Catfishing and social media scams have taken the digital age by storm, entrapping millions worldwide. Anyone can create a fake profile or commit identity theft by pretending to be a celebrity, political figure, or even one of your friends. This pressing lack of regulation has made social media and identity theft almost inseparable, creating a digital landscape for catfishing practices to thrive due to a lack of fake profile detection. There’s only one answer to the problem: implementing social media identity verification.

In 2023, a shocking 22%, nearly 1 in 4 people, were victims of being catfished by a false digital identity in the UK.

But catfishing has become a global epidemic, with equally alarming statistics emerging from the US and other regions. The danger posed by fake profiles is indisputable, raising the critical question: how will online dating and social media platforms fight back?

Love at First Swipe

Romance fraud and catfishing practices go hand in hand; where you find one, you’ll likely find the other. Scammers aim to forge strong emotional attachments with their victims, driving them to make decisions based on emotion rather than rationale. They carefully craft the “perfect profile” to entice their victim, helping them fabricate the deceptive emotional connection. Techniques such as “love bombing,” which consists of showing victims exaggerated displays of affection, are also common practices used to lure in vulnerable people online and build trust, which is critical. Once emotional dependency reaches an all-time high, the scammer can coerce their victim, usually resulting in substantial financial losses.

Liz Ziegler, Fraud Prevention Director at Lloyds Bank, states,

“Targeting those looking for love is a cruel, but sadly common way for fraudsters to cash in. Scammers can be incredibly convincing and leave their victims both emotionally and financially drained.”

Social Media Scams and Fake Profile Detection

Social media platforms have tackled the problem of fake profiles for years. In the fourth quarter of 2023, Facebook removed nearly 700 million fake social media accounts after removing 827 million in the previous quarter. But no matter how many suspicious users are removed, more undoubtedly reappear.

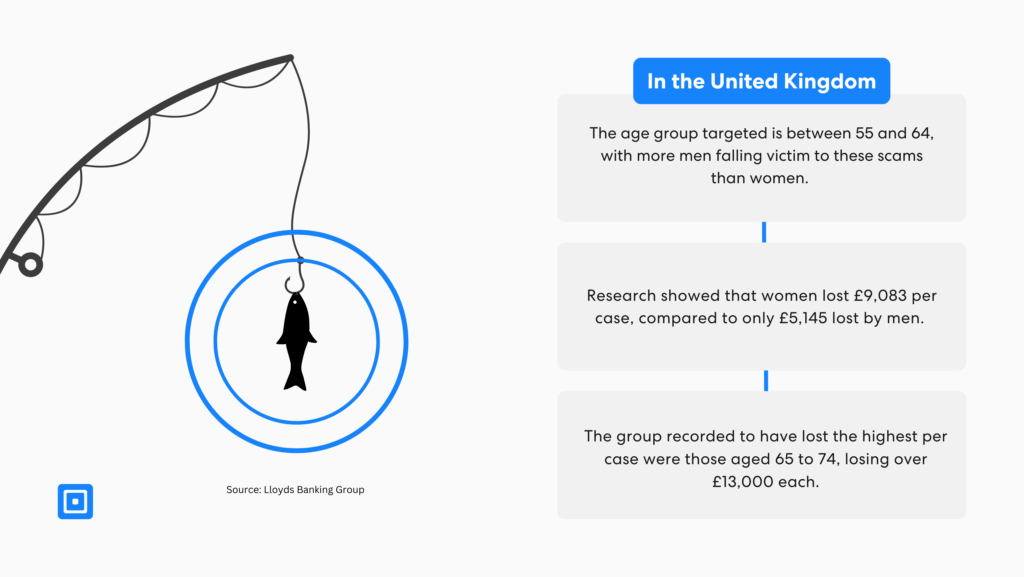

UK-based research suggests that the age group most commonly targeted in these attacks is between 55 and 64, with more men falling victim to these scams than women worldwide. However, when women are the victims of romance fraud, the scam typically results in much higher losses. Women lost £9,083 on average in 2023, compared to only £5,145 lost by men. Interestingly, the group recorded to have lost the highest amount were those aged 65 to 74, losing over £13,000 each on average.

Despite most victims of romance fraud being over 18, many are also underaged. Snapchat was found to be a prime example of a high-risk setting for catfishing aimed at minors.

Social Media Platform Snapchat Finds “Sextortion” on Its Platform

Snapchat, a widely used social media platform amongst Gen Z users, decided to undertake a large study to clarify the number of fake users and catfishing on its platform.

They found shocking evidence of young teens being subjected to sexual extortion online, which has now been labeled as “sextortion.” Predators connect with minors and establish friendships, often leading to minors sharing personal information and even explicit content. The fraudster then threatens their victim with sharing the explicit content online unless, of course, they pay. They looked at 6,000 young users on their platform and found that 69% of them admitted to having experienced this kind of online abuse.

One particular case, featured on the BBC in 2023, received messages that stated:

“I’m going send these to all your followers and ruin your life if you don’t send me £3,000. But I’ll delete them all if you send me the money.”

With the current digital landscape, it’s almost impossible to get minors to stop using social media platforms, but they can be protected from these social media scams with increased social media identity verification and fake profile detection processes.

The Cost of Catfishing for Global Economies

Online dating and social media scams are extremely lucrative for fraudsters, as victims will often send money repeatedly if they trust their scammer and believe they have cause for making unreasonable requests. For this reason, scammers often use urgency as a tactic when communicating with victims.

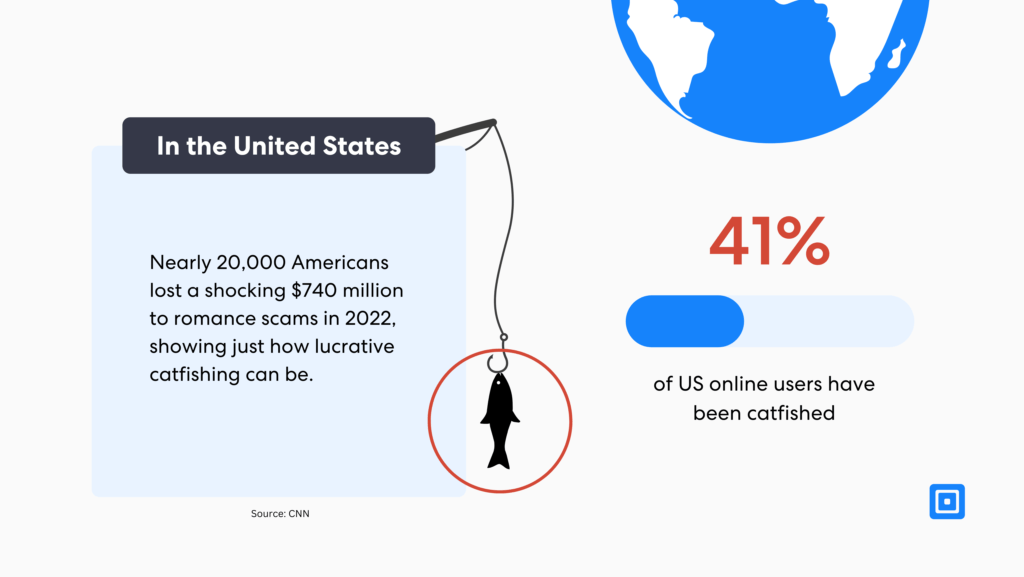

In the United States, catfishing practices related to romance scams account for the biggest financial losses of all internet crimes.

CNN reported that nearly 20,000 Americans lost a shocking $740 million each to these forms of romance fraud in just 2022. The FTC stated that the total cost for the whole year amounted to an eye-watering $1.3 billion lost, with 70,000 Americans being catfished.

In the United Kingdom, the National Fraud Intelligence Bureau received over 8,000 reports of romance scams in 2022, totaling £92 million, with an average loss of £11,500 per victim.

However, catfishing practices are certainly not limited to these nations, as they occur worldwide. The BBC noted in early 2023 that catfishing has become a major concern in West Africa:

“Nigeria and Ghana have become synonymous with catfishing: pretending to be someone you’re not online as part of a romantic or financial scam.”

The reality of the situation is that you risk encountering catfishing scammers wherever there is internet access and social networks, and something needs to change.

Regulations Supporting Identity Verification Practices

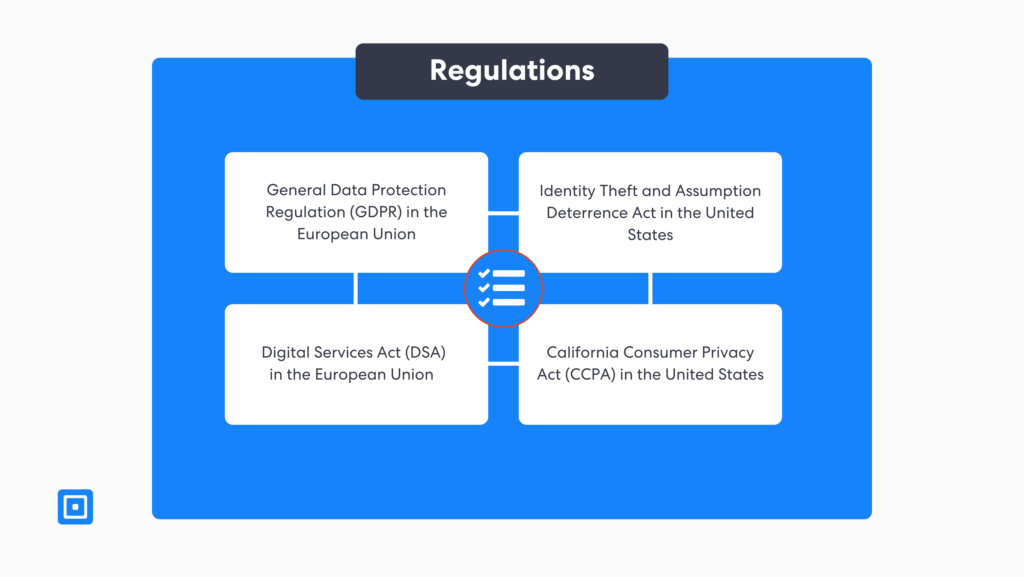

Protecting users on social media has proved difficult due to a lack of awareness of fraud. Users are unable to spot the signs of criminal activity online. For this reason, many national and international regulatory bodies have put regulations in place to prevent catfishing cases, although a lot more work is needed to end these practices. Some of these regulations include:

International Regulations

- General Data Protection Regulation (GDPR) in the European Union: The GDPR outlines standards for data privacy that all platforms should follow and mandates identity verification processes to authenticate customer identities, preventing criminal abuse such as catfishing.

- Digital Services Act (DSA) in the European Union: The DSA mandates Know Your Customer (KYC) processes for all business users’ digital identity and helps flag and remove fake accounts. The DSA reduces money laundering risks and financial crime overall.

National Regulations

- Identity Theft and Assumption Deterrence Act in the United States: This regulation, created by the US government, makes any form of identity theft a federal crime and allows victims of these criminal activities to report it.

- California Consumer Privacy Act (CCPA) in the United States: The CCPA requires financial institutions and other businesses to be transparent on data collection to reduce misuse of information, which often leads to catfishing practices.

Regulations also help prevent serious forms of online fraud, such as terrorism financing and other illicit financial activities. These activities sometimes utilize fake profiles or steal identities to solicit donations and receive funds through untraceable means, such as cryptocurrencies.

What’s Next for Dating and Social Media Platforms?

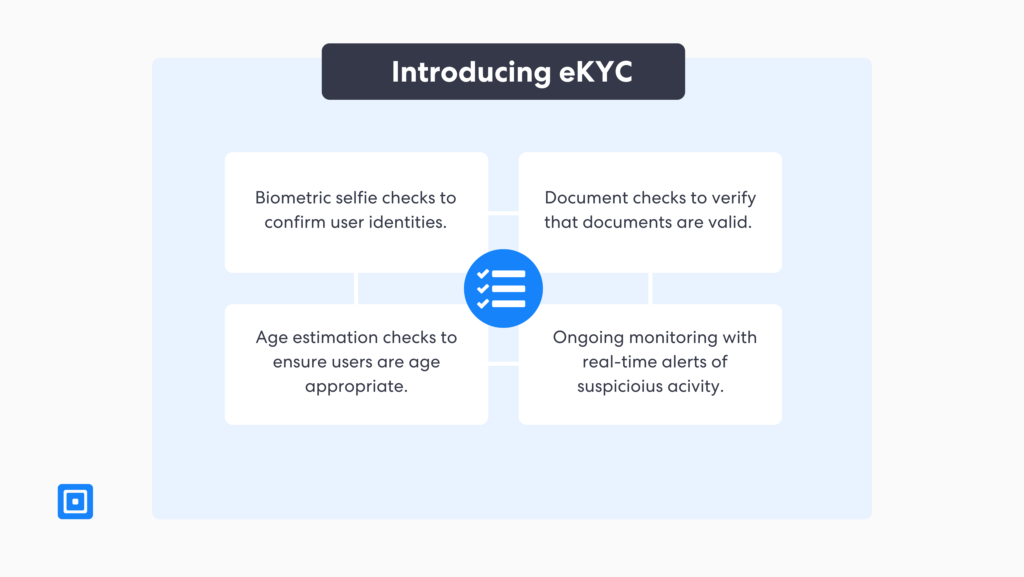

Online dating and social media platforms need to start enhancing security for their users by implementing IDV and KYC processes. Urging users to protect their identity online should also be standard practice amongst these platforms.

Implement Social Media KYC with ComplyCube

At ComplyCube, we offer a range of IDV and KYC solutions. Choose a bespoke verification process for social media users to prevent identity theft and fake accounts on your platform.

Incorporating KYC requirements, such as a biometric identity check, would be a strategic move for social media platforms. It would help prevent online dating and social media scams with fake profile detection to stop catfishing practices, as the biometric check can compare a scanned selfie with the existing government-certified document image. Liveness detection is also used in our identity check to ensure the user is present and detects any presentation attacks. A document check can also be incorporated to ensure that documents provided by users are valid, increasing accountability and, therefore, safeguarding the platform.

Get in touch with our team to secure your platform and protect your users from catfishing practices.