The Financial Action Task Force (FATF) held its sixth and final FATF Plenary meeting from June 26-28, 2024, under the presidency of T. Raja Kumar of Singapore. This significant event gathered delegates from over 200 jurisdictions and observers from various international organizations where FATF updates were discussed.

The three-day discussions covered critical issues related to money laundering, terrorism financing, and proliferation financing. Find a comprehensive overview of the FATF’s expectations, evaluations, and efforts of this session below:

- Changes to country monitoring.

- Updates on high-risk jurisdictions.

- Renewed ICRG criteria.

- 5th round of Mutual Evaluations.

- Increasing international cooperation.

- Evaluations of India and Kuwait.

- The New FATF Presidency.

- Women in the FATF.

- The Russian Federation’s suspension.

- Technical compliance.

- Virtual Assets.

Updates on Country Monitoring

One of the key outcomes of the FATF Plenary was the new list of jurisdictions under increased scrutiny and monitoring. Jamaica and Türkiye were congratulated for their substantial progress in addressing the regulatory deficiencies previously identified in their Anti-Money Laundering (AML) regimes. Both countries completed their Action Plans within the agreed timeframes and were thus removed from the FATF’s increased monitoring list.

However, this does not mark the end of their responsibilities. Both countries will continue to collaborate with the FATF and their respective local regulatory bodies to strengthen their AML and CFT frameworks further.

Monaco and Venezuela, however, were added to the increased monitoring list. These countries have now committed to implementing Action Plans to resolve the strategic deficiencies that were identified during the Plenary. This addition highlights the ongoing global efforts to ensure all jurisdictions meet the FATF standards for combating financial crimes.

High-Risk Jurisdictions

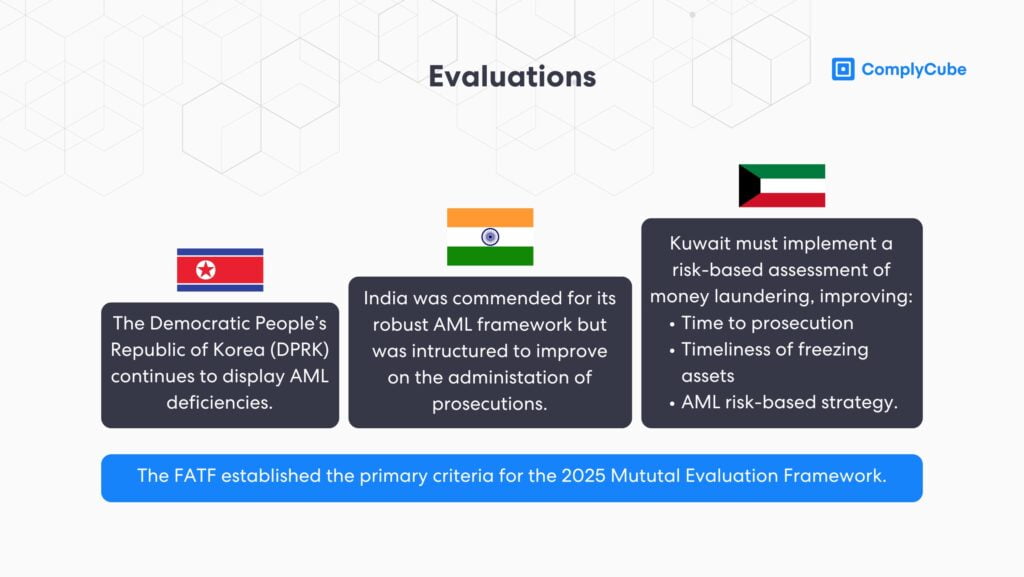

The FATF Plenary meeting reiterated its increased concerns regarding the Democratic People’s Republic of Korea (DPRK). Despite frequent requests for action, the DPRK continues to exhibit significant deficiencies in its Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) regimes.

The DPRK’s illicit activities relate to the proliferation of weapons of mass destruction and pose serious threats to international security. Furthermore, the region has multiple connections with the international financial system, which heightens proliferation financing risks. During the Plenary, the FATF called for heightened vigilance and the renewed implementation and enforcement of countermeasures when trading with the DPRK.

Successful Revision of ICRG Criteria

The FATF achieved a milestone regarding the revision of the criteria used in the International Cooperation Review Group (ICRG) process. The process is now more understanding of the challenges lesser developed countries face regarding the scope and capacity for money laundering. The revision was completed to ensure that the FATF’s grey and blacklists specifications remain effective and fair in comprehending AML deficiencies that could pose a threat to the security of the global financial system.

5th Round of Mutual Evaluations

The Plenary found common ground on how countries will be assessed for the upcoming 5th Round of Mutual Evaluations, revising FATF standards. These standards now focus more on asset recovery and international cooperation to prevent the proceeds of illicit activity.

Therefore, in the future, countries must show a commitment to prioritizing asset recovery, confiscating criminal assets, and collaborating globally. Learn more about these Mutual Evaluations by reading FATF Recommendations in 5th Mutual Evaluations.

International Cooperation

T. Raja Kumar met with the leads of other FATF-style regional bodies to discuss progress and set priorities for the upcoming year. These partnerships are crucial for the success of international financial regulation, and the key priorities were found to be:

- Increase the value and voice of FATF-style regional bodies.

- Prepare for the new round of Mutual Evaluations.

- Strengthen AML/CFT expertise on a local level.

Mutual Evaluations of India and Kuwait

Discussions involved the joint FATF, Asia Pacific Group (APG), and Eurasian Group (EAG) mutual evaluation report on India and the joint FATF-MENAFATF (Middle East and North Africa Financial Action Task Force) report on Kuwait.

India

India was commended for its high level of technical compliance with FATF requirements and its effective AML regime. However, the evaluation discovered shortcomings in areas such as preventative measures in various non-financial sectors and delays in prosecutions relating to money laundering and terrorist financing.

Kuwait

The report on Kuwait detailed that there was a reasonable legal and supervisory framework to address issues around money laundering, but there are issues in producing strong outcomes. Therefore, the Plenary evaluated that Kuwait must enhance its comprehension of money laundering risks, improve prosecutions, and ensure assets linked to malicious finance are frozen in a timely manner.

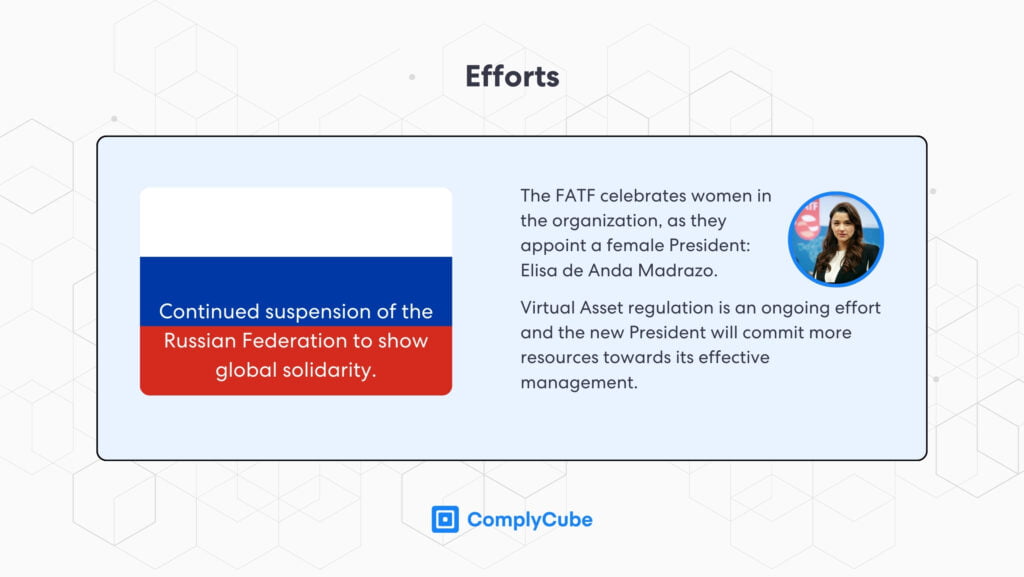

FATF Priorities Under the New President

The new President, Elisa de Anda Madrazo, outlined her priorities as chair of the FATF for the coming years. Financial inclusion through a heavily endorsed Risk-Based Approach (RBA) was at the top of her list. She also wishes to embark on a successful round of Mutual Evaluations. Her focus will be on supporting and implementing the newly revised FATF standards for the next 2 years, notably in asset recovery, beneficial ownership, and Virtual Assets (VAs).

Celebrating Women in the FATF

In the wake of a woman being appointed as President of the organization, the FATF took another step towards promoting gender equality, launching a multicultural mentoring program and an e-book, Breaking Barriers: Inspiring the Next Generation of Women Leaders. The FATF is fully committed to empowering women and promoting gender equality in the regulatory and AML sector.

FATF Continues its Suspension of the Russian Federation

The continued suspension of the Russian Federation displays the FATF’s solidarity against the Russian Federation’s invasion of Ukraine, contravening international law. This continued suspension since March 2022 serves as a reminder for jurisdictions to remain vigilant against emerging risks, threats, and crimes following the sanctions and impositions made against Russia.

Technical Compliance and Corruption Standards

During the Plenary, reviews were made to ensure adequate safeguards were in place for financial system gatekeepers, including accountants, lawyers, real estate agents, and trust and company service providers. These updated safeguards are designed to ensure individuals carrying out these roles cannot abuse their position for malicious financial activity or be blackmailed into doing so.

Regulation of Virtual Assets

The FATF agreed to announce its 5th annual update of the implementation of FATF standards on VAs and Virtual Asset Service Providers (VASPs). Many regions still remain non-compliant or partially compliant, enabling the sector’s misuse in proliferation financing and money laundering.

Furthermore, the organization is developing legislation that accurately reflects the growing infrastructures that are used to facilitate cross-border transactions. This should make cross-border payments faster, cheaper, more transparent, and inclusive of AML/CFT regulations.

About ComplyCube

ComplyCube is a market-leading SaaS AML provider. These FATF updates are an example of the global forces that sway international regulation. If your business is looking for a solution that enables compliance with FATF recommendations as well as regulatory bodies in local jurisdictions, ComplyCube can help.

Get in touch with a specialist today to learn more about their suite of Anti-Money Laundering, Know Your Customer, and Identity verification services.