Identity proofing is the process of verifying a user’s identity, confirming that they are who they claim to be. It is a critical component of a business’s security infrastructure, as digital identity verification solutions can accurately identify fraudulent presentation attacks. With the development of new technologies, such as deepfakes, businesses must fortify their authentication processes before they face the inevitable losses that identity fraud entails.

The Evolving Threat of Identity Fraud for Businesses

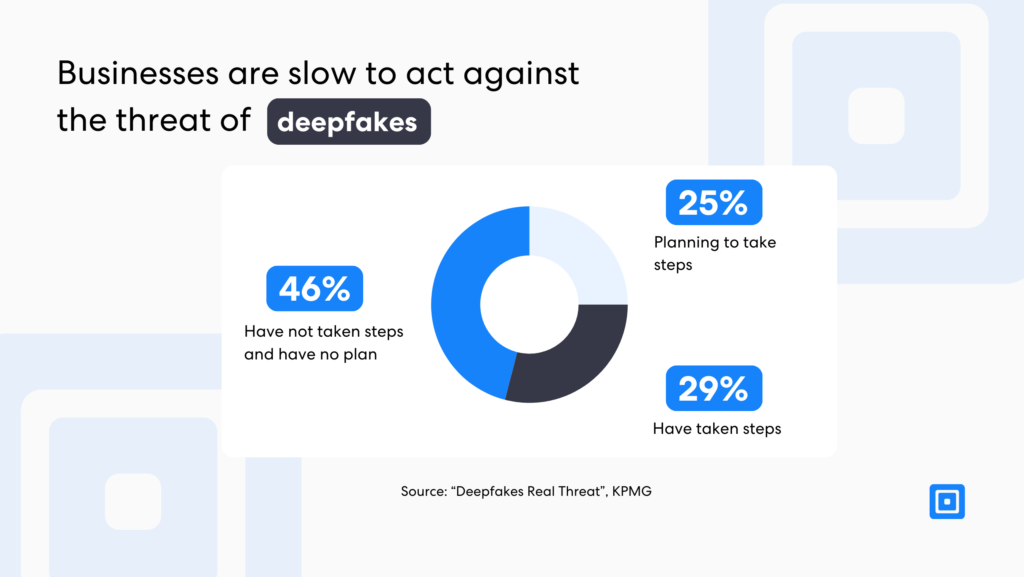

In 2023, a study by KPMG found that the majority of businesses in the US were at risk of presentation attacks, with only 29% of organizations having implemented the necessary PAD measures, including a biometric authentication process.

As deepfakes emerge in mainstream media, businesses must prepare themselves for sophisticated presentation attacks that can only be counteracted with robust liveness detection practices. Synthetic identities are also on the rise, with data in the US pointing to serious economic losses due to Synthetic Identity Fraud (SIF). These consist of fictitious identities that combine real and fabricated information and prove highly deceptive.

The Federal Trade Commission data shows that consumer-reported fraud reached over $10 billion in 2023. That marks a new level of losses, and a good portion of this statistic comes from Synthetic Identity Fraud (SIF).

This quote provides a stark reminder of the vulnerabilities that businesses face. A significant portion of these losses is attributed to the creation of synthetic identities. This rise in synthetic identities and attacks involving deepfakes underscores the urgent need for businesses to enhance their defenses.

Fiverity’s 2024 Identity Fraud Report states that “The total loss due to SIF can be estimated at $31.8 billion for a mature identity with an average of 7 accounts and an average loss amount of $3,000 per account and $30.3 billion under assumptions of 5 accounts per identity with an average loss of $4,000 per account.”

For businesses, these losses represent not only direct financial damage but also a broader risk to their operational integrity and reputation. The fact that synthetic identities are proving highly deceptive means that many companies might unknowingly be onboarding fraudulent customers, exposing them to further financial losses, potential regulatory penalties, and reputational harm.

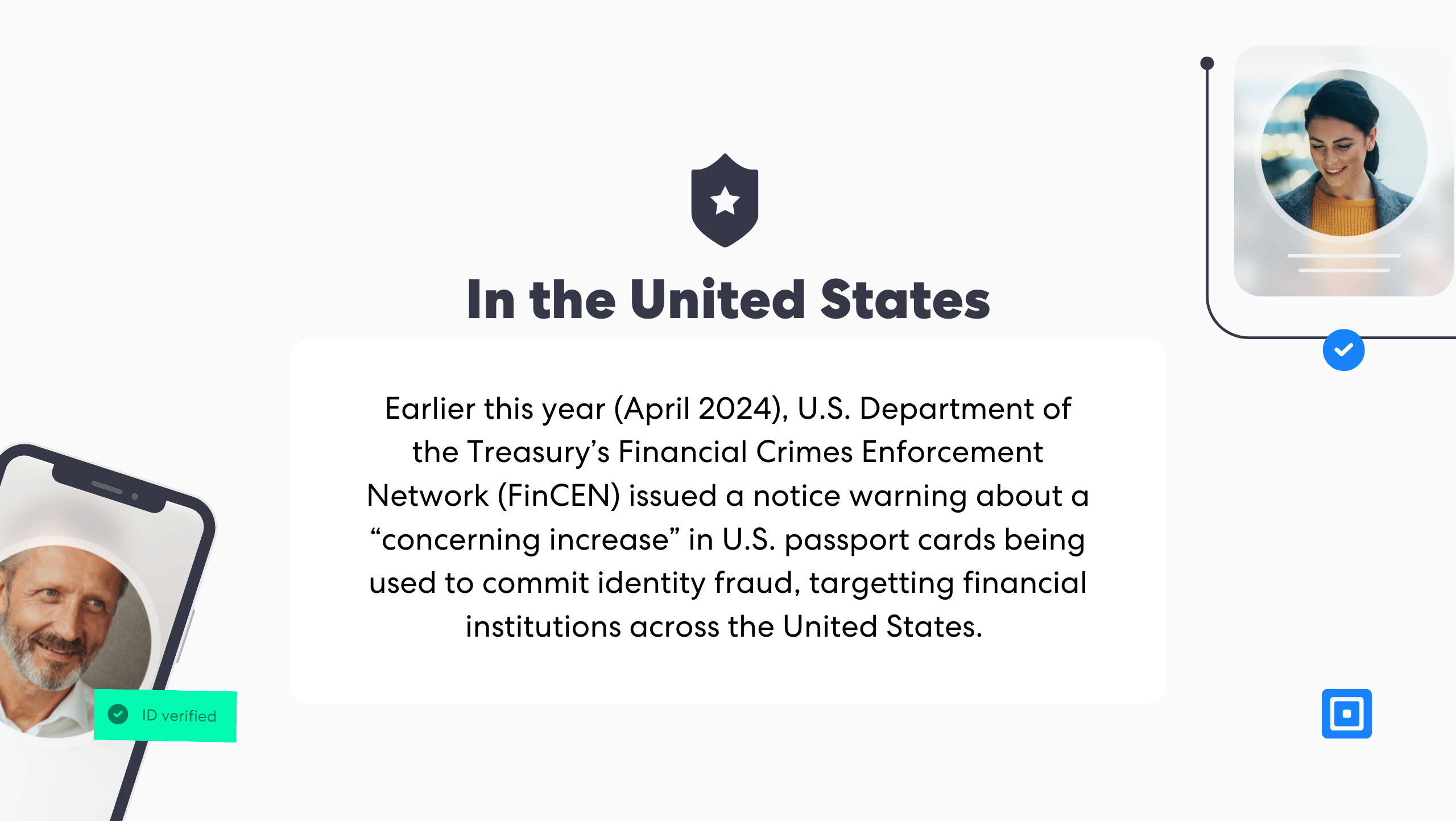

The US Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) issued a notice in April of this year warning that there had been a “concerning increase” in US passport cards being used to commit identity fraud, targeting financial institutions across the United States. Therefore, the need for sophisticated document and identity checks is continually increasing as national bodies identify an undeniable growing threat.

How Identity Proofing Works

Identity proofing allows for the verification of a user’s identity through sophisticated solutions, including biometric identity verification, document checks, and more. The right identity-proofing system can automatically perform this work, gathering information about the user, verifying their claimed identity, and approving their registration or access request without margin for error.

Identity proofing plays an important role in both new account opening and authentication scenarios. Verifying the identity of new customers and authenticating existing customers over the lifecycle of their relationship with a business protects the company from fraud.

Identity Verification: Use Cases

In reality, most businesses would benefit from some form of identity verification process, as most systems and databases contain sensitive data that could be breached. However, some examples of potential ‘use cases’ include:

Financial Institutions: Banks, fintechs, and payment processors need identity proofing to prevent fraud, comply with KYC and AML regulations, and secure customer accounts during new account openings and transactions.

Healthcare Providers: Hospitals, clinics, and telehealth services use identity proofing to protect sensitive patient data and ensure compliance with privacy regulations like HIPAA.

Telecommunications Companies: Mobile and internet service providers use identity proofing to verify user identities, prevent unauthorized access, and protect customer data.

E-commerce and Retail: Online retailers need identity proofing to prevent fraudulent transactions and protect both customers and the business from unauthorized access and fraud.

Social Media Platforms: Social networks utilize identity proofing to verify users, enhance security, and prevent issues like catfishing and impersonation.

Mobility as a Service Companies: Ride-sharing and other transportation services rely on identity proofing for driver verification to ensure safety and security for all users.

Crypto Exchanges and Wallets: Cryptocurrency platforms use identity proofing to verify users, prevent fraud, and comply with regulatory requirements to secure digital assets and transactions.

Identity Proofing Solutions: Liveness Detection

Liveness detection is a security feature used in biometric identity verification systems that ensures biometric data (such as a fingerprint, face, or iris scan) belongs to a live, present individual rather than a spoof or fake representation (like a photo, video, 3D mask or deepfake).

Nearly 8 in 10 Brits want banks to adopt the latest technology to keep their accounts safe. Citizens even ranked security as a priority over ease of access or account opening.

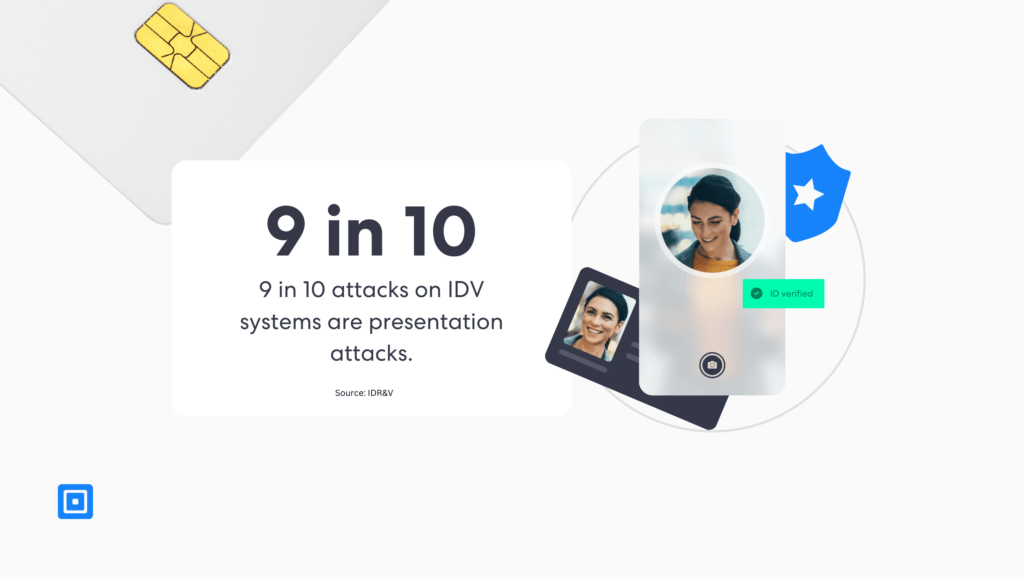

Liveness detection offers the highest level of security when it comes to identity verification, which is now being demanded by users. With 9 in 10 attacks on IDV systems being presentation attacks, liveness detection must be implemented to secure authentication processes from being hacked.

A recent study on 1,000 UK bank users conducted by FICO underlines that 73% of people consider comprehensive fraud protection a primary concern when creating their accounts. This concern is to be expected, with news on how deepfakes are being used to open accounts fraudulently circulating worldwide media platforms. Using liveness detection to spot subtle signs of fraud in micro-expressions, skin texture, and more is essential to differentiating a presentation attack from that of a live person.

The Rise of Deepfakes

Deepfakes and the misuse of synthetic content pose a clear, present, and evolving threat to the public across national security, law enforcement, financial, and societal domains.In 2023 alone, the use of deepfakes to bypass facial authentication systems in the U.S. increased by 704%.

The U.S. Department of Homeland Security warned that “deepfakes and the misuse of synthetic content pose a clear, present, and evolving threat to the public across national security, law enforcement, financial and societal domains.”

With the growing demand for strong fraud prevention in new account openings, advanced presentation attack detection systems are more than just a security measure—they offer businesses a distinct competitive edge. As James Roche, a principal consultant at FICO, emphasizes, “Customers are looking for providers they can trust, so institutions should shout about the excellent fraud protection they provide.”

Digital Identity Verification with ComplyCube

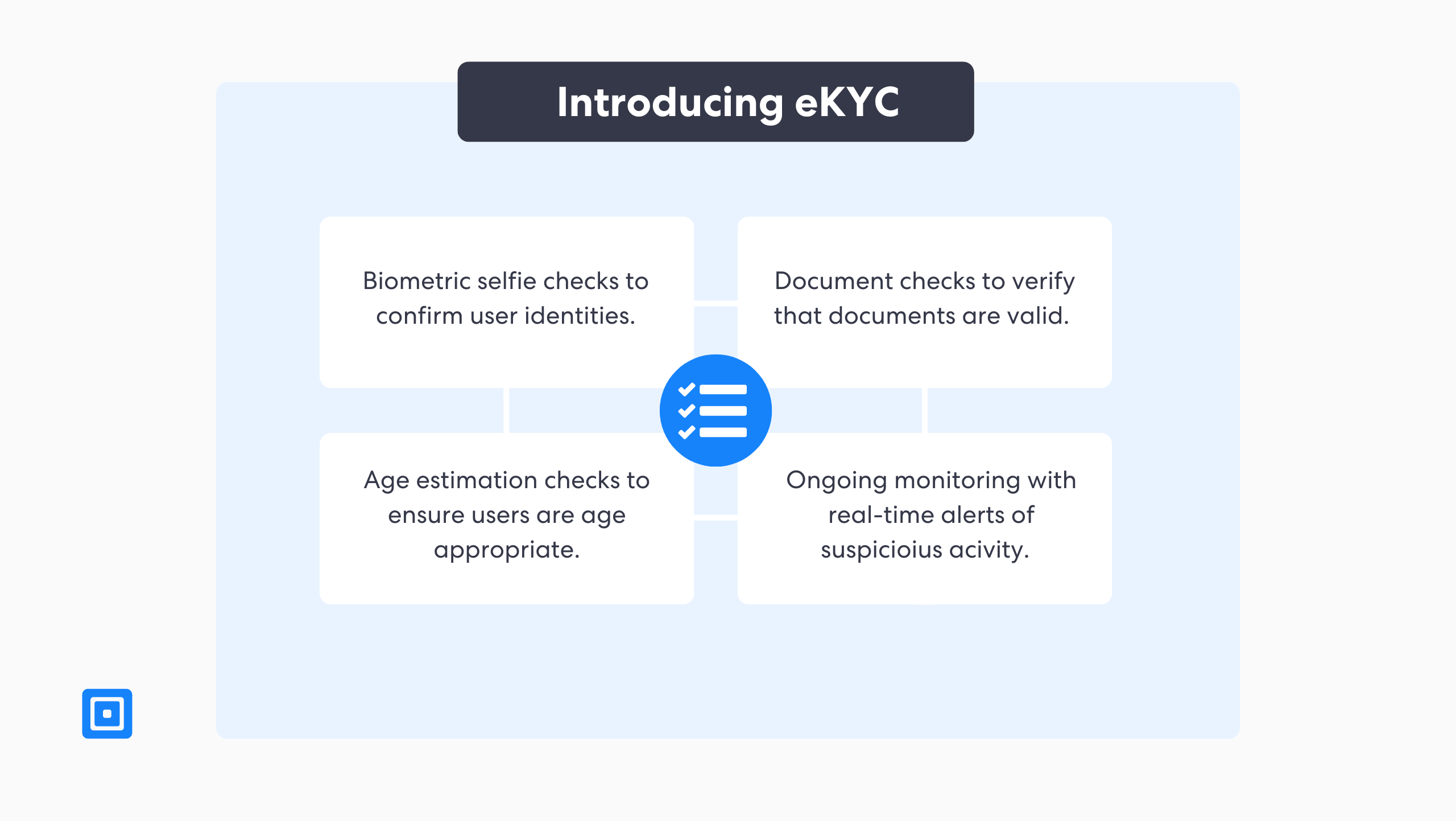

ComplyCube offers a state-of-the-art identity proofing solution that analyses biometric data efficiently in a matter of seconds, as well as examines the validity of documentation. Some of the features of their solutions include:

Robust facial recognition and similarity: ComplyCube’s advanced ISO 30107-3 and PAD Level 2-certified biometric liveness detection technology can verify whether the person presenting the identity document matches the documentation submitted. Their IDV technology provides a comprehensive analysis, leveraging biometric and behavioral vectors to give you the highest level of assurance.

Advanced document verification: ComplyCube leverages the optimal blend of AI and trained human experts to conduct various checks on ID documents, ensuring they haven’t been compromised, forged, copied from the internet, expired, or blacklisted. Supported identification includes passports, travel documents, driver’s licenses, national ID cards, residence permits, and visa stamps.

Expert liveness detection: Their AI-powered PAD-Level 2 liveness detection software can determine genuine customer presence and identify imposters. ComplyCube leverages anti-spoofing detection that protects businesses from sophisticated attacks.

Seamless biometric enrolment: Technology that provides the best-in-class guided face capture to deliver frictionless authentication to access Finance, Telecommunications, Travel, Enterprise Services, and much more.

Identity Proofing Services

ComplyCube is renowned for its state-of-the-art identity verification (IDV) and anti-money laundering (AML) checks, offering advanced security measures alongside a seamless user experience. The platform streamlines onboarding processes to under 30 seconds while maintaining precise IDV, AML, and KYC compliance.

Reach out to ComplyCube’s expert compliance team to explore how liveness detection can be implemented to protect against sophisticated fraud attempts.