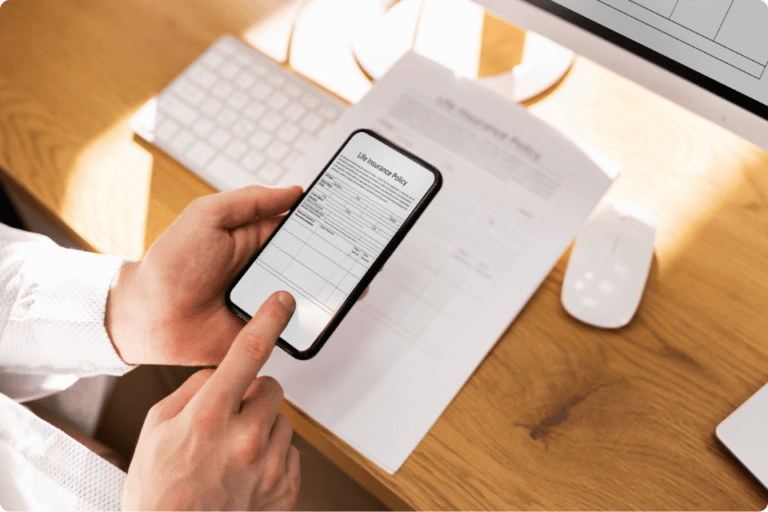

Multi-language and content recognition

ComplyCube’s OCR technology supports multiple languages and various text formats, including printed and handwritten texts.

Versatility that powers global operations, comprehensively capturing data across an array of languages and formats.