The UK Digital Securities Sandbox (DSS) is the UK government’s policy for gradually implementing a framework for tokenizing traditional financial instruments, such as securities like company equity. This framework requires relevant firms to adhere to crypto KYC (Know Your Customer) regulations, and simultaneously, it supplies a degree of flexibility for achieving UK Security Token Offering (STO) compliance.

This guide dives into the DSS specifications, the regulations firms must abide by, and the future of STOs in the UK and around the world.

What are Digital Securities?

Digital securities are virtual representations of traditional securities; however, they are issued, stored, and traded on a Distributed Ledger Technology (DLT) or a blockchain.

The Bank of England (BoE) describes the following assets as examples of financial instruments that could be issued and traded under the DSS:

- Equities,

- Emissions allowances,

- Corporate and government bonds,

- Units in collective investment undertakings, used in index funds,

- Money market instruments, such as commercial paper (debt for short-term liabilities).

Digital securities and tokenized Real-World Assets (RWAs) are rapidly growing topics. As blockchain technology continues to grow around the world, tokenization of Real World Assets has been described as its’ killer use case’. Learn more about Security Token Offerings and RWAs by reading Security Token Offering (STO) Compliance.

What is the UK Digital Securities Sandbox?

The DSS is the UK’s first initiative to integrate Distributed Ledger Technology (DLT), or blockchain technology, into its financial markets. The comprehensive Bank of England consultation paper can be found here.

Purpose and Goals

First and foremost, the DSS is designed to foster innovation by giving firms the ability to experiment with new financial utilities that the technology enables. However, it does so in a regulatory flexible environment displaying the government’s attitude to managing financial stability risks.

This flexibility enables the technology’s swift adoption into the market. DLT technology increases the efficiency of value transfers, reducing post-trade settlement time and increasing transaction integrity and security.

Regulatory Framework

The DSS was established under the Financial Services and Markets Act (FSMA) of 2023, giving the Bank of England (BoE) and the Financial Conduct Authority (FCA) regulatory authority over participating firms.

Commencing on January 8, 2024, these regulators have the power to oversee and modify tokenized Real World Asset (RWA) rules and regulations for market participants. The DSS regulations enabled 3 business model opportunities.

- Undertaking the activities of a Central Securities Depository (CSD) by being a Digital Securities Depository (DSD).

- Operating a trading platform or venue, such as a recognized investment exchange (must not be an overseas investment exchange).

- Combining both into one Financial Market Infrastructure (FMI) to create a hybrid structure.

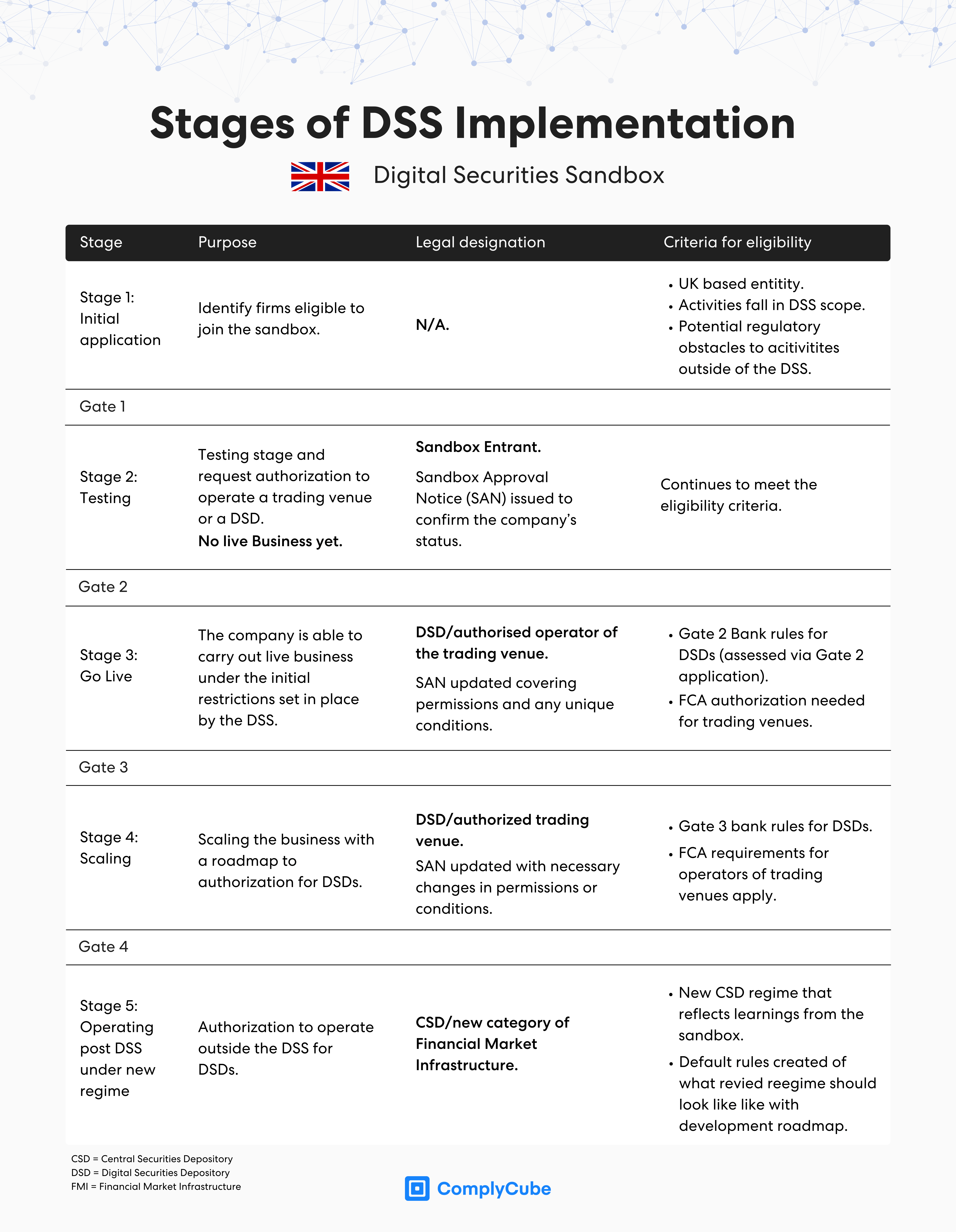

Implementation

The FCA and BoE will establish a suitable application process according to the DSS for firms wishing to participate. They will jointly oversee and supervise applications and grant permissions to relevant applications.

Both regulators are responsible for performing due diligence and ensuring that participating firms are doing so with the intention of contributing to the sandbox rather than abusing its regulatory flexibility. The DSS is designed to be flexible and accommodate various business models, so long as there is sufficient oversight for the potential for misuse.

Testing and Adaptation

The DSS is a living policy, meaning that the regulators have the authority to amend the sandbox when necessary to accommodate the greater adoption of digital assets.

The adoption of new technology in this area, if done safely, could lead to a technological transformation, fostering greater efficiency in the financial system.

The Digital Securities Sandbox serves as a test for regulatory sandboxes in other financial domains. If it is successful, the UK will endorse sandboxes as a more commonly practiced integration method for new policies.

Key Features of the Digital Securities Sandbox

The sandbox is highly flexible and a testament to the DSS’s regulatory oversight, attracting a diverse array of Financial Market Infrastructures. Each sandbox entrant has a unique pathway to develop their product in line with the regulatory framework to transition outside of the DSS’s jurisdiction to a new and permanent regime.

The DSS creates a safe environment for real and live commerce, allowing businesses to get hands-on experience with blockchain utilities without fear of regulatory compromise. However, there are limits to the activities FMIs may participate in while under the scrutiny of the sandbox. This is to reduce financial stability risks and maintain market integrity.

Long-Term Goals

The ultimate ambition is to foster a tried-and-tested formula for regulating digital securities. The sandbox’s regulatory flexibility should ensure that the final policy not only works but also encourages more firms to participate.

It should be noted, however, that there is no guarantee that firms accepted into the program will be granted permission to operate outside of the Digital Securities Sandbox. Firms must always meet all relevant standards and display a willingness (and capability) to continue adhering to those standards.

The DSS is itself a regulatory sandbox for similar initiatives. Should the trial succeed, this methodology will likely be used across the board. Regulatory sandboxes are already used in financial regulation in Hong Kong and Singapore, as well as numerous other Asian regions. Learn more about Singapore’s stablecoin sandboxes by reading Hong Kong Crypto Regulation in 2024.

Complementary Developments

The UK is actively pursuing a strategy to develop a world-leading and on-chain Real-Time Gross Settlement (RTGS) integration between blockchains (ledgers). Project Rosalind, the UK’s Central Bank Digital Currency (CBDC) initiative, works in parallel with the DSS to merge instant settlement systems with the innovations happening in the blockchain industry.

How Does Crypto KYC Impact This?

Crypto KYC and AML (Know Your Customer and Anti-Money Laundering) are vital processes in the tokenization of financial instruments. Just as with traditional securities, digitized financial instruments require the same investor screening process to ensure individuals are not abusing the financial system.

KYC for crypto can take many forms, and different platforms will require different processes based on their unique Risk-Based Approach (RBA). A strong KYC flow for a tokenized platform would consist of:

A robust Identity Verification (IDV) flow, including document and biometric verification.

Customer Due Diligence (CDD) and AML checks run continuously in the background.

If required, on-chain transaction screening and monitoring to identify where transferred funds originated from.

This workflow is one example of the customizability that ComplyCube offers its crypto clients. The AML industry leader built its suite of solutions to offer the most flexible array of services on the market. If your platform requires specific AML, KYC, or IDV checks, reach out to a specialist today.

What is the Future of Tokenization?

The world is catching on to the possibilities tokenization brings. Greater market liquidity, 24/7 access to markets, instant settlement, and financial inclusion are only some of the innovations that DLT technology enables.

Tokenised markets could potentially be worth as much as USD24 trillion by 2027.

HSBC estimates that the tokenized asset market could reach $2 trillion by 2027, a behemoth compared to today’s tokenized market size of only a few billion dollars. Given these estimates, it’s not surprising that the UK has opted for a sandbox approach to regulating this new market.

Such large-scale growth is only possible with effective and adequate regulation that lacks loopholes. The UK Digital Securities Sandbox should provide exactly that.