New crypto regulations continue to divide economies, nations, and families. The ever-increasing narrative, however, or should we call it reality, is that new crypto compliance and regulations are beginning to proliferate, everywhere.

It wasn’t long ago that Centralized Exchanges (CEXs) could onboard new users with nothing but an email, bypassing most of the then poorly administrated Anti-Money Laundering (AML) regulations – in fact, some still probably are. However, the gap between Virtual Asset Service Provider (VASP) operational capacity and crypto compliance is closing. Fast.

This month’s newsletter dives into the nuances of regulation from around the world. From renowned crypto hubs to ‘I didn’t know Khazakstan had a crypto scene’, this update has got something for everyone!

Hong Kong reservations persist: Will the region’s regulatory caution inhibit industry leadership?

First Digital Trust believes that Hong Kong’s cautious and slow-moving regulatory framework could hinder its growth and prevent its industry leadership in the digital asset space. This regulatory caution is evidenced by the number of licenses the Securities and Futures Commission (SFC) has granted—a mere two: OSL Exchange and HashKey Exchange.

Obtaining an SFC license to operate a Virtual Asset Trading Platform (VATP) surmounts millions of dollars in legal fees and internal audits, amongst many other contributions. The region’s series of comprehensive, yet rather complex, regulations also makes the reality of adhering to these rules an expensive endeavour too.

The SFC has a rather large backlog of VATPs waiting for an answer to their license submission; the regulator has promised that all institutions currently waiting to hear back from them will do so by the end of 2024.

While it’s true that Hong Kong’s legislative landscape is fiddly, it is not its undoing. The province boasts strong stablecoin adoption, regarding both the technology’s applications, and real world utility. The Hong Kong Dollar is poised to receive its own stablecoin, pegged 1:1, via Jingdong Coinlink Technology Hong Kong Limited, a subsidiary of JD Technology Group. This being said, Hong Kong faces stiff competition.

Bybit obtains its provisional license from the VARA

Bybit established its HQ in Dubai 2 years ago, obtaining a provisional license to operate in Dubai in September. So, what does this tell us? Well, despite it taking the firm 2 years to obtain this license, Dubai and the Virtual Asset Regulatory Authority (VARA) move faster than other key regions, notably Hong Kong. Last year, Bybit obrained its Minimum Viable Product (MVP) license in Dubai, beginning its journey towards a fully licensed company in Dubai.

Dubai’s strategic location, progressive policies, and innovation-driven environment offer unparalleled opportunities for businesses and investors in the cryptocurrency sector.

Helen Liu, COO at ByBit.

That is not to say that Dubai and its native digital asset regulator, VARA, cut any corners; this is far from the truth. Dubai (and the UAE at large) has some of the most contemporary and comprehensive crypto legislation, making the region a front-runner in attracting talent and adoption.

Bybit Growth Statistics

ByBit has experienced a notable uptick in market share volume, rising from 8% to 16% from October 2023. This exemplifies the value that taking a compliance-first approach has on growth in the crypto exchange industry, following Coinbase as a regulatory leader.

As of September 2024, Bybit’s trading volume is roughly 35% of Binance’s and generates around the joint second-highest 24-hour volume of any centralized exchange, matching crypto.com’s volumes.

Standard Chartered starts custody services for digital assets in the UAE

Standard Chartered Bank has always held a slightly more amenable attitude towards disruptive technology, particularly blockchain. It should come as no surprise, then, that the American giant has begun offering digital asset custody services in the United Arab Emirates (UAE).

The bank has taken on Brevan Howard Digital, the crypto digital asset segment of the British-based hedge fund, as its first client. The bank reported, in a somewhat familiar score, that the UAE was chosen due to its ‘well-balanced approach to digital asset adoption and financial regulation.’ This rhymes heavily with Helen Liu’s comments on Dubai.

These developments mark an extraordinary development for the bank’s move into the digital asset sector. Standard Chartered will have to adhere to the Virtual Asset Rulebooks, mandated by the VARA upon all cryptoasset companies, as well as other pertinent regulations for the UAE at large. For more information on UAE and Dubai crypto regulations, read our guide here.

Tether launches a stablecoin in the UAE

The largest distributor of stablecoins, Tether, will release a stablecoin paired to the United Arab Emirates Dirham (AED). Tether’s CEO discussed the UAE’s significance in the global economy.

This new Dirham stablecoin will strengthen Tether’s existing suite of tokens, which include coins tied to the US Dollar, Euro, Chinese Yuan, and Mexican Peso. It also continues to suggest that Dubai, the UAE at large, and the Middle East are emerging as the key hotspots for the cryptocurrency market.

With favorable regulatory environments, forward-thinking leadership, and strategic location, the UAE is certainly in a dominant position to continue innovating in the industry and attract key players, like Bitget, to its borders.

SEC vs eToro: US crypto trading services to significantly drop

Following a settlement with the Securities and Exchange Commission (SEC) and a $1.5 million payout, popular trading platform eToro will shut down many of its crypto trading services and offer only Bitcoin, Bitcoin Lightning, and Ethereum positions.

The charges made against the platform were that they had operated as an ‘unregistered broker and unregistered clearing agency in connection with its cryptocurrency offerings.’ This incident brings up previous contentious discussions around how the SEC regulates crypto assets, with the securities regulator claiming many decentralized infrastructures and their tokens share common traits with traditional American securities.

Importantly, the settlement only affects users in the US; users elsewhere in the world will continue to have access to the firm’s full range of crypto trading services. That feature, in particular, sheds light on where the SEC continues to stand in the crypto regulatory battle.

The American regulator remains locked in discussions with many digital asset companies, including exchanges and developers of decentralized infrastructures like Ethereum. While this is nothing new, the SEC’s continuation of its hardened stance under Gary Gensler’s leadership raises certain questions.

How will the attitude of US election candidates towards cryptocurrencies impact the outcome of this political event?

American election candidates don’t find common ground on crypto

While we seem to cover this topic every month, it is for good reason. America remains the largest crypto market in 2024 and, as such, is a vital geopolitical region for the crypto industry. 2 months on from Kamala Harris taking over from Joe Biden as the Democratic nominee, she is yet to deliver a decisive opinion on crypto policy.

Kamala Harris Position

There has been no mention of digital assets, Bitcoin mining or any related industries in her election campaign policy positions. While name-dropping AI and various other innovative industries, there was no specific mention of crypto or blockchain, leaving some of her supporters who are also blockchain advocates on something of a political tightrope.

However, there have been indirect links between Team Harris and the crypto sector. The CEO of Circle, the issuer of the USDC stablecoin, has ‘commended Kamala Harris’s campaign for showing a “concerted effort” to understand digital assets.‘

Mark Cuban has also discussed that her political advisors have reached out to him regarding the administration of crypto regulations. Potentially, Harris’s current silence on matters of crypto is due to a lack of comprehensive understanding.

Donald Trump Position

Quite conversely, Trump has jumped onto the crypto bandwagon, promising hugely bullish regulatory changes. Promising a new crypto exchange called World Liberty Financial and declaring that America should hasten to mine all remaining Bitcoin inside its jurisdiction, it is clear for which side the former President bats.

Trump has always been an advocate for building strong financial markets, sometimes at the expense of other economic policies. It’s possible that his intention to back crypto and its favorable regulation is to onboard many key players in the industry as Republican voters. However, it’s likely much of this will change before the November election!

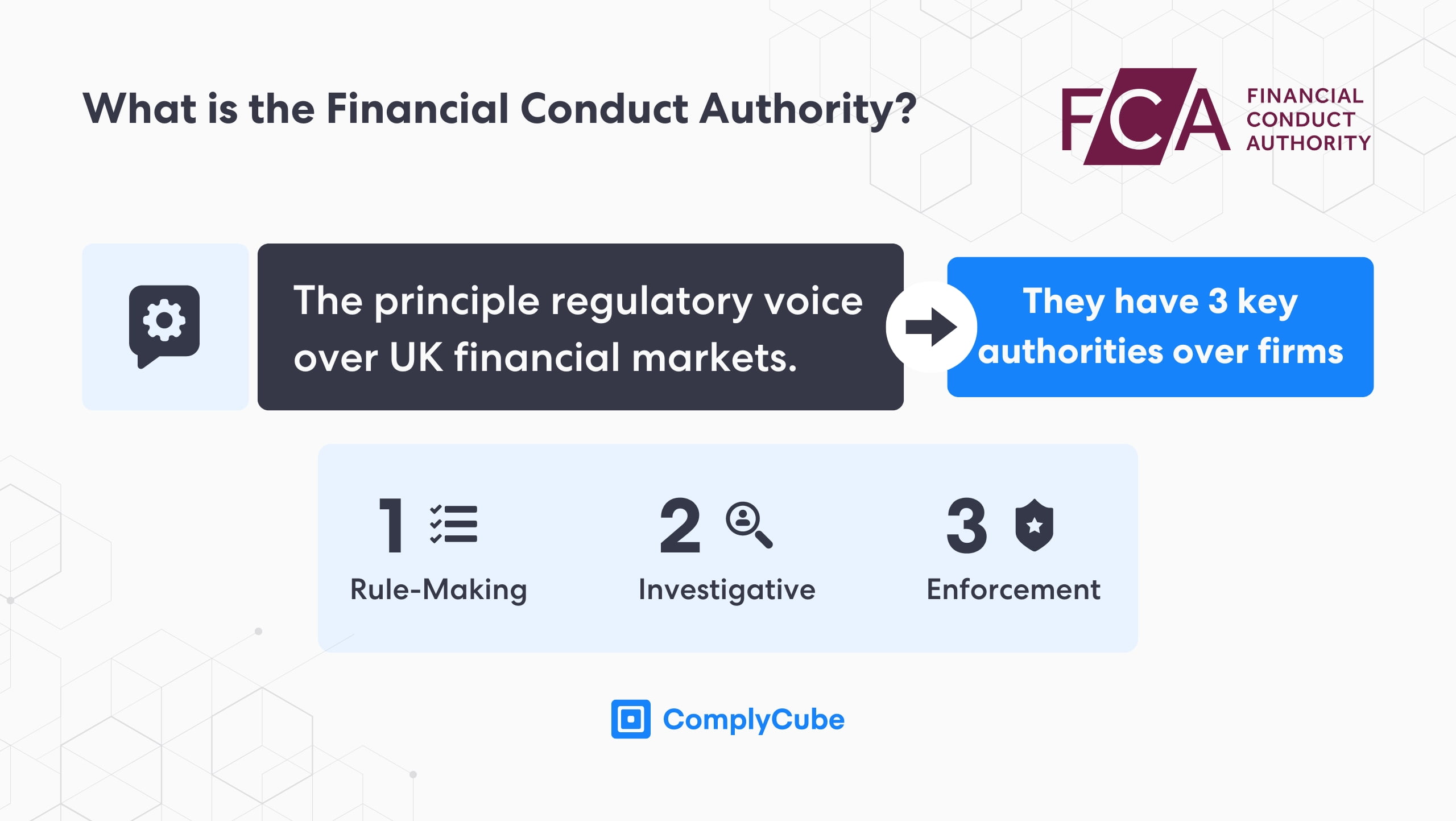

UK new property laws on digital assets

On the other side of the pond, new rules have just been set in the UK regarding the legal definitions of cryptocurrencies. Now, Bitcoin, Ethereum, USDT, and other digital assets are considered personal property, signifying a vast development in the legal adoption of digital assets.

Bitcoin and other digital assets can be considered personal property under [this] new draft law.

This new Bill is designed to protect holders of cryptocurrencies under British law, particularly in regard to events such as divorce and consumer protection rights in the wake of fraudulent crypto schemes and scams.

Justice Minister, Heidi Alexander, said:

It is essential that the law keeps pace with evolving technologies and this legislation will mean that the sector can maintain its position as a global leader in cryptoassets.

This is a significant step forward for the UK in its ambition of making the UK a digital asset hub, a feat that only further regulatory developments will enable. While this ruling will have no direct impact on many Virtual Asset Service Providers (VASPs), it exemplifies the British government’s progress and current thinking. Learn more about current UK and FCA crypto compliance legislation by reading our latest guide here.

Nigerian SEC licenses 2 exchanges under new regulations

The Nigerian Securities and Exchange Commission has announced that it granted 2 crypto exchanges a license under its Accelerated Regulatory Incubation Program (ARIP), with 5 other VASPs moving into its Regulatory Incubation (RI) program.

These preliminary licenses are designed to precede a full license from the regulator to ensure proper transparency and protection for each supervised product and service.

A history of crypto policy in Nigeria

In 2021, the Central Bank of Nigeria (CBN) banned Bitcoin due to the lack of regulation to protect consumers and prevent issues of money laundering and finance proliferation. However, at the turn of the year, in December 2023, the CBN overturned this, marking 2024 a watershed moment for digital assets in the country.

The regulatory authority has licensed 2 Centralized Exchanges:

Busha Digital Limited

Quidax Technologies Limited

And granted 5 other digital asset firms into its RI program:

Trovotech Ltd

Wrapped CBDC Ltd

Housing Exchange Ltd

Dream City Capital

Blockvault Custodian Ltd

Binance granted consent for a full regulatory license in Kazakhstan

Binance, the leading global exchange by users, volume, and pretty much every other metric, has just been granted a license in Kazakhstan. The CEX leader has to undergo an external financial audit, internal audits, and regulatory inspections to ensure the digital asset firm complies with Kazakhstan’s regulations.

Once in effect, this license will evidence Binance’s reversal of noncompliance over the last couple of years. The firm was found to be wittingly permitting money laundering and finance proliferation, among other financial crimes. These developments ultimately led to the arrest of its founder, Changpeng Zhao (known in the crypto community as CZ).

Binance’s license will also be the first license granted to any digital asset company in the country, marking a significant milestone for Kazakhstan. Cryptocurrencies have long been touted as a tool for granting financial freedom and breaking down barriers to finance. This move from Kazakhstan demonstrates the region’s desire to stimulate economic growth.

Binance founder, CZ, set for release on September 29

While we are on the topic of CZ, his release date is scheduled for September 29th. While the ex-CEO has been banned from ever managing the exchange again, this could serve as a catalyst for the sector’s growth. Changpeng Zhao has long advocated for enhanced crypto regulations, and his renewed voice from outside the prison cell could enable these developments.

That wraps up this month’s crypto regulations highlights. Make sure to come back next month for more key news and discourse around global crypto compliance! Head over to our crypto regulations blog page for more sources on crypto regulations from around the world and how they might impact you. Alternatively, get in touch with one of our compliance specialists to learn more about the ComplyCube crypto solutions!