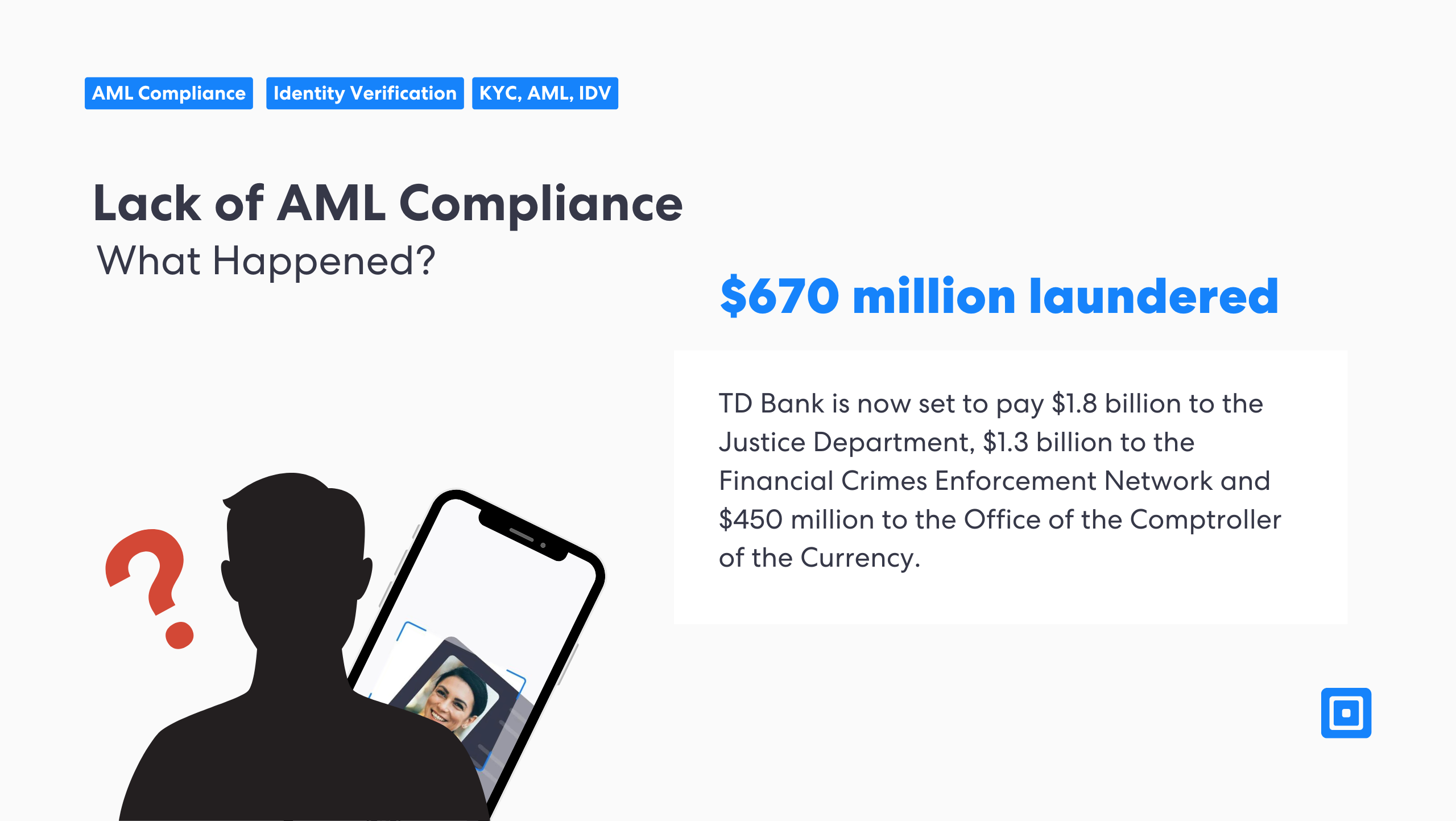

This month, Toronto-Dominion (TD) Bank was hit with one of the biggest AML fines in history, over $3 billion, due to AML failures. Labeling this as simply a “failure” might even be considered to be sugarcoating the story, as three money laundering networks collectively transferred more than $670 million through TD Bank accounts from 2019 to 2023. Whilst organizations might think they can’t afford to invest in state-of-the-art AML software solutions, can they really afford not to when fines can reach $3 billion? Anti money laundering compliance frameworks and AML tools cannot be overlooked, as this often ends in financial ruin, with otherwise respectable organizations unnecessarily incriminating themselves.

Unfortunately, TD Bank is now paying a hefty price for possible naivety. Many businesses might not imagine that not adequately funding an AML program may very well be the first step to pleading guilty to serious financial crimes, such as money laundering conspiracy. TD Bank is now set to pay $1.8 billion to the Justice Department, $1.3 billion to the Financial Crimes Enforcement Network, and $450 million to the Office of the Comptroller of the Currency.

What is AML Regulation?

Anti-Money Laundering (AML) refers to a set of laws, regulations, and procedures designed to prevent criminals from disguising illegally obtained funds as legitimate income. These regulations are applied primarily to financial institutions but extend to a range of industries, requiring them to detect, prevent, and report suspicious activity.

AML programs focus on identifying and monitoring suspicious transactions, implementing due diligence procedures such as Know Your Customer (KYC) requirements, and filing Suspicious Activity Reports (SARs) with authorities. The goal is to combat financial crimes, including money laundering, terrorist financing, corruption, and fraud. Key features of AML software might include:

- Customer Due Diligence (CDD): This involves gathering data on customers to ensure they’re not involved in illegal activities. For more on CDD, read “What is Customer Due Diligence?”

- Know Your Customer (KYC): KYC similarly looks at risks posed by new customers, often verifying their identities, background checks, and more.

- Sanctions Compliance: AML also includes sanctions screening, which are tools used by countries or organizations to impose restrictions on regions, entities, or individuals. Regulated businesses must carry out sanctions risk screening as a required practice for sanctions compliance.

AML regulations are globally influenced by organizations such as the Financial Action Task Force (FATF), which provides international standards to ensure countries have effective systems in place. Financial institutions are required to continuously monitor transactions, maintain records, and enforce compliance through internal controls. Non-compliance with AML regulations can lead to severe penalties, loss of reputation, and even legal action for the institutions involved.

TD Bank Pleads Guilty to the Bank Secrecy Act

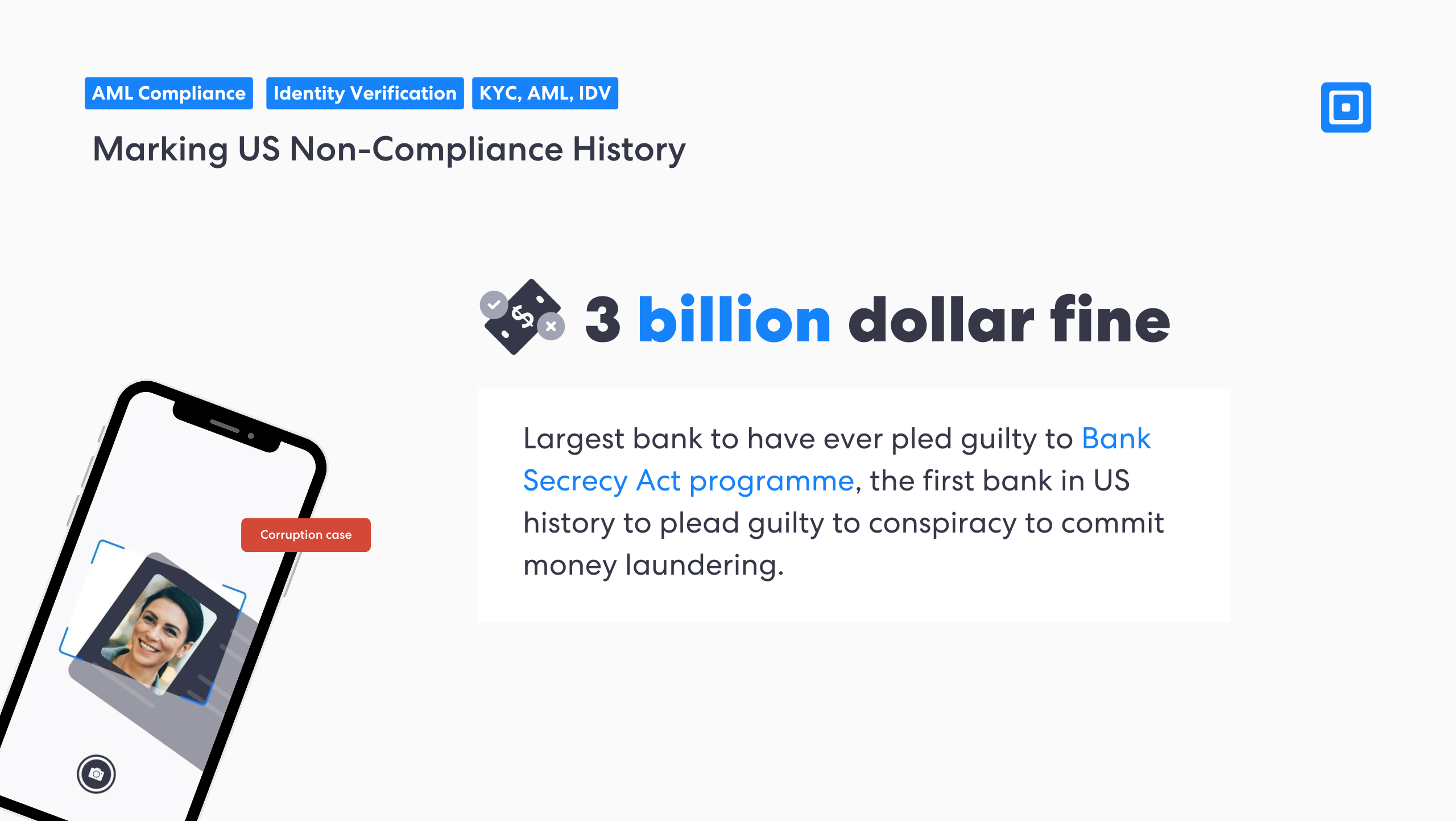

TD Bank is the sixth-largest bank in North America and has been operating since 1852. It is, in fact, the largest bank to have ever pled guilty to Bank Secrecy Act program failures and the first bank in US history to plead guilty to “conspiracy to commit money laundering”.

First bank in US history to plead guilty to “conspiracy to commit money laundering.”

Attorney General Merrick B. Garland stated, “Today, TD Bank also became the largest bank in U.S. history to plead guilty to Bank Secrecy Act program failures, and the first US bank in history to plead guilty to conspiracy to commit money laundering.” Attorney General Garland’s statement underlines the seriousness of this case by emphasizing that it marks a historic level of accountability. TD Bank’s plea is significant not just because of the scale of the institution but because it’s the first time a U.S. bank of this size has acknowledged such failures in compliance under the Bank Secrecy Act (BSA) and money laundering conspiracy.

The largest bank in U.S. history to plead guilty to Bank Secrecy Act program failures.

The bank’s AML fine stems from a deeply embedded and systematic problem within the organization – a lack of adequate prioritization. Investing in sophisticated internal mechanisms to detect and report suspicious transactions and customers can often seem like a hindrance to an organization due to the costs and time invested. Yet, in the long term, it becomes clear that AML controls and comprehensive compliance strategies should always remain at the heart of a company’s culture and operations – a preventative measure that could save the business an insurmountable amount.

What Caused Non-Compliance?

The US Department of Justice argued that TD Bank chose profits over compliance with the law—a decision that is now costing the bank billions of dollars in penalties. Forbes states that TD Bank’s U.S. arm ‘failed to appropriately fund and staff‘ its anti-money laundering program.

Relying on generic or outdated software for AML tools that don’t provide adequate detection of complex money-laundering schemes is a massive gamble for financial institutions like TD Bank. Some companies adopt a “checkbox compliance” approach, with software or policies that do not offer best-in-class AML protection but rather are solely created to avoid non-compliance. These protocols will often fall short in an audit or investigation, so businesses must make sure they partner with proactive platforms that are able to stay ahead of advances in digital fraud.

Anti Money Laundering Compliance for Financial Institutions

AML software is critical for all financial institutions, as it ensures legal compliance with mandates issued by national and international watchdogs. Regulatory requirements differ globally, so choosing a solution that can achieve compliance in different jurisdictions is critical.

AI and machine learning are some of the newest technologies to have entered the AML space, offering key features that can identify potential risks and suspicious activity. Decision-making around compliance efforts must be fortified by thorough research into money laundering AML software that can ensure regulatory compliance and prevent illicit activities like terrorist financing.

AML software that can help businesses fortify their AML infrastructure includes:

- Know Your Customer (KYC) and Enhanced Due Diligence (EDD): The use of advanced KYC solutions, including thorough identity verification and ongoing customer screening, would have helped identify clients who are high-risk quickly, fortifying AML efforts. This can then trigger an Enhanced Due Diligence (EDD) process to further assess customer risk. Customer onboarding processes should always be fortified by a KYC process, which identifies politically exposed persons and analyses customer information with scrutiny. For more on risk-based AML approaches, read “What is a Risk-Based Approach (RBA)?”

- Automated Suspicious Activity Reporting (SAR): Automated AML workflows, combined with alerts for compliance teams, would ensure quick escalation of critical information to prevent money laundering activities from continuing undetected.

- Real-Time Transaction Monitoring: One key AML failure was the bank’s inability to monitor over 90% of transactions on its network, allowing billions of dollars in suspicious activity to go unchecked. Implementing robust, real-time transaction monitoring with AI-driven analytics could have flagged irregular patterns, such as the daily $1 million cash deposits that went unreported. A system utilizing behavioral analytics could have detected abnormal deposit patterns and high-risk activities.

AML Solutions with ComplyCube

ComplyCube offers state-of-the-art AML software solutions, including sophisticated AML screening to lower financial crime risks. Combat money laundering with one of the best AML software solutions on the market, leveraging AI-powered risk assessment, adverse media screening tools, and more to ensure compliance.

Work with a global provider that can fortify your compliance framework with solutions powered by artificial intelligence. Ensure security in each customer journey with the right software, allowing businesses to onboard new customers quickly and safely.

For more information on ComplyCube’s AML software, reach out to one of their compliance experts.