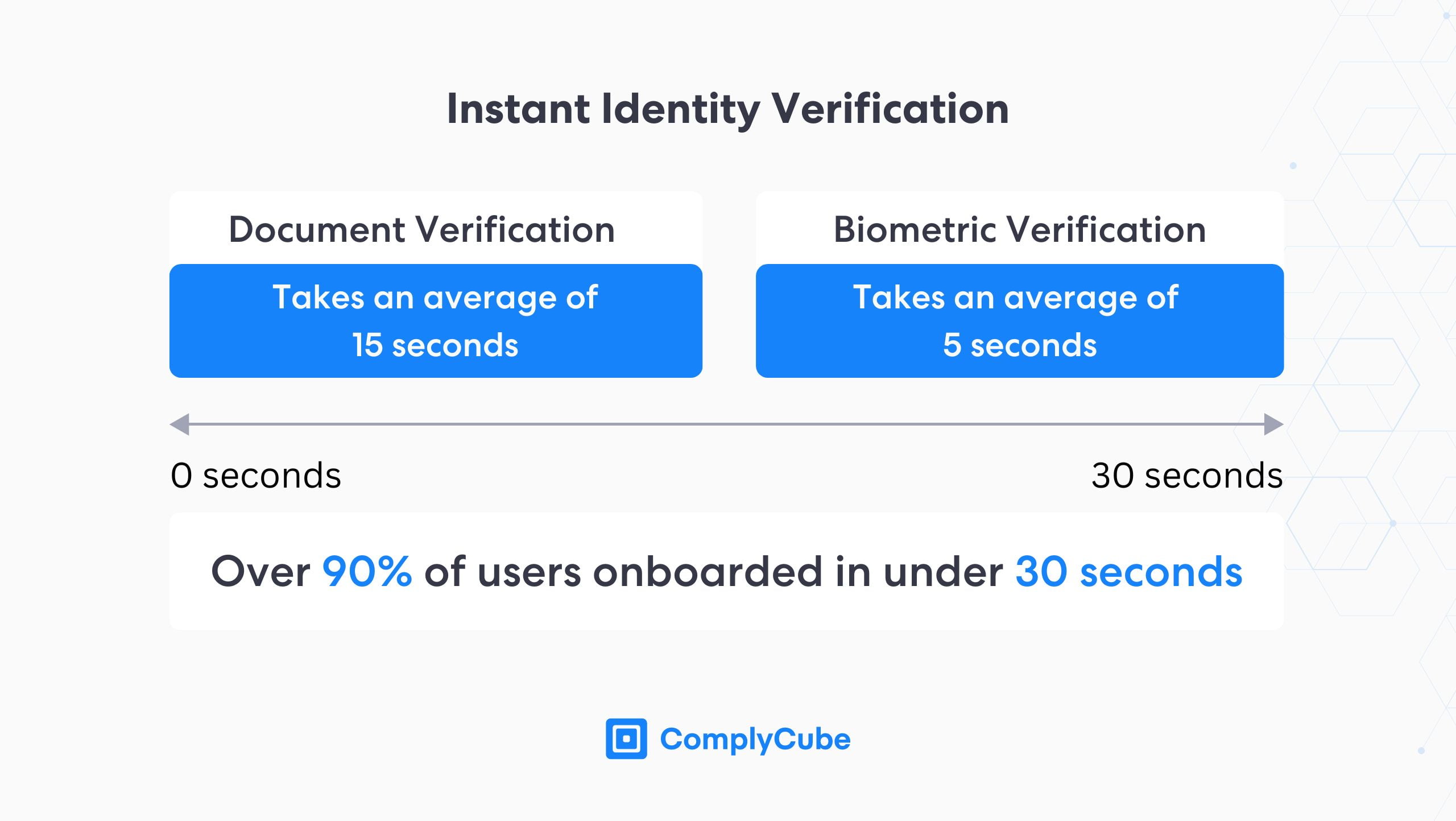

Now, document verification takes less than 15 seconds and is completed with a far higher level of precision. KYC and AML solutions for banks scan up to 25 data points on ID documents instantly, leveraging powerful AI-powered analytical engines. For more information on ID verification, read ComplyCube’s guide: What is Document Verification?

Biometric Verification

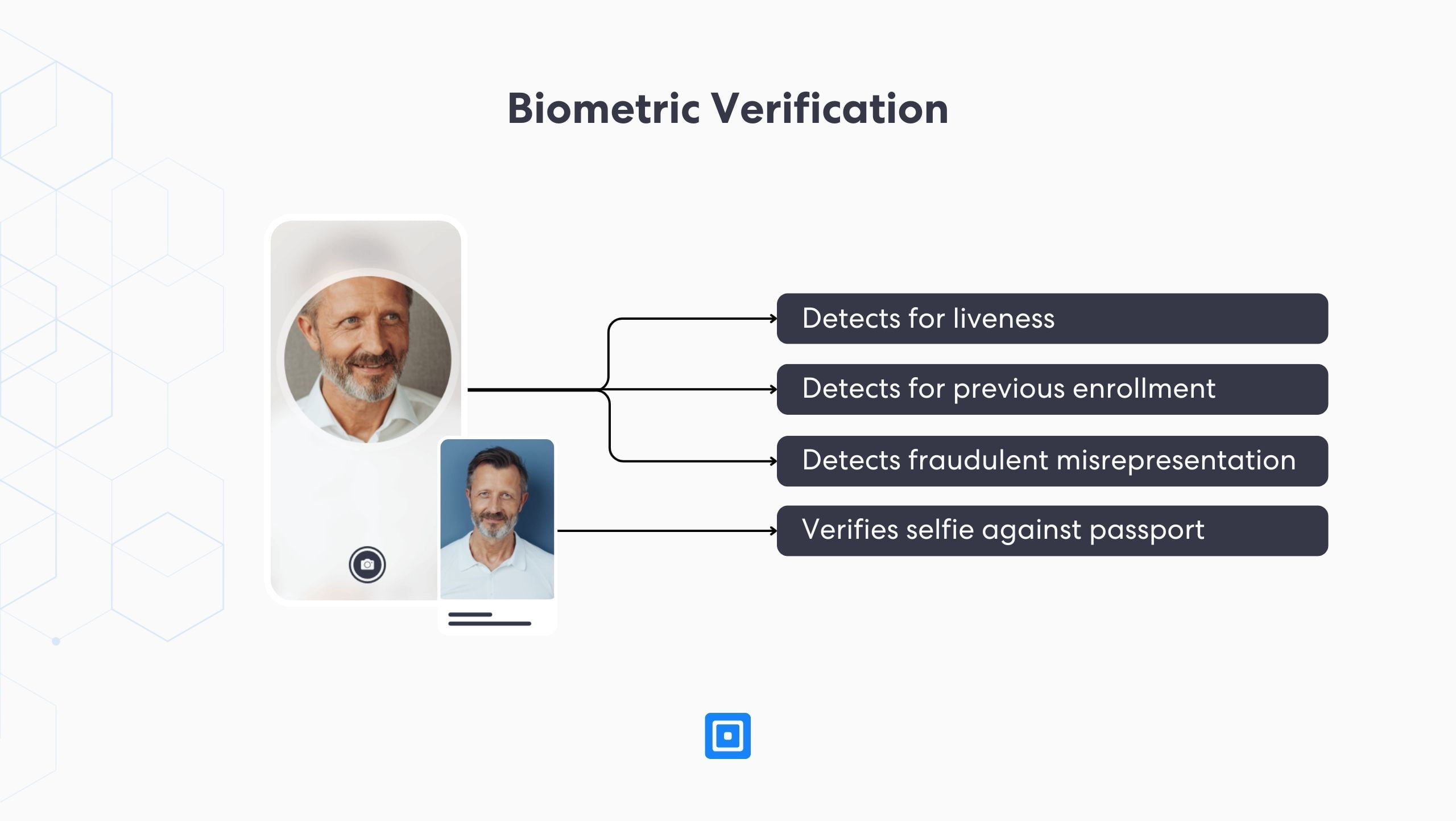

Utilizing a similar AI engine, biometric authentication matches an uploaded selfie for similarities with the image in the user ID. This process uses facial recognition and Presentation Attack Detection (PAD) technologies which are used to qualify that a selfie is authentic.

PAD technology builds 3D facial maps that are used to analyze potential pixel tampering, micro-expressions, skin texture, and many other fraudulent methods. Biometric verification, when provided via a KYC solution, can be completed in under 5 seconds.

When these processes are automated, identity verification provides businesses with both a secure and extremely efficient client acquisition experience. An onboarding process can be finished accurately in under 30 seconds, ensuring client satisfaction is prioritized without compromising client data integrity or regional compliance requirements.

Maximizing Customer Experience

Whether you are a bank, neobank, of other financial service, there are now a wealth of institutions that provide similar services. This makes effective client acquisition integral to reducing customer churn, maximizing acquisition rates, and the continued success and operation of modern-day banks.

However, reports suggest that banks have been slow to integrate such processes.

Customer Due Diligence

Customer Due Diligence is a broad process that encompasses a plethora of different services designed to do two things:

Give institutions greater identity assurance over their users and

Ensure that users do not pose a threat to your business.

These threats could come in many forms but typically relate to individuals who might engage in suspicious activity. CDD is designed to leverage customer information to reduce fraud risk. The complexity of due diligence required varies from customer to customer. For more information on CDD and its various gradients, read What is Customer Due Diligence (CDD)?

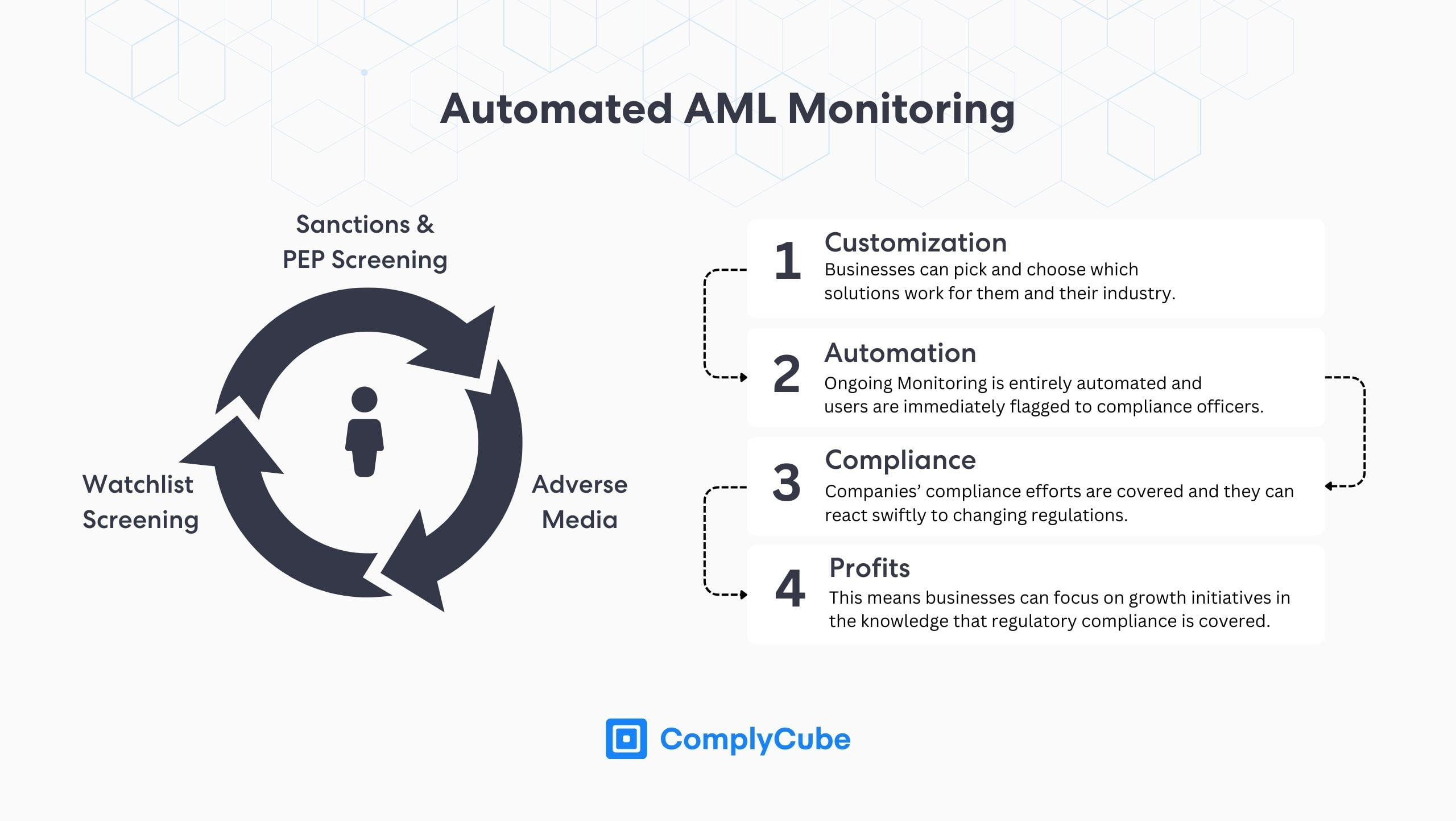

Sanctions and PEP Screening

Sanctions and Politically Exposed Person (PEP) screening prevent bad actors, including internationally sanctioned institutions and legal entities, from bypassing your AML program. This process is significantly improved by partnering with a KYC solution provider.

Partnering with a KYC service significantly streamlines this process. Automating the system that ratifies users against sanctions and PEP lists creates a higher level of precision at a much swifter pace.

What is a PEP?

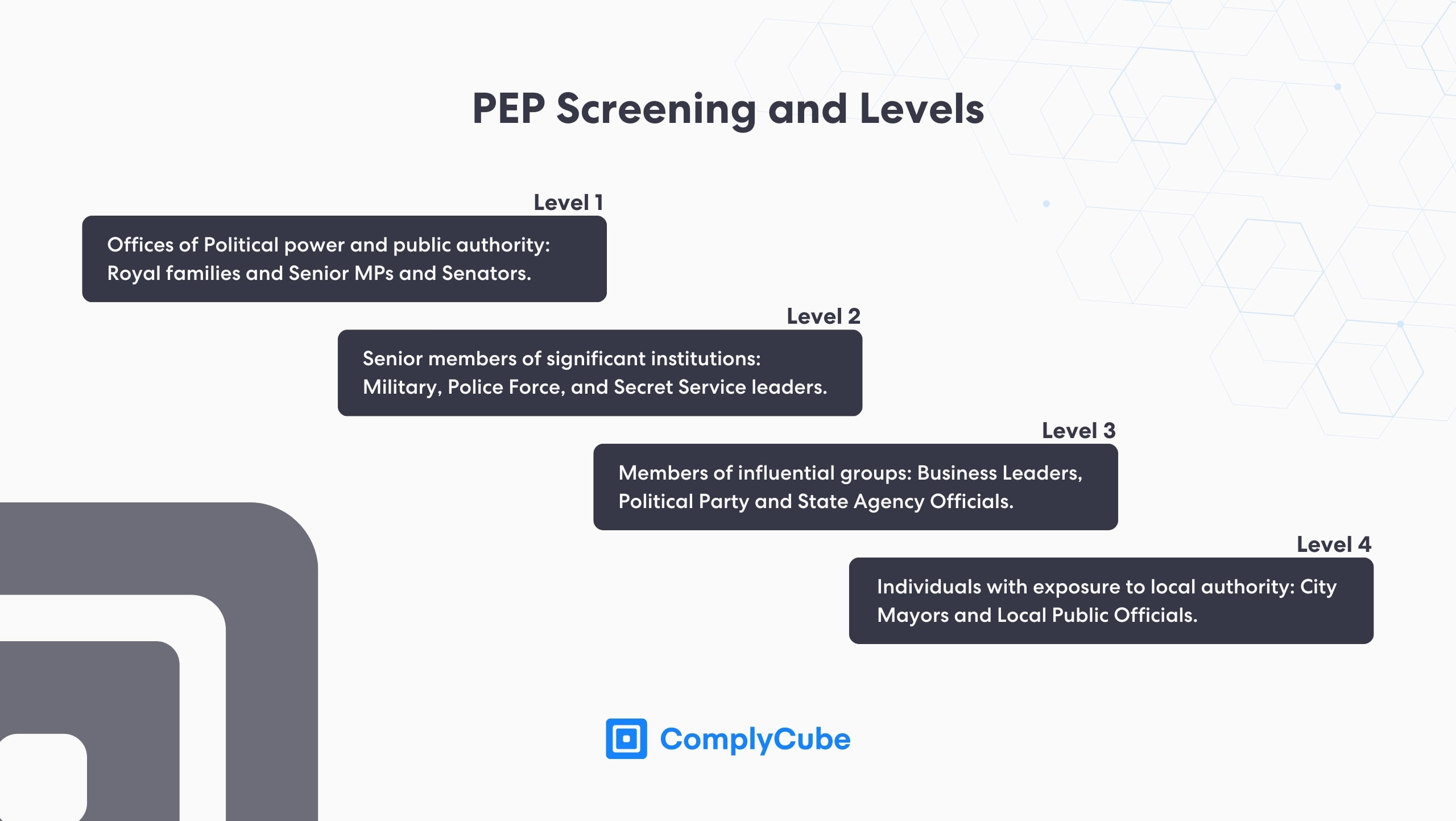

A Politically Exposed Person is anyone in a natural position of authority. This does not have to be an office directly related to politics but could be of an aristocratic or corporate seniority nature too. These types of offices might have a connection to government or financial institutions that could be leveraged to a corrupt benefit.

For example, a PEP level 2 individual would include a senior leader of a national police force. An office like this would naturally come with various privileged exposure to government processes. This exposure could be exploited due to an individual’s own corruption or indirectly leveraged through blackmail or other malicious behavior.

For these reasons, PEP screening is fundamental to modern KYC processes. KYC services enable the immediacy of this information, allowing timely decisions over necessary due diligence and potential transaction monitoring that may need to occur.

Adverse Media Coverage

Automated processes have enabled the immediate detection of associated risks. Adverse media checks identify customers who have appeared negatively in news outlets across the globe. A negative appearance could include anything from alleged money laundering activities in a foreign country to a local arrest made on a user.

This process is crucial in building a structured risk profile that enhances a bank’s ability to make informed and smart decisions for its users in real-time. It will automatically flag a user as a potential risk upon their appearance in media, empowering smart decisions.

Watchlist Screening

Watchlist screening allows banks to immediately accept or reject users upon an initial assessment. This capability drives efficiency by minimizing wasted time on unnecessary checks. If a client’s name matches with a name on a federal list they are flagged red and can be rejected.

The technology used to provide this system as an automated service is called fuzzy matching. ComplyCube uses this proprietary technology to optimize its AML software’s workflow. Fuzzy matching supports wider AML compliance by analyzing the etymology or derivations of names.

Fuzzy matching significantly streamlines the screening process and allows for risk thresholds to be set depending on a bank’s Risk-Based Approach (RBA), thereby further streamlining client verification. However, a bank’s RBA is often highly risk-averse, limiting the customizability to reduce thresholds.

Ongoing Monitoring

The continuous monitoring of users, including the practices discussed, is indispensable to modern-day banks. Once a client profile has been created and a risk assessment established, this service continually checks for updates in a user’s background or status.

Client profiles undergo perpetual vetting, with their risk scores updated in real-time if required. This task is becoming progressively less viable for banks as the volume of data required to analyze is so vast.

The birth of artificial intelligence and machine learning-powered systems has significantly improved businesses’ abilities to analyze data accurately, facilitating the shift towards automated AML solutions for banks.

KYC and AML Software

With the increasing complexity of fraudulent and financial criminal activity paving the path for increasingly intricate regulations over money laundering risks, KYC and AML solutions will become fundamental to the safe operation of banks.

Sustained regulatory developments from organizations such as the Financial Crimes Enforcement Network and the Financial Conduct Authority make meeting these dynamic regulations challenging.

This is a challenge solvable by KYC software, or eKYC. KYC solutions make identifying individuals who might launder money far less challenging for compliance professionals. Higher-risk customers can be prescribed particular due diligence measures to ensure compliance is achieved.

Automation and eKYC

Developments in the accessibility of digital data and machine learning technologies have permitted this advancement in AML systems. When identity verification is automated, it can be completed in under 30 seconds.

Furthermore, the time required to complete customer verification is a fraction of that of traditional methods while significantly improving precision. Human error does not have to be accounted for when AI-powered analytical engines can scan and verify documents and facial biometrics in seconds.

The real advancement, however, is in the automation and customization of customer due diligence and continuous monitoring of banks’ clients. These are processes that have been revolutionized by automatic systems due to the sheer volume of data required to screen customers. For more information on this, head to ComplyCube’s documentation page here.

About ComplyCube

ComplyCube partners with a host of clients across various industries, including banks, credit unions, crypto, fintech, telecoms, and more. Taking the lead in digital identity verification, due diligence, and AML compliance, ComplyCube offers a leading service with a global reach.

Their services are available in 220+ regions, enabling their core value—to build trust at scale—to be extended worldwide. ComplyCube’s services are wrapped in its all-encompassing platform, which is swiftly becoming a necessity for every compliance officer who uses it.

It’s time to leave the complexities of AML and KYC compliance behind. If you are looking for a new partner in AML, KYC, and IDV, start a conversation here.