This month, we’re tracking the rise of the $Trump meme coin, which has gained serious traction ahead of the inauguration. Meanwhile, Turkey sharpened its crypto regulations, Malaysia cracked down on unlicensed exchanges, and the U.S. Securities and Exchange Commission (SEC) continued to hold firms accountable. It’s a busy time in the world of digital assets—let’s dive in.

Price of New Trump Meme Coin Soars Ahead of Inauguration

Donald Trump has unveiled a new cryptocurrency, the $Trump meme coin, ahead of his second-term inauguration as US president. Announced on social media platforms, the coin has seen its value skyrocket from $20 to over $70 per token, with $24bn in trading volume and a $14bn market cap by Sunday morning. Meme coins, which are often based on internet trends with little to no intrinsic value, are prone to volatile price swings, as seen with other recent meme coin failures.

Trump’s move into crypto comes as the community anticipates a more favorable regulatory environment under his leadership. The president-elect has promised to make the US the “crypto capital of the planet.” He has nominated crypto advocate Paul Atkins to head the SEC and plans an executive order to create a crypto advisory council once in office. Despite these promises, concerns persist about the speculative nature of cryptocurrencies, with some fearing the market could be heading towards a bubble.

A key detail is that CIC Digital LLC, a Trump-owned company, controls 80% of the 200 million $Trump coins in circulation, which is expected to grow to 1 billion over the next three years. This move follows Trump’s previous successful releases of crypto trading cards and his son’s involvement in the crypto industry. Some have raised red flags over potential conflicts of interest.

The $Trump coin’s website claims its purpose is to express support for Trump’s ideals rather than be an investment vehicle, distancing itself from any political campaign. Despite these disclaimers, its launch has triggered significant interest and investment from major crypto firms.

While the $Trump meme coin soars through its obvious initial success, this coin further strengthens the ties between the crypto sector and political agendas in the United States like never before, as this shortly follows the rise of Dogecoin. For more on Musk’s coin, read “Dogecoin Rises, With Crypto Fraud Set to Follow.”

Learn more about the rise of Trump’s new meme coin here.

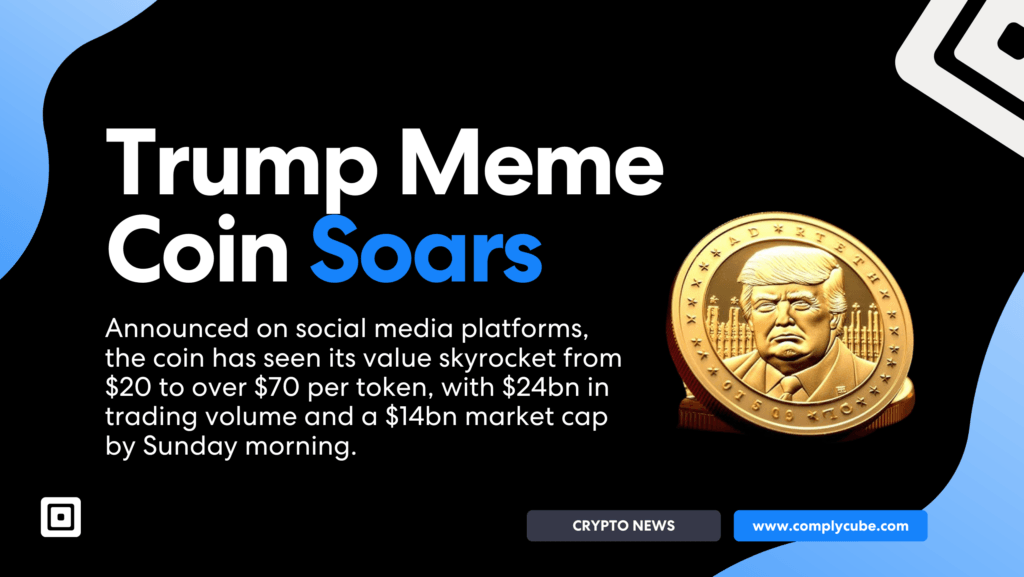

Crypto Regulation Back On the Cards? US Senator Unveils Congressional Strategy

Senator Tim Scott, Chairman of the U.S. Senate Committee on Banking, Housing, and Urban Affairs, has outlined his priorities for the 119th Congress, with a focus on creating clear and effective regulations for cryptocurrencies. Scott criticized the previous administration’s lack of clarity, particularly under SEC Chair Gary Gensler, which he argued led to cryptocurrency projects moving abroad.

Scott’s legislative agenda aims to develop a tailored regulatory framework for digital assets, ensuring consumer protection, financial education, and compliance with relevant laws, such as the Bank Secrecy Act. At the same time, he stresses the need for flexibility to allow innovation in emerging financial technologies like stablecoins while maintaining U.S. competitiveness in the global crypto market.

Beyond regulation, Scott also intends to integrate digital asset oversight into national security policies, ensuring financial technologies support U.S. economic strength. His overarching goal is to drive financial inclusion and create economic opportunities, building on past successes to strengthen America’s position both domestically and globally.

Find more information here.

MiCA in Action – Crypto.com Leads the Way

Crypto.com has become the first major global cryptocurrency exchange to secure an in-principle Markets in Crypto-Assets (MiCA) license, enabling it to operate in the European Union. The MiCA framework, which aims to enhance transparency, consumer protection, and market integrity, requires crypto firms to adhere to strict rules on governance, transparency, anti-money laundering protocols, and stablecoin reserve requirements.

Eric Anziani, Crypto.com’s President and COO, expressed strong support for MiCA, believing it will improve confidence in the crypto industry across the EU. The move follows last month’s approval of MoonPay under the same regulation, marking a significant milestone for the European digital asset market.

While the approval highlights Crypto.com ‘s commitment to compliant growth, the company is also under scrutiny by the Commodity Futures Trading Commission (CFTC) for allowing betting on major football games like the Super Bowl. For more information on MiCA and its effect on the crypto sector, read “MiCA Regulation and the Future of RWAs.”

Read more on Crypto.com’s recent story here.

BitMEX Fined $100 Million For Violating Bank Secrecy Act

BitMEX, a global cryptocurrency exchange, has been fined $100 million for violating the Bank Secrecy Act by failing to implement an adequate Anti-Money Laundering (AML) and Know Your Customer (KYC) program. The company was found to have willfully ignored U.S. regulations despite serving U.S. customers. BitMEX executives knowingly allowed U.S. traders to use their platform without proper verification, undermining national security and financial integrity.

It is critical that all financial institutions, including cryptocurrency exchanges, comply with these rules to protect our country’s economy and national security.

Attorney for the United States Matthew Podolsky said: “Anti-money Laundering and Know Your Customer rules protect Americans from fraud, combat money laundering, and prevent the financing of terrorist activity. It is critical that all financial institutions, including cryptocurrency exchanges, comply with these rules to protect our country’s economy and national security. Today’s sentence sends a clear message that companies that willfully violate these rules and refuse to implement AML/KYC programs will face consequences.”

In addition to the fine, BitMEX was sentenced to two years of probation. The company’s founders and executives had previously pled guilty in 2022 to similar violations. The FBI’s New York Money Laundering Investigation Squad investigated the case.

This settlement highlights the importance of compliance with AML and KYC laws, especially for financial institutions operating internationally. The Justice Department has emphasized that such violations will not be tolerated.

Find more on this story here.

SEC Slaps Digital Currency Group with $38 Million Fine for Negligence

The U.S. SEC has imposed a $38 million fine on Digital Currency Group (DCG), accusing the company of negligence in misleading investors about the financial health of its subsidiary, Genesis Global Capital (GGC). The SEC’s findings, released on January 17, 2025, claim DCG misrepresented GGC’s stability during a critical time in 2022, following the default of a $2.4 billion loan by GGC’s largest borrower, Three Arrows Capital. Despite mounting losses, GGC made public statements portraying financial stability, which the SEC now deems misleading.

DCG also issued a $1.1 billion promissory note to GGC to present positive equity, though the lack of transparency around this note further obscured the true financial situation. This culminated in GGC’s bankruptcy filing in January 2023 after suspending withdrawals.

The penalty highlights ongoing challenges in regulating the rapidly evolving crypto market, especially as the incoming Trump administration signals potential reforms. Critics argue that the SEC’s reactive approach fails to address broader regulatory issues, with the cryptocurrency sector still facing uncertainties and systemic risks. Despite the fine, DCG expressed relief that the matter is now resolved.

Read more about the SEC’s fine here.

Turkey Strengthens Crypto Regulations as New Framework Takes Effect

Turkey is tightening its digital asset regulations with a new framework that will come into force in February 2025. This update, aimed at reducing illicit financial activity, follows the European Union’s Markets in Crypto-Assets (MiCA) regulation and introduces stricter Anti-Money Laundering (AML) measures.

The new law requires individuals to share identifying information with Virtual Asset Service Providers (VASPs) for transactions over 15,000 Turkish liras ($425) and when opening new wallets. If VASPs cannot verify users’ identities, they must flag transactions as “risky” or even terminate the business relationship.

Our main goal with crypto asset regulation is to make this area safer.

Treasury and Finance Minister Mehmet Şimşek stated, “Our main goal with crypto asset regulation is to make this area safer and to eliminate the risks that may arise. Our approach is not restrictive but based on eliminating uncertainties and controlling possible risks.”

The regulations also set licensing and operational requirements for VASPs, including capital, staffing, cybersecurity, and organizational standards. The Capital Markets Board will oversee the sector.

With Turkey’s thriving crypto market, this move is expected to increase legitimacy and attract more investors, reinforcing Turkey’s position as a regional crypto hub.

Read more on Turkey’s new crypto regulations here.

Bybit Ends Operations in Malaysia following an order from the Securities Commission Malaysia (SC)

In Malaysia, the Securities Commission has taken a tough stance on unlicensed crypto operators. It ordered Bybit, a global crypto exchange, to cease operations in the country for failing to comply with local regulatory requirements and flagged Atomic Wallet as operating illegally.

Atomic Wallet, which is also embroiled in a hacking incident linked to North Korean cybercrime group Lazarus, is among several unregistered VASPs in Malaysia facing action. The regulator’s crackdown aims to protect investors and ensure compliance with capital market laws.

Bybit was also ordered to disable its website, mobile apps, and social media channels in Malaysia, marking another significant move in the ongoing global effort to enforce stricter crypto regulations.

Read more on Malaysia’s crackdown here.

Time for Some Light-Hearted Creative Criticism?

So you’ve made it to the end of our newsletter. It’s time to enjoy a little satire, worthy reader, you’ve earned it.

🔥THE CRYPTO CUBED POEM: JANUARY🔥

Trump’s meme coin skyrockets, a political twist,

With 80% in his pocket— he just couldn’t resist.

Senator Scott states new rules, loud and clear,

While crypto giants read them, sweating in fear.

A couple of corporates faced hefty fines,

As the market keeps pushing the regulatory lines.

Back to the drawing board, they scramble with haste,

To ensure they’re compliant—before it’s too late.

Stay tuned for our January newsletter, and have a great month!