Customer identity verification is heavily reliant on the accuracy of the tools and software used throughout the onboarding process. While customer identification tools have become more widely available and increasingly sophisticated in recent years, presentation attacks—also known as spoofs—continue to evolve globally. These attacks occur when a fraudster uses the biometric data or physical characteristics of another person to gain access to an account or system fraudulently. With digital identity verification strategies that employ biometric verification and liveness detection, businesses can defend their operations from these attacks. This guide will examine how presentation attacks occur and what makes customer identity verification so critical and yet challenging for modern businesses.

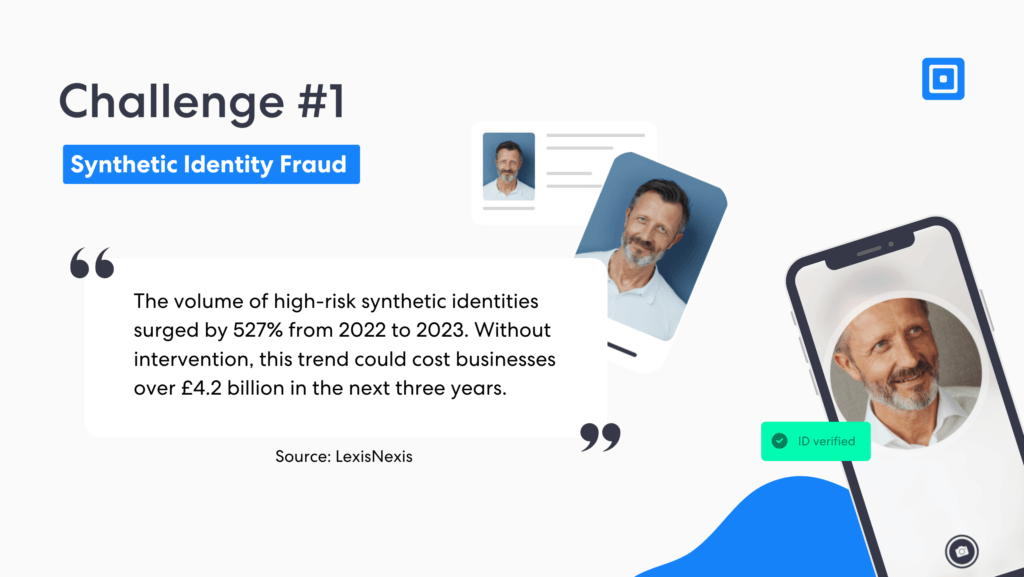

Challenge #1: Synthetic Identity Fraud

Synthetic identity fraud occurs when fraudsters combine real and fake information to create a new, untraceable identity. They often utilize one or a few components of real data, such as a Social Security number, and supplement that with a new name, address, or other verification details. In doing so, the fraudster creates a brand new identity.

The fastest-growing financial crime in the United States.

Synthetic identity fraud is a concern for businesses when trying to verify customers, with KPMG recently labeling it the $6 billion dollar problem. They state, “As the fastest-growing financial crime in the United States, synthetic identity fraud bears a staggering $6 billion cost to banks. To perpetuate the crime, malicious actors leverage a combination of real and fake information to fabricate a synthetic identity, also known as a ‘Frankenstein ID.'”

The Problem

Synthetic identities use information that is sufficient to surpass traditional and simplistic customer identity verification tools. These identities make it very difficult for financial institutions to detect risks and circumvent fraudulent activity, such as fake loan applications or money laundering schemes.

The Solution

Advanced identification verification tools powered by artificial intelligence, including biometric identification verification leveraging liveness detection, can detect synthetic identities. Sophisticated Know Your Customer (KYC) strategies employ biometric checks, which ensure your customers are present and genuine during a transaction. These easy-to-use biometric verification processes allow for fast customer onboarding while using AI technology to detect spoofing. Biometric systems are also able to pull biometric data and analyze facial features, using data samples such as subtle microexpressions and skin texture to ensure liveness. For more on synthetic identity fraud, read “Detecting Synthetic Identity Fraud in 2025”.

Challenge #2: Cross-Border Identity Verification

Digital identity verification has become increasingly critical as more companies expand their services and products worldwide. While the digital economy benefits businesses, verifying customers’ identities across borders can be challenging, as each jurisdiction has varying compliance requirements and documentation standards.

The Problem

Different formats, degrees of available data, and strategies for identifying global customers make it challenging for companies to verify the authenticity of their clients and customers. Language differences, varied verification standards, and simply knowledge of differences limit organizations’ success. Fintech Global touches on this in their discussion on cross-border identification challenges, “Businesses must navigate these complexities by tailoring their verification processes to align with each country’s legal framework.”

The Solution

Implementing a unified, automated identity verification solution ensures cross-border compliance. ComplyCube’s customer screening services provide global coverage, leveraging smart technology that is adaptable to varied compliance requirements. Market-leading platforms can navigate the challenges of multi-jurisdictional variations in real-time. Furthermore, by implementing AML monitoring with watchlist screening, organizations gain fortified protections from international threats.

Customers are required to provide information that can be verified against existing records or through their biometrics. However, data—such as basic bank account details—varies greatly across regions, and regulatory compliance requirements can differ significantly. Hence, partnering with a platform that can stay ahead of these complexities and ensure compliance in all regions is essential.

Challenge #3: Error-Prone Verification Processes Unable To Detect Sophisticated Attacks

Many organizations use error-prone manual methods for data and identification. The lack of liveness detection technology and AI-powered biometric verification puts these organizations at risk of severe financial penalties from regulators.

The Problem

The use of spoofing techniques continues to increase, with fraudsters gaining access to sensitive information on the black market or using AI to generate deepfakes. Without advanced Identity Verification technology, including a biometric verification process, it is practically impossible for organizations to identify spoofing attempts, which have now become unbelievably sophisticated.

The Solution

The use of AI and machine learning technology can drastically improve detection rates and accuracy. To combat spoofing, onboarding processes must implement advanced liveness detection and biometric screening. Any organization offering digital services must move beyond traditional, outdated methods such as manual verification to mitigate the risk of a user’s identity being fraudulent.

Challenge #4: Ensuring a Positive Customer Experience During Verification

Identity verification can be intrusive, cumbersome, and frustrating for customers. While customers do recognize the value of verification, they often do not want to be hampered by numerous steps and processes that are difficult to follow due to clunky processes.

An experience-driven secure journey can even become a competitive advantage.

“Customers expect an easy digital experience, including fast authentication and login, as well as seamless web and mobile interactivity. Companies that are able to offer all this while maintaining strong security standards will gain customer loyalty. An experience-driven secure journey can even become a competitive advantage,” notes a study from McKinsey.

The Problem:

Finding a balance between rigorous security and a frictionless user journey is critical for maintaining customer trust and loyalty. Yet, customers become more frustrated as more digital identity verifications are employed. Customer experience is a critical component of any online interaction. Customers know the risks of data breaches and expect sensitive information to remain protected. Yet, this extra layer of protection, in common forms, can slow down interactions. Extensive delays and slow processes are simply not acceptable in the eyes of the consumer.

The Solution

Advanced solutions, such as biometric verification, do not need to impede customer satisfaction as they are simple and qucik processes. Leveraging a platform like ComplyCube ensures a simple verification process – which takes about 30 seconds to complete. Prioritising a seamless onboarding process for the end user allows financial institutions to retain customers without sacrificing compliance.

ComplyCube offers several methods to prevent fraud, meet regulatory requirements, and improve the KYC process without limiting customer interaction. Passive verification, for example, quickly and easily determines unique characteristics, allowing customers to move through the process easily with minimal effort.

Challenge #5: Balancing Data Privacy With Comprehensive Verification

Privacy remains a critical component of any transaction. Just as organisations must verify customer identification, consumers want to be sure the company or person they are interacting with is not misusing their personal data. Strict data protection and privacy laws, such as GDPR and CCPA, deter a companies’ ability to carry out checks on sensitive customer data.

The Problem

Financial institutions are under pressure to balance transparency with data minimisation. They must ensure that they collect only necessary information without exposing sensitive data. The rise of strict data protection laws, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S., hinder businesses in their ability to fully investigate and assess risk.

The Solution:

Partnering with the right KYC (Know Your Customer) platform is key to navigating the delicate balance between data privacy and risk mitigation. The ideal KYC solution must help businesses meet their compliance obligations without compromising on privacy. This means leveraging identity verification processes that prioritise data minimisation and ensure that only essential information is collected during the verification process, in line with global data privacy standards such as GDPR and CCPA.

For example, KYC platforms that offer OCR (Optical Character Recognition) technology can help accurately capture and verify information from government-issued IDs, while liveness detection and face matching features prevent the use of fake IDs and identity fraud. These technologies allow institutions to confidently verify that the person applying for a loan or opening an account is the same person on the credit report, without exposing sensitive data.

Employing Effective Customer Identity Verification

As identity theft and deepfakes become more common and complex, companies must find a way to stay ahead of the threats. Partnering with the right platform, like ComplyCube, minimises the challenges organisations face while empowering businesses to verify customer identities quickly and effortlessly. Biometric verification, live identity verification methods, and robust AI and machine learning-backed strategies ensure effortless protection.

Protect your business with a trusted partner. Contact a compliance expert at ComplyCube today to explore how their biometric verification solutions can safeguard your business.