Artificial Intelligence (AI) has already reshaped multiple business processes in its short lifetime. Reacting swiftly to its capabilities will put you ahead of your competition. This same reasoning applies to automated KYC verification processes. Know Your Customer or KYC automation has bridged a considerable gap between regulatory compliance and operational efficiency.

This guide explores how KYC automation powers business infrastructures and enables regulatory adherence through streamlined identity verification, customer due diligence, and Anti-Money Laundering processes.

What is Know Your Customer?

KYC is the general process that businesses use to understand who a client is. This involves multiple stages of identity verification, customer due diligence, and ongoing monitoring to ensure a client does not bring a risk to a business’s reputation.

Identity Verification Processes

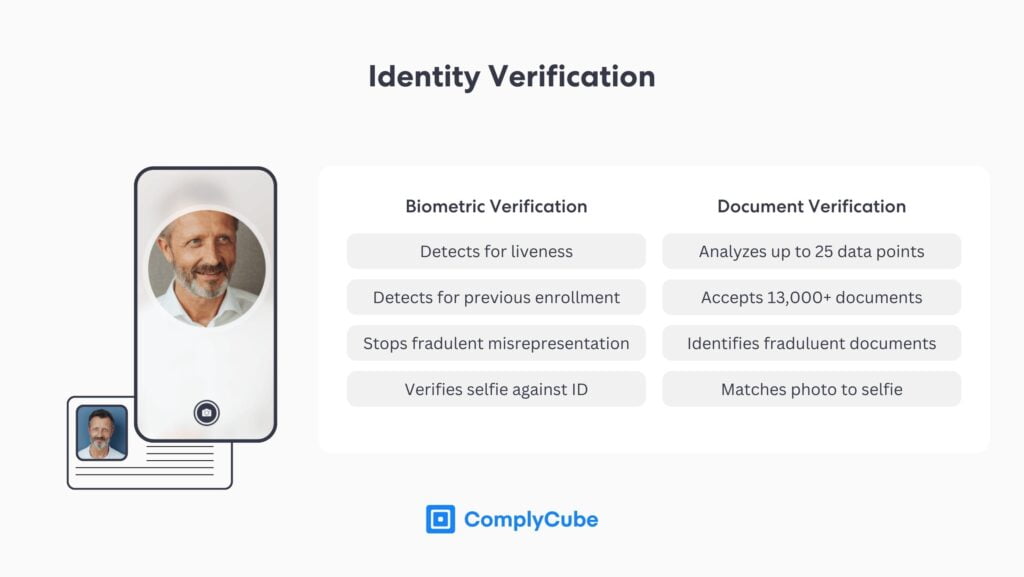

Identity verification (IDV) can be completed in different ways but typically follows a document and selfie upload pattern for a safe level of identity assurance. These images are then analyzed for similarities, as well as potential tampering. This process would previously have been done manually by a human and would have been very prone to errors in precision.

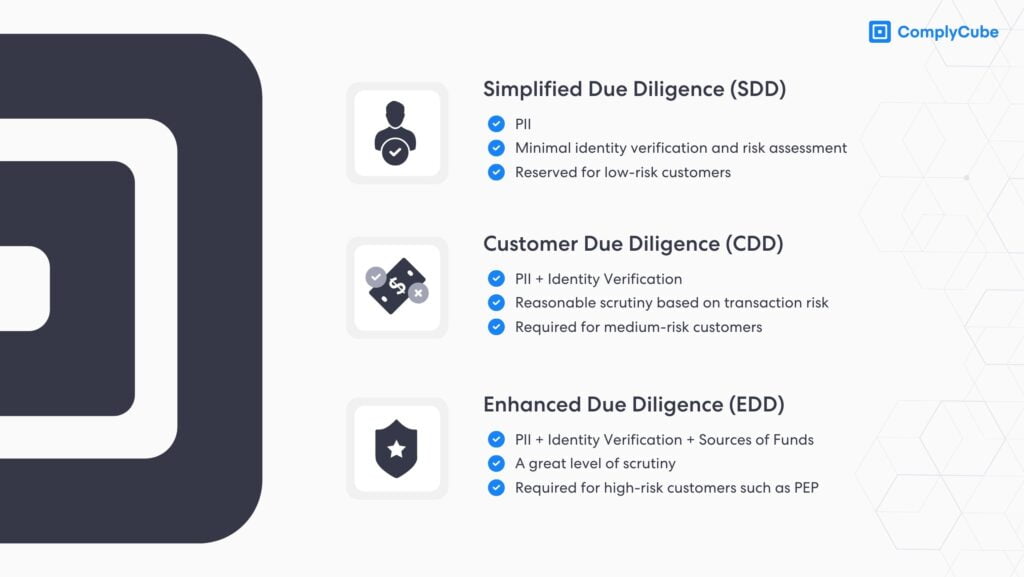

Customer Due Diligence (CDD)

Once a company has established that the user’s identity is authentic, it can begin its customer due diligence. This process, also a painstaking one to complete manually, involves checking the user’s profile against a host of partnered databases, such as a telecom’s or credit bureau’s, to provide further clarity over the identity of a user. Customer due diligence also enables Anti-Money Laundering (AML) risk scoring for clients, giving businesses adequate information to make informed decisions on their users.

Ongoing AML Monitoring

Ongoing monitoring is the continued due diligence and vetting of a user. Ongoing AML monitoring describes similar processes to CDD but vets clients constantly in real-time. A manual team could not mimic this process due to the vast quantity of data that would need to be analyzed around the clock. This process relies on strong partnerships with various databases and the technology to enable live updates.

Ongoing due diligence is even more pertinent now that the EU Council has updated its crypto AML regulations. All crypto transactions over €1,000 throughout the European Union must be scrutinized through enhanced due diligence, making the continuous monitoring of customer data more critical than ever.

KYC strategies are typically employed to meet regulatory compliance but are also used in association with a company’s set risk-based approach. These processes are critical in an institution’s monitoring, prevention, and deferral of financial crimes, such as money laundering.

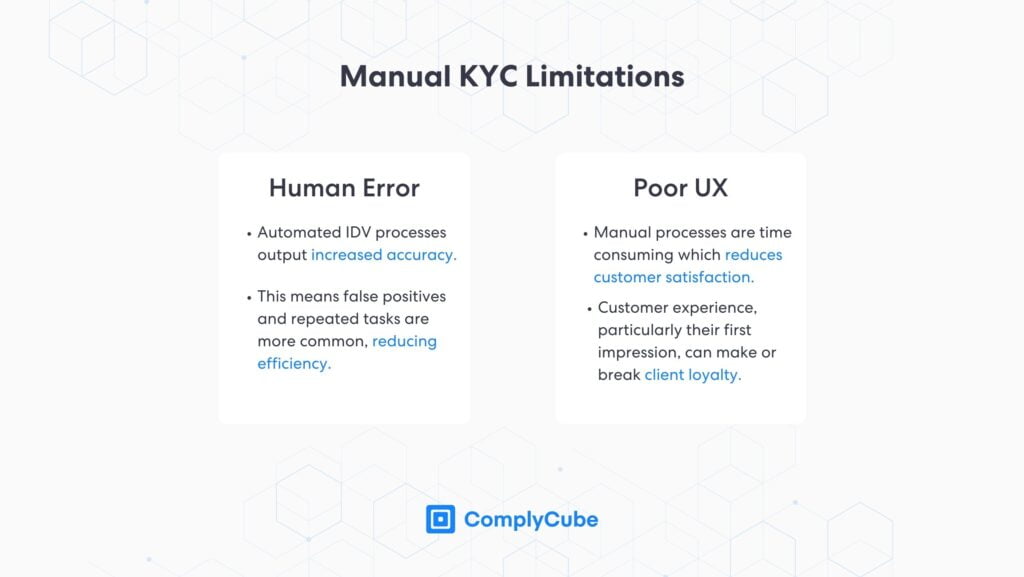

Limitations of manual KYC

Manual KYC processes cannot scale with the volume modern companies handle. Manual handling of the above mentioned tasks is slow, arduous, and littered with human error. This leads to a poor customer experience and aggregates the natural limitations that have been overcome by automated KYC verification.

Human Error

Mistakes can never be eliminated, especially when dealing with the intricate verification of identity documents and supporting images. Machine learning (ML) technologies can be trained to output precision far higher than a human eye could achieve. This enables businesses to employ their staff for far more effective purposes, such as initiatives relating to revenue growth and company expansion.

Human error in reporting, manual data entry, and regulatory checks significantly contribute to the number of false positives compliance teams are burdened with. This has a knock-on effect on net operational costs as tasks must be unnecessarily repeated, leading to reduced efficiency.

Poor Customer Experience

Perhaps more significantly, manual KYC checks take time. While increasing internal efficiency and reducing operational costs should be a priority for all businesses, a lengthy client acquisition process could lead to customer frustration and severe damage to your business through failed signups.

Customer experience is vital, particularly when competition in your market is fierce, and a manual KYC process can take days at a time. KYC, and as a result, client acquisition that is not instant will constrain growth and act as your bottleneck to success.

What is Automated KYC Verification?

KYC solutions represent a transformative leap in handling, verifying, and monitoring customer data. The AI technologies employed enhance regulatory compliance and significantly improve customer onboarding experiences with seamless and customized identity verification workflows. These are compounded with integrated customer due diligence and ongoing monitoring solutions in one all-encompassing platform.

It’s well documented that Automated KYC verification solutions significantly streamline businesses’s compliance efforts. This allows firms to operate without fear of implicit involvement in financial crimes, ensuring a secure environment for both the company and its users.

Automated Identity Verification

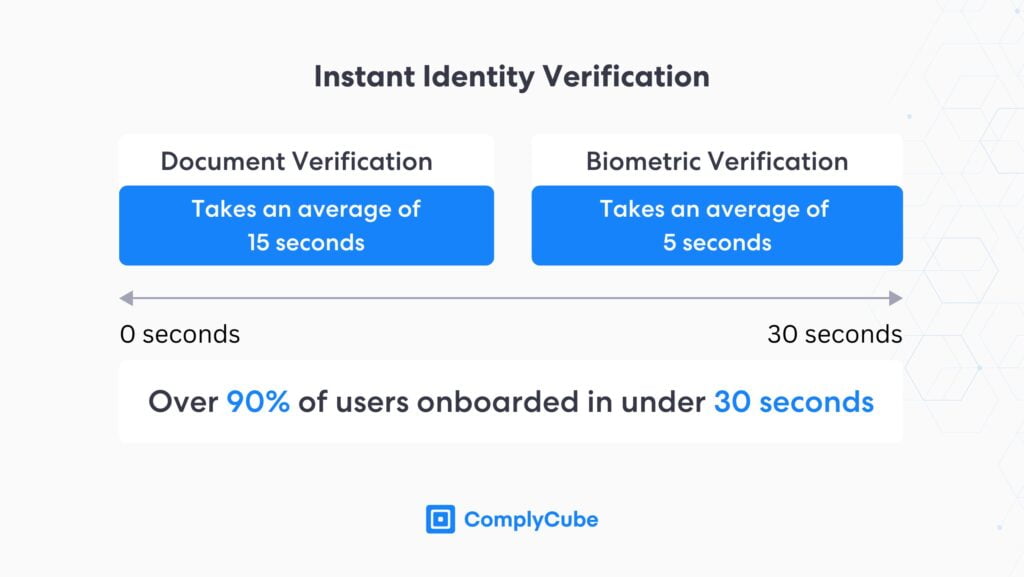

eKYC solutions, fueled by powerful AI engines, verify identity documents and their specific security features at unparalleled speed and precision. This feat is beyond the capabilities of even the most trained human eye. These advanced systems use sophisticated matching algorithms to scrutinize up to 25 data points on ID documents such as passports and driver’s licenses and powerful facial recognition technology to check thousands of selfie pixels to ensure authenticity.

These processes, known as document and biometric verification, significantly reduce the time it takes for a customer to sign up and can be completed in less than 60 seconds. Companies providing KYC services typically host an array of alternative but similar services, which can be customized per a company’s requirements. For more information on the types of automated KYC solutions available, browse ComplyCube’s list here.

Powerful Tools to Streamline Customer Due Diligence

The automation of KYC processes does not stop at client acquisition. Customer due diligence and ongoing monitoring are integrated into the same solution. This makes automated KYC verification services a comprehensive instrument for KYC and AML methodology.

Customer due diligence refers to the risk assessment and profiling of a client. This involves further IDV measures, vetting users against multi-bureau databases, and watchlist and adverse media screening. This process is highly time-consuming and costly for businesses due to the volume of data that must be processed. Automation solves the problem.

More data analyzed

Faster confirmation

Precise risk score

When this process is automated, no stone is left unturned, and these data sets can be examined instantly. It mitigates customer dissatisfaction and ensures compliance standards are met. Clients are then accurately and swiftly attributed their risk score, and the user can be acquired according to the required regulatory framework in place.

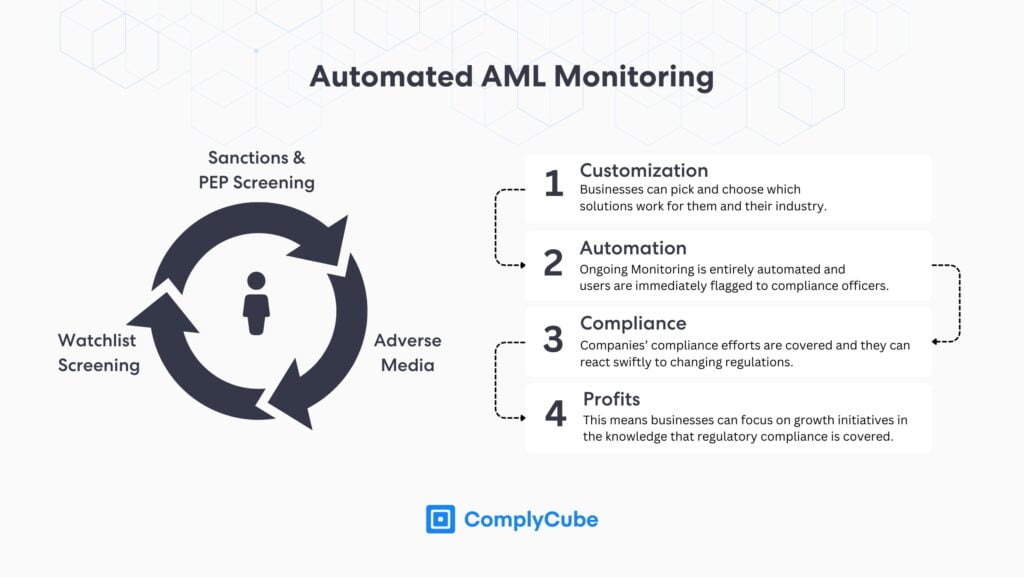

Automated AML Monitoring

AML monitoring would be a near-impossible task to optimize manually, requiring significant resources. This is because the correct application of ongoing monitoring requires checking an ever-growing volume of data sets.

For example, the client of a start-up neobank was portrayed negatively in an obscure Columbian newspaper for money laundering charges. Traditional vetting and due diligence methods would have a slim chance of picking this up, especially if the news article did not make it to national media.

An automated AML monitoring solution would detect such an occurrence. By continually scanning global news outlets for adverse media coverage, the detection of any negative media impressions is immediately reported on the user’s profile. This detects the appearance and supplies all relevant data to compliance officers to make informed and timely decisions.

Advantages of Automated KYC Verification

Verifying clients automatically brings a host of benefits to businesses no matter the level of identity assurance required.

Time-Saving

Know Your Customer automation significantly reduces the time spent reviewing user documents and checking for authenticity. This means operational efficiency is substantially increased, and companies see reduced manual errors. The speed of these automated processes enhances the customer experience and allows companies to process and accept a far higher volume of clients.

Cost Saving

Reducing the time spent on mundane tasks means that operational costs can be significantly minimized. Automated KYC procedures allow businesses to focus on what is important to them by reducing the number of false positives and repeated tasks. This means there can be a more streamlined company culture, and efficiency can be maximized.

Automated KYC also saves businesses from potential fines that come from non-compliance. Crypto KYC (and its non-compliance) is an excellent example of this. In 2023, crypto and related FinTech groups were fined $5.8 billion for non-compliance with AML regulations. Many of these fines could have been mitigated had a sufficient KYC and AML strategy been established.

Accurate Conclusions

The precision of KYC solutions means that data accuracy is exceptionally high, improving the data analytics of compliance officers. eKYC processes, by their nature, endorse secure, malleable, and fluid information. As these AML systems are cloud-based and provided by leading SaaS companies, data is readily available and extractable for compliance officers to make instant and accurate decisions.

Furthermore, user data is upheld to the tightest and most enhanced security standards, including GDPR, CCPA, and the Data Protection Act. This is exemplified through ComplyCube’s auto-redact feature on ID images and selfie uploads of users under 18.

Compliance Made Simple

Regulations, particularly in FinTech industries, rapidly change. Automation and Know Your Customer solutions make adhering to these regulations far simpler. For instance, the FATF frequently updates which countries are on their black and grey lists due to financial and geopolitical movements. Automated KYC solutions enable timely reactions to updates in these lists.

Crypto firms already working with a KYC partner would be able to react swiftly to this news, discussing which solutions are required from their existing provider. This enables reactionary measures to be made under pressure with ease.

Easy Integrations

With integration simplicity at the heart of KYC automation, your existing tech stack doesn’t need to change to facilitate KYC services. Workflows are integrated into your website via a robust API (Application Programming Interface) or SDK (Software Development Kit). This means they can be customized and designed to your business’s brand.

Embedding KYC solutions into your current flow is vital. It contributes to an exceptional user experience, enhancing brand reputation and leaving new customers satisfied with a pleasant, user-friendly experience.

Artificial Intelligence in Automated KYC Verification

The integration of cutting-edge AI and advanced algorithms into automated KYC verification processes is the power behind the shift in how businesses onboard customers and ensure compliance. These advanced technologies streamline data extraction, document verification, and all stages of the KYC process, enhancing the efficiency of Anti-Money Laundering regulatory compliance.

Machine learning engines, such as facial recognition technology, ensure errors are minimized and repeated tasks, or false positives, are mitigated. AI also enables around-the-clock monitoring of deep data sources to ensure that user’s risk profiles are accurate and updated in real-time.

Automated KYC processes would not be possible without the development of advanced AI technology. For this reason, companies at the forefront of AI development must do so ethically. As these systems are handling sensitive user data about race, gender, sex, and many other sensitive categories, ethical AI development is fundamental to ensure potential biases are omitted.

Should I Integrate Automated KYC?

The systems powering modern automated KYC verification strategies are bringing huge ROIs to businesses that use them. This puts them ahead of their competition as operational efficiency, profit margins, and reputability are all optimized.

Future of KYC

Businesses employing a manual KYC process will not have the operational scalability to grow alongside the market or their competition. Regulatory requirements to Know Your Client are expanding into more industries than ever before; only with KYC automation can a business scale meet the demands of its users.

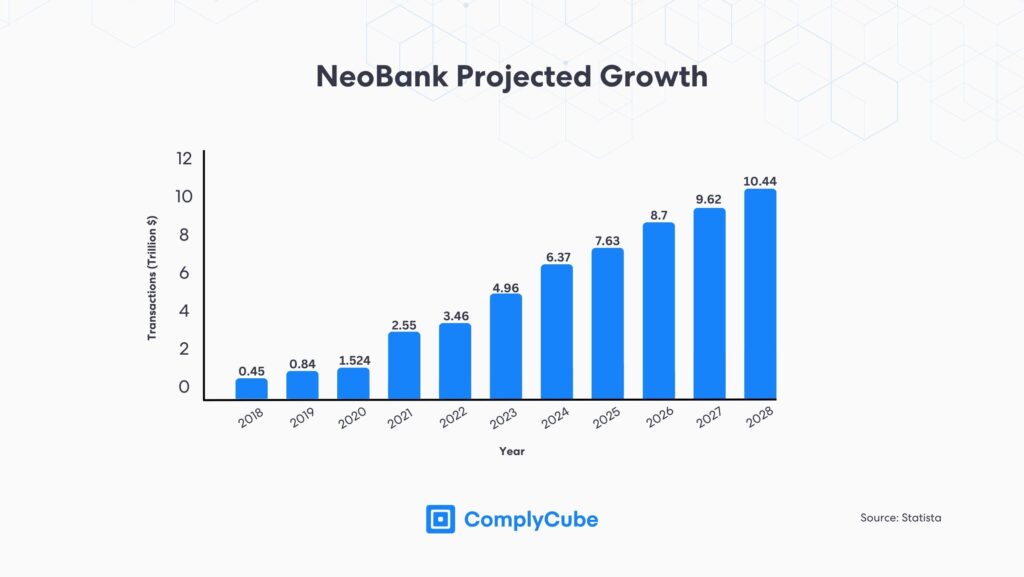

Taking Neobanking as an industry example, 2024’s expected transaction volume is anticipated to be $6.37 trillion and climb to $10.44 trillion in 2028.

In the Neobanking market, the number of users is expected to amount to 386.30m users by 2028.

The rising volumes depicted in these figures highlight the trajectory of FinTech sectors, like Neobanks, and underscore the imperative for KYC strategies to evolve in tandem. As the user base and transactions within these industries expand, there’s a pressing need for KYC processes to embrace automation and increase scalability to manage the demand for Financial Services effectively.

Has Your Business Embraced Automated KYC Verification?

The rapid expansion of FinTech sectors, including Neobanks, necessitates the evolution of KYC strategies to match the growing volume of transactions and user base, highlighting the importance of automation for scalability and efficiency. Automated KYC verification, powered by advanced AI technologies, streamlines identity verification, customer due diligence, and ongoing monitoring, ensuring regulatory compliance while enhancing operational efficiency.

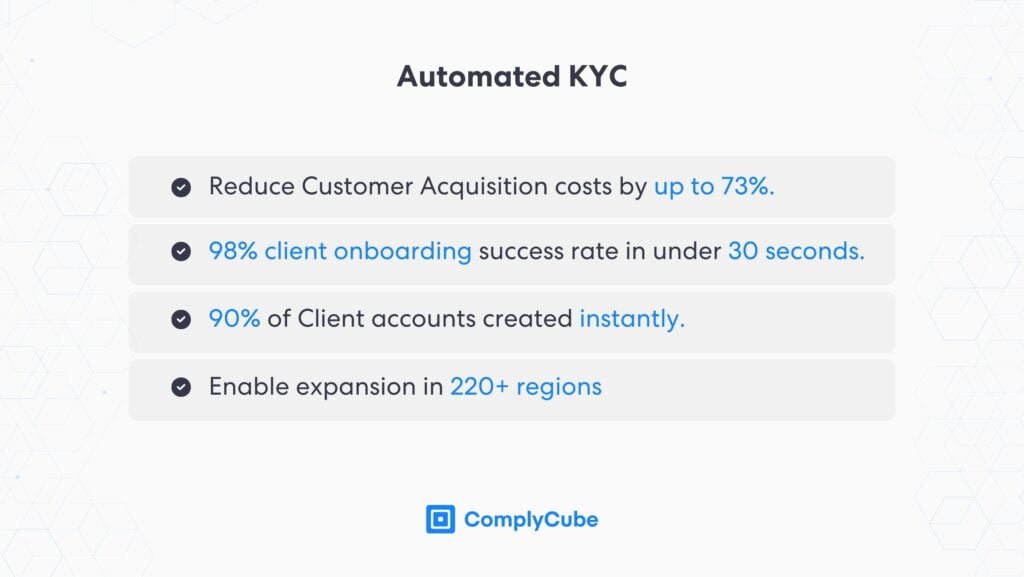

ComplyCube’s proprietary technologies provide a comprehensive suite of utilities to enable businesses to expand without limits. Hosting 220+ regions, 13,000+ documents, and typical onboarding processes completed successfully in less than 60 seconds, they are becoming a common choice for growing companies.

The future of KYC lies in embracing technological advancements to meet the increasing demands of the financial services industry, ensuring secure, efficient, and scalable customer verification processes. If you are looking for a new AML, KYC, and IDV partner, start a conversation with one of our specialists today.