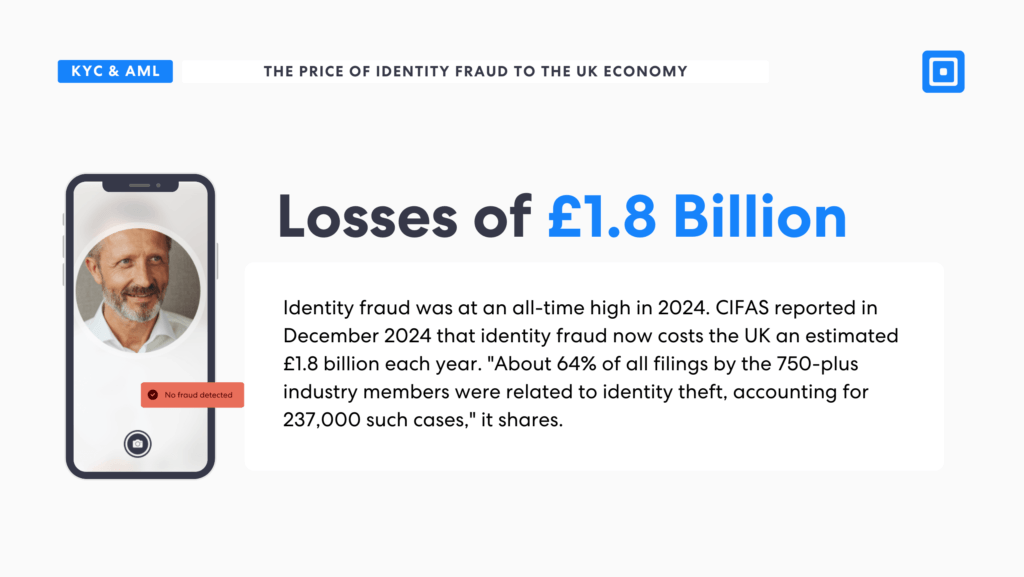

Identity fraud in the UK has continued to escalate over the past few years, enabled by advanced technologies, including artificial intelligence, that have allowed the development of sophisticated deepfakes. A report by CIFAS in December of 2024 unveiled that identity fraud now costs the UK an estimated £1.8 billion each year, a shocking statistic that urges change in onboarding processes for increased identity fraud protection.

Modern digital attacks are almost impossible for standard software or manual checks to detect, and deepfakes are often undetectable to the naked eye. Businesses across all industries must find a way to prevent identity theft to protect their revenue streams and customer data. This guide will explore the fraud risks you face before your clients or your business becomes a victim of identity fraud.

What is Identity Fraud?

Identity fraud occurs when one party uses another person’s information, such as the other person’s name, social security number, address, or other personal or financial information, to commit fraud. Fraudsters then leverage stolen or artificial data for various nefarious reasons. These could include opening bank accounts, lines of credit or taking on the identity of an unsuspecting victim.

Any business that collects sensitive personal data must take steps to negate the risk that their customers, partners, or other stakeholders’ personal identification and data will remain safe. Such data breaches have both a direct and indirect impact. Organisations face risks from identity fraud in the UK, including:

Non-compliance fines and losses

Customer churn and loss

Reputational damage

Without effective mitigation strategies, stolen documents, hacked accounts, or fraudulent bank accounts could cause significant financial loss for organizations of all types.

Consider that the financial implications to businesses in the UK equate to about £4 billion directly related to identity theft. Data clearly indicates that nearly 40% of all businesses face some level of fraud related to data theft each year. Act quickly to mitigate these risks.

Looking at the UK Identity Fraud Landscape Since Covid

Data provided by CIFAS, a non-profit membership association in the United Kingdom focused on fraud prevention, in their Fraudscape report shows that member organizations indicated that 310,000 cases of fraudulent conduct were added to the National Fraud Database (NFD) in 2020. About 82% of those cases were directly related to fraud or misuse of identity.

The report takes a deep dive into the underlying cause, noting that COVID-19 played a prominent role in this process as more consumers in the UK turned to credit cards to support their day-to-day living expenses. Consumers invested heavily into online purchases to meet basic needs, creating an increased risk for digital identity theft.

Fraudsters were using the pandemic as an opportunity to steal personal and financial information from the public.

As noted by CIFAS, “Key to this was fraudsters using the pandemic as an opportunity to steal personal and financial information from the public.” The report also noted a 23% increase in companies being impersonated, which drove misuse of company accounts by an increase of 26%. These factors are likely attributed to the stimulus packages provided to UK businesses.

By 2022, the National Fraud Database (NFD) reported an even higher increase in fraudulent conduct, reaching 409,000 cases, the highest number ever reported. This was about a 14% increase from 2021 figures. Worryingly, another 12% increase drove figures up again in 2023.

A Look at 2024

Identity fraud was at an all-time high in 2024. CIFAS reported in December 2024 that identity fraud now costs the UK an estimated £1.8 billion each year. “About 64% of all filings by the 750-plus industry members were related to identity theft, accounting for 237,000 such cases,” it shares.

Identity fraud now costs the UK an estimated £1.8 billion each year.

The Insurance Fraud Bureau (IFB) has taken aggressive steps to warn the public about the risks of the ever-increasing number of identity thefts occurring in everyday transactions. The agency notes that fraud cases stemming from stolen identities “have nearly doubled in the past 12 months.”

While anyone could be a victim, about 64% of those who suffer identity attacks are people over 61 years of age, yet CIFAS also notes an increase in the number of younger people sharing sensitive data across social media. CIFAS Director of Intelligence Stephen Dalton states, “Identity fraud continues to be a favored tactic for many criminals while exploiting innocent people to steal their identities and use personal details to fraudulently open and abuse financial products and services.”

The UK is not alone in this battle. In the US, over 1 million reports of identity theft streamed into the Federal Trade Commission in 2023, with more than $10 billion worth of fraudulent actions. That’s 14% higher than the previous year reported by the FTC identity theft report.

The Rise of Synthetic Identities

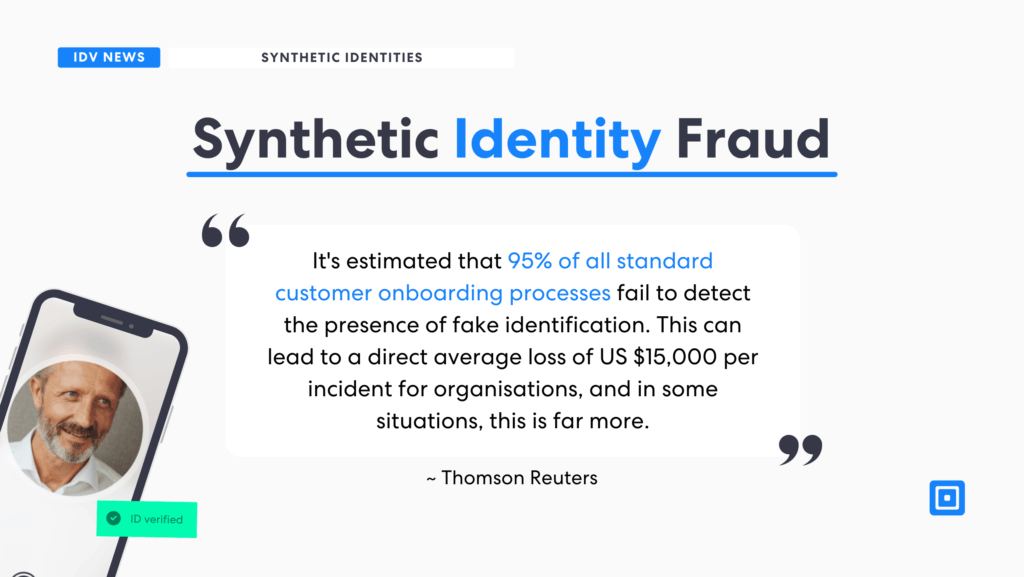

Many people report identity theft when they see suspicious credit applications and unusual transactions on bank statements. They may also receive bills or letters from debt collectors. However, synthetic identities amplify risks. These identities are created with one bit of authentic information, such as an accurate social security number.

Fraudsters create these identities so that they seem like real customers. The identities are “real enough” to allow fraudsters to pass Know Your Customer (KYC) verification processes. A fraudster creates a new name, identity, and profile for them. Some create social media accounts to prevent a fraud department check on their identification. No fraud alert goes out because the person is not real, and no one’s credit report suffers directly. As a result, the fraudsters can perpetrate the fraud over time.

UK Watchdogs Fighting Identity Fraud

Educating consumers and businesses about such risks is the best strategy for reducing ongoing fraudulent activity. With fraud cases growing, it has become imperative for third-party organizations to create robust plans. The following organizations are providing further advice and guidance to mitigate these risks:

Financial Conduct Authority: The FCA, the main financial services regulator in the UK, is working to ensure companies in the financial sector comply with all anti-money laundering rules.

- Information Commissioner’s Office (ICO): The ICO regulates the methods of processing personal data, which is critical to minimizing further risk growth. This includes developing more accurate identity verification.

HM Revenue & Customs (HMRC): HMRC regulates operations outside traditional financial services, including accountancy, real estate, and high-value dealers. It also enforces stringent guidelines to alleviate identity theft.

The National Crime Agency (NCA): The NCA continues to focus on organized crime, including money laundering and those behind the identity theft scams.

Office of Financial Sanctions Implementation (OFSI): As a component of the HM Treasury, this organization is working to enforce financial sanctions throughout the UK.

However, is there enough regulation and advice in place to stop fraudsters? While beneficial, it does not alleviate the strain on businesses faced with the ongoing need to mitigate identity fraud in the UK. More advanced identity fraud protection, including secure KYC and AML processes, are needed to safeguard businesses and individuals alike.

Why Do Regulators Induce Regulations to Combat Identity Fraud?

Reducing identity fraud has true value for global economies, businesses, and individuals alike. Regulation offers protection and a stable framework for businesses to grow securely. Regulators aim to achieve this by applying and adopting increasingly robust strategies:

- Financial losses: Identity theft leads to significant financial losses for both consumers and businesses.

- Customer protection: Regulations aim to safeguard consumer personal information. Strategies are in place to protect consumers from unauthorized access and misuse. Without such strategies, the risk of financial devastation and the inability to prove losses is increasingly challenging.

- Public trust: Another fallout from identity theft risks is irreparable damage to an institution’s reputation. The regulatory framework clarifies the organization’s focus on minimizing risks and building public trust with customers and stakeholders.

- Limit criminal activity: Fraudsters use this information to commit crimes, often exploiting the most vulnerable of victims to years of financial loss and difficulty. On a much grander scale, regulators aim to apply rules that minimize money laundering and terrorism-related activities, which could be directly funded through such gaps.

- Facilitate fair competition: Standards ensure that all organizations have the same requirements and a level playing field. This can help with compliance-related matters that lead to an unfair advantage, such as by creating lax security.

Combating Identity Fraud With ComplyCube

ComplyCube’s advanced platform empowers organizations to prevent fraudulent practices within their businesses’ digital walls, offering needed customer protection. With advanced identity verification methods, including biometric verification that leverages liveness detection technology, onboarding processes are fortified, and businesses are secured.

Contact one of ComplyCube’s compliance experts for more information on how to protect your business from identity fraud.