Know Your Customer (KYC) is a foundation of the United Kingdom’s anti-money laundering regulations. It mandates organizations to identify and authenticate their customers and assess the risk of business relationships and financial transactions. Understanding KYC requirements UK is not only essential to meeting the law’s requirements but also to contributing to their role in protecting the overall economy from the threat of money laundering, financial terrorism, and identity fraud.

Advanced KYC processes enable the UK financial system to maintain its reputation, build consumer confidence, and make the UK a reliable and secure location to conduct international business. This guide provides a comprehensive overview of the different legislation governing KYC regulations in the UK, best practices for maintaining strong KYC procedures, and details the impact of non-compliance.

Regulatory Obligations Governing KYC Requirements UK

The main UK legislation overseeing KYC compliance is the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations (MLR), enacted in 2017. This regulation incorporates the European Union’s Fourth Money Laundering Directive (4MLD) within UK legislation and aligns with updated world standards circulated by the Financial Action Task Force (FATF). The FATF is an international organization formed in 1989 to combat money laundering and the financing of terrorism.

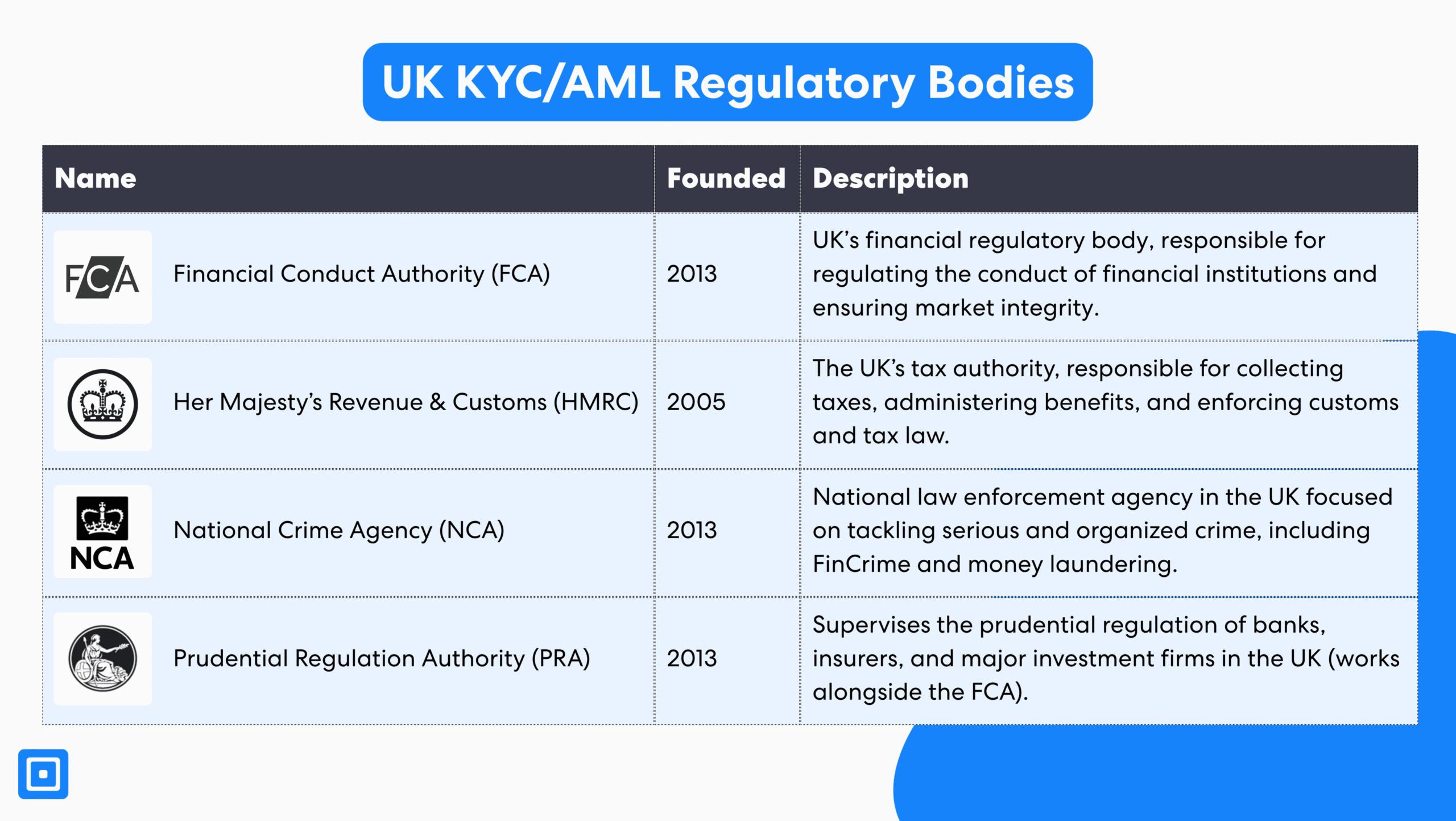

The FATF recommendations are the standard against which Anti-Money Laundering (AML) and KYC processes are measured worldwide. The UK is a founding member, revising its regulations every few years to maintain FATF requirements. In the UK, the responsibility to uphold AML and KYC compliance is divided among various domestic key regulatory and supervisory bodies:

- Financial Conduct Authority (FCA) — Established in 2013

- Her Majesty’s Revenue & Customs (HMRC) — Established in 2005

- National Crime Agency (NCA) — Established in 2013

- Prudential Regulation Authority (PRA) — Established in 2013

The Role of the Financial Conduct Authority (FCA)

The Financial Conduct Authority (FCA) is a financial regulatory body in the United Kingdom and the principal regulator for financial services firms, including banks, investment firms, insurance companies, and cryptoasset businesses. It operates independently of the UK Government and enforces compliance with KYC and Anti-Money Laundering (AML) regulations. This includes investigating breaches, imposing fines, and implementing sanctions on businesses.

Her Majesty’s Revenue & Customs (HMRC) Responsibilities

HMRC oversees non-financial businesses and professions, such as money service businesses, trust or company service providers, high-value dealers, and art market participants. HMRC is accountable for ensuring these sectors comply with KYC and AML rules, conducting inspections, and issuing penalties for non-compliance.

The Purpose of National Crime Agency (NCA)

The National Crime Agency is a national law enforcement agency in the United Kingdom. It leads the UK’s response to serious and organized crime, including money laundering, cybercrime and terrorist financing that goes across regional and international borders. The NCA receives and analyzes suspicious activity reports (SARs) from regulated entities and coordinates national efforts to disrupt financial crime.

Prudential Regulation Authority (PRA) and the Bank of England

The Prudential Regulation Authority works closely with Financial Conduct Authority (FCA), both coordinating under a Memorandum of Understanding. Operating under the Bank of England, the PRA focuses on the prudential regulation of major financial institutions, including banks, building societies, credit union, insurers, and large investment firms, ensuring their stability and resilience.

The UK’s regulatory framework is dynamic, with frequent updates to address emerging money laundering risks and remain in step with FATF compliance framework recommendations. Specific regulation bodies are also founded to supervise niche sectors, such as the Solicitors Regulation Authority (SRA) and the Legal Sector Affinity Group (LSAG) within the legal and accountancy professions. By aligning closely with FATF standards, the UK continues to lead globally in preventing financial crime and promoting corporate transparency and security.

Best Practices for Alignment with Stringent KYC Regulations

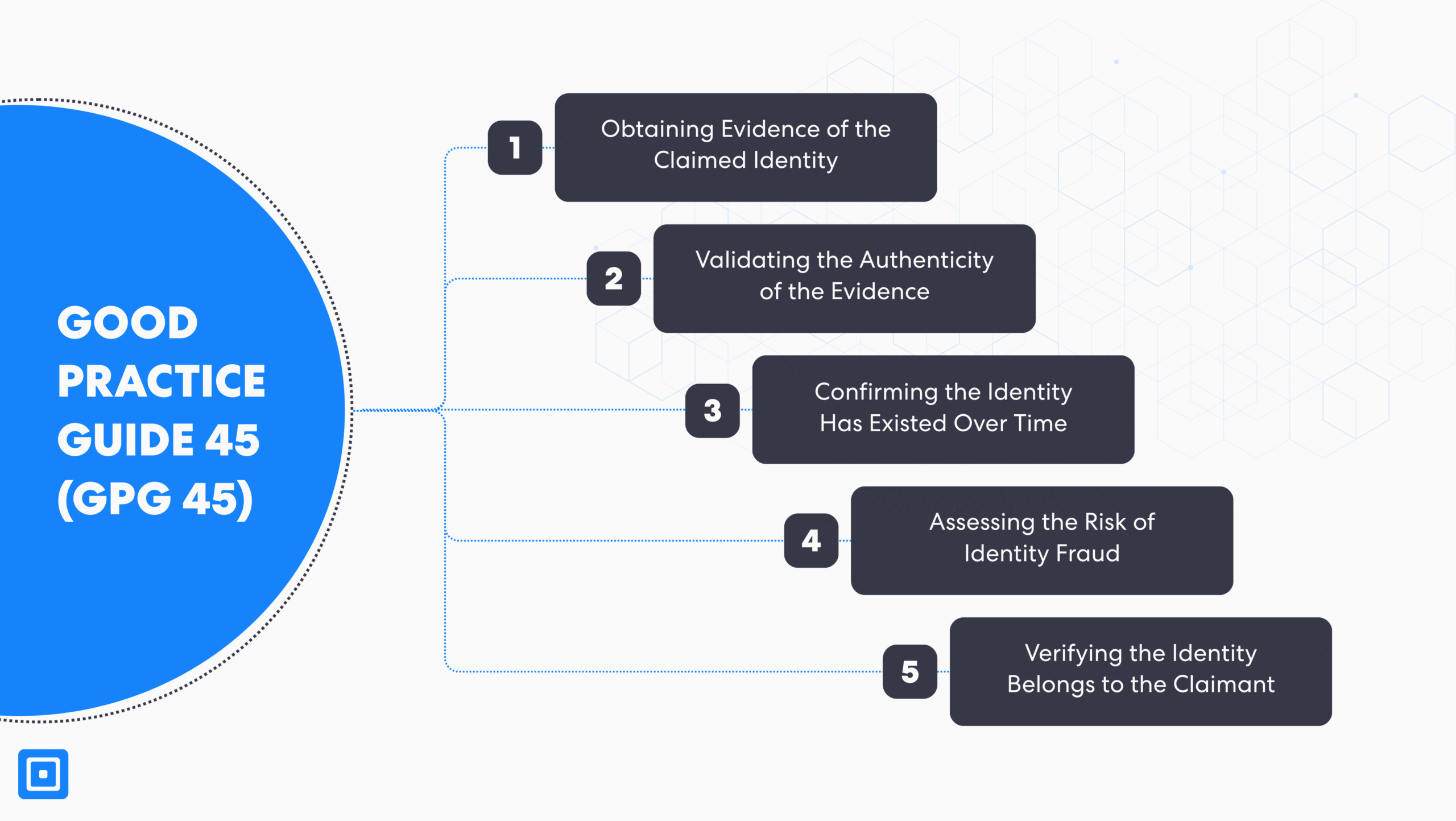

The UK Government’s Good Practice Guide 45 (GPG 45) is a foundational document for identity verification across both public and private sectors. While not legally binding, GPG 45 provides a clear, outcomes-based compliance strategy framework for verifying the identity of customers, employees, and third parties. The GPG 45 is designed to help organizations determine the appropriate level of Know Your Customer (KYC) rules based on the service or transaction risk profile.

1. Obtain Evidence of the Claimed Identity

The first step is to gather evidence that supports the customer, merchant, or entity identified. This includes physical documents, such as a passport or driving licence, or digital records, such as information from a trusted database.

2. Check the Evidence is Genuine or Valid

Once collected, evidence must be examined to confirm the documents authenticity and validity. This involves checking for signs of forgery, counterfeiting, or tampering on physical documents, or verifying digital records against authoritative sources.

3. Check the Claimed Identity Has Existed Over Time

This step involves confirming that the identity attributes have been active and consistent over a period of time. Historical data, like credit history, utility bills, or employment records, can be used to demonstrate that the claimed identity is not synthetic. This helps guard against identity theft, particularly through the use of fabricated or stolen identities.

4. Assess if the Claimed Identity is a High-Risk Customer

Cross-referencing the identity against known fraud databases, watchlists, and sanctions lists is vital to accessing a customer’s risk profile. This stage aims to identify warning signs such as links to previously compromised identities, unusual patterns, or other red flags that might indicate a higher risk of identity theft or misuse.

5. Check that the Identity Belongs to the Person Who’s Claiming It

The final step is to verify that the individual presenting the identity is genuinely entitled to use it. This can involve biometric authentication and leveraging liveness detection technology. The purpose is to ensure that the person submitting the evidence is not an imposter but the rightful owner of the claimed identity.

Each step is scored, and the combination of scores determines the overall confidence level in the identity verification process. Modern compliance platforms enable businesses in the financial sector to streamline and further fortify Know Your Customer (KYC) verification through comprehensive ongoing monitoring, enhanced due diligence, and robust KYC checks to ensure regulatory compliance.

Key Components of a Comprehensive KYC Process for UK firms

Compliance software and tools have drastically changed how financial institutions tackle Know Your Customer (KYC) requirements. The use of sophisticated technology enables banks, cryptocurrency, real estate, gaming, and other financial sector players to meet KYC obligations and run customer due diligence with increased speed, accuracy, and consistency. This empowers businesses such as financial institutions and others to effectively manage risky financial transactions, combat money laundering, and prevent terrorism financing proactively.

Customer Identification Programme and Identity Verification

The cornerstone of a strong KYC process is a Customer Identification Program (CIP). CIP refers to gathering significant KYC documents to verify a customer’s identity. Automated screening systems streamline this process by leveraging Artificial Intelligence (AI) and Machine Learning (ML) technologies to make conducting KYC checks and biometric verification rapid and secure within regulated markets.

Customer Due Diligence and Enhanced Due Diligence

When a customer’s identity has been verified, compliance software can conduct comprehensive Customer Due Diligence (CDD) and, where necessary, Enhanced Due Diligence (EDD). Due diligence is a crucial step in KYC and Anti-Money Laundering (AML) regulations. It encompasses assessing the risk profile of each business relationship, identifying beneficial owners, and screening for Politically Exposed Persons (PEPs) or links to high risk third countries.

Ongoing Monitoring and Risk Management

Know Your Customer (KYC) requirements do not end at the onboarding stage. Financial institutions must continue conducting ongoing monitoring to remain aligned with AML regulations in real-time. The risk profile of individual and corporate clients can be subject to changes easily, making continuous monitoring compulsory to prevent money laundering and terrorism financing in the long-term. The timely escalation of Customer Due Diligence (CDD), where heightened risk indicators are witnessed, is crucial.

Risk-Based Approach and Compliance Strategies

Adopting a risk-based approach is essential in KYC processes. This approach entails utilizing risk management efficiently through prioritizing and tailoring resources in accordance with risk policies. For instance, financial transactions and business relationships occurring in regulated markets or high-risk third countries would require more stringent ongoing monitoring and due diligence to counteract financial crime and remain alignment with KYC regulations.

The Benefits of an Automated Compliance Framework

By automating KYC checks, financial institutions will reduce operational costs, minimize human error, eliminate potential risks, and enhance customer experience by significantly lowering onboarding times. In summary, establishing a robust Customer Identification Program (CIP), enhanced Customer Due Diligence (CDD), and enabling ongoing monitoring enables UK businesses to meet KYC requirements efficiently and achieve regulatory compliance.

Penalties for Non-Compliance in the UK with Real Examples

Failure to conduct robust KYC checks and meet KYC requirements has harsh implications for companies in the United Kingdom. This section will detail the severe penalties UK banks and other financial institutions face, reflecting the commitment to safeguarding the financial system from financial crime and illicit financial activities.

Financial crime costs every one of us here today, consumers and firms alike. It violates the financial systems we rely on to live our everyday lives and uses them against us. ~ Sarah Pritchard, FCA Executive Director of Markets and International.

Santander UK PLC — £107.7 million fined

In 2022, Santander UK Bank was fined after the FCA identified persistent weaknesses in its anti-money laundering controls for business banking clients. The bank’s weaknesses allowed suspicious funds of more than £298 million to be permitted, creating a high-risk environment for terrorist financing and FinCrime to thrive.

National Westminster Bank PLC (NatWest) — £264.7 million fined

NatWest was fined in 2021 for failing to monitor and report suspicious financial transactions involving a jewellery company that deposited £264 million of cash. Although NatWest leveraged compliance software, it was unable to pick up red flags, demonstrating weak KYC documents collection and due diligence on high-risk merchants.

William Hill Group — £19.2 million fined

Three gambling businesses owned by William Hill Group paid a total of £19.2 million in 2023 for their AML failures. The organizations were found allowing clients to make large deposits without adequate KYC checks during the COVID-19 lockdown.

When we launched this investigation the failings we uncovered were so widespread and alarming serious consideration was given to licence suspension. ~ Andrew Rhodes, Gambling Commission Chief Executive and Commissioner.

The cases above highlight the consequences that UK businesses will face if they neglect KYC requirements, fail to verify customers’ identities, or overlook potential risks in business relationships with private and unlisted companies or high-risk clients.

Meet Stringent KYC Requirements UK

Conducting detailed KYC checks is imminent in the fight against financial crime, money laundering, and terrorist financing. It ensures that financial institutions, electronic money institutions, insolvency practitioners, and even independent legal professionals uphold the integrity of the UK’s financial system.

Rigorous KYC verification on customers, beneficial owners, and merchants empower firms to accurately access the risk associated with each business relationship and fulfill their due diligence obligations. As UK regulations evolve, adopting scalable and tailored KYC processes remains as the key for compliance and safeguarding the UK from financial crime. Get in touch with a team member today.