A biometric identity verification solution is crucial for organisations across all sectors, especially in finance, an industry heavily prone to fraud. Biometric identity verification is far more effective than error-prone manual methods, for both achieving compliance and for preventing fraud. Both active and passive biometric identity verification methods offer significant value to organizations by enhancing security and improving user experience. However, it is essential to understand both of their strengths and limitations to leverage them effectively. This article will look at some of the key benefits and potential challenges that each approach offers, providing insight into their role in modern security systems and explaining why a balanced, informed strategy is crucial for optimal implementation.

The Benefits of Biometric Identity Verification

Biometric identity verification uses users’ physical and behavioural characteristics to verify identification and limit identity fraud. It is far more reliable than simple verification methods like knowledge based questions or passwords which can be easily hacked to prevent fraud. Biometric security technologies are fascinating and expansive, ranging from 3D facial recognition to fingerprint recognition.

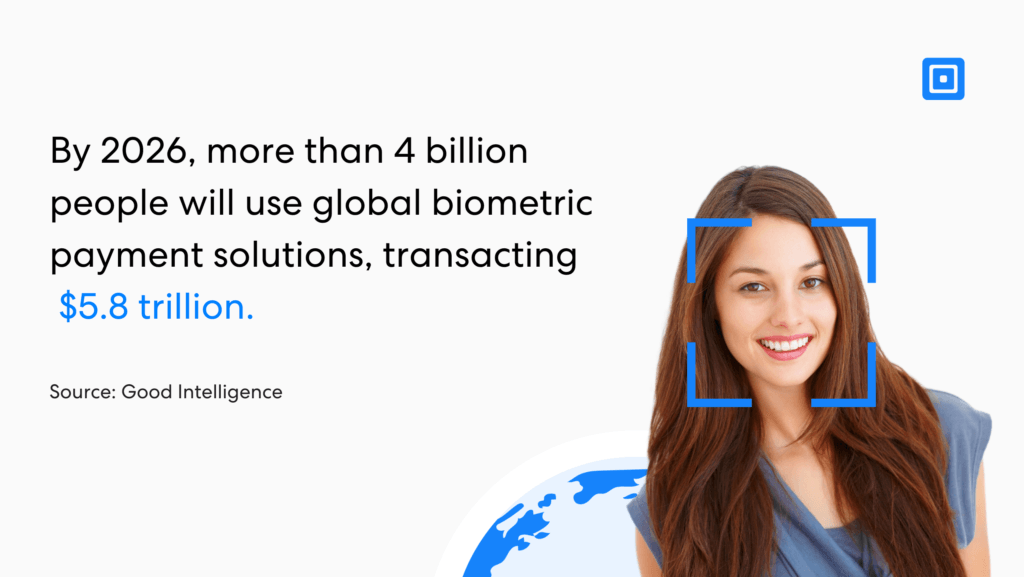

By 2026, more than 4 billion people will use global biometric payment solutions, transacting $5.8 trillion.

In the fintech sector, behavioural biometrics and facial recognition software offer a depth of understanding unlike any other. Data from Juniper Research indicates biometrics will authenticate more than $3 trillion of transactions in 2025, a 650% increase from 2020. Another survey conducted by Goode Intelligence states that by 2026, more than 4 billion people will use global biometric payment solutions, transacting $5.8 trillion through the digital economy.

Biometric identity verification offers several benefits over traditional verification processess, such as:

- Enhanced security that eliminates fraudulent attempts to open accounts or other fraudulent attempts to gain access to sensitive data.

- More accurate in determining if the applicant is a real person to provide fraud protection, especially with the use of facial biometrics.

- Security in minimising personal data sharing, ensuring compliance with all government agencies.

- Difficult, if not impossible, to replicate, much like having a person physically present for.

Utilising an identity verification solution, such as live detection or a process that uses passive authentication, can streamline organisational safety. Businesses must decide between implementing active or passive biometric verification methods, as each offers varying benefits.

What is Active Biometric Identity Verification

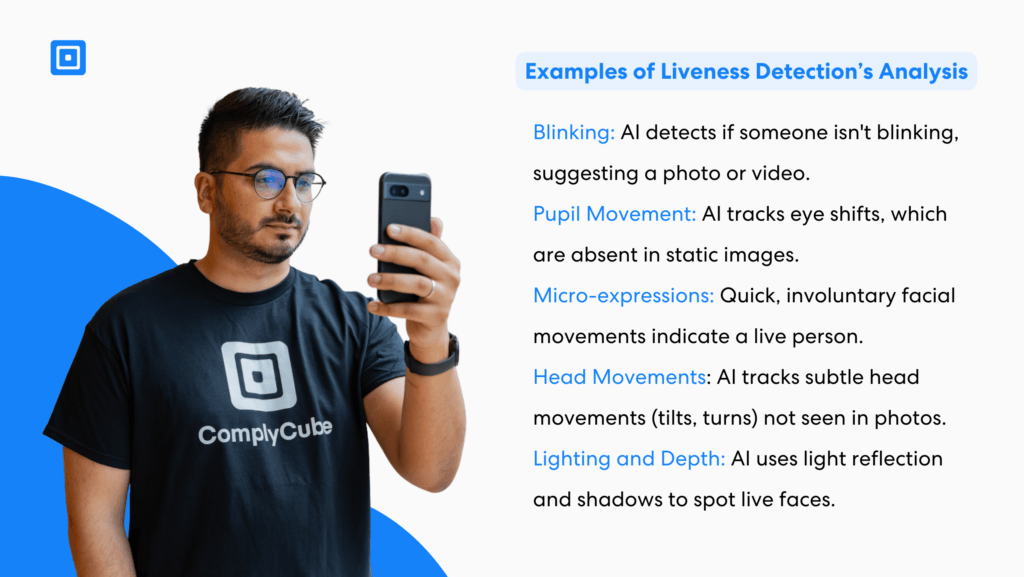

Active biometric checks, such as liveness tests, require a user to perform a specific action in front of the camera. This active authentication proves the user’s identity and demonstrates that they are really present when signing a document or agreement to a loan. Tasks might include following a dot on the screen with their eyes or turning their head in a specific direction. The technology follows the user’s face and actions to provide an extra layer of protection.

A relevant Forbes article shares that, “There are advertisements for AI that can turn a single photo of an AI-generated face into a convincing video that can fool liveness checks used by fintechs and banks for selfies and driver’s license verification during the Know Your Customer process.”

This is no longer possible with active biometric identification, which uses liveness detection software. An AI-generated “person” cannot interact with a biometric verification system in the way technologies such as liveness detection require. Fortified digital services are critical to businesses within the financial sector, and liveness detection is one of the most important IDV technologies for companies to leverage when ensuring that they meet the highest standard of regulatory compliance and reduce costly identity fraud attempts.

What Is Passive Authentication and Identity Verification

Passive biometric identity verification still requires uniqueness testing and data verification but eliminates the “live” part of the process. These methods can use facial features or identify a person’s identity based on their physical characteristics.

The demand for facial biometrics is growing, with an Allied Market Research report indicating this market reached $9.6 billion in demand in 2022. Forbes states,”Currently, facial biometrics already provides users with a secure, quick way of verifying and validating their identity. It is now also possible to know, from submitting a document number or a selfie, if the biometric data received is connected to that person. This can make the identity validation and verification process much simpler, quicker and more efficient.”

Active vs. Passive Biometric Identity Verification in Fintech: Use Cases & Benefits

Biometric verification has dramatically changed the fintech and financial services industries by providing a seamless and secure method that maintains requirements for user-friendly functionality. More transactions are taking place online than ever before, increasing the need for more advanced security solutions. Traditional PINs and passwords do not prevent security breaches, but biometric identity verification can. Biometric data, such as fingerprints, behavioural traits, and facial patterns, are more reliable at combating the very real threat of identity theft.

In the fintech sector, active biometric verification and passive biometric verification are two critical methods that financial organisations deploy. While both reduce fraud and improve accuracy, they function differently and serve distinct purposes. Active methods are often applied in high-risk or high-security financial situations:

- Secure Login & High-Value Transactions : Banks and payment providers use facial recognition or fingerprint scans to ensure that transactions are genuine and secure.

- Onboarding: New customers might need to actively verify their identity by scanning their fingerprints or facial features as part of account setup.

- Multi-Factor Authentication (MFA): Financial companies can integrate facial scans or fingerprint scans as a second verification step for sensitive transactions.

Active biometrics detect fraud more accurately because they require the person to act deliberately. These liveness checks are far more advanced than just security questions. Bypassing these systems, which rely on sophisticated liveness detection technology, is next to impossible for a fraudster.

How Financial Organisations Use Passive Biometric Verification

Despite being slightly less accurate that active biometric verification, passive biometric verification still offers global fintechs a high level of security without compromising on user experience. Passive verification does not require any action from the end user, making it a seamless process for all parties. Passive systems monitor user activity for anomalies—e.g., changes in typing patterns or behaviours—to flag potential fraud. These liveness checks are hard to beat. Some of passive biometric verification’s key features include:

- Continuous Authentication: Monitoring user presence throughout a financial session without requiring frequent re-entry speeds up the process and ensures ongoing support as information changes.

- Streamlined Mobile & Online Banking: Passive facial recognition or behavioural tracking allows users to access apps or make transactions with minimal effort, offering a smooth identity verification solution.

Passive biometric methods create a seamless, frictionless experience for the customer because they do not apply additional layers of live verification. This makes tasks such as logging into a payment app quick and easy.

Advantages of Active Biometric Verification in Fintech

Financial institutions looking for superior verification of data and identity verification benefit the most from active biometric verification, as it is extremely accurate due to the use of liveness detection. Active methods require user engagement, reducing impersonation attacks, such as a fraudster using a spoofed or AI-generated identity by quickly spotting subtle inconsistencies in markers such as skin texture or subtle micro expressions. With this method of biometric authentication, financial institutions engaging in customer onboarding can safely offer remote identity verification.

Active biometric methods provide proven protection for organisations that need high-security measures, such as government-backed payments or financial lenders. These emerging technologies that apply a person’s biometrics can quickly verify customers, even for high-risk encounters such as high-value loans. Two-factor authentication and facial verification work well as an anti-money laundering solution.

How Active Identity Verification Minimises Identity Fraud

When logging into a mobile banking application, a bank might prompt users with both facial recognition and fingerprint scanning as part of the authentication process, ensuring no unauthorised access. Another example is establishing a meeting with a financial advisor to discuss sensitive information. Liveness identity verification, such as moving the head in a specific direction, can help establish a secure conversation with an authentic party around the globe.

Advantages of Passive Biometric Verification in Fintech

There’s still value to passive biometric verification. It is convenient, scalable, and frictionless, improving customer experience. These are key customer retention strategies for nearly all fintech companies. For those in digital services, the passive liveness detection technology provides numerous benefits:

1. Seamless User Experience

Passive methods work in the background, minimising the need for repetitive actions and ensuring a fast identity verification process. This leads to faster payment checkouts, faster login times, and a more seamless overall process. Passive methods are a verification solution that does not interfere with customer service.

2. Reduced Drop-Off Rates

The reduction in friction minimises the risk that customers will pause and not come back to the onboarding and verification process. This leads to fewer abandoned sign-ups or online transactions for individuals, satisfying more customers. Online identity verification is a critical component for organisations offering services on a mobile device, and a reliable but fast verification process is needed.

3. Scalability for High Transaction Volumes

Passive systems can navigate larger user groups simultaneously without demanding users to engage in more laborious tasks. They are more cost-effective as a fintech platform scales operations. Onboard new customers quickly, ensuring compliance and minimising presentation attacks and other fraudulent activities across numerous people at one time.

Passive Verification: Use Case Example

Behavioural biometrics (like analysing patterns of typing or device navigation) can passively monitor online banking sessions for fraud while enhancing user experience by maintaining seamless transitions between tasks.

More elaborate methods, such as voice recognition and facial recognition, enable organisations to capture customers’ likenesses against previous data. This can work within seconds, providing access to apps and tools quickly.

Utilisation of the Biometric Check: A Critical Move Forward as an Identity Verification Method

Biometrics, where active identity verification is used for the most robust and sensitive transactions or passive identity verification is used for large-scale results, can create a far more advanced and effective level of security for companies throughout the fintech industry.

ComplyCube offers biometric check solutions that are leading the way from face recognition to behavioural biometrics. Designed to provide both active and passive strategies, including cutting-edge liveness detection, ComplyCube enables fintech companies to meet customer experience needs with compliance requirements and fraud reduction. For more information on ComplyCube’s services, reach out to their expert compliance team.