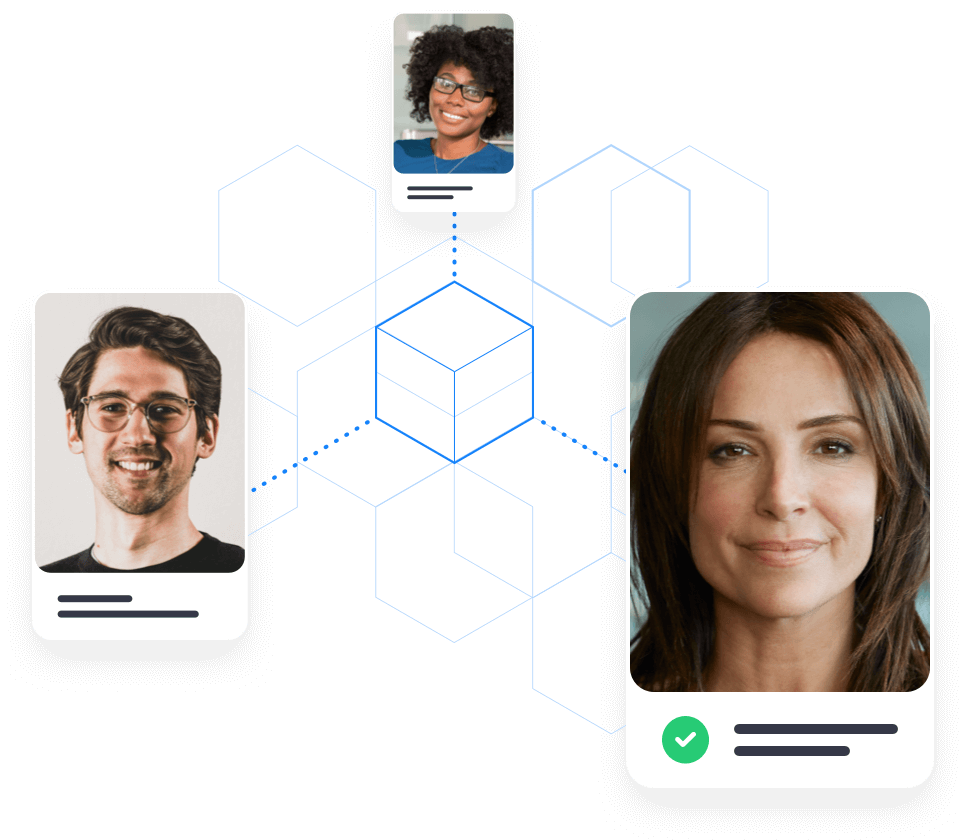

Multi-layered Verification with NFC technology

Our multi-layered verification combines RFID analysis with visual checks, liveness detection, and security feature validation for robust fraud prevention.

RFID analysis ensures accurate data extraction, while visual checks meticulously inspect documents for authenticity and integrity.

This comprehensive approach provides robust protection and confidence in your onboarding process, minimizing the risk of manipulation.