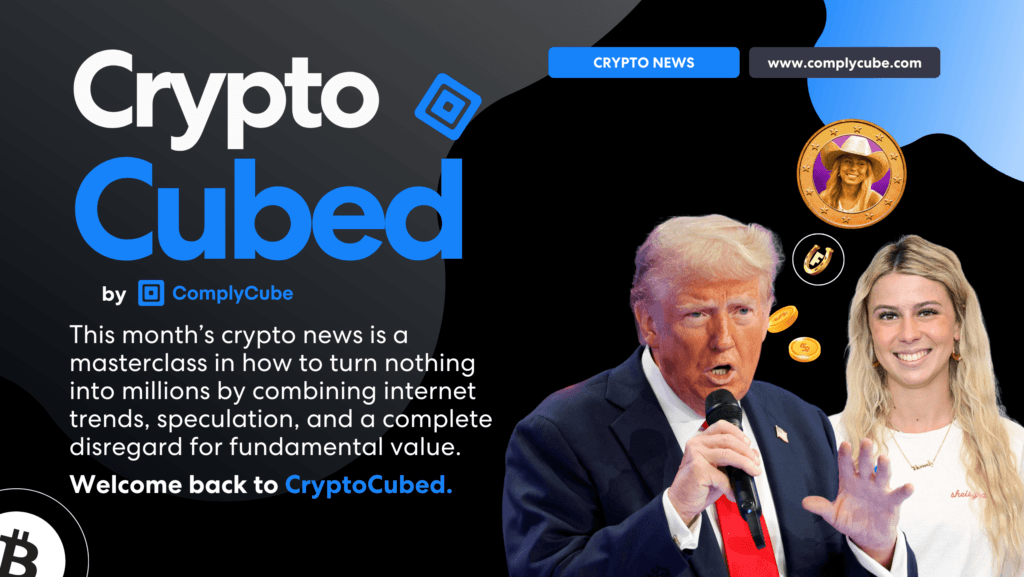

This month’s crypto news is a masterclass in how to turn nothing into millions by combining internet trends, speculation, and a complete disregard for fundamental value. Welcome back to CryptoCubed!

Fartcoin is on the rise with NBC News comparing it to 2023’s Peanut the Squirrel meme coin (a coin named after a dead squirrel) which experienced turbo growth last year. Meanwhile, the HAWK meme coin launched by TikTok influencer “HAWK TUAH” girl crashes and burns, and a crypto trader has turned $27 into $52M with meme coin Pepe token investment.

We’ll let you know when you can invest in reality again. For now, buckle up and enjoy how meme coin investors throw their money into the wind and walk away multi-millionaires.

💰 Bitcoin Soars Above $106,000 After Trump’s Latest “Announcement”

Bitcoin climbed to an all-time high, surpassing $106,000 on Monday, following President-elect Donald Trump’s indication that he intends to establish a U.S. bitcoin strategic reserve akin to the country’s strategic oil reserve. This announcement fuelled optimism among cryptocurrency enthusiasts.

Bitcoin has experienced a significant price increase of over 50% since the November 5th election, which resulted in Trump’s victory and the success of numerous pro-crypto candidates. This surge has contributed to the cryptocurrency market nearly doubling in value this year, reaching an all-time high of over $3.8 trillion, according to CoinGecko data.

📈 “Hawk Tuah” Girl’s Potential Pump and Dump of HAWK Meme Coin

Hailey Welch, known as the viral “Hawk Tuah” TikTok star, faces backlash after her newly launched meme coin value crashes within only a few hours of its release. This has led to allegations of having carried out a “pump and dump” or “rug pull” scheme, arguing that her team may have profited by artificially hyping the coin before selling off their holdings.

Meme coins such as this have been booming in popularity due to their jokey, cheap appeal for investors.

Welch has denied these claims, stating her team hasn’t sold any tokens. However, investors remain skeptical, with some accusing her team of misleading them. Experts highlight the risks of meme coins like Hawk, which are often volatile and risky despite their popularity. This situation mirrors other controversies involving influencers promoting cryptocurrencies without full transparency, such as Kim Kardashian’s $1.26 million fine in 2021.

Read the whole story on BBC News.

🪙 Do StableCoins Undermine The Euro? The Last Phase of MiCA is Here

The next stage of MiCA (Markets in Crypto Assets) has taken effect this December. Although the crypto industry has had ample opportunity to get ready, the new rules will still require adjustments to how crypto businesses operate.

The initial phase of the EU’s crypto regulation began in June, but its full implementation will be finalized in December. The most significant change is the requirement for all Crypto Asset Service Providers (CASPs) to secure authorization to operate within the EU. This includes adhering to stringent security, governance, and compliance standards. While this will impose additional responsibilities on crypto firms, they’ve had sufficient time to prepare, and the purpose behind the legislation is widely regarded as positive.

Stablecoins are at the centre of MiCA’s (Markets in Crypto Assets) most drastic changes. New rules effective since June limit the volume of stablecoins that can circulate over a set period—reflecting concerns about stablecoins, especially USD-pegged ones, potentially undermining the Euro.

The situation will become even more challenging for stablecoin issuers starting in December. They will now need an e-money authorization in at least one EU country to continue operating. While stablecoins are relatively stable, well-regulated, and low-risk compared to other crypto assets, the EU’s stance may seem disproportionately strict. However, aside from these stablecoin requirements, MiCA generally lays out a balanced path for blockchain innovation, aiming to support growth while managing oversight.

Read more on MiCA here.

⚠️ Memecoins Like Fartcoin Riding Trump’s Victory Tidal Wave

It seems as though crypto valuations and absolute mockery now go hand in hand, as major news outlets report on Fartcoin’s drastic jump in valuation.

Yes, it’s called Fartcoin. Yes, it is totally useless. And yes, it has nevertheless tripled in value over the past week to a market capitalization of more than $700 million.

NBC News argues that buyers and sellers of meme coins such as Fartcoin are betting on the “greater fool”, counting on the fact that despite the coin being worthless and having no underlying driver of value, people will still buy it anyway arguably due to virality, momentum and excitement. However, this makes the often short-lived lifespan of viral internet memes one of the greatest risks in training meme coins.

However, in a very select few cases, investing in memecoins based on viral incidents has been extremely lucrative. An example is the Peanut the Squirrel (PNUT) meme coin incident, a based on a squirrel who died. Coinbase agreed to add the token to its listing roadmap, leading to a 20% price surge and a market cap of $1.34 billion. This continued to increase until hitting an all-time high in November 2023.

Find more information here.

🇬🇧 UK’s FCA Asks For Feedback

Last month, the U.K. government announced its intention to propose legislation in order to bring the crypto sector under the Financial Conduct Authority’s (FCA) oversight. The FCA said that its goal is to develop, “a balanced regime that addresses market risks without stifling growth.”

The regime will look to reduce and prevent financial crime, protect and put consumers’ needs first [and] maintain market integrity while supporting the use of technology to help strengthen the U.K.’s growth and competitiveness. ~ FCA

The Financial Conduct Authority (FCA) is now seeking feedback on new proposed rules as part of the U.K.’s strategy to create a comprehensive regulatory framework for the crypto industry. The latest discussion paper outlines potential registration, disclosure, and conduct requirements to combat market abuse in the sector.

These proposals include implementing robust internal controls and encouraging information sharing among registered crypto trading platforms to identify and address market misconduct.

We encourage industry to share its expertise and help us shape the rules. We want industry to take the lead in developing new ways of disclosing important information to make sure people understand the risks before purchasing crypto. ~ FCA

Learn more about the story here.

💰 Turning $27 into $52M

A cryptocurrency trader is said to have transformed a $27 investment in the Pepe meme coin into an astonishing $52 million, according to blockchain analytics firm Lookonchain.

An extraordinary 1,900,000x return.

Memecoins have emerged as some of the top-performing cryptocurrencies this year, thanks to their impressive returns. Hao Yang, Head of Financial Products at Bybit, argues this is a symptom of the younger generation’s “disappointment in the financial system”. “The success of memecoins can be seen, like punk rock, as a symptom of disillusioned young investors who have seen the opportunities afforded to their parents disappear,” Yang stated to Cointelegraph.

Read the full story here.

Time for Some Light-Hearted Creative Criticism?

So you’ve made it to the end of our newsletter. It’s time to enjoy a little satire, worthy reader, you’ve earned it.

🔥THE CRYPTOCUBED POEM: DECEMBER🔥

Fartcoin rose on a viral breeze,

$700M banked with laughable ease,

Has the sector just gone mad?

Or must all meme coin names be bad?

Donald Trump, the Crypto King,

He hasn’t really said anything,

“Yeah, I think so” – is that a concrete plan?

Meanwhile every newspaper, “What a strategic man!”

The crypto sector explodes into brawl,

and CrypoCubed is here to tell all.

Stay tuned for our January newsletter and have a great month!