Facial recognition Identity Verification systems power the digital world. Whether you’re logging into your crypto exchange, signing up for a new credit card, or signing a contract for a new job, Identity Verification software (also known as IDV solutions) is pivotal in building trust in the digital economy.

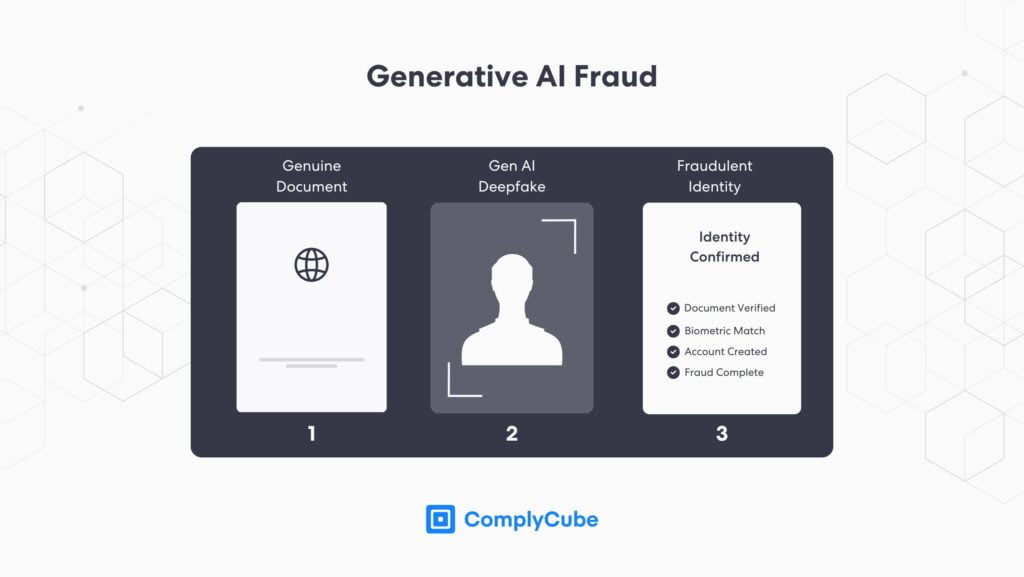

This is particularly important in 2024, as fraudulent methodologies have embraced Artificial Intelligence (AI) to create convincing but fake online identities. AI-powered IDV solutions are now an imperative tool for businesses that wish to protect themselves and their users against these threats.

This guide discusses how the technology behind facial recognition systems counters fraudulent attacks and why these Know Your Customer (KYC) solutions are a modern must. It will also elaborate on the difference between facial recognition technology and IDV solutions.

What is Identity Verification?

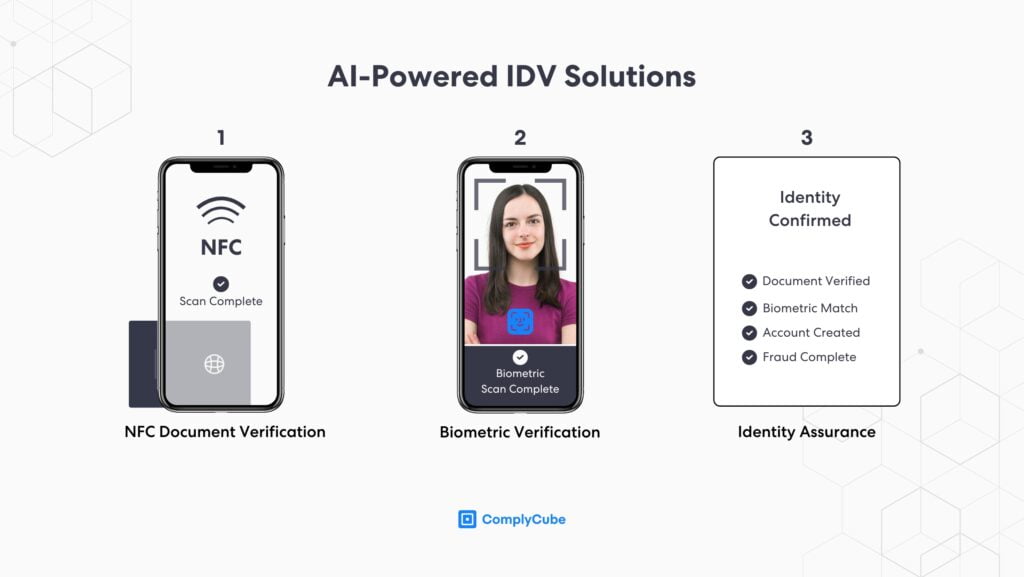

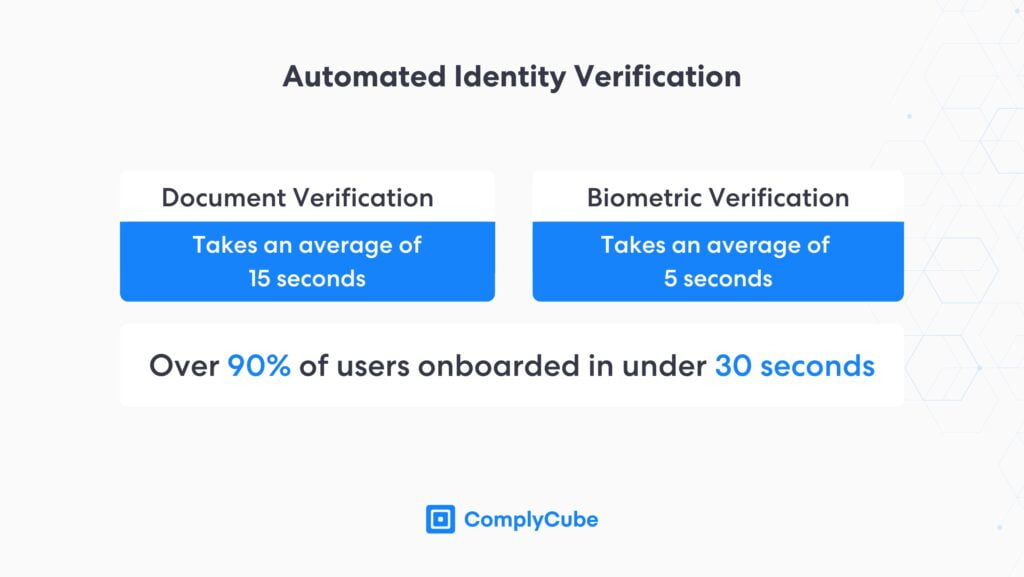

Identity Verification is the process of establishing a person’s identity. Multiple methods can be used to verify that someone is who they say they are, the most common of which include document verification and biometric verification.

Document and biometric verification work in tandem to create an ultra-high level of identity assurance. Leveraging cutting-edge AI, KYC documents can be verified and matched to selfies to ensure that the user is who they say they are. For more information on document verification, read What is Document Verification?

What are Facial Recognition and IDV Solutions?

Identity Verification solutions are digital tools used by businesses worldwide to verify and authenticate their users. Facial recognition technology is fundamental in this recurring process and fosters an unparalleled level of identity assurance by analyzing and verifying key facial features.

Usually, biometric verification is paired with document verification, and these facial biometrics are matched for similarity with a stock image of a KYC document. Together, these processes take an average of 30 seconds.

How Does Facial Recognition Work?

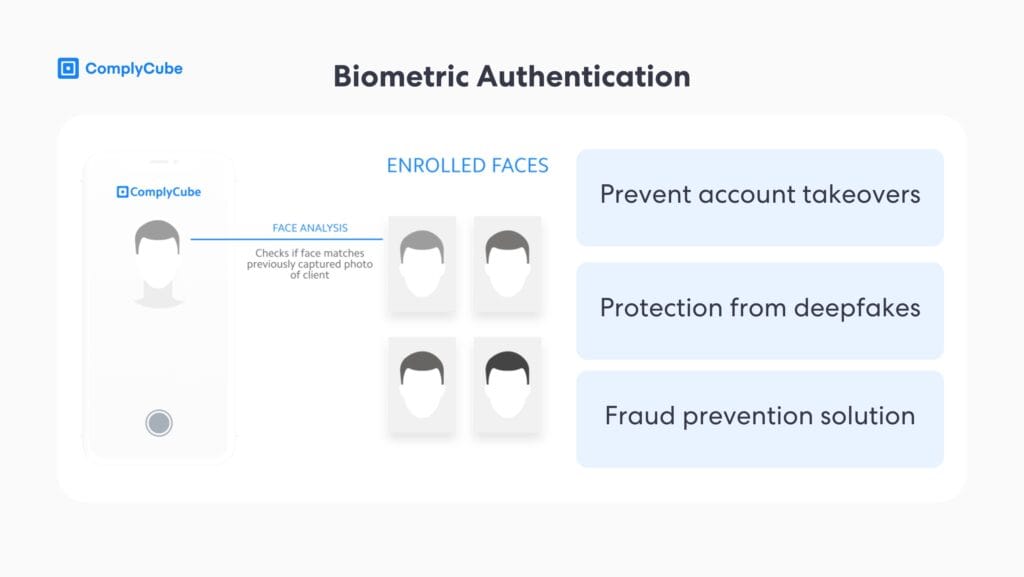

Facial recognition works by verifying biometric data with advanced machine learning technology and is the process used in biometric authentication. Once a user has signed up for a service, such as a crypto exchange, their facial data will have been saved in the exchange’s database for compliance and authentication purposes.

When a user goes through facial authentication to sign in, say a week later, this biometric information is used to compare against the data extracted from the authentication process. Ultimately, the same technology is used in both facial recognition software and biometric verification systems.

Biometric Verification Technology

Digital biometric verification enables the secure verification of anyone from anywhere. Sometimes known as selfie verification, it utilizes advanced machine learning and facial recognition algorithms to detect presentation attacks.

Presentation attacks are a fraudulent methodology used by malicious individuals to try to impersonate others. ComplyCube’s biometric verification uses its proprietary Presentation Attack Detection (PAD) technology to build 3D facial maps and analyze expressions, pixels, and skin texture to ensure that the selfie image is genuine.

Advanced Liveness Detection

PAD technology, or liveness detection technology, ensures that even the most meticulously crafted fraud attacks can be detected. This technology helps build trust in the digital and global economy, but it cannot be adopted quickly enough.

10x increase in deepfakes detected globally across all industries in 2023.

While this figure is alarming, it is far worse in certain specific sectors. Shocking statistics from the crypto industry suggest that deepfake fraud scams are set to rise by over 200% in 2024 alone. Read Why Identity Verification AI is crucial.

These statistics denote a growing necessity every year for the adoption of advanced face recognition technology in IDV solutions. In 2024, deepfakes are so convincing that the only plausible method to verify new accounts and authenticate users who sign in is with an automated Identity Verification process.

Benefits of Selfie Verification Software

The benefits of adopting a facial recognition system are numerous and far outweigh not searching for a state-of-the-art solution. A robust identity verification software will directly contribute towards business growth and detect and prevent fraud.

Facial recognition solutions vastly improve a business’s security against fraud. By adopting biometric verification technology, businesses can improve the rate of fraud detection while improving their customers’ safety. In the context of crypto exchanges, certain accounts have been drained in minutes due to poor IDV controls and deepfake detection software.

Businesses can also enhance their KYC onboarding process through biometric verification. Selfie checks take an average of 5 seconds to complete, contributing to a sleek, reliable, and fast KYC process.

A swift KYC onboarding process significantly improves the User Experience (UX), resulting in a higher satisfaction rate with customers. Long and drawn-out client acquisition processes are the leading factor in customer churn. Efficient onboarding will mitigate user attrition.

Furthermore, a face recognition system enhances KYC scalability. These solutions can onboard new users with a high level of precision in under 30 seconds, allowing firms to facilitate the demanding volumes that modern-day services experience.

Selfie verification empowers global compliance. These solutions verify users in seconds and are typically entirely cloud-based. Running on a software-as-a-service (SaaS) business model, Identity Verification solutions can be distributed worldwide, meaning the same solution can be used by the same company worldwide.

Lastly, facial recognition offers greatly reduced business costs, particularly the Cost of Client Acquisition (CCA) and Customer Due Diligence (CDD). CDD, a wider part of an Anti-Money Laundering (AML) process, could historically take business hours per customer. Automated KYC solutions, however, reduce the time and cost of these business operations.

ComplyCube’s Facial Recognition Identity Verification Solution

By employing advanced biometric methods, IDV solutions streamline the verification process, significantly reducing the risk of fraud while providing a first-class and seamless experience for legitimate users.

Servicing a range of sectors, including telecoms, e-commerce, crypto, fintech, traditional finance, and many more around the world, the firm is helping businesses transition into a secure and digitally entrusted society.

ComplyCube is committed to innovating the compliance and security industry, helping businesses build trust at scale. This is a particularly pertinent mission in the face of increasing fraudulent technologies, such as AI-driven deepfakes.

If your business faces challenges identifying these threats or simply requires a new KYC onboarding process, contact a ComplyCube compliance specialist to learn more.